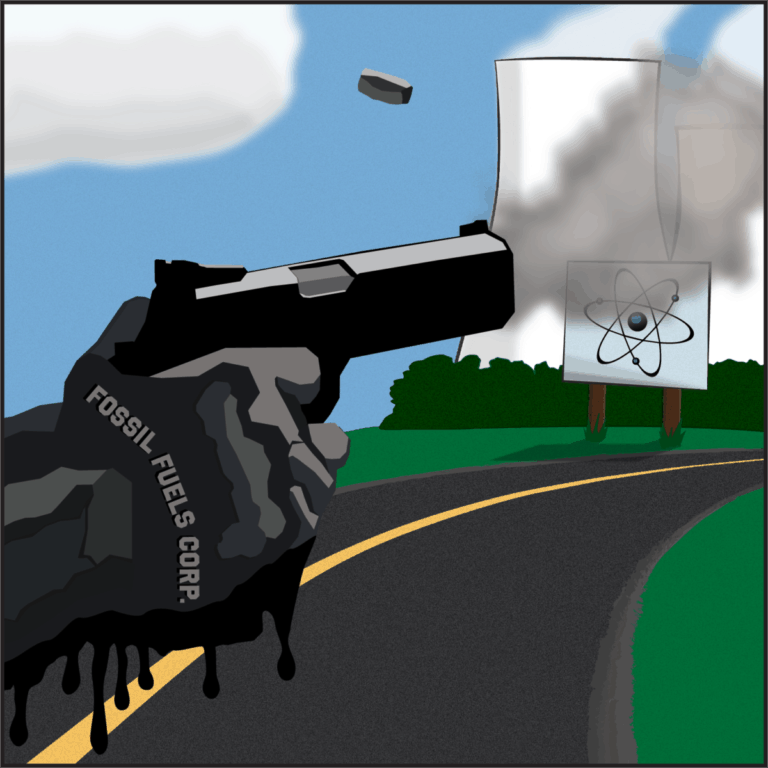

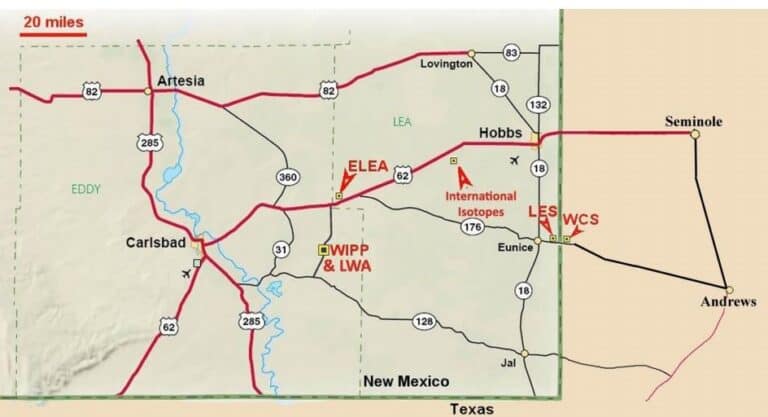

Oil and gas opposition to consolidated interim spent fuel (CISF) storage facilities in Permian Basin

An article titled “US sweetens pot to study siting for spent nuke fuel storage” was published in the January 26, 2023 edition of the Washington Post. The article included a paragraph that credited “environmentalists” as being the main source of opposition to construction of consolidated interim spent fuel (CISF) storage facilities that are either licensed…