Parnassus Versus Green Century: A Contrast in Styles

Cross-posted from Nucleation Capital

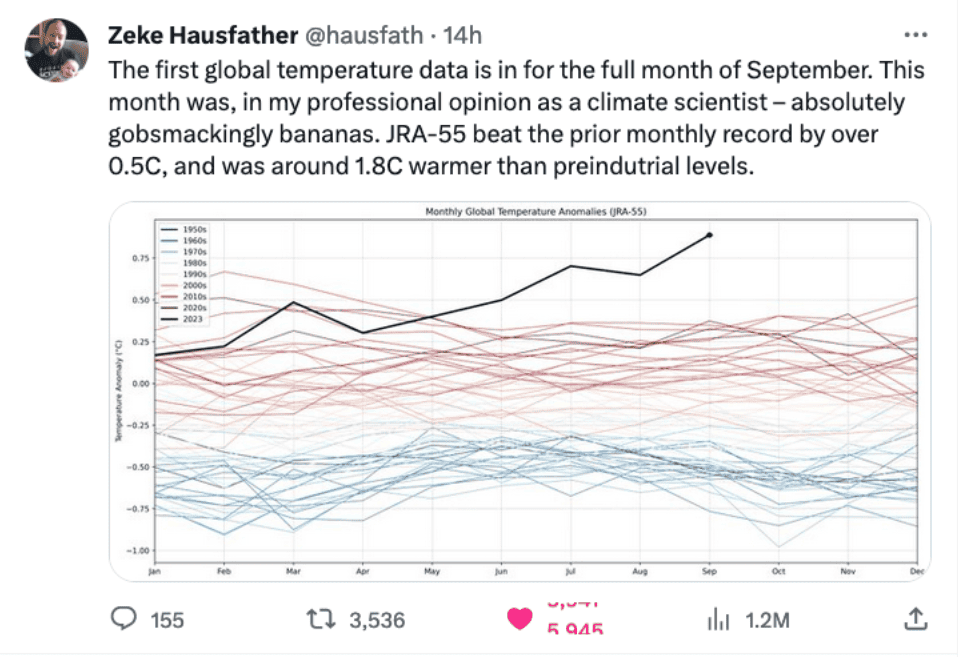

June, July and August of 2023 were the three hottest months the Earth has ever seen by such a large margin, it left climate scientists agog. Climate disasters are abounding apace, with the U.S. hit by 23 large-scale disasters, a record-breaking year already. In Pakistan, extreme rainfall and flooding affected 33 million people, killing more than 1,700, displacing more than 8 million and causing damage estimated at over $30 billion, not counting the estimated 2.2% loss to the country’s gross domestic product. North America and even Hawaii were ravaged by intense forest fires, with record acreage subsumed, scorching towns like Hahaina, killing hundreds, and forcing evacuations in areas of the northeast, northwest and Hawaiian islands once seen as refuges from the expected heat. Decade of increasingly severe drought, now complicated by shortages and war, have displaced millions in Iraq and other regions of the Middle East and the bad climate news is just getting worse, adding to the cacophony of the alarm bells being rung by scientists in almost every field. In this context, when it is clear that we are not coming close to winning this fight, it’s illuminating to contrast how two competing sustainable investment groups have chosen to address their obligation to invest sustainably.

As Nucleation Capital first reported back in May, Parnassus Investments, a leading sustainable investment fund, issued a stunning press release in which they announced the removal of their negative investment screen on nuclear power along with a positive outlook for its role in reducing emissions.

As Nucleation Capital first reported back in May, Parnassus Investments, a leading sustainable investment fund, issued a stunning press release in which they announced the removal of their negative investment screen on nuclear power along with a positive outlook for its role in reducing emissions.

In a succinct six paragraphs, Parnassus explained the basis for this momentous decision that reversed a policy in place for the entire 39 years of their existence. While it is not issuing an absolute commitment to invest in nuclear equity, the statement showed that Parnassus’s Sustainability team had thoroughly researched the issue of nuclear power and were sufficiently convinced to change their minds.

We regard this milestone decision as an impressive example of science and fact-based ESG leadership, reflecting actual changes in the nuclear industry over the last few decades as well as the utter catastrophe we are facing, if we don’t find better ways to reduce emissions from our energy usage. Similarly, around that same time, Bank of America Securities analysts released their first “BUY” recommendation for nuclear power in nearly four decades. In BofAS’s highly detailed report, titled “The Nuclear Necessity,” a team of five analysts explained why they were “bullish on nuclear power” and laid out both the case for and the methods by which investors should start increasing their exposure to nuclear equities and uranium. This event, we noted was yet another milestone.

Nevertheless, on August 30th, writing in a publication called ESG Clarity, Leslie Samuelrich, the CEO of Green Century Funds, another investment fund which considers itself a leader in sustainable investing, issued her pushback in the form of doubts. Ms Samuelrich wrote: “Even though I knew for months that an ESG firm was thinking about removing its exclusion on nuclear power producers, I was taken aback when I read their press release. Why would they revert their position and turn to nuclear when investing in renewable energy has grown so dramatically?”

Nevertheless, on August 30th, writing in a publication called ESG Clarity, Leslie Samuelrich, the CEO of Green Century Funds, another investment fund which considers itself a leader in sustainable investing, issued her pushback in the form of doubts. Ms Samuelrich wrote: “Even though I knew for months that an ESG firm was thinking about removing its exclusion on nuclear power producers, I was taken aback when I read their press release. Why would they revert their position and turn to nuclear when investing in renewable energy has grown so dramatically?”

Ms. Samuelrich then proceeds to trot out five dog-eared paragraphs containing the standard litany of antinuclear arguments (Safety, Cost, Timing, Emissions and Waste) which, like figures in a wax museum, reflected views so frozen in time, no amount of new data or climate rationale could have had any effect. She makes no reference to nuclear’s improved safety performance, nor any mention of new designs nor the accelerating customer interest in them. The stark contrast between the perspectives laid out by these competing sustainability-focused investment firms offers an excellent opportunity to compare the styles and seriousness of their approaches to their ESG investment missions.

Parnassus Investments

Parnassus Investments was founded in 1984 to provide socially-responsible investments. Headquartered in San Francisco, they now have 70 employees and about $42 billion in assets under management (as of Sept. 30, 2023). This is a serious investment firm with an impressive $600 million in AUM per employee.

Reflecting Parnassus’s seriousness is the Climate Action Plan that the firm adopted in December 2022. This Plan established a goal of net-zero emissions in all their funds by 2050, in alignment with the Paris Agreement. This document and commitment demonstrate that Parnassus understands this key point: it is not enough to avoid fossil fuels; society also has to figure out where all the future clean power that we need will come from. It’s the long-term “rubber meets the road” reality check. Parnassus’s statement that they will now include nuclear in their investment universe to support the transition to a low-carbon economy reflects their deep thinking about this urgent reality.

We imagine that it must have been a difficult decision for the Parnassus team. But they displayed the intellectual honesty to take a deep, critical look at the landscape for where we will produce our clean energy and, like many of us, found the calculations around deployment of renewables did not add up. It is never easy to have to change one’s mind. Never easy to reverse course. With respect to nuclear—which evokes so much knee-jerk prejudice and emotion—even being open to an objective evaluation is difficult. Many members of the antinuclear community see it as such a betrayal, they’ll question your motives. What ultimately forces objective people to look more closely at nuclear is the fact and increasing certainty that we cannot meet our climate and energy goals without it. Parnassus demonstrated both analytical clarity and courage in their decision to abandon their negative screen and allow nuclear back into the universe of possible equities—without a thought of abandoning their commitment to rigorously evaluate each prospective candidate for its adherence to high ESG performance metrics.

Although in 1984, Parnassus was also concerned about the safety and cost issues involved with nuclear power, they have since learned that nuclear is a critical source of low-carbon power whose benefits include both safety and a stability. They’ve also recognized that, over the years, tighter regulations have led to improved designs and operating performance. Additionally, they were pleased to find that the new generation of nuclear technology being developed now offers both higher safety and lower costs. The Parnassus investment team, led by Marian Macindoe, Head of ESG Stewardship, has clearly done a deep dive into today’s more diverse nuclear industry, where a broader menu of options are being developed, and believes that “nuclear energy will be an essential source of fuel in the transition to the renewable sources required to support a low-carbon economy . . . and a reasonable choice.” This reflects considerable research and learning. We applaud the extremely professional work this team has done.

Green Century Funds

Green Century Funds, founded in 1991 by a “group of environmental and public health nonprofits,” has nearly $1 billion in assets under management as of June 30, 2023. Green Century’s Registered Investment Advisor, Green Century Capital Management (GCCM), has 13 employees, six of whom provide investment advisory or research work (as of GCCM’s most recent ADV) about $86 million in AUM per employee. Any profits from their investment advisory operations go to Paradigm Partners, a holding company owned by the founding entities, predominantly NGOs affiliated with Ralph Nader’s Public Interest Research Group — Mass PIRG, NJ PIRG Citizen Lobby, Conn PIRG, CA PIRG, Washington State PIRG, Missouri PIRG Citizen Org, Colorado PIRG, PIRGIM Public Interest Lobby, and Fund for the Public Interest. These are all advocacy groups. None are scientific or investment experts.

Green Century’s stated mission conforms to an advocacy model: to help people save for their future without compromising their values and to help investors “keep their money out of the most irresponsible industries.” In other words, Green Century Fund applies a simplified, reductive view that merely screens out investments that don’t meet their “values” — i.e. no fossil fuel, tobacco, nuclear and conventional weapons, nuclear energy, genetically modified organisms (GMOs) and other industries “whose core business threatens the environment and public health.” Green Century specifically does not aspire to invest into companies that will enable a sustainable future. They also have not have a published “climate action plan,” from what we could see, and they have made no specific commitment to decarbonizing their fund. We were curious as to what they do invest in.

A cursory overview of Green Century’s Equity Fund, the largest of its four mutual funds boasting $544 million in AUM, reveals the following Investment Categories and percentages of investments:

- Software & Service 23% (52% of which is Microsoft)

- Semiconductors 10% (52% of which was NVIDIA)

- Media & Entertainment 8.2% (83% is Alphabet)

- Pharmaceuticals & Biotech 7.3%

- Financial Services 6.4% (26% is Mastercard)

- Capital Goods 6.2% (20% is Caterpillar or Deere & Co.)

- Food & Beverage 4.5% (57% is Coke and Pepsi)

- Renewable Energy & Energy Efficiency 4.1% (90% is Tesla)

- Healthcare 4.0%

- Consumer Discretionary 3.7%

- Equity REITs 3.0%

- Insurance 2.9%

- Household/Personal Products 2.7%

- Consumer Services 2.5% (43% McDonald’s)

- Materials 2.5%

- Tech Hardware & Equipment 2.5% (43% Cisco)

- Transportation 2.0% (31% Union Pacific Corp)

- Consumer Durables & Apparel 1.2% (58% Nike)

- Banks 0.9%

- Telecom .8% (98% Verizon)

- Commercial & Prof. Services .5%

- Consumer Staples .3% (54% Sysco Corp)

- Automobiles .3% (Rivian is here at 17%)

- Utilities .2%

- Healthy Living 0.0%

There are several interesting things that pop out from our review. Of the top 9 listed investment categories, containing 70% of the total assets, five have a majority of capital concentrated in just one or two companies. Thus, by dollars, this fund is dominated by its investments in Microsoft, NVIDIA, Alphabet, Mastercard, and Tesla. While these are great companies, it is notable that all of them, without exception, require massive amounts of electricity for their success. Which means from a sustainability perspective, that they will need reliable, affordable and growing sources of clean electricity to remain profitable over time. Where will that come from?

In her written response to Parnassus, Leslie Samuelrich pointedly asks “Why would [Parnassus] revert their position and turn to nuclear when investing in renewable energy has grown so dramatically?” Well, we think Ms. Samuelrich might find her answer in her own firm’s largest portfolio. It lacks meaningful investment in clean energy. Green Century claims to have put 4% of its assets into “Renewable Energy & Energy Efficiency.” If that were true, one could imagine justifying that level, as the traditional Energy sector represents 4.7% of the market capitalization of the S&P 500 index [S&P 500 9/30/23 FactSheet]. A closer look, however, paints a different picture.

Of the 4% of assets designated as Renewable Energy & Energy Efficiency, 90% was actually invested in Tesla. Tesla is an electric car company, as everyone knows. Cars, even when electric, are neither a source of “renewable energy” nor do they produce “energy efficiency.” But Green Century knows this because it has properly categoried Rivian, another electric car manufacturer, in the “Automobile” category. Yet, Green Century chose to put Tesla into the “Renewable Energy” category. Perhaps this is because Tesla acquired Solar City, and so has a small division that sells solar panels and battery walls. But Tesla’s 6/30/23 10-Q reports that “Energy Generation and Storage” produced less than 7% of Tesla’s total revenue ($3.038 billion of total revenue of $48.256 billion) for the first six months of 2023.

Aside from Tesla, the amount of capital that Green Century has invested in Renewable Energy & Energy Efficiency is just 0.4%. These investments include five companies, of which Johnson Controls represents 60%. Johnson Controls provides HVAC systems, fire protection, and automated data information about energy use for many types of commercial buildings. They also service “90% of the world’s top marine and oil and gas companies for all types of assets and facilities.” In other words, a sizeable portion of their business derives from the oil and gas industry, conveniently ignored by Green Century. For argument’s sake, we’ll assume that Johnson is credibly working towards “energy efficiency” wherever they are but they are definitely not creating renewable energy.

The remaining .16% portion of “Renewable Energy & Energy Efficiency” holdings is comprised of four investments: Acuity Brands, Itron, Ormat Technologies and First Solar. Acuity Brands markets smart lighting and building management solutions. Itron provides smart networks, software, services, meters and sensors to help manage energy and water. Acuity and Itron may contribute to energy efficiency, but neither produces renewable energy. Ormat Technologies claims to be a leader in providing “Green Power Plants” spanning geothermal power, solar power and “recovered” energy (i.e. storage). First Solar, the only US-based solar manufacturing company, claims to offer next-generation solar technologies, a high-performance, low-carbon alternative to conventional photovoltaic panels. At last, two companies that actually contribute to the creation of renewable energy! Yet the Green Century fund invests less than 0.12% of its total assets into these two companies. In contrast, Green Century has invested over 2.5% in Coke and Pepsi — more than twenty times the amount invested in renewable energy companies that Ms. Samuelrich claims are growing so quickly.

We are a bit “taken aback” by the choices made by Green Century, not only their degree of concentration in a few large cap companies but the misleading industry categorizations and failure to invest meaningfully in the lauded renewable energy companies working to clean our energy system. Ms. Samuelson argues that sustainable investors should support the renewable energy sector, so why isn’t she, if she truly believes that “the world is set to add as much renewable power in the next five years as it did in the past 20?”

Samuelrich asks, “Why gamble with the environmental and public health risks of [nuclear], especially when renewable energy is cleaner and cost competitive?” The answer is clear to those who actually do the research and care about facts: because neither solar nor wind actually provide the reliable or climate resilient power that societies demand and need. Geothermal remains highly limited by geography. So, as we’ve witnessed, without a truly reliable source of clean energy, humanity will continue to demand reliable but dirty fossil fuels and emissions will keep growing—as they have continued to do, despite big increases in renewables. The only clean and firm source of power that can scale up with the speed we need it to, is nuclear. It’s gotten a whole lot better over the last 40 years—in part due to the public’s concerns about it’s safety and increased regulatory scrutiny—and now a new slate of advanced designs with different sizes and features is emerging and buyers like Dow Chemical and Microsoft are leaning in.

We would urge all sustainable-minded investment groups not to take shortcuts and pander to aged ideologic tropes like Green Century, but instead examine today’s facts and data carefully and think critically, as Parnassus did, about the real challenges around how we will produce the enormous and growing amounts of clean grid-scale, distributed and industrial-process heat power on which we all depend. Simply saying “no” to technologies you don’t like may have been a justified approach three decades ago but it has not helped solve climate. Nor will it enable one’s investors to participate in the growth of a sector that is increasingly recognized as being fundamentally critical to our survival. We are extremely glad that serious, research-focused investors are figuring this out and are willing to do the hard work, risk the bruises that may result from following the facts to where they sometimes inconveniently reside, and leave open their capacity to invest in technologies delivering a more sustainable future.

References

- New York TImes, Record Number of Billion-Dollar Disasters Shows the Limits of America’s Defenses, by Christopher Flavelle, Sept. 12, 2023.

- World Bank: Pakistan: Flood Damages and Economic Losses Over USD 30 Billion and Reconstruction Needs Over USD 16 Billion – New Assessment, October 28, 2022

- Parnassus Investments: Parnassus Investments Removes Investment Screen for Nuclear Power in Support of Our Transition to Low-Carbon Economy, May 1, 2023

- ESG Clarity: Should we embrace nuclear energy to solve the climate crisis? By Leslie Samuelrich, CEO of Green Century Funds, August 30, 2023

- Bank of America Securities, RIC Report, “The Nuclear Necessity,” by Jared Woodard, published May 11, 2023.

- Parnassus’ Annual Stewardship Report, Principals and Performance in Action 2023

- Green Century’s Equity Fund Holdings, as of June 30, 2023, with assets of $544,380,517.

- Parnassus Funds, totalling over $42 billion as of 9/30/23.

Very nicely done! I would enjoy reading a reply from Green Century, but of course one would have to wait a long time for such wax figure ideologues to do so. Re Parnussus: I think it is also possible that they’ve noticed the beginning of a very, very robust bull market in uranium, and may have a case of FOMO…