Is Levy County nuclear plant too expensive to compete with natural gas?

On Saturday, May 11, 2013, the Tampa Bay Times published a lengthy piece by Ivan Penn titled Levy nuclear plant more costly than a natural gas facility that uses a detailed analysis with substantial “error bars” around cost estimates to show that under nearly all scenarios considered, the two reactor installation that has been proposed for Levy County, Florida is a more expensive option than a natural gas power plant.

The effort is a serious attempt to raise questions about the proposed facility and to ask hard questions about the company’s statements about the reasons that they are going forward with the project. Despite my unreserved support for nuclear technology development, I believe the nuclear industry needs to understand the implications of the results and consider taking action to that will encourage unbiased observers to change the underlying assumptions.

The primary action we need to take is to develop a cost aware culture that understands that losing control of cost is almost as hazardous for the health of the general public as losing control over quality or safety. A “cost is no object” approach to quality and safety cannot be sustained because it results in a culture where even the tiniest issue can result in responses that have almost no upper limit in capital expenditures or man-hours. Anything that gets reported becomes a high priority item; which often skews resource allocation and prevents or delays actions that may be more important.

There is an ever present danger of political pressure to move as slowly as possible to make effective regulatory decisions. We must never lose sight of the fact that people who oppose the use of nuclear energy are well-funded, well-connected, and highly motivated to add as much cost and delay as possible. It is often politically easy for the regulator to announce that they are going to review every change and analyse every issue in an unconstrained manner that pays no attention to the cost associated with the imposed delay.

Our competition does not make the same mistake; they often push back against overreaction to minor issues and effectively use cost-based arguments to help establish action plans based on sound prioritization decisions. Take, for example, the delays and associate cost increases that resulted when inspectors at plant Vogtle noticed that the rebar pattern for the basemat did not exactly match the version of the concrete construction code that was used during the design certification application. Based on news reports, here is the chronology:

April 26, 2012 NRC says Vogtle rebar differs from approved design

Rebar installed at the construction site for Plant Vogtle’s new Unit 3 reactor is not consistent with approved design standards, according to the U.S. Nuclear Regulatory Commission, whose inspectors identified the issue last week.

July 14, 2012 Nuclear Regulatory Commission rejects plan to modify rebar in Plant Vogtle’s Unit 3 reactor

A proposal to modify – rather than replace – non-conforming rebar in the foundation of Plant Vogtle’s Unit 3 reactor is unacceptable, according to the U.S. Nuclear Regulatory Commission.

October 23, 2012

NRC approves plan to resolve Plant Vogtle rebar, concrete issues

Southern Nuclear’s request to amend Plant Vogtle’s construction license to resolve issues with noncompliant rebar and unlevel concrete will be approved, according to the the U.S. Nuclear Regulatory Commission.

March 14, 2013 First nuclear concrete placed at Plant Vogtle expansion

Georgia Power has completed the placement of basemat structural concrete for the nuclear island at its Vogtle Unit 3 nuclear expansion site, a significant achievement in the building of the first new nuclear units in the United States in 30 years.

Anyone who has been involved in a complex project will recognize the costs and schedule impact associated with resolving an issue that slows construction progress for nearly a year on a project with a projected total cost of approximately $14 billion. It appears, from the outside looking in, that the necessary modifications were relatively minor, even though they consumed a huge chunk of analytical resources along with substantial time investments by associated company license experts. During the entire episode when construction was not moving as scheduled, the company was paying $274 per hour of regulatory review time.

I have no knowledge of the details, but I am nearly positive that there were opportunities to more quickly address the issue and move to the same safe decision in a much shorter period of time.

It is construction performance and regulatory responses like that that makes cost estimators add plenty of padding and contingencies. Of course, if things go more smoothly, there is a normal human tendency to use up the available budget. The result is that large, complex nuclear projects often ratchet with a strong bias in the upward direction. The nuclear industry must take effective action to slow the ratchet effect and to help the regulator recognize that cost is an object whose control contributes to overall public safety. If we do not succeed, the result will be a more precarious dependence on fossil fuels, a power source with known deleterious effects on human health and climate stability.

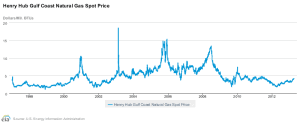

There are a few assumptions and analysis techniques worth challenging in the Times report. It appears to me that their models used natural gas price assumptions that smooth out variations and spikes to result in a steady, inflation driven increase in the price. That is unrealistic based on history.

Like many recent cost comparison studies, the Times report starts with the assumption that natural gas price performance during the period from 2000-2008 was an aberration that resulted in prices that will not be seen again for another decade. The narrative that the industry currently encourages is the one in which the new technology of horizontal drilling with hydraulic fracturing has created an enormous, cheap resource that is the source of a long period of low prices.

Even with an overestimate of the capital cost of a nuclear power plant, the cost comparison between natural gas and nuclear energy would be quite different under an assumption that prices from 2008-2012 were caused by a difficult-to-repeat confluence of irrational exuberance in the drilling industry, a drop in demand caused by the Great Recession of 2008-2012 and a couple of mild winters. If natural gas prices return to the pattern established in 2000-2008, fuel expenditures and the capacity factor assumption for a replacement gas plant would both lead to much higher costs than calculated for the gas plant alternative.

I also have to challenge the capital cost assumption made for the gas plant. As I understand the cost estimates for the Levy county power station, about $4 billion of the $24 billion cost estimate is associated with building the required transmission infrastructure to tie the plant into the grid. A gas plant construction project would need to make a similar of investment in transmission and distribution infrastructure, but the Times asserts that a natural gas plant with the same output as the Levy county plant can be built for $2.5 billion.

I also wonder if there is any accounting in the comparison for the cost of the increased gas pipeline infrastructure. I am sure that Mr. Penn realizes that Florida is a peninsula that does not produce its own natural gas; the pipelines that supply Florida do not have enough available capacity to supply a new 2200 MWe plant operating at the assumed 81% capacity factor.

There was one more issue with the article that indicated to me that the author is not actually interested in a fair comparison. Though people who have not been following nuclear issues closely might miss the bias indicator, long term participants in the battle for public understanding should see the problem in the following concluding quote:

Diversity in any system is a good thing, “but there’s no point in overpaying for it,” said Bradford, who approved 21 nuclear plants while a federal regulator. The financial realities of nuclear plants changed long ago, he said.

Including nuclear in an “all of the above” strategy “has become kind of a last refuge of scoundrels,” Bradford said. “If we’re talking about world hunger we don’t talk about an all of the above strategy. We don’t say, ‘Lets fight world hunger with caviar.’ “

Peter Bradford has made a career out of being a former Nuclear Regulatory Commission member who is opposed to the use of nuclear energy. He serves on the board of the antinuclear UCS, a group that includes a few scientists and a lot of antinuclear lawyers. Peter Bradford was a member of the Nuclear Regulatory Commission from August 1977 through August 1982. That period included the Three Mile Island accident, after which there were no new nuclear plants licensed for at least three years.

I need to do some research to find out which 21 plants he claims to have approved. Perhaps one of you could do that for today’s homework assignment. I need to get ready for my day job.

I left a bunch of comments blasting their natural gas calculations in which the author and a lady from SACE negatively responded. Here was my first one:

More work needs to be done on the calculations and analysis. The numbers in this column are too simplified and actually incorrect.

For one, Levy wouldn’t be producing “8.87 million megawatts.” The unit of production is megawatt-hours and it would be 17.7 million MWh a year from Levy. (2,200 MW * 92% capacity factor * 8,760 hours in a year = 17.7 million MWh)

Once this is adjusted, then we can calculate how much it would cost for the fuel for natural gas. According to EIA, it takes about 7.5 cubic feet of gas to produce a kilowatt-hour. Therefore, a gas plant that replaces Levy would need 133 billion cubic feet each year. The annual cost for 133 Bcf at a low $5/thousand cubic feet comes out to $660 million. $660 million times 60 years comes to $40 billion without any escalation in gas price.

The fuel costs alone are six times more what this column calculates is the total cost of a gas plant. Further, the analysis explanation needs more explanation. What was the capital cost used for gas? What were the construction times? What were the discount factors in order to calculate NPV?

A simple calculation as shown above for one piece of evaluating the costs of competing technologies shows that the column’s cost conclusions are incorrect and need to be reanalyzed.

Article states: “… each of the two units.”

1100 MW x 0.92 capacity factor x 8760 hours = 8.865 million MWh (rounded to 8.87 in article).

The concern at Levy is not cost-overruns (which you detail for Vogtle), but rising projected costs for new reactors (on top of which any cost-overruns must be added). In Levy County, ratepayers are asked to pay in advanced for new construction (as much as $50/month on average electricity bill), with an initial cost estimate of $5 billion and a reactor completion date of 2016. “About half of all reactors ordered of docketed at the Nuclear Regulatory Commission have been canceled or abandoned. Of those that were completed and brought online, 13 percent were retired early, 19 percent had extended outages of one to three years, and 6 percent had outages of more than three years” (here). In other words, new nuclear is risky, Duke understands this (especially after Crystal River debacle), and CWIP (as is widely acknowledged in court challenges, energy utility board staff, and even low public acceptance of the program), shifts the financial risks of such large capital projects away from licensees, vendors, and bond holders onto ratepayers (who may never see a return on their investment in cost effective, reliable, and useful electricity in a deregulated and evolving electricity market). Risk is proportional to reward in most financial settings, but apparently not for ratepayers in Levy County (where risk may very well lead to higher electricity costs than available alternatives).

So yes, I look forward to this discussion and insights from nuclear proponents on a “cost aware” basis (as Rod puts it).

@EL

…shifts the financial risks of such large capital projects away from licensees, vendors, and bond holders onto ratepayers (who may never see a return on their investment in cost effective, reliable, and useful electricity in a deregulated and evolving

Oops – I think you slipped an extra word in there. We are talking about a regulated market in which the government oversight is supposed to protect the ratepayers and assures that they get reliable electricity. Yes, there may be some risk being transferred, but that is the whole point of the regulatory compact in which the utility agrees to be bound by an obligation to serve and produce electricity with oversight for both cost and reliability. In return, customers, who are represented by a public utility commission, agree to pay a fair price.

I have no religious conviction that “free markets” are the best solution to all problems. Electricity is too important to be left to chance. Skilled providers with functional oversight seems to be a better solution.

Reliable electricity is a misnomer here (and Progess Energy, now Duke, has been allowed to play on an incredibly long leash). Rate increases were approved for one AP 1000 at $5 billion and a completion date of 2016 (a second power plant was added to proposal in 2008). They’ve already missed their targets, they failed to win a federal loan guarantee, NG prices are at all time low, total project costs have risen 340 – 440% (excluding financing and cost-overruns), and project now has a completion date of 2024 (18 years from approval of original ratepayer financing deal). Ratepayers are on the hook for billions, and there is little certainty that either of these plants will ever get built.

You already know my view on CWIP (and the Levy County proposal). It’s ill conceived, adds little certainty to private lending, credit worthiness of vendors and developers, lower costs to local ratepayer base, it hurts the industry more than it helps (creating perception the industry needs additional props and supports to be commercially viable), and violates “used and useful” standards for ratebase increases widely followed by public utility commissions. The CWIP Law in Florida was an act of the State Legislature, not public utility commissions representing ratepayers. These are not companies that are in severe financial distress (or otherwise hamstrung from raising funds from private lending markets). The original 1976 FERC rule allowing for CWIP financing for private utility development describes the following (p. 1039):

Ratepayers in Levy County need to be asking for their money back. Lawsuits are pending, and considering the significant changes made to the project (including adding a second reactor, and loss of federal loan guarantee) additional due diligence is merited. Ratepayers already have a significant stake in the project, but no authority or voice in decision making. As the article in the Tampa Bay Times suggests, due diligence is likely to be problematical in this instance, and may point to other projects and alternatives as being in the better interest of local ratepayers, adhere to “used and useful” standards with no long construction delays (pitting one ratepayer against another), pose lower risks for private market lenders, and greater reliability and certainty to energy markets from less costly and easier to finance alternatives.

“less costly and easier to finance alternatives.”

… which is … natural gas I presume? Or coal? But even some Republicans are now saying that they expect some kind of carbon tax to be imposed sooner or later. And natural gas prices will most certainly at least double in the next 60 years, in real prices. If I were a ratepayer in that area, I would be very happy to pay the CWIP in return for permanently low electricity prices with no risk from co2 taxes or expected natural gas price volatility that is already baked into the cake.

Moreover, as a ratepayer, I would write to responsible bodies to urge them to support the new-build and help prevent delays. I would show up at anti-nuclear demonstrations and a pro-nuke and help fight the spread of FUD, etc. Any ratepayer that knows what is good for him will be happy with the CWIP and will support the nuclear new-build, if only for the children. Only short-termist, selfish, natural gas cornucopeans would find fault with this project, I think.

Powerplants are going to see competition from both LNG exports and CNG/LNG trucks; there are no fewer than 4 Shell/TA branded LNG stations going into Florida, with Flying J and Petro no doubt doing the same. A full shift of heavy trucks to NG fuel would increase NG demand substantially, and likely eliminate the current surplus. Gas-fired base-load plants cannot compete with NG at even $8/mmBTU, let alone the $12-14 likely to prevail if N. American prices rise to parity with world prices. Nuclear is going to be a cash cow.

An aside energy economics thing;

It’s amusing to me how most people in here NYC metro — even in low income areas — will opt to pay more for $$ bottled water and $$ organic veggies and $$ “free range” meats “because you can never pay enough for health” over plain old standard stuff, but have qualms about paying just a little extra for an electric bill for an environmentally clean and publicly healthy (in normal operation AND rare accidents) low-footprint and often inconspicuous power source. Just thinking such quality of life factors fits into the plant building equation too…

James Greenidge

Queens NY

The official budget for VC Summer is $10B for 2200 GW. Where are they getting costs will double when post first of a kind costs generally drop to half which is the cost the Chinese are building their first of kind AP-1000 plant?

Even in 3rd world UAE with no industrial capacity, Korea is building plant for less than the VCSummer cost.

Note not a single gas power plant would be built if owners had to guarantee the input price of fuel for 60 years like nukes in effect do. With the current crop of Big Oil corrupted regulators these sharks just build the dirt cheap gas plant and pass the gas price costs on to the rate paying sucker while tacking on a 15% gratuity needed to satisfy the graft.

Keep in mind that the price of gas will shortly be heading to its cost at $10/mcf having recently hit $33 in New York,

Big Oil owns our media and all our politicians. It’s that iron grip more than just the stupidity of the nuclear utility that stops nuclear construction.

In 20 years the West’s third world bankrupt ghg spewing economies will be running on 40 cents a kwh wind and 90 cents a kwh solar but getting all its energy from 17 cents a kwh gas, while the BRIC country’s zero GHG populace will be laughing at our dumb butts while running their prosperous country on penny a kwh Gen IV nuclear.

Our conned butts. They will be laughing at our conned butts.

We will reap what we have sown, and we have sown the whirl wind.

“In 20 years the West’s third world bankrupt ghg spewing economies will be running on 40 cents a kwh wind and 90 cents a kwh solar but getting all its energy from 17 cents a kwh gas, while the BRIC country’s zero GHG populace will be laughing at our dumb butts while running their prosperous country on penny a kwh Gen IV nuclear.”

“We will reap what we have sown, and we have sown the whirl wind.”

No, no Paul! You got it all wrong!! It’s — “We will reap what we have sown, and we have sown the wind mill!”

Gotta be PC you know! 😀

James Greenidge

Queens NY

Ha! Ha! James, that’s good! Perhaps not exactly what St. Paul had intended to write so long ago, but he would have approved of your sense of humor! 😀

Where is this quote from (it seems to be in several locations on energy related blogs)? Is it some some true believer creed or mantra, crowd sourcing misinformation and deceit at every turn? Where do we get 0.40/kWh wind and 0.90/kWh solar? Or 0.01/kWh nuclear? I thought we were talking “cost aware” analysis, and not made up apocalyptic or anti-science conspiracy?

15 cents a kwh cost of wind (13.5 cents ontario tariff), 8 cents a kwh 5 times sized transmission cost ( new england iso study), 17 cents a kwh gas backup (Ontario agreement with TransCanada). Solar add 50 cents with 10 cents for 7 times sized transmission and same gas backup (Ontario tariff solar 60 cents /kwh)

@seth. Ridiculous. FIT is a financing scheme (front loaded to pay off the cost of investment more quickly), and is not comparable to market rates for energy. It’s specifically designed to provide greater security to investment returns on new developments in developing markets. The only transmission costs added to a generation project are to connect it to the grid (all energy resources benefit from the grid, not a single development). And you can’t charge the cost of other generation on the grid to solar or wind. A MW is a MW (last time I checked). You get a small efficiency loss from operation of spinning reserves, and nothing more.

Over the last four years, cost of energy for onshore wind has had a median value of 0.06 cents/kWh (in 109 projects on the open source database provided by DOE and NREL). A high cost of 12 cents/kWh. Solar PV (74 projects) has had a median value of 0.28 kWh (with different technologies and solar availability in the mix). The Ontario electricity market is a unique anomaly … and many folks are paying much higher rates (nuclear included) because of years of mismanagement and a failure of the market to cover actual cost of energy for decades. There are several large scale energy developments in the Province in the near term (coal phase out and nuclear upgrades), and they are rapidly adding capacity to cover the anticipated shortfalls once these programs go into effect. It will be decades before rates and the market stabilizes in the Province.

Hmm. I’m willing to bet that you, EL, have never worked in or near the control room of a grid control center or of a power station of any significant size. If you had, you would know that a MW when you need it is worth far more than a MW when you don’t need it.

So what if onshore wind costs 6 cents a kWh, if it’s not there at all when grid dispatch needs it? Useless as a chocolate teapot. Any supplier of dispatchable power needs other generation in his portfolio, typically open-circuit gas, with which to balance his fickle wind or solar at a moment’s notice. Capacity that is typically half as efficient as a modern combined-cycle gas turbine. Capacity that would not be needed at all if the supplier had not lumbered himself with unreliables.

Your figures are not comparing like with like. It doesn’t surprise me at all that the overall cost of *dispatchable*generation that includes wind is well on the way to the cost of the gas backup. How could it be otherwise when the capacity factor of wind is 20-30% and serenely disregards the awkward detail of when it’s actually needed?

Ontario is not a developing country. FIT rates are established at the minimal levels necessary to attract the investment . In any case, the largest/latest wind farm in the US – Shepherds flat came in at 15 cents a kwh.

You are quoting subsidized grid pricing under RES not unsubbed construction cost.

Derp.

A windmill generates avg power of 20% peak. Transmission facilities are needed for peak.

More derp.

Wind uses inefficient OCGT plant running up and down with every gust to balance the load. Less gas less GHG using efficient CCGT plant.

My advice – learn to read before posting.

The price paid by a utility for windfarm-generated electricity is driven up by state mandates that XX% of a utility’s power come from “renewable sources”, usually explicitly defined to exclude nuclear or large hydro. The $/MWH would probably be higher, except that (1) utilities understand that this is intermittent, unreliable electricity (how much would you pay for a car that ran “sometimes”?), and (2) the PTC (and extinct Sect 1603 30% grants) provide a cushion to the windfarm operator.

@Seth. No I’m not. LCOE is unsubbed construction cost and assumptions are provided on the site.

Source please!

I get 12.2 cents/kWh using CF provided by Caithness and NREL’s LCOE calculator (25 years, 8% discount, $2367/kW capital cost, 24.2 capacity factor, $37/kW-yr Fixed O&M, 0 variable, 0 heat, 0 fuel).

Please don’t do that again. It’s really annoying. If you have better facts to provide you are entirely free to do so. So far, I haven’t seen any.

@EL,

The NREL database itself has the following disclaimer:

The data gathered here are for informational purposes only. Inclusion of a report in the database does not represent approval of the estimates by DOE or NREL. Levelized cost calculations DO NOT represent real world market conditions. The calculation uses a single discount rate in order to compare technology costs only.

So it is not to be used as a tool for cost comparisons. And this subject has been discussed in past posts, maybe not with you but others.

Additionally NREL is a cheerleader for wind and sun funded by the US taxpayer and AWEA. They also self-reference in the database. They use their own reports for various cost issues but very few of their white papers are actually based on real-world situations.

If the database is truly open then why use their own research for the backbone? Why not go out and get widely used reports or commission more independant reports? Why does the database use their report from 1995 as their main mechanism for economic evaluations of energy sources?

Point is that any data used from that “open” source database is suspect in my viewpoint and should not be used for real world market conditions as its own disclaimer recommends.

Indeed. Their disclaimer does suggest database should be used for informational purposes only. I agree with your assessment. Variable discount rates, capacity factors, labor costs, fixed costs for large and small developments, local market rules, etc., are some of the many factors that pertain in real world market conditions (and are not fully captured by baseline LCOE estimates). And subsidies and RES in different States are irrelevant to the estimates in the database. So what numbers do you think are better?

DOE wind market report shows levelized PPA prices in $30-40/MWh range (which are very competitive with wholesale power prices with PTC and regional market supports in the mix). They report installed project costs in 2011 at 2,100/kW (anticipated to drop further in 2012), and capacity-weighted average energy or sales cost at roughly $74/MWh. The most current cost of energy surveys from LBNL and NREL are here (with and without subsidies). Wiki has links to other sources, some of them already quite dated (EIA, International Agency for Energy and EDF, California Energy Commission, CSIRO in Australia, RWI in Germany, and others).

I take you will agree with me that the unsubstantiated numbers provided by seth are rather fanciful and unimpressive (and have no objective basis in any of the research reports cited above, or anywhere else for that matter).

Database originates from Open Government Directive to provide more transparency and easy access to government sources of information on-line. Given this charge and mandate, it seems entirely appropriate to provide NREL and other sources of government research and empirical studies. It seems to have been designed specifically for this purpose (with government references serving as the backbone).

@EL,

No I do not agree with your comment about Seth’s numbers. His numbers may not be 100% correct but they do factor in the cost of FIT’s which makes them more accurate in my opinion then numbers from people or organizations whose primary goal is to push wind and solar.

NREL is not an objective source in my viewpoint as I stated already. So I will not look at an NREL source unless it is to understand what latest twist of wind, solar energy efficiency techniques they are attempting to push at taxpayer’s expense

And I also do not accept the other DOE links you provided. They are also wind cheerleaders in my viewpoint. Their primary function is to push wind power onto the US grid which they state right on their main webpage.

These links you keep supplying do not quantify the effect of the various subsidies as they should in my opinion. They typically gloss over the fact that all types of FIT’s, subsidies and legal requirements affect power generation decisions at the boardroom level. And these numbers and legal requirements are important to consider even if you don’t believe so.

Your sources aren’t sufficiently independent to provide defendable numbers due to their goals of pushing more wind and solar onto US grid. They have been given access to US taxpayer money to push wind and solar, not to provide non-biased numbers and cost figures.

The only source that might be objective is the EIA but I have not seen them publish real time cost numbers. They only publish levelized costs for 2018 in their latest annual report. However those numbers are based on advanced nuclear (which has yet to be built so this number is speculative at this point) and simple averaged capacity factors for wind and solar which differ widely across the nation as they state. However they do differentiate between dispatchable and non-dispatchable which is a subject that NREL and DOE try to avoid discussing.

http://www.eia.gov/forecasts/aeo/electricity_generation.cfm

But even the EIA’s numbers are not 100% accurate and are generalizations of several factors that must be considered. The difference between your sources and the EIA is that at least the EIA acknowledge these issues up front in their long list of disclaimers which I have pulled several for this discussion:

The availability of various incentives, including state or federal tax credits, can also impact the calculation of levelized cost. The values shown in the tables in this discussion do not incorporate any such incentives (emphasis is mine)

Policy-related factors, such as investment or production tax credits for specified generation sources, can also impact investment decisions

Conceptually, a better assessment of economic competitiveness can be gained through consideration of avoided cost, a measure of what it would cost the grid to generate the electricity that is otherwise displaced by a new generation project, as well as its levelized cost….. Estimating avoided costs is more complex than for simple levelized costs, because they require tools to simulate the operation of the power system with and without any project under consideration (emphasis is mine)

Think about it this way from my standpoint as one who has supplied cost numbers on a small hydro job. If you had to decide what power source to build but the government was telling you that your organization will be fined if it did not meet the legally mandated 20% RPS requirements AND they were willing to hand over a grant of $X millions for your organization to build a legally defined “green” energy source what would you do?

You would be hard pressed to walk away from the free government money. You would also have to explain to your board of directors or public oversight committee that they would have to pony up more money out of the company coffers to build the new facility AND get ready to be fined for not meeting state RPS requirements.

So yes government fiats of the RPS requirements and free money supplied at taxpayer expense affects the decision making process of many boardrooms despite your belief they do not.

This discussion goes in line with my other discussion about how to level the playing field to make nuclear less costly. RPS requirements, avoided costs (which is a discussion wind and solar advocates avoid) and policy factors are issues that penalizes nuclear while promoting small, inefficient, intermittent power generation sources, some that are in violation of federal animal protection laws.

http://bigstory.ap.org/article/ap-impact-wind-farms-gets-pass-eagle-deaths

With all due respect, you haven’t described FIT programs very accurately or very well. Many programs have digression schedules (such as those in Germany). In Germany, the FIT rate on all projects decreases at least by 1% each month (as much as 2.2% in some instances). The initial offer price is not the cost of energy for these developments.

Ontario is unique in many ways. The initial offer price was very high to stimulate the build up of local manufacturing capacity in the Province (the program includes high and every expensive domestic content requirements). They are 20 year contracts (40 years for hydro) that revert to the market rate at the end of the period. Cost of energy is typically averaged over operating lifetimes (and not FIT contract periods). And yes, seth has given inaccurate numbers for FIT contract prices in Ontario: Wind (11.5 cents/kWh), Rooftop Solar (48.7 – 54.9 cents/kWh depending on size of project), Groundmount Solar (34.7 – 44.5 cents/kWh dependent on size). For cost of energy, I would give 25 years to wind, and 30 years to solar PV (as nuclear advocate Peter Lang has done here).

If you’re going to exclude sources such as DOE, LBNL. NREL, EDF, French Energy Institutes, US State Energy Commissions, RWI, CSIRO, and EIA (with qualifications) I’m not sure what that leaves us with (for nuclear, wind, solar, or any other generation technology). How are we to do resource planning if all we can look at is industry generated statistics, usually proprietary, for projects that have already been completed in the past? You really don’t think there is anything worth considering or using for informational or resource planning purposes from any of these departments and agencies (regardless of topic or focus of study)?

Who’s not talking about avoided costs? I’ve seen several studies (particularly for non-utility generation) on this basis. Idaho uses “avoided costs” as a compensation tool for independent power producers (wind and solar) on projects smaller than 100 kW (10 MW for non-wind and non-solar IPPs). The challenge from a resource planning perspective is that not all energy resources are the same. Grid reliability, public safety, consumer acceptance, investor interest, variable costs, efficiency and conservation of non-renewable resources, construction timelines, manufacturing capacity, environmental impacts all play a role. If avoided costs were the only variable in the game, wouldn’t we be just fine with a hydro and fossil grid (and little else). Perhaps a smidgen of wind (since it seems to be next in line at $74 – 96/MWh, no subsidies, and dropping).

@EL,

Yes I am going to disregard cheerleading sources. End of discussion.

Oh wait … maybe not… just one last point about your NREL resources …Even the DOE themselves are now announcing they are going to revisit their 2008 wind study to apply current market conditions because they are now acknowledging they promoted wind power in 2008 instead of studied it.

http://nawindpower.com/e107_plugins/content/content.php?content.11502

Mr. Zayas is incorrect about the effects of energy efficiency versus the effects of the economic issues in lowering energy usage and he is not truly turning over a new leaf about windmillls. But at least he is now admitting that the DOE should only be studying, not promoting, wind going forward. That is about the best acknowledgment I suspect that this administration will take as far as stepping back from promoting one energy source over another at this point in time. The question is if the DOE will actually take this step or if this is a trail balloon to see if the AWEA pushes back since EERE has historically been the dog being wagged by the tail of energy efficiency “experts” and AWEA.

My comment was not to discuss FIT’s as you are now trying to state. That is you trying to change the direction of the discussion. My comment was to critique your sources of information as being cheerleaders for wind and solar.

But since you asked, FIT’s are subsidies plain and simple. They are direct transfers of money from one party to another. You can claim that they are needed for developing solar and wind. I disagree. There were other methods such as tax breaks, grants, government sponsored collaborations, etc that are commonly used for other nascent industries. But instead solar and wind lobbyists wanted taxpayer cash. So FIT’s were instituted which I consider to be a direct raid on a country’s treasury (i.e. taxpayer’s wallets) to line the pockets of a few companies and individuals.

FIT’s and PTC’s should not be needed for a mature technology but AWEA and sun lobbyists keep clamoring for them. Dr. Chu himself stated wind is a mature technology so let’s end FIT’s, PTC’s and other forms of direct cash subsidies for wind and solar.

However, I suspect that the markets for wind and solar would dry up fairly quickly since that is THE major economic aspect in their favor. They were able to slip in another $12 billion back into the US government expenditures this year by legislative shenanigans. Subsidies no matter what they are called are the reason the wind industry is going gangbusters building this year to ensure they qualify for the PTC’s since they are very concerned next year the trough will run dry.

And you are the one avoiding my comments about the EIA data, the fact that yes – government policy affects utility boardroom discussions, the cuisine art aspect of windmills and my attempt to have you think outside your box by considering yourself in a decision making role for a utility company.

You are now deflecting the debate by providing new sources of data instead admitting that the original sources you provided are substandard to this level of discussion. The sources you first submitted do not discuss avoided costs so don’t try to change the discussion by sidestepping with new sources.

However it is interesting that you mention Idaho since they have been doing battle with FERC about PURPA which, for now, FERC is winning but Idaho’s case will gain strength over time since it based on the cost to its ratepayers not the survivability of wind and solar producers.

http://www.puc.state.id.us/internet/press/032613_FERCNARUCresponse.pdf

Finally I am not discounting EIA data as you stated that I am. I am pointing out that their data set might be the only place to start with to discuss relative system costs by showing you how they qualify their data. The EIA are not in the business of promoting energy sources, only gathering data. There are reservations I have about EIA’s ability to foretell the future but they are about the closest source of independent data out there. If you don’t like their qualifications take it up with them but then you will be fighting an entire economic system not just arguing with nuclear advocates such as myself.

This discussion is about making cost decisions concerning utility systems for the US not Europe or Canada and a good starting point is needed. Your initial data is advertised as the ending point for system discussions but as I have shown that data is not even a good point to start from since the sources don’t even begin to dive into the true system costs of a 24/7/365 functioning grid. Continued attempts to bring in new data indicates a shift in your arguments and I will take that as acceptance that my original points have been proven.

Huh?

By current market conditions, they appear to be referring to wind energy’s ability to scale very rapidly, improvements in turbine technology (allowing for better performance in less than robust wind resources), “less foreboding” challenges to transmission adequacy than “originally thought,” and changes to macroeconomic forces (namely, energy efficiency and slowing down of demand growth). So yes, I’m glad you embrace this effort, and redoing reports for advancing and rapidly developing technologies from 2008 that are already out of date.

Again. You haven’t really described FITs very well or accurately. FITs involve zero expenditures of taxpayer generated funds. You say you prefer “tax breaks, grants, government sponsored collaborations, etc” for new technologies and developing market support. These are taxpayer generated funds. So your critique isn’t really very well argued or very clear.

In fact, I’m having a little trouble following your critique. It has something to do with eagles. Since we have thrown out all reports on the matter (from the long list of agencies and departments mentioned above … EIA being the exception), I really don’t know where we can take the discussion at this point? The best I can tell, you seem to be saying AWEA is controlling the process, dictates public spending and government sponsored research programs and agencies, and that public utilities are captive to their lobbying interests and stakeholders? I find this pretty far fetched and unrealistic. AWEA barely got it’s PTC extended for another year. They are a small player in Washington. Onshore wind is going to be fine without it’s PTC. Historical figures for energy subsidies on renewables remain small. With nothing left to study the matter, I guess the only source of information left standing is unfounded conspiracy theory … I suppose we can speculate on that indefinitely!!

@EL

FITs involve zero expenditures of taxpayer generated funds.

Fine. Call them “ratepayer” funds. It is very rare to find a taxpayer that is not also a ratepayer or a ratepayer that is not also a taxpayer. On a Venn diagram of groups, there is almost complete overlap between the two.

In both cases, the source of the funds is someone who is compelled by government edict to pay the price of government action.

Please remember that FIT stands for Feed In Tariff. In nearly every case I can think of, “tariff” is a synonym for “tax”.

@EL,

Yes I am always for revisting reports that were cheerleading the effort to switch our grid system from solid, proven baseload system to a weather dependant system.

And as I said in my original comment, Mr. Zayas hasn’t turned over a new leaf nor would I expect him to. His job is to support wind and other non-traditional energy approaches. His commentary leaves much to be desired but the fact that he stated DOE/EERE will now study wind versus promote wind is a different tone then in the past few years.

I still don’t think you get it on FIT’s. This isn’t magic money. It doesn’t just fall out of trees. That money is coming from the government coffers or ratepayers and is going to a few companies and individuals. FIT’s by their very definition require someone to pay higher then retail power rates. That money just dosen’t appear magically. Someone has to pay it. The ratepayers or the government or both pay when FIT’s are implemented.

Tarriffs are supposed to rachet down over time as the technology advances. How many times has that happened for wind or solar? It took a financial crisis in Germany for them to rachet down their solar tarriffs and it took a similar financial crisis here in the US for wind and solar groups to wake up that the trough of taxpayer cash is not endless.

Tax breaks are not cash payouts. 1603 grants are literally cash payouts. PTC’s end up being cash payouts since they are based on power produced not capital costs of the wind generators.

Yes AWEA has provided money and support to NREL for wind reports. Nothing new to report here. Plain to see on some of the NREL wind reports how the NREL people acknowledge the support from AWEA.

Onshore wind is not going to be fine. That is why AWEA got members of the Congress in wind heavy states to slip the $12 billion back into the US budget at the last minute. Otherwise the money would have been forced to a floor vote and may have been defeated. AWEA is the lobbying arm for several wind mill suppliers. They stood to lose millions if that $12 billion was not added back in.

And I am not surprised you are having problems following my criticism about the killing of eagles. Most wind advocates are having problems realizing their favorite electricity generation source is given special consideration for killing eagles while fossil fuel companies are fined. It is hard for them to comprehend that a supposedly “green” source of energy is doing environmental damage and is in violation of the federal animal protection acts.

The point being that IF wind power were held to the same standards as fossil or nuclear facilities every wind mill would need an EIS before it would be allowed to generate one more kw-hr of power. All wind production should stop while EIS’s are prepared to deal with the killing of eagles but that isn’t happening because people appear to be are okay with the idea that eagles are dying from collisions with windmills. I am not and will continue to bring this point up to every wind supporter when they preach to me about the evils of nuclear power.

Also no conspiracy to my comments. Just a case of following the money. Who gets it, where it comes from. So don’t belittle my comments by trying to paint me with a conspiracy brush.

End with that note we are done with this discussion since you have declared me a conspiracy theorist. No more useful discussion will occur at this point in time unless you are willing to truly look at the money trails.

Is there anything I described incorrectly? It’s my understanding the money comes from ratepayers (for a service that is delivered and has high public acceptance), and not trees or taxpayer generated subsidies. And it doesn’t go to just a few companies or individuals (as it would for a project that is highly concentrated in a single location). It’s benefits are broadly distributed (just like the resource itself). It benefits producers of locally manufactured content, local contractors during construction, shares owned by local residents and businesses, lease payments to local landowners (typically in range of $3,000 – 5,000 per turbine per year), boosted local tax revenues (primarily municipal and state), local job and training opportunities, and more. FITs often provide opportunities that wouldn’t otherwise be there for local residents and small community groups and businesses to become owners and operators of their own power generation equipment (and at no additional cost to the government). And the development and financing of these projects is typically entirely private, and over time adds to the public treasury (rather than takes away from it).

So yes, I think once again you have not described FITs very well or accurately. Particularly as concerns impacts on “a country’s treasury”, and benefits to companies and individuals (which you seem to think primarily benefits “a few” large legacy producers and special interests in the industry). If you know anything about Germany, and how FITs have sidelined major utility giants, you might think twice about your statements (with respect to being more informative, but also moving away from your baseless conspiratorial claims).

@EL : If your description of FIT was correct, to pay someone to dig a hole, and another person to fill it would be a *very* efficient way to boost the economy.

The correct way to measure the dynamism of a sector of economy is to count how much useful goods it’s able to produce per unit of money invested/person employed. As renewable needs more money to generate the same amount of good (electricity), they’re dragging the economy down.

Imagine you’re a shoemaker, and need 1 employee and $10 to make a pair of shoes. Your client can spend $10 on a pair of shoes, and then $10 to go to the restaurant where his spending employs a second person.

Now, somehow things change and you need 2 employee and $20 to make a pair of shoes.

Your client will spend $20 on it, and have no money left for the restaurant. The restaurant will have to let go his employee.

Employment didn’t actually grow since the new employee you’re hiring is the one the restaurant had to terminate.

And people have a lower standard of living, because where they could both buy a pair of shoes and go to the restaurant, they now can do only the first.

About Germany, sidelining the major utility giants was unambiguously a bad thing. They are the ones with the big pockets to finance long term projects, and pay people full time to build the future of energy generation.

If it didn’t also have very cheap lignite which is still generating a majority of it’s energy, the choices Germany is doing currently would be suicidal.

@EL,

Definition of a hypocrite: a person who acts in contradiction to his or her stated beliefs or feelings

You have indicated that name calling is not acceptable behavior in your vigrous and numerous complainants in other articles on Rod’s blog.

However your actions over the past few posts speak louder then your words.

By labeling me as a conspiracy theorist while loudly complaining when your were labeled are the actions of a hypocrite.

You are now in with the catagory of other anti-nuclear advocates I have come across. The ones who consider themselves morally superior to nuclear advocates but resort to the low road when faced with the weaknesses of their preferred power generation sources.

So to conclude, your actions of labeling me are an indication that: a) the points I raised are ones you have questionable experience to debate and that b) because of that questionable experience, you have nothing left in your box of debating tricks so are running to hide behind name calling.

Not in the least. I haven’t called you anything. I’m up for a substantive and objective debate on anything you wish? I don’t find it particularly illuminating to engage in conspiracy thinking on the power of the AWEA (which I consider to be fairly weak), or dismiss most empirical and objective research on renewables on the basis that it may be favorable to renewables (which you label as “cheerleading”).

You’ve simply defended the indefensible (as far as I can tell): plain inaccuracies presented by you and seth on FIT pricing schedules (which are fairly easy to confirm or disconfirm), their relationship to energy costs (when viewed from a perspective of all other sources of information including the EIA), and your conspiratorial charge that resource planning decisions are made with respect to bias, special interest lobbying, and an agenda to fleece the taxpayer and raid the public treasury. I don’t find these statements to be illuminating, or very well argued or substantiated in your comments. On a purely factual and objective basis, I also find many of them to be incorrect (and easy to point out as such).

To be clear, I have called your “arguments” (claims and statements) to be based on conspiracy, to be unfounded (as they appear in some instances), or lack an objective or verifiable basis (not “you” as a person). Especially so when you throw out most relevant empirical and objective studies on the matter that may be used to engage with substantive and objective issues, or even answer some of your own rebuttals (no less). I fully welcome your critical and analytical comments on my posts. If I have stated anything that is factually incorrect, I would hope you would point this out as well. If you have better sources than the one’s I have offered, please provide them. If you think I’m not sufficiently critical of renewables or other energy resources (and their relative costs and benefits, advantages and disadvantages, short term prospects and long term potentials), let’s have that discussion and be as open minded and evidence based as we can be. This doesn’t make me a hypocrite. It makes my arguments (claims and statements) fair game.

And yes … I fully agree with you, and believe like yourself that emotional and personal attacks are as you suggest (a pretty good sign that someone may have lost the argument, and the relevant substantive issues are no longer being debated).

Germany has remained competitive by focusing on high end consumers goods and a highly skilled and well paid workforce, and not on low labor costs. Are they an anomaly?

Renewables compare well with fossil fuels on labor intensity (they are not as mechanized or capital intensive). They scale quickly, are not financed with high debt loads, and have fast rates of return (compared to nuclear). Energy costs are competitive with modest subsidies, often contribute to stabilizing wholesale prices and lowering of peak energy rates, and are getting more affordable (as other energy resources are getting more expensive). And global trends may likely benefit early investment in higher cost renewables (and manufacturing capacity) in terms of longer term benefits, declining costs, and the business cycle.

I don’t necessarily accept your premise they are dragging down the economy. They appear to be a bright spot in some respects, sopping up lots of cash that is sitting around in banks, offshore accounts, and hedge funds … brought out of hiding in financial services casinos and put to use to promote business activity (a benefit by any measure).

I linked to a story below about a bankruptcy filing (here and here) that may be looming in Texas by the private owners of Comanche Peaks. They are being constrained by the high debt load that comes with a 40 – 60 year long term bet on nuclear (and a business climate that is constantly shifting with looming technology shifts, environmental regulations, and evolving market design in the coming decades). For them, the bet was a poor one, and high debt is dragging down their ability to respond to new opportunities.

There are several ways to look at the concerns that you have identified (and the micro economics of productivity, holding today’s business climate static, is just one of them).

@EL

Germany has remained competitive by focusing on high end consumers goods and a highly skilled and well paid workforce, and not on low labor costs. Are they an anomaly?

Methinks you answered your own question. How sustainable do you think a world economy can be if all countries focused on high end consumer good produced by a highly skilled and well paid workforce? How many “high end” consumers are there that can afford BMWs and Mercedes?

You also ignore the underlying unemployment and the electric power rates for consumers that are 4 times what I pay here in Virginia. Sure, I use a lot more electricity per year than the average German (or American) consumer, but I like the comfort of a large home, a couple of refrigerators, big screen TVs, large washing machine & dryer, and a fast responding electric stove. Even with all of those conveniences, my electric bill is about 5% of the total ownership cost of my home.

Rod – If you think about it, you’ll realize that this is part of the problem.

I know where you live, and I know that you can get a lot of bang-for-your-buck when it comes to owning a large home. Furthermore, I know that a comparable home in other places — say four hours to the north, where many policy-makers live — is far more expensive. Thus, 5% of the total ownership cost of their home would be a lot of money to you and me, but they probably see it the same way that you do — 5% is not much. To them, paying 4 times what you pay for electricity is no big deal.

This reminds me of the time I spent promoting nuclear power at an Earth Day event in Charlottesville about a decade ago. I remember talking to a middle-aged woman about the social and economic benefits that come with having access to affordable energy, which nuclear power could provide. She disagreed. She was staunchly in favor of “renewable” energy and even went so far as to claim that she didn’t mind paying 10 times as much for her electricity as she does now.

One glance at the jewelry that she was wearing was enough for me to realize why she didn’t mind.

@Brian

Since I lived the DC area for the 12 years before moving to our lovely city, I know what you mean about our communications challenge.

I guess part of my advantage (or disadvantage) is that I have also had personal experience that helped me to understand the importance of electricity as a manufacturing input. When I ran a small plastics products factory that make things by heating plastic and injecting the molten fluid into a mold at high pressure, the highest paid “employees” were the two feeds from the local power company. They each made about $5,000 per month in a factory with a total annual revenue of about a million dollars.

When running that factory, I also met some terrific people who worked very hard and did not make anywhere near as much money as I do now. A cost that is “no big deal” to me or to many policy makers would be HUGE for them.

We need cheap energy that is also clean. That product threatens the wealth and power of influential people, but there are so many more beneficiaries that it will eventually happen. However, I hate the passive voice, so I am actively working to make it happen as soon as possible.

Brian,

Similar story.. Talking with a co-worker about 4 years ago who was on the admin side of the non-nuclear utility company in the Pacific Northwest where I was working under contract at the time. The subject was the on-going debate about the off-shore wind facility in Massachusetts otherwise known as the Cape Wind Farm (BTW, I really hate the term “farm” used to describe an industrial wind facility.)

Anyway this co-worker was upper middle class, intelligent, and had relatives that just happened to live in Massachusetts who were doing well for themselves but all were anti-nuclear. We would have some good discussions about power generation issues on a regular basis. So we got to talking about putting in an off-shore wind facility as a first-of-a-kind project.

I asked him what his relatives thought about their power rates tripling or quadrupling to support the wind facility since it looked like things were heading that direction.

Response: Well..they can afford it since it is green energy and helps the planet.

Okay…. next question…..What about the low income rate payers that happen to live in Massachusetts? (as an aside – his office was next to the low income assistance office in our office building. So he would pass by that office more then a few times every day and see those that were unable to pay their bills)

Ans. That is what the low income assistance programs are there to do. To help the less fortunate.

Okay…. 3rd Q:. You realize that if the power rates go up that significantly then the state sponsored assistance funds will need additional money to help those in need and on top of that more people will qualify. That may mean taxes will need to go up to keep the assistance plans funded. It also means the utility companies may need to raise more money for their own low income funds as well. So how do your relatives feel about their taxes being raised to support the low income assistance funds?

Response: Well that is expected and the federal wind subsidies should help pay for that as well.

Hummmm……interesting idea…but you realize that federal wind subsidies are coming from all of us (we were in a group of about 7 at that time).

Response: What do you mean?

I mean that WE fund the federal subsidy programs through our tax dollars. So that means WE would end up paying a very, very small portion of that off-shore wind facility based on your idea.

BOOM….Light went on…He understood his GCE* about energy tax and tariff issues that he and I had been discussing for some time.

Needless to say he was not happy with me about bursting his myth balloon about how the governement is financially involved with wind and nuclear generation. Our few conversations from that point on were businesslike and professional but we never had another debate about power generation issues again. Which was actually too bad since he was knowledge even though he several blind spots.

* GCE = Gross Conceptual Error for those that are not used to seeing that acronym.

Bill – Your co-worker must have been an intelligent guy, because you were eventually able to get through to him. Most of the people that I have encountered with the kind of preconceptions that you describe never would have made it that far — and it wasn’t for lack of trying on my part to explain it to them.

The attitude of being willing to pay more for electricity that comes from a source that is “saving the planet” is all too common among the upper and upper-middle classes in rich, industrialized Western countries. This is why I have been calling electricity from wind turbines and solar panels “boutique power” for years now.

It’s even marketed like boutique products. Notice that electricity from wind doesn’t come from an industrial plant or facility, it comes from a “farm” like fresh tomatoes. This is sleazy marketing at its most cynical and effective.

What these spoiled yuppies rarely stop to consider is that not everyone can afford to shop boutique for their essentials, and when the government steps in and buys boutique for them, then everybody pays additional hidden costs, and the economy as a whole suffers.

Did you explain to him that “average” wholesale prices can be reduced by lowering energy costs with additional supplies, and more importantly lowering peak energy rates with additional supplies from power purchase agreements that may be above the wholesale market average?

This is what studies show on the impact of Cape Wind on regional market prices in Massachusetts and New England (and the cost benefit for consumer across the income persepctive).

http://www.capewind.org/downloads/CRA-Updated-Cape-Wind-Report-29Mar2012.pdf

Charles River Associates have done two studies on the issue. The most recent suggests: “With Cape Wind in service, over the years 2014–2038, the price of power in the New England wholesale market would be $1.86/MWh lower on average.” For Massachusetts alone, the impact is estimated to be greater, and represents a $1.95/MWh savings. For the years modeled in the study (with no carbon prices in mix, and projected natural gas prices from EIA in 2012), the aggregate savings are estimated to be $7.2 billion over 25 years. Greater if natural gas prices rise above projected levels.

Hmm … wholesale electricity prices drop by $1.95 per MWh. You don’t say?

Meanwhile, the federal government loses $22 of tax revenue for each MWh produced by Cape Wind. So, while the wholesale rate payer in Massachusetts saves two bucks, the tax payers all over the country lose twenty-two.

That’s surely a sweet deal for somebody, but not me.

You do realize, don’t you, that in a region like New England, with an energy market that has limited access to low-cost baseload power, any additional generation capacity with low marginal costs is going to drive down the wholesale price of electricity.

Do you have any idea what would happen to the wholesale price of electricity if someone were to add a merchant AP-1000 nuclear plant to the market? I guarantee you that the price would drop far more than a tiny 0.2 cents/kWh.

A “savings” of $1.95/MWh is absolutely nothing. It’s completely dwarfed by fluctuations in the market due to the price of fuel, particularly natural gas. For example, according to ISO New England, the wholesale price of electricity in New England dropped by $10.59/MWh in just one year, from $46.68/MWh in 2011 to $36.09/MWh last year.

If I lived in New England and cared about the price of electricity, I’d be out campaigning for fracking and I’d say screw Cape Wind.

@Brian Mays. Glad we agree that Cape wind is not going to triple or quadruple energy prices in New England (as incorrectly suggested above).

Not correct. PTC is for first 10 years of production (not the entire life of the project). The cost to you is nothing. As you suggest, the lost revenue in federal taxes is some $332 million (at 38% capacity factor). The benefits are $7.2 billion in aggregate cost saving for consumers, 805 construction and manufacturing jobs, and 154 direct permanent jobs in New England. In addition, we finally get started on an offshore industry, and technology development, training, and manufacturing that comes along with it.

If someone wants to build a merchant nuclear plant that will be up and running in 5 – 15 years in New England (with a 40 – 60 year investment horizon), I’m sure there are plenty of good reasons to do that as well (if financing, siting, lower competitive costs, and other concerns can be arranged).

No, that’s according to one study that was commissioned by the company that wants to build the facility. You have to apply the qualifiers. Unfortunately for dreamers like you, reality rarely follows the rose-colored conclusions of such optimistic studies, so no, I don’t agree with you. My opinion is that the jury is still out. The optimistic projection shows a “benefit” that is entirely trivial, but it could be far worse.

Considering that the anticipated operational life a wind turbine is only 20 years, I’d say that the PTC covers a hell of a lot. If you want to knock it down to $11 of tax revenue per MWh, then fine. I should point out that’s still over five times the putative benefit to ratepayers that you have suggested. Note, however, that this 20-year estimate is usually given for on-shore wind turbines. It’s unclear today what the real operational life of off-shore wind turbines will be considering the environmental and maintenance challenges that they will face.

Stop smoking crack. It’s not good for you, particularly when commenting on blogs.

So we’re talking about between $100k to $140k per job just from federal subsidies. Hell, why don’t we just take the money and give it to people?!

Sorry, while I don’t mind paying federal taxes, I would like it to go to something more useful than the hypothetical possibility of saving a bunch of a-holes in New England from paying an additional 0.2 cents/kWh in their electricity bill.

Nevertheless, I agree that it would be wise to transition away from burning oil for electricity (and that is what Cape Wind is largely projected to replace). Only technological backwaters like New England, Italy, and other Third-World regions still burn oil for electricity.

Er … 5 to 15 years? Cape Wind was proposed in 2001. In case you haven’t noticed, it’s now 2013. The first-of-a-kind EPR nuclear reactor in Finland was proposed three years later, yet it’s probably a good bet that it will be up and running before Cape Wind.

By the way, that EPR will produce over eight times the amount of electricity (on average) than Cape Wind, even assuming your ridiculously optimistic assumption of an unprecedented 38% capacity factor.

@Brian Mays. 25 year operating life … 38% capacity factor … lower wholesale cost of energy …

These are basic assumptions for offshore wind, and Cape Wind in particular. Crack has nothing to do with it. Just up-to-date knowledge, familiarity with published research and achievable goals (current and long term development program), and in your instance a willingness to be informative and keep to basic verifiable facts. And perhaps one more thing, when your inaccurate and faulty claims are highlighted, to learn from mistakes, and stop fighting back with childish attacks and additional inaccurate and misleading claims.

This is not a very informative way to calculate employment benefits (AP has called it “grade school arithmetic”). I take it you oppose the PTC and direct taxpayer loans for new nuclear on this basis? Cost of PTC (8 years, $19/MWh, 800 direct permanent jobs, 92% CF) for Vogtle will be $177K per job. Throw in taxpayer debt liability to federal budget from loan guarantee and you get $10.6 million per job.

So yes, even for a FOAK plant in US, Cape Wind looks like a pretty good deal for ratepayers, federal taxpayer, job creation, and electricity markets in New England. Unless you want to make up some other numbers to suggest the contrary?

@EL

I’ve sailed in the area where Cape Wind plans to locate. Perhaps my samples are not representative, but I would bet a substantial quantity of money that a CF of 38% in that area is not achievable. It might be achievable in other off-shore areas, like off of the coast of Denmark.

I also spent a few years as a requirements officer (financial analyst) in the office of the OPNAV staff responsible for paying the bills to maintain ships and submarines. I’m pretty sure that a 25 year life for off shore wind turbines is pretty optimistic since the cost of maintaining equipment exposed to sea water, spray, and occasional nor’easters can become quite high as the equipment ages and corrodes. There will be less incentive and fewer available resources to effect repairs needed anytime after the PTC has ended. As I understand it, that money flow stops at the ten year point.

How many permanent jobs do you think an off shore, industrial wind facility will actually create?

Unlike the wind PTC, the PTC that Vogtle and Summer may qualify for was strictly limited and focused at reviving a nuclear plant construction industry that had been dormant in the US for more than 30 years. The total amount of new nuclear capacity that could qualify was 6,000 MW, there is a limit on the total amount per plant, the number is not indexed for inflation, and it could not be used for any plant using technology licensed prior to 1998. (This specifically leaves out Watts Bar II and Bellefonte as potential recipients.)

Once again, I will also remind you that the highly publicized loan guarantee for Vogtle has never been closed. At the recent Nuclear Energy Assembly, it sounded to me like Tom Fanning is planning to continue moving forward without the loan because the government’s offered terms and conditions are far less attractive than what he can obtain in the open market. There is no taxpayer debt liability to the federal budget and that is likely to remain true.

EL – Hey, Congratulations! You found a wind turbine with and advertised “25 year structural life time — outstanding by industry standards.” How long did that Google search take?

An 8 MW Vestas turbine … interesting, but irrelevant. Now what is the expected life time of a 3.6 MW Siemens wind turbine, like the ones that are planned for Cape Wind? I’m willing to bet that they are the (non-outstanding) “industry standard” of about 20 years.

(Aside: Since we’re being so sloppy about equipment, do you mind if I used the advertised statistics for the EPR when talking about the new plants in Vogtle? I’d really like to claim that Southern is adding 3.2 GW of capacity, instead of 2.2 GW.)

Also, since you have no engineering background, I should explain that the “structural life time” refers to the expected life time of the structural components — e.g., the big pole that holds the turbine up above the water. What is the mechanical life time of this turbine? Vestas doesn’t say. What is the mechanical life time of the actual turbines that will be installed at Cape Wind?

All a 25-year structural life time means is that if your mechanical parts crap out on you after a dozen years, you can stick a new turbine up on the same pole and expect that the pole should last another dozen years.

Well, I don’t see where you get that figure from the link you posted, but I am aware that the DOE often uses a ~37% capacity factor (probably at the insistence of the NREL renewable cheerleaders) for some of its projections, but this figure is used for a brand-new plant that is sited in moderately favorable wind conditions. Do you really think that the “farm” will have a 37% capacity factor 10 years into operation, as components and entire turbines start to break down?

The DOE uses 33% as a reference capacity factor for onshore wind turbines, but the experience of countries with wind turbines in Europe tells another story. The capacity factor of wind power in Denmark, Germany, and the UK is always below 30% every year and is typically in the low twenties. An optimistic 38% comes with a huge grain of salt.

I agree that it’s grade school arithmetic, but it is an excellent response to your grade-school thinking of pointing out how many jobs a project to build an power plant will create.

It appears that you have entirely missed the point: the purpose of a power plant is to produce power, not jobs. Ideally, such a plant should produce as much electricity with as few jobs as possible, since that indicates a superior average productivity of each worker. The real benefit in jobs will come by applying the electricity to produce other useful goods and services, and the less companies have to pay for energy, the more they can spend on workers. Why can leftists never figure this out?

@Rod Adams and Brian Mays. Your belief and opinion on these matters (25 year timeframe reported by developers and equipment manufacturers, detailed studies of wind class averages for Horseshoe Shoal, and contract obligations for Southern Company and vendors and proceeding without Loan Guarantee) are duly noted.

154.

As I said: “basic assumptions.” Here’s the same for Siemens. And yes, “structural capacity” refers to “every component” (including nacelle) not just towers (unless you wish to make things up on a forever basis).

Average CF for Danish offshore wind farms in 2012: 44.9%.

You real need to stop making up numbers, and misleading with entirely faulty statements.

EL – Ah … a 6 MW turbine … you’re getting warmer, but still off the mark.

But I suppose you’re excited about where the brochure mentions that it is “possible to verify the structural capacity of every component” through “Highly Accelerated Lifetime Tests on the complete nacelle, simulating 25 years of real life …” Well, I say more about that below.

The nacelle is merely the “shell” that covers the generator, gearbox (if used), etc. When an engineer talks about “structural capacity” it doesn’t refer to a specific component or components; rather, it refers to the ability of the components to withstand a structural load — in this case the high winds that can be encountered during storms at sea — without breaking. It doesn’t refer to the performance of the mechanical and electrical components to do their job of generating electricity, to not catch fire (as they are prone to do), etc.

Furthermore, “simulating 25 years of real life” is not the same thing as stating that the equipment is likely to last 25 years. No competent engineer doing reliability testing would test only to the expected end of life. Testing is done well beyond when the device is expected to fail to understand how failures work for the minority of devices that defy the odds and outlive their life span. All of this is necessary to understand the underlying mechanisms of failure and to get reliable statistics to give a good estimate of when the majority (or other specified fraction) of devices will fail.

Thus, if Siemens is bragging about “simulating 25 years of real life,” then that certainly means that most turbines are not expected to last that long — the standard 20 year life span is a good guess of what they might expect. Their sales staff put in the larger number, however, because they know that corporate executives and people like you, who have no understanding of engineering fundamentals, will get confused and think that the turbines will reliably last for 25 years.

Yes, the data that you have linked to clearly show that capacity factor decreases as the equipment ages. For example, using the 2012 numbers:

New Turbines (age less 7 years): 46% capacity factor

Older Turbines (age between 7 and 14 years): 38% capacity factor

Oldest Turbines (age greater than 14 years): 26% capacity factor

However, I was referring of a larger sample than just 871 MW of capacity (less than the output of one 1970’s-era nuclear reactor; Cape Wind alone is well over half of that). The average capacity factor since 2000 for all of Denmark’s turbines is only 23.3%. The average over the last five years is just 25.5%. This is much less than the 33% that is usually touted for onshore turbines.

This is why assumptions of a capacity factor of 33% for onshore turbines and 38% for offshore turbines are just plain silly. Sure, you might find a couple of examples of fairly new, well-placed turbines that might hit that level or higher, but cherry-picking gives a poor estimate to use for any serious calculations.

Anyhow, this has gone on far too long, and I have already given you too much of an excuse to soapbox. As I mentioned in another comment, I understand that you can dodge and tack and spout nonsense indefinitely. If anyone here were buying the horse manure that you’re spreading, then they would have piped up in support long ago, so I don’t understand what you think you are accomplishing.

But hey … if you want to link to the sales brochure of an Acme 12 GW roadrunner-proof wind turbine because it makes you feel important or fools you into thinking that you have made a valid point, then please go ahead. However, I’m tired and have better things to do.

@EL:about the study just above the author say that the lowering of electricity price will generate indirect jobs, but actually it doesn’t lower the *cost* of generating power in those alternative units, which means their profit margin lowers, and they’re very likely to terminate jobs, which negates this gain.

What’s more, the indirect job generation only exist anyway if the reduction of the market cost is more than the total cost of the PTC and the cost of grid expansion required, which is quite unlikely.

About your answer to my previous post :

Did you ever learn about the Hartz IV reform ? Becoming competitive by lowering labor cost is *exactly* what Germany has done, see http://www.dw.de/german-labor-costs-rise-more-slowly-than-in-the-rest-of-the-eu/a-15906818

But the averages don’t tell the whole story, Germany is a mix of highly qualified people who can command a high price on the market because they produce high quality goods, and of low qualified people with no minimal wage and little social protection who makes it very competitive everywhere no high qualification is required, for example installing solar panels at a much lower cost than in the US.