Logical Basis For Sec. Rick Perry’s Resiliency Pricing Rule.

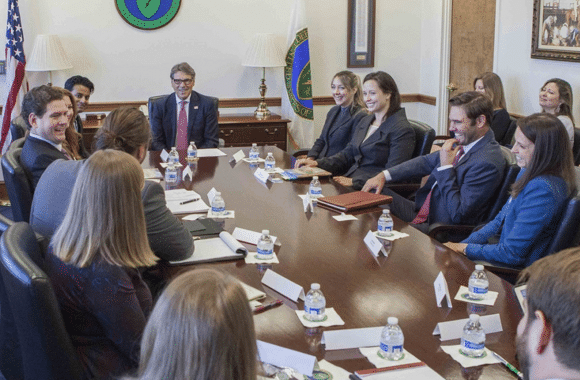

Credit: DOE

The intense conversation Energy Secretary Rick Perry purposely initiated with his Sept. 29 letter to the Federal Energy Regulatory Commission continues to occupy the attention of specialists. The direction was concise: implement pricing rules that protect electricity generators that meet certain requirements from being pushed into early retirement.

The marching orders came with an aggressive but achievable deadline of 60 days. That time frame was chosen so the rules would take effect before the winter heating season began in earnest.

It’s worthwhile to try to explain why the rest of the population should pay more attention to what the specialists are doing and saying.

I’ll do my best to avoid all jargon and acronyms here. I’m also going to give you my interpretation of the winks, nods, secret handshakes and carefully avoided articulation of special interests. My translation is based on deep research, professional experiences and careful observations spread over a lifetime of interest in the business of delivering electricity.

Atomic Insights does not consume your bandwidth or degrade your experience by running ads.

We encourage everyone to read our content and discuss it civilly in our moderated forum.

Background Of The Letter

Before someone new to the conversation can begin to understand the flurry of interest among specialists created by The Letter, they need to understand why energy is so important to the United States that it has a full cabinet-level department called the Department of Energy.

The Energy Department just celebrated its 40th anniversary. It was formed out of a number of different agencies and assigned a cabinet-level secretary in the late 1970s, after nearly a decade in which energy and electricity shortages played an outsized role in the economy and had a major impact on political alignments.

One of the fundamental components of the legislation that created the department was to endow the secretary with enough authority that the person chosen for the role could be held accountable for taking action to avoid crises and for taking prompt action to respond to crises.

Secretary Perry, a man with significant executive experience and an understanding of both responsibility and authority, listened carefully to his staff and interpreted what they were telling him about the the state of our nation’s electricity grid and its future vulnerability if certain planned trends continue.

The issue that concerned him was the growing reliance on natural gas for power generation.

Why Would Perry, A Proud Texan, Worry About Increasing Use Of Natural Gas?

It would be absurd to claim that Secretary Perry has any fundamental objections to using natural gas to generate electricity. It is a useful fuel source that burns pretty cleanly, and it has recently been made more accessible.

By using modern techniques that have been developed and refined during the past 40 years through a cooperative effort between the Department of Energy and a few stubborn inventors, we can finally extract gas from shale reservoirs we have known about for a century or more.

Coming after a decade in which natural gas was scarce enough to drive its price up by 600-700% (from about $2.00/Mcf to $12-$14/Mcf), the availability of refined techniques for extracting gas from shale caused a massive wave of development that released an accelerating volume of natural gas into an energy market that wasn’t growing much.

Ironically, one of the contributing factors for the Great Recession was the skyrocketing price of gas, the same factor that motivated capital markets to finance the massive wave of new source development.

A growing supply of a commodity into a flat or slowly growing market for that commodity is a recipe for falling prices. The low price trend was exacerbated by rapidly growing production from opportunistic power sources like wind and solar that displaced the highest cost generators, often natural gas, from the wholesale power market whenever they happened to be available.

Those sources were not economic on their own, but they were shovel-ready construction projects. As part of the 2009 American Recovery and Reinvestment Act, the U.S. government supercharged its existing program of helping them become economic. From 2009 to 2014, the government paid $25 billion in cash grants to wind and solar developers, providing about 30% of the cost of construction. Those grants were not the only incentive to build wind and solar, but they were important.

As a result of an oversupply of natural gas – which is partly a result of market displacement by rapidly increasing electricity production from wind and solar and partly the result of increasingly risky loans to production companies – electricity prices on competitive wholesale markets have been at an unsustainably low level for more than five years.

That has led to a cumulative “missing cash” challenge that has been especially hard on owners of nuclear and coal-fired power plants because they have higher fixed costs.

Even low-cost, ultra-clean hydroelectric generators are being stressed because their reduced income is inhibiting their ability to invest in life-extending maintenance or capacity upgrades.

Why Are Fuel Secure Generators At Risk Of Premature Retirement?

All three of these large, reliable and well-proven generating sources have lower average fuel costs than natural gas. But if they can only sell a portion of the kilowatt-hours they are capable of producing, at prices that are held down because supply is larger than demand, their profits disappear.

Electricity-generating companies are all suffering from the oversupply of generating capacity and the resulting low prices. They are all run by people who have some understanding of basic economics, which tells them that the only way to return prices to a profitable – higher – level is to eliminate capacity.

Not surprisingly, the plants being chosen for early elimination to reduce oversupply and drive up wholesale prices are the ones that have the highest fixed costs. They are also plants whose fuel sources have been the victims of long-running demonization campaigns.

The war on coal began sometime in the 1990s with a growing emphasis on the risks posed by CO2 accumulation.

In the U.S. that war was intensified and formalized in the 2000s by campaigns like the Sierra Club’s Beyond Coal marketing effort. Aubrey McClendon, one of the key players in the shale gas production boom, was famously exposed by Time Magazine for donating $25 million to fund that war against a competitive power source.

Sierra stopped taking his money after the arrangement became public, but it did not return the money that had already been spent. After halting their fundraising from a clearly conflicted source, the Sierra Club successfully convinced Michael Bloomberg to fund their campaign.

While Bloomberg’s billions from an investor-focused media firm are not as clearly tied to oil and gas as McClendon’s were, there is little doubt that a substantial portion of his wealth comes from the oil and gas business.

The war on the atom began sometime around 1970, right around the time that nuclear plants began supplying a significant share of the U.S. electricity market.

The antinuclear effort has numerous funding ties to oil and gas interests, a small selection of many examples includes money from Robert Anderson used to found Friends of the Earth, grants from the Rockefeller Foundation, Pew Charitable Trusts, Tides Foundation and the Rockefeller Brothers Fund to support a number of antinuclear efforts over the past 40 years, and overt funding from organizations like the Oil Heat Institute of Long Island to fight specific power plants like Shoreham.

Many of the connections have been documented in articles published on Atomic Insights in the category of ‘smoking gun’.

Those sustained propaganda campaigns make it politically easier for owners to shut down units that are actually making money, but at a rate that is insufficient to meet corporate margin goals.

The survivor of the elimination rounds of the modern wholesale electricity markets, should they be allowed to continue their present path without intervention, is abundant, clean-burning, currently “cheap” natural gas.

Note: The quotation marks around cheap stem from fact that it is a relative term. Compared to the $14/Mcf gas commanded in early 2008, today’s price of near $3.00 per Mcf is very low. Compared to the <$2.00/Mcf of early 2015, today’s price is 50% higher. Compared to the average $0.80 / MMBTU (where Mcf ~= to MMBTU) all-in fuel price paid by nuclear plant operators in the U.S. natural gas fuel is almost 4 times as costly as nuclear fuel.

It’s worthwhile reminding readers at this point that natural gas is produced, marketed and sold by oil companies, the same or similar entities that brought us the economic disruptions of the 1970s.

What’s Wrong With The Market Choosing A Winner And Letting Competitors Die Off?

When used as one of many options, abundant gas has been a huge boon to the American economy.

Like all other imperfect fuels, gas has some drawbacks. It is almost as difficult to store as electricity. It cannot be moved by truck or train without a massive investment in infrastructure needed to supercool it into a dense liquid instead of a diffuse vapor.

It moves reasonably efficiently through pipelines, but there are many places where pipelines do not yet exist. Many existing pipelines are sold out and can only provide interruptible transportation services that aren’t available when needed the most. Many existing pipelines are older than the oldest “obsolete” nuclear or coal plants. Some have not been well maintained.

Pipelines are also subject to the economy of scale, where a larger diameter pipe isn’t much more expensive to plan and install than a smaller diameter pipe. Capacity, however, increases as a function of the square of the diameter.

The result is that there are pipelines that can continuously deliver enough fuel for a dozen or more large power stations. There is some redundancy in the system, but a single pipeline casualty can create delivery constraints for a large region.

An example event happened in Taiwan in August 2017. During a heat wave, grid demand came perilously close to equaling the maximum generating capacity of the grid. Workers at a large gas fired power station where six individual units combine to produce nearly 9% of Taiwan’s electricity made an error that cut off the gas supply to all six units for two minutes.

The result of that error was a blackout lasting more than 5 hours and affecting more than 6 million customers. No one in the U.S. – especially in areas like New England, Florida, California and perhaps even Texas should be under any illusions that we would be immune from such an event.

Even more concerning than brief shutoffs, both accidental and man-made pipeline explosions have happened in the past and will happen in the future.

Some, like the August 19, 2000 explosion near Carlsbad, NM, have taken several months to repair sufficiently to restore full capacity. That particular event reduced the maximum capacity to deliver natural gas to California by about 30% and played an unsung – but important – role in the energy crisis in that state that began in the fall of 2000 and lasted through the spring of 2001.

Even if there are never any catastrophic pipeline failures, an increasing dependence on natural gas that results from permanent elimination of alternatives leads to an increasingly fragile power system. Imagine, for example, the effect of increasingly successful campaigns to restrict or eliminate the hydraulic fracturing/horizontal drilling techniques that have combined to create the shale gale.

Even if fracking continues without any new regulatory restrictions the natural gas industry is actively working to build demand for its product by increasing exports, replacing power output from closed coal and nuclear stations, attracting new industrial customers with cheap gas and increasing use of compressed natural gas and LNG as vehicle fuels.

These marketing efforts will eventually cause demand to equal or exceed supply.

In that case, natural gas fuel for power generators will shift to a sellers’ market where prices will rise. It is uncommon for electricity producers to buy gas on long term contracts, so they will be exposed to those prices almost as quickly as they happen. In a market where there are few alternatives to burning gas, however, power producers are not too concerned.

As has been proven in numerous historical examples, people will pay prices that are several times the existing level in order to keep power flowing to all of the devices that they value. We don’t live in the 19th century when the only use for electricity was “keeping the lights on.”

When gas prices rise, electricity prices rise just as rapidly if coal, nuclear and hydro plants have been pushed into retirement.

That’s one of the reasons that so many suppliers have reacted so negatively to Secretary Perry’s order to establish sustainable pricing rules for power plants that are not vulnerable to dramatic changes in the natural gas market or the natural gas delivery infrastructure.

The objectors might couch their objections in words like “blow up the market” or “suppress pricing signals” or “picking winners and losers,” but their real concern is that price volatility will be buffered in ways that might prevent them from succeeding in their multi-year effort to create a more volatile market.

That kind of market provides more lucrative returns for traders and the dominant fuel suppliers.

Didn’t We Decide To Let Markets Rule A Long Time Ago?

Electricity is a uniquely vital commodity in a modern economy. Almost none of the life-enhancing or life-saving inventions on which we depend and which we generally take for granted function without it. Even though our daily living patterns change drastically when we have no electricity available in our homes, small businesses, farms or factories, we have an extremely limited capability to put any of the product away in case of emergency.

Because of its unique nature of being both vital and difficult to store, the business of manufacturing, transmitting and delivering electricity to customers has been closely supervised and governed by a complex, ever evolving set of rules for nearly 100 years.

Without those rules and that supervision, many customers would be left behind as being too difficult or too expensive to serve. There would be an unbearable variation in costs depending on factors beyond the customers’ control.

The importance of Secretary Perry’s decision to take action within a constrained, but adequate schedule can best be illustrated by a brief segment of his recent testimony to the House Energy and Commerce Energy Subcommittee. (Start 1:37:46 End 1:40:39)

Congressman McKinley of West Virginia asked Sec. Perry to paint the picture of what it might be like if we had another Polar Vortex in the U.S. in the next few months. Perry shifted with visible discomfort in his chair and then said the following quietly, but with obvious conviction.

“Well, I’m not sure I want to paint that picture and unduly scare the people of this country. But I think we need to be responsible. I think we need to be really mature in the conversations that we have with people in this country. I go back to the fact that I do not want any of you to have to stand up in front of your constituents and explain to them why they did not have power.”

Regional, national and global energy markets have complex interactions that are rarely discussed in ways that are understandable to non experts.

The Department of Energy was created in recognition of the need to put specialists in many different aspects of the energy supply system into the same organization. Among other advantages, that allows them to feed a single decision maker with enough pieces of a complex puzzle to enable discernment of patterns that might be otherwise difficult to see.

The Letter needs to be taken seriously and appropriate action needs to be taken before it’s too late. Once a nuclear plant retires, it is gone for good. Coal plant retirements are not quite as final, but they cannot be restored to service promptly or cheaply.

Since coal and nuclear plants are not being built, the supplier base for spare parts is dependent on incremental repairs and replacements for the existing plants. If the market for parts like heat exchangers, pumps, steam plant piping and valves shrinks much more, that supplier base might disappear from the U.S. altogether.

Electricity is simply too important to be left to an unsupervised market driven by players who are not responsible or accountable to their customers.

Note: A version of the above was first published on Forbes.com. It has been edited and republished here with permission.

One of the more fascinating Classical Economic theorems states there is no such thing as a market that is both free and stable: a completely free market in any commodity of necessity must devolve into oligopoly and monopoly, either of which eventually deliver that commodity to the consumer at a higher price than did the free market from which they came.

So the E.U. has their Competition Commission, and we our anti-trust laws and Federal Trade Commission.

Adam Smith was not the free-market ideologue would-be oligopolists make him to be. Smith was a Scot who as a child witnessed first-hand the predations of a “free” market regulated by the English. Wealth of Nations was a populist tract expounding how a “free” market should ideally work, minimally regulated such as to achieve the goals, not of the few, but of the larger society it serves.

Illuminating, Rod. Thank you.

Here is a good article on the impact to commodities from electric vehicles.

https://oilprice.com/Alternative-Energy/Renewable-Energy/The-Impact-Of-EVs-On-Commodities-In-One-Chart.html

Now add in the added impact on these same commodities from the batteries needed to provide short period stabilization (less than an hour) and eventually long term (several days or more) back up for homes and then utility district scale. There is no way that batteries are going to get less expensive than they are now.

Fusion power will come before this fairy dust battery I keep hearing about.

I just can not see how we can afford a majority Electric Vehicles, 100% like CA, or battery backup for renewables separately let alone both without massive increases in the price of electricity.

We can’t, but that doesn’t stop the wind fantasy movement. It is a vaguely considered, but concretely held article of faith with them that there is storage that will cure all of wind’s ills. They haven’t crunched any numbers and amongst the converted, even those with engineering skills refuse to consider the possibility that it can not work.

This.

I had hopes for the Iowa Stored Energy Park. Using sandstone aquifers as reservoirs for CAES struck me as brilliant, especially in a state as windy as Iowa.

ISEPA completed its testing, scheduled no followups, and disappeared. Even its web site is history. Storing energy, even when your medium is free, is hard.

The thing nobody else is doing is conversion, like finding a way to make cement clinker as power is available. Converters which can run as dump loads and are economic at low duty cycles are the only thing left. The thing, though, is that with enough such converters the negative pricing that’s killing nuclear power goes away… and nukes will run them at higher duty cycles than ruinables.

@EP

The problem I have with these dreamers is that they do not realize the magnitude of the energy usage. In 79 or 80 while living in NJ we had a very cold spell lasting for several weeks. While talking to my neighbor, who worked at PSE&G, how cold it was and how long it had been so cold he told me that for the last few weeks they have been gasifying coal to maintain the gas pressure. He said that most of the reserves in the underground storage have been depleted to the point that without the conversion there would be no gas pressure at all. He also talked of how it took all summer just to fill up the storage caverns, abandoned slurry extracted mines. Look at https://www.eia.gov/naturalgas/storagecapacity/

Over 4,000 Billion cubic feet of storage in the US, 1,000 billion in the NY, NJ, PA area and PSE&G does not have enough to supply their customers for two weeks. Do the calculation of therms to joules and then to battery capacity. No way, no how can batteries do it. and environmentalists will never let Hydro be the backup source for their dream of 100% renewable. Using more distribution lines will mean doubling and even tripling the capacity of existing HV power transmission lines, and then only used less than 25% of the time, if that. Look at how hard it is to get an Oil Pipeline. Why is it going to be any easier to build their dream – a HV DC power line?

Most people cannot do math. Of those who can, too many will not.

“Anyone who cannot cope with mathematics is not fully human. At best he is a tolerable subhuman who has learned to wear shoes, bathe, and not make messes in the house.” — Lazarus Long (Robert A. Heinlein)

Or as someone likes to say all the time, MPAI (most people are idiots).

We need to get the idiots out of critical places, like public office and voting booths.

I view being innumerate as roughly equivalent to being illiterate.

Unfortunately, while society regards illiteracy as a sad tragedy and something to be corrected even as late as old adulthood if possible, society seems to view innumeracy are an irrelevant characteristic like baldness.

On further consideration society views baldness as worse than innumeracy. There are innumerable baldness “cures” and vast fortunes spent on “correcting” baldness. No such effort is put into correcting innumeracy.

Engineer-Poet says,

> ISEPA completed its testing, scheduled no followups, and disappeared. Even its web site is history. Storing energy, even when your medium is free, is hard.

Not really. After spending 80% of a decade and 20% of the advertised cost of $400 million on lots of computer modeling, and 3 test wells, they decided they’d picked a bad location, folded, and wrote a report on mistakes made.

“…57 municipal utilities in four states who owned the project, ended the project after eight years of development because of project site geology limitations. About $8.6 million had been invested in ISEP by the ISEPA members, the U.S. Department of Energy’s (DOE’s) Storage Systems Program, and the Iowa Power Fund.”

“…cost and economics considerations, while important, are only two of the challenges for implementing cost-effective bulk storage. Institutional, policy, legislative, and market forces also exist and need to be addressed.”

“…computer reservoir modeling … results showed the geology of the site to be challenging because of low permeability of the sandstone storage structure. Instead of the contemplated 270 MW, the site could perhaps accommodate a smaller CAES Project of about 65 MW… found the Dallas Center site as unsuitable for a CAES project of any size… showed that a CAES project smaller than 270 MW would not be cost-effective…The Board agreed and voted unanimously on July 28, 2011, to terminate the project.”

SAND2012-0388, Printed January 2012, Lessons from Iowa: Development of a 270 Megawatt Compressed Air Energy Storage Project in Midwest Independent System Operator

Engineer-Poet says,

> Even its web site is history. Storing energy, even when your medium is free, is hard.

Not really. The site has essentially been replaced by one of the consultants:

http://www.lessonsfromiowa.org/

Ah, wonderful! Thanks for that.

The discussion about the troubles caused by very low wholesale market prices reminds me of what I’ve always said about policies that mandate large amounts of renewable generation, regardless of cost, practicality, or if new generation is even needed. As time goes on, I’ve come to believe that the 3rd part of that statement is the most important.

It would be one thing if policies gave a preference to renewables whenever a utility was planning to build new generation (i.e., when demand required it). But forcing a large amount of new generation onto a saturated grid is another. If the new renewable generation must be built, then some other generators must be removed, and very low market prices is the mechanism by which this is being achieved. The non-renewable generation with the highest ongoing costs will go first, and prices will fall until enough traditional generators close to make room for the mandated renewables. People are trying to blame cheap gas, but it is clear that mandated renewables are playing a large role in this.

With respect to the issue of finding replacement parts for existing nuclear plants, I’m actually somewhat surprised that there is not a reasonable supply chain for those components. We have hundreds of nuclear plants that are at an age where they would need such replacement parts. Is that not enough demand to justify the industrial capacity to produce those parts?

Follow on question. To what degree is the wonderful NQA-1 (or N-stamp) program responsible for this? I’ve heard a lot about the lack of N-stamped suppliers. Are any of these components similar to ones used in other industries? In other words, are there large numbers of industrial suppliers that could provide those components, if not for the “nuclear grade” requirements? We all know how nuclear-grade versions of similar (or identical) components cost several times as much. In this case, there may be a lack of availability in addition to high cost.

Of all the major power disruptions, nation-wide over the past five years, only 0.00007% were due to fuel supply problems. The vast majority were the result of severe weather knocking down power lines

http://rhg.com/notes/the-real-electricity-reliability-crisis

So the whole let’s give nuclear and coal more money thing is just lobbyists, and has no basis in reality.

Nuclear power is deadly, dirty, short of uranium in 8 years, and several times the cost of solar or wind.

https://www.quora.com/Why-do-we-need-nuclear-energy/answers/45697265

Waste to synthetic fuels can provide the backup that solar and wind need.

Hydro too.

@Brian

I approved your comment with some trepidation. My guess is that it’s a “fly by” comment consisting of false talking points designed to derail a meaningful conversation.

If I’m wrong, you will take the time to engage again. If I’m right, your comment will be put where it belongs.

Every thing is verified with links and logic. Please, discuss something I wrote. Fuel problems are indeed .00007% of the major grid outages. The problems with nuclear are all facts. LNT and collective dose are proven. epidemiology does not work for 100,000 extra deaths out of 8M and the authors of the IAEA papers mostly admit that, right in their papers. The IAEA and the DOE are both chartered to promote nuclear power, it’s right on their web sites. It’s really important to realize the IAEA is a PR agency, just like the Tobacco institute. They only admit thyroid cancers because they are rare except for radiation exposure and do show up in epidemiology studies. It takes 100,000 tons of .1% ore per reactor year (GW), the average overburden is around 20 times globally for open pit uranium mining. In situ requires a waiver to allow them to destroy water systems, since the now porous rock continues to leach. The IAEA graph of mining capacity shows a shortfall in 2025 if nuclear increases, and around 2035 if it decreases. Then is shows a resource depletion shortly thereafter. You can search peak uranium The average quality of the ore has decreased to less than .1 and even .01 in some cases. Right around .01% is takes more energy to mine and refine than it can ever create. Add in the million year storage energy and costs, and nuclear is net negative energy.

Go to Lazard energy and check the cost before subsidize, which doesn’t even include some of the major gov breaks for nuclear and nuclear is several times the cost of solar or wind. Solar and wind are being sold at less than 2 cents per KWH in many places in the world, without gov breaks.l

Check out the links I provided, they go into more details with links. I know you don’t want to hear or accpet it, but they are backed up.

Go to Lazard energy and check the cost before subsidize, which doesn’t even include some of the major gov breaks for https://www.guideadda.com/best-washing-machine/ nuclear and nuclear is several times the cost of solar or wind. Solar and wind are being sold at less than 2 cents per KWH in many places in the world, without gov breaks.