New testing rules benefit oil producers

One of the odd circumstances that arises out of extracting, transporting and marketing a commodity in high demand is that overall industry profits can increase as an indirect result of experiencing a scary accident that destroys a portion of a now infamous small town and kills nearly four dozen people. One predictable response to such an accident is for regulatory bodies to impose rules that slow production; when that happens the market often reacts with unit price increases that benefit oil producers.

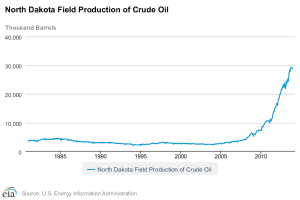

Here is the sequence. In June 2013, crude oil production in North Dakota was continuing to soar, partially assisted by an increasing number of rail terminals that ease constraints on market access for drilling companies. The increased terminal capacity increased the rate at which cars could be loaded and sent on their way to lucrative market destinations.

In 2013, there were 400,000 tank car loads of crude oil shipped in the United States, up from just 10,000 cars in 2009. Each tank car carries a little more than 700 barrels of oil; the average rate of transportation via rail was almost 800,000 barrels of oil per day.

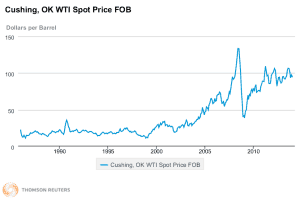

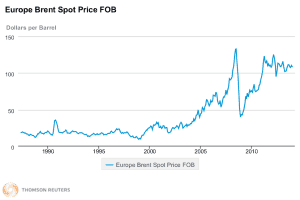

Partially due to the increasing production rate from North Dakota’s Bakken formation, crude oil prices in the summer of 2013 continue trading for well under $100 per barrel; the Energy Information Agency reports a June 2013 price for West Texas Intermediate (WTI) of $95 per barrel.

In early July 2013, a train carrying crude oil extracted from the Bakken formation in North Dakota suffered a major accident that resulted in an explosion and subsequent conflagration that destroyed significant portions of Lac-Megantic, Quebec and killed 47 people. The rail cars carrying the crude oil were the same DOT-111s used to transport the majority of crude oil in the US; approximately 69% of the liquid tanker cars in the US are DOT-111s.

Accident investigators blamed the lower flash point of Bakken light sweet crude oil for increasing the consequences of the rail car derailment. They later discovered that the cargo had been incorrectly categorized as packing group 3, which is the least hazardous category of flammable materials. It should have been classified as packing group 2, which is the same category as gasoline.

At the time of the fiery accident, properly categorizing the material would not have changed the tank car requirements but it would have more correctly informed first responders about the hazards they would be facing in fighting the blaze. Since July 2013, there have been additional accidents involving rail cars carrying crude oil. The ones involving crude from the Bakken, including a November 8 derailment in rural Alabama and a December 30 derailment near Casselton, ND have resulted in explosions and conflagrations but no injuries to people because they happened on open sections of the track where there were no people nearby.

On February 25, the Federal Railroad Administration, which is an agency of the Department of Transportation, issued emergency rules that require shippers to more frequently test and certify the contents inside tanker cars before shipment. On Friday, February 28, Reuters reported that the WTI price for the week closed at $102.59, completing a string of eight weeks of increasing prices. The reporter credited discussions of slowing shipments from the Bakken formation as the reason that traders believed that supplies would fall in relation to demand. There were some rumors that some Bakken rail terminals were closed; the more likely case is that the additional testing requirements slowed the loading processes.

Oil production in the US is approximately 8.5 million barrels of oil per day; each dollar increase in the price increases the revenue in the extraction end of the business by about $3 billion per year.

Yesterday, Warren Buffett, a well diversified investor whose Berkshire Hathaway holding company owns both BNSF, which is a major shipper from the Bakken formation, and a company that produces tanker rail cars, told an interviewer on CNBC that he expected new rules to require additional safety improvements to the tanker car fleet.

In some ways, this series of events brings back memories of the aftermath of the Deepwater Horizon accident that resulted in 11 deaths and a six month period of dumping millions of gallons of crude oil into the Gulf of Mexico. Most parts of the petroleum business, including the owners of the polluting well, benefitted as crude oil prices gradually increased around the world as a result of moderate extraction restrictions. Though there were other pressures, the slowing of exploration and production from the Gulf of Mexico contributed to a rise from a summer 2010 crude oil price of about $75 per barrel to a spring 2011 price of $123 per barrel.

In contrast, the consequences of the disaster at Fukushima, where an epic tsunami wiped out the power supplies for a nuclear power station and created a situation that destroyed four reactors — three of which were loaded with fuel and operating at the time the wave hit — has created a widespread slowdown in the nuclear industry. Market effects of that event include contributing to a dearth of new plant orders in most parts of the world, a loss of nuclear plant output, and a reduction in nuclear fuel consumption that has pushed the price of uranium down to levels last seen in the 1990s.

Correction: Lac Megantic Quebec, not Ontario

@Jim Baerg – Thank you. Corrected.

Québec

I wonder how Berkshire Hathaway can parlay new rules for rail transport of oil and the construction of tank cars into new barriers to competitive entry.

Perhaps they can even extend rules to include regulatory barriers and cost increases to pipeline construction.

I expect they have teams of lawyers and lobbyists burning the midnight oil optimizing new sets of rules. They can smell opportunity, for sure.

From a pro nuclear NRC Chairman of the pass :

http://www.tampabay.com/opinion/columns/column-safety-of-st-lucie-plant-is-assured/2168242

The perverse incentives that permeate the National Energy Security enterprise continue to confound – the threat of Excelon to shutter plants in the Illinois as unprofitable in the face of natural gas availability is surely a sign of an entire system in “cardiac fibrillation” but if anyone knows where to apply the “paddles” I’ve not heard about it.

I don’t see how this ends well!

Apply the paddles in the transport industry. Converting heavy trucks to CNG/LNG will sop up the N. American oversupply and make both exports and gas-fired generation far less attractive. It would also cut oil imports by a substantial amount and increase US energy security.

The fuel system pieces to make this possible are heading for production. It won’t be long now.

Let them look over here in Europe for a head start. We’ve got buses on LNG, not really common, but the technology is working and working well. And part of the cars drive on LPG, but that won’t help you, as it is a waste product of oil refining.

I agree that we should use NG for transport in the US, for several reasons.

However, in the shorter term, NG exports may provide the “paddles”. We’ve been having a fairly balanced debate in this country about the merits of exporting NG. But it appears that the situation in the Ukraine has shifted the debate markedly. Now there is support for not only exporting NG, but quickly expediting the process, from accross the political spectrum. People (especially on the right) like the idea of using US gas to blunt Russia’s BG “weapon”.

http://www.bloomberg.com/news/2014-03-04/ukraine-seen-building-support-for-u-s-natural-gas-export.html

LNG exports are receiving permits and won’t break ground for some time. LNG dispensers at major chains of truck stops have been going in for over a year. Westport and Delphi are pushing dual-fuel injection systems into production; that will allow diesel engines to be run on perhaps 90% natural gas with no alterations beyond the fuel system, and both new production and retrofits appear likely to me.

I wouldn’t be surprised if most of the LNG export projects are cancelled due to market uncertainties. The LNG plants themselves are vulnerable to things beyond mere markets; angry electorates upset about NG price increases, or just plain angry people, may get them shut down.

Apply the paddles to the state “renewable” energy mandates. And restructure the purchasing structure so that reliable energy gets priority over momentarily cheap.

Someone quoted a Hansen paper in which he states that he was told that the state renewable energy mandates’ purposes was exactly to kill off base-load coal and nuclear and that is what it is doing.

State renewable energy mandates are an extremely clever and efficient legislative method of destroying affordable, reliable electricity.

I couldn’t possibly agree more. We need federal legislation that overturns these unfair, inefficient policies. Either that or a court mandate (more on that later…..).

Another benefit of overturning this nonsense and going back to cheaper, more efficient baseload would be to bring down the price of gas. If we can do that, and bring down the price of Oil, we’d also have less threat from a resurgent Russia.

Russia would be a much more peaceful country with $6 /mmbtu gas and $75 / bbl Oil.

We can partly blame Kerry for his part in killing the IFR in 1994.

@Jim Hopf

There is a trend in this country. It is a large trend. It is the closing of old coal plants. Many gigawatts are set to be closed in 2016. I heard this situation described by one utility vice president as a train wreck. Exporting natural gas will exacerbate this train wreck. Load growth continues. Few new nukes are being built. No new coal plants are being built. In the cold Winters of the next few years, we may find ourselves needing that gas for both our heat and our lights. Exporting that gas could lead to supply problems when the US needs that gas the most.

A diversity of baseload electricity types including nukes is best, but it isn’t going to happen soon. I don’t want to freeze in the dark.

From the following detailed article on Exelon’s threat:

http://www.chicagobusiness.com/article/20140301/ISSUE01/303019987/exelon-warns-state-it-may-close-3-nukes#

There is the following key paragraph:

“Mr. Crane apparently has ruled out asking for long-term power purchase agreements with the state that would ensure the nukes were profitable but that also would severely undermine Exelon’s longtime commitment to letting markets work. At a November investor conference, Mr. Crane raised long-term contracts as a way to address Exelon’s nuke woes, but he backed away from that idea in a February conference call with analysts.”

Think about the statement carefully. If they really thought the nukes would be unprofitable, and we’re really considering shuttering them, why wouldn’t they accept a long term PPA that would *ensure* their continued profitability? I can think of only two possibilities.

One, they’re not planning on closing the nukes, because they know that they will become much more profitable in the future (due to increased gas prices), and they don’t want to sign a PPA that will limit that upside potential. They’re just using the threat of closure to gain some financial incentives that will further improve the bottom line. (That said, I strongly believe that existing nukes *should* get financial benefits to reflect their non-polluting nature. All non-emitting sources should be treated equally.)

The other possibility is that they’d rather close the plants in order to “improve” the supply/demand balance in the region, resulting in higher market prices for power and higher profits (despite higher operating costs at fossil (gas) units). At times I wonder other plant operators (SONGS, Kewanee) are thinking the same thing, at least in part. Anyway, it’s possible that plant closures could result in higher profits than continuing to operate the nukes under a PPA.

@Astute Observer

Interesting handle there. I tend to agree that there are numerous layers associated with Crane’s statements about long term contracts.

One of the biggest challenges to “letting the markets work” for a vital commodity like electricity is that markets don’t like over capacity. They punish suppliers for maintaining the ability to supply peak loads without straining, yet electricity is a product that is virtually impossible to stockpile for high demand situations.

Ferdinand Banks is right; electricity should be a regulated product so that countless other products can be produced and sold at market determined prices.

Also as much as people are obsessed with foreknowledge they believe everyone involved should have had for a exceptionally rare event in japan, where is the anger here that these accidents were not predicted, prevented, or mitigated by backup systems ?

No one in the public has been harmed from radiation or has even been shown to have received significant exposure in that extremely rare catastrophe induced accident.

Yesterday it was revealed that five MORE coal power plants in North Carolina had no discharge permits for rainwater. Also that regulators had known about it since 2011 and probably going back to 2008. Not just that coal waste is routinely stored in the open in marginally lined/unlined impoundments, for any industrial facility that large near any waterways there probably should be a water management plan with regulators. None of this is new or “extreme” environmentalism. They were given a free pass to routinely pollute and it took YEARS AND a ACCIDENT for someone to catch/even report it.

“ a ACCIDENT” – Lol who am I kidding.

I cant even find a SINGLE list of all the recent coal ash spills. Just a few of the recent major ones off the top of my head:

Dan River in North Carolina Feb 2014

Lake Michigan Oct 2011

Kingston Fossil Plant Tennessee Dec 2008

In 2009 the EPA released a list of 44 hazardous coal ash impoundments. Not tor the potential for toxin release, but just for the likelihood of their mechanical failure directly involving loss of life.

And, speaking of scary accidents and slowing down an industry, I see another gas explosion happened, this time in NJ, that absolutely leveled 55 condominium units and killed at least one person. Not much media coverage so far. Bet there would be if it was caused by a nuclear plant. Think it will slow down the gas industry much? Something tells me, not really.

The one they found the body several hours later on the hood of a nearby car? That was weird. In addition to the huge explosion at the well in Greeley Co Monday that injured two.

“In 2009 the EPA released a list of 44 hazardous coal ash impoundments. Not tor the potential for toxin release, but just for the likelihood of their mechanical failure directly involving loss of life.”

Don’t be only concerned with the back end of the coal pile, the fly ash piles. For many years we’ve heard of some people on the other end of that coal pile, the ones who rake it out of the earth. We’ve heard of them dyin’ of the black lung (Coal workers’ pneumoconiosis (CWP)). This is from Wikepedia:

“There are currently about 130,000 underground coal miners actively working in the United States. The mining and production of coal is a major part of the economy in several developed countries. In the past ten years, over 10,000 American miners have died from CWP. Although this disease is preventable, many miners are still developing advanced and severe cases.”

http://en.wikipedia.org/wiki/Coalworker%27s_pneumoconiosis

I guess if you are one of those hard case free market boys, you’d argue it was their choice to work in the mines. Well, the arguments won’t make much difference either way as they are just as dead.

People can have power plants clean enough that you can eat off the floor or you can have dirt burners. The choice is yours.

Yes, I am still learning on a lot of this. CWP takes a huge toll. Not to mention the excessive mining accidents in the coal industry.

Until recently Eino I thought that coal ash slurry and coal slurry were the same thing. They are not. Coal slurry impoundments are where they wash and float coal before its burned and it is a mix of waste water and the chemicals used. (like that MCHM stuff that split into Elk River in west Va. just recently).

In 1972 125 people were killed, 1,121 were injured, and over 4,000 were left homeless by a coal slurry related series of dam failures in Logan County, West Virginia, not to mention 132,000,000 gallons of waste released. Of course its not like they keep it out of the environment anyway.

Other notable incidents :

Aberfan Disaster Welsh village October 1966 – 116 children and 28 adults killed.

Martin County sludge spill Kentucky, October 11, 2000 – water for over 27,000 residents contaminated, all aquatic life – Coldwater Fork, Wolf Creek killed.

Look at this:

Settlement Involving Alpha Natural Resources Totals $27.5 Million

The government said the company and its subsidiaries violated water pollution limits in state-issued permits more than 6,000 times between 2006 and 2013.

You cant get any more repeat offender than that and yet they settled and the info would not have been released were the court documents not investigated. Can you imagine any other industry a single company having 6,289 violations over a period of years and practically nothing being done or reported. Then a wrist slap.

This is the company that spent $7.1 billion to purchase Massey Energy.

Massey also was still fighting lawsuits after dumping 1.4 billion

gallons of toxic coal slurry waste into former coal mines between 1978 and 1987.

After some of the ridiculous stuff people disparage nuclear for you really couldn’t make this up.

@John T Tucker

Did you miss this quote from article you cited:

“The proposed settlement is the largest ever of its kind.”

$200 M to clean up pollution and reduce discharges as well.

Combined, this is 25% of their market cap … and in excess of their gross income for 2012 (of 208.67 million). In 2013 they had gross income of negative $620.64 million.

http://www.marketwatch.com/investing/Stock/ANR

Stock is down some 92% from it’s high in 2010.

Rod’s comment:

‘Market effects of that event include contributing to a dearth of new plant orders in most parts of the world, a loss of nuclear plant output, and a reduction in nuclear fuel consumption that has pushed the price of uranium down to levels last seen in the 1990s.’

Market news today: The price of Uranium stocks has totally detached itself from the weekly spot price of Uranium in the last few weeks. Contrary to the last 3 years now, U stock prices are going up!

News of Japan restarting their nukes is serious. Plus the fact that Russia controls 30% or U mining and 60% of fuel enrichment definitely helps. Hey, Ukraine and Europe has seen Putin near the natural gas supply switch too often…

I see that Warren Buffet and his fossil fuel profits figure prominently in this post. He was a multi-million dollar contributor to the Obama campaign and was once considered for a post in the Obama Administration. He routinely advised Obama about economic subjects. Is it any wonder then that Obama appoints anti-nukes into the NRC and the DOE shills out pennies for nuke loan guarantees while providing billions for useless wind and solar that always require spinning fossil reserve? Methinks that those who voted for Obama are just like the fox in the Aesop fable of The Fox and the Grapes. We reap what we sow, folks, and as the prophet Hosea points out, we have sown the whirl wind. And just to debunk the idea that I am a neo-con, I have as much disgust for RINOs and CINOs as I do for the other end. I had to hold my nose to vote for Romney and even then I almost vomited, but at least he was pro-nuclear energy.

I think your TV only has one channel, Paul.

Smile, man.