Will the U.S cold wave help solve OPEC’s oil inventory hangover?

Since 2014, investor-focused publications have used terms like ‘awash in oil’, ‘oil glut’ and even ‘world is “drowning” in oil’ to describe the world’s stockpile of already extracted and stored inventory of crude oil. Similar phrases have also been occasionally used to describe inventories of various refined products like gasoline, distillate fuel oil, and kerosene.

The stubborn cold wave that has been in place in the U.S. for the past several weeks may help to solve that problem for OPEC and other oil producers. If current actions continue for much longer the deep freeze may lead to a pricing situation that the investment community calls “bullish.”

Most of the customers who purchase refined oil products will not react with such positive-sounding language. Neither will oil refining companies that are not part of a vertically integrated multinational oil company.

How does sustained cold weather reduce oil inventories?

Many observers who talk about energy believe that nearly all of the oil used in the U.S. is in transportation markets. They might wonder how severely cold weather would drain oil stockpiles and return pricing power to oil market bulls. After all, winter storms can ground air travelers keep motorists and truckers off the road and thus not burning much fuel.

Under most circumstances that is a reasonably accurate interpretation. The U.S. Northeast is different as the result of a series of choices that led to a large scale trend.

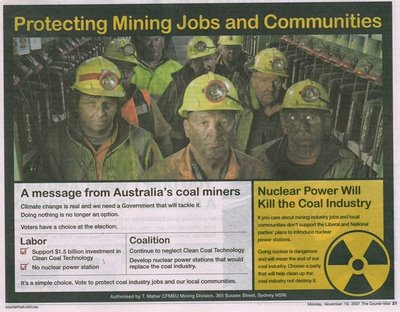

Though the Northeast‘s historical dependence on imported oil made it an early adopter of nuclear energy and one of the most pro-nuclear areas of the country, it has been home to a strong and successful antinuclear movement since they late 1960s. It’s also a region where coal burning has always been barely tolerated as a last resort where there were no cheaper alternatives.

Since the introduction of cheap natural gas extracted from vast reservoirs either in the region or adjacent to it, antinuclear forces and anticoal environmentalists have successfully pushed for the permanent retirement of several large generating stations.

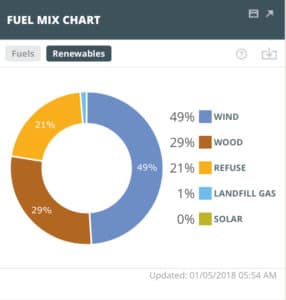

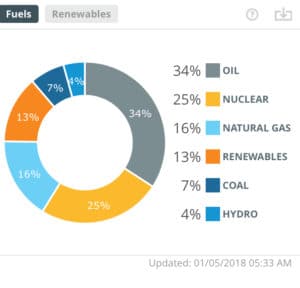

The electricity that used to be produced by those stations has been replaced by burning natural gas, capturing more wind and solar when available and burning “other renewables” (a term that refers mainly to wood, refuse and landfill methane).

When it gets really cold, however, natural gas can suddenly become something entirely different from “cheap.” In some parts of the system there are periods when a million BTUs of natural gas costs more than 10 times as much as it does in other parts of the system.

That price differential is made possible by the nature of a fuel that is normally a vapor at standard temperatures and pressures. Vapor can’t just be loaded onto a truck or into a rail car to be moved to an area where a shortage has created a big price differential. If the normal pipeline transportation system is at capacity, there is a constraint that cannot be overcome in the short term.

Since natural gas has a vital use in keeping people at safe living temperatures during cold weather, an increasing portion of the limited capacity for moving the fuel is diverted into the heating market. Since the amount of fuel needed to keep a space warm in a function of the difference between the indoor temperature and the outdoor temperature, fuel burn increases dramatically at the kind of temperatures experienced in recent weeks.

All of these effects were made obvious during the winter of 2013-2014, a period that is called the Polar Vortex. Of course, what we are currently experiencing is also a polar vortex, but now people are creating new terms in either an attempt to reduce confusion or to bump media ratings.

After the winter of 2014, the lesson that seemed to have been learned was that natural gas supplies, particularly in New England where there is a limited delivery capacity, are insuffient to handle severe weather. Some pipeline expansions have been completed, and several more are being planned. Total capacity has increased, but not sufficiently and not fast enough.

As a stopgap, grid operators have provided incentives for gas fueled generators store fuel on site. Since gas is as difficult to store as it is to transport, the stored fuel is generally in the form of distillate fuel oil (a term that describes a petroleum product that is almost interchangeable with diesel fuel and heating oil). In a few rare cases, the stored fuel is liquified natural gas, but those tanks are more expensive to install and maintain than oil tanks.

Of course, storing fuel on site comes with its own limitations. Tanks have a finite capacity and a finite cost. Filling a storage tank ties up capital; in a warm winter, it is quite possible that the oil will not be needed. Oil price volatility adds risk to the decision on when to fill tanks and what to do with leftovers once the weather warms back to the point where gas is suffiently abundant and cheap again.

A somewhat complicating aspect of the situation is the fact that there is still a large heating oil market in the Northeast. Less densely populated areas rarely have a natural gas distribution system, leaving customers with the choice of oil, propane or wood for heat. Even in areas there there is gas, some customers haven’t converted. There is an initial expense, some customers like to have their heating fuel on site, some are convinced by fuel delivery company ads that oil heat is better than gas heat and fuel oil prices have been low enough to be competitive.

When cold weather extends its stay, there can be a series of cascading events that can eventually have dramatic effects. The effects start as local, but can quickly affect the world oil markets.

Generating stations begin running low on stored fuel and must arrange to be refilled. Homes and businesses that use oil for heat have the same issue and will often be in the market for refills in competition with the electricity generators. Storms can inhibit transportation and cause delays in delivery.

When the weather is brutally cold, running out of fuel can be deadly. Even if the local delivery service can schedule a delivery, there may be limits on the amount each customer can obtain and the prices might shock some customers who are not on some kind of stabilization plan.

The bottom line is that a country that had successfully eliminated oil from the electricity and space heating markets has returned to dependence during cold spells. Though that situation has national level implications – every president since Nixon has promised to reduce out dependence on oil – the decision seems to have been made by the faceless market.

Who decided to make the U.S. electricity and heat supply more dependent on oil?

In reality, markets do not make decisions. Individuals and teams do, often without any kind of grand strategy. At the risk of being dismissed as a conspiracy theorist, I’ll remind you that the most successful players and investors employ teams of some of the brightest people in the country to help them plan their market moves. Some of those teams focus on tactical, short term trades, but some also engage in long range, strategic planning.

Some of my smartest acquaintences have become quite successful by participating in these teams.

The shift between excess supply and insufficient supply only requires a few percent change in either supply, demand, or both.

Since the “glut” has been with us for over three years, there has been a dedicated effort in the past six-nine months to restrain production and encourage new demand. Some of the new demand has been created by the retirement of coal and nuclear plants; I suspect that some of the political and economic power of the efforts to force closure came from oil and gas promoters and speculators.

The U.S. entered the winter with fuel inventories that were slightly below those from the same dates in recent years. It also has shut down a number of generating stations burning fuels that are competitive with oil and gas, providing options that mitigate some of the effect of unexpectedly strong weather-related demand.

Unfortunately, there will be a great deal of money moving from some pockets into other pockets without actually improving overall national wealth.

The 30 day delay in decsion making that Energy Secretary Perry granted the FERC in relation to his NOPR requesting a grid resilience pricing rule seems to have provided an opportunity for nature to make a forceful comment in favor of fuel diversity. It may be okay for the nation to choose to replace coal and nuclear plants with natural gas and renewables, but the potential costs of that decision are becoming more apparent.

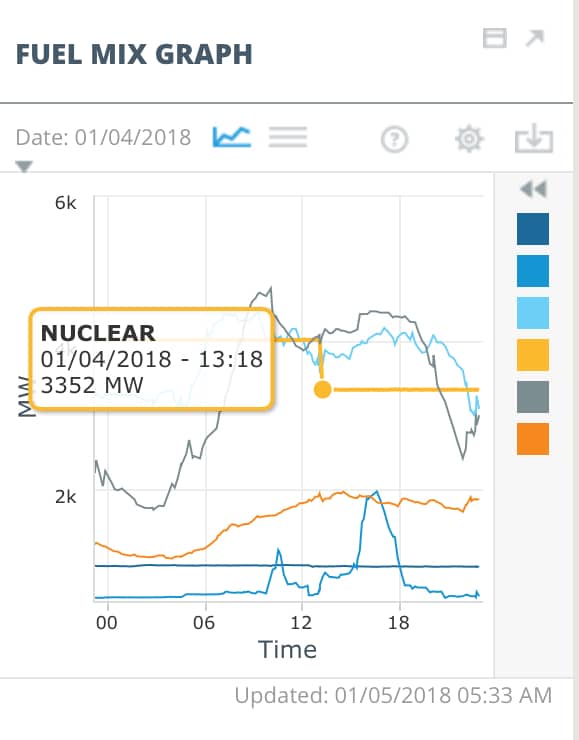

PS Yesterday at 1:18 pm, a fault in the grid serving the Pilgrim nuclear station caused the plant to go off-line. That was the first time in the past several weeks when the fuel sources supply graph for ISO New England changed from a straight line at 4031 MW. Fortunately, there was a sufficient margin of available generation to make up for the Pilgrim trip.

“PS Yesterday at 1:18 pm, a fault in the grid serving the Pilgrim nuclear station caused the plant to go off-line.”

Off topic of main subject, but above quote is not technically accurate (and I don’t mean to split hairs on the time reference). Per the NRC Event Report: https://www.nrc.gov/reading-rm/doc-collections/event-status/event/en.html#en53147 the loss of the one Off-site Power line did not directly cause Pilgrim to go off-line. It was a procedural requirement (“management decision”) to reduce power and manually trip the plant. Why? (obviously a “loaded question”). They still had one other Off-site power line. In your opinion (and experience) is it safe (acceptable risk) to run a Light Water Reactor with only one Off-site power connection; or even with none, for that matter?

But the “answer” explains why Entergy is pulling the plug on Pilgrim.

Well, of course. ANYTHING that boosts oil demand will “help” solve OPEC’s inventory problem. But by how much, though?

Suppose the extra demand comes to 100 GW(th). At 6.1 GJ/bbl, this comes to about 1.4 million bbl/d. The EIA reports 424.5 million bbl of crude oil inventory at the end of last month. I don’t know what the minimum operating inventories are, but a depletion pace that would take the better part of a year to get to zero doesn’t sound like a big issue to me.

NB, I suspect that the district heat plants on Manhattan have switched over to oil as well due to pipeline capacity constraints. There’s more inventory burned up.

According to a report today on oilprice.com, most analysts expect inventories to grow for the next 6 months.

There is nothing to the contrary on that site that I could see.

My first thought/question upon reading Rod and Meredith’s coverage of the energy markets during this cold snap is, what is the quantitative value of NY state’s ZEC program? Prior AI posts summarized that “the ZECs will be priced at $17.48 per MWh. When combined with the wholesale price of electricity — currently about $39/MWh in the New York market — the ZECs will provide nuclear plant owners with a total revenue of ~ $56 per MWh.”

As the recent “EIA Today In Energy” points out, spot market wholes electricity prices in New York city reached $200/MWh on January 1, 2018 – I wonder what the hypothetical net value of the ZEC would be over these cold snap periods and would the value offset its any costs from prolonged supply “gluts” the rest of the year?

Rigzone has a more nuanced view of the future for oil inventories.

https://www.rigzone.com/news/wire/winter_storm_threatens_us_east_coast_energy_industry-04-jan-2018-153019-article/

@mjd: Tech Specs require two independent offsite power sources. If one is lost, they are allowed to operate for a certain number of hours. If those hours have elapsed and the source is not restored, then the Tech Specs require the unit be shutdown. It is essentially a pre-solved set of coarse rules for managing risk with different scenarios of degraded systems. Compliance is mandatory, and not a “management decision “.

@cpcragman

Whose permission is required to revise tech specs? Is a licensing amendment required?

Is there any Lee-way provided if external conditions merit special considerations? I’m not saying those existed here, since there was an adequate system reserve available – albeit at a far higher marginal cost per MWh.

CPcragman, I obviously know the meaning of Tech Spec LCOs and Action Statement completion time requirements (but not Pilgrim specifics). Typically for Loss of an Off-site Power Source 72 hours is allowed for restoration. From the info available, Pilgrim S/D within 1 hour of the loss. If so, that was by Management Decision, not Tech Specs. And they had already started and loaded the EDGs. So I still would like to know why they actually S/D so quick.

@Rod Adams says January 6, 2018 at 4:53 AM

Rod, NRC permission is required via License Amendment. “Lee-way” can be provided via the Licensee asking NRC (at-the-time) for “selective enforcement” and giving the technical justification. NRC may or may not approve it. But it is/has been successfully used in other cases.

How has “wood” burning energy become classified as ‘renewable’ anyways? WHY can we not get SOME adoption of nuclear energy as being renewable? There’s practically none, even in the industry!

The definition of “renewable” is political, not scientific. There’s no scientific reason to include wind and solar while excluding hydro.

I’m arguably running on not-very-renewable renewable energy, as my heat for last night and today was coming from burning borer-killed ash trees. Letting them rot doesn’t help matters, though. Might as well get all the benefit we can from them.

Hunster, wood is considered to be a renewable because presumably the tree lot will regrow. This classification is controversial.

Nuclear is not considered to be renewable under the dubious assumption that we will eventually run out of uranium.

Uranium in seawater is in equilibrium with the seabed rocks. It is effectively inexhaustible.

I seem to remember the Tech Specs are a part of the licensing basis. I used to fill out paper for minor changes long ago.

Great article, Rod.

Do you know if the “refuse” portion of the renewables is literally burning trash in incinerators or is it landfill gas or what? I can’t imagine that the former is any cleaner for the environment than burning coal.

I am burning quite a bit of wood myself these days. Better to burn it than let the termites release it as methane. Doing my part to save the planet.

Your discussion of the “oil glut” made me wonder what the current status of the US Strategic Petroleum Reserve is. 93% full with ~143 days of of import protection. This is not the highest inventory ever, but it is tied for the maximum duration of import protection ever…

https://www.energy.gov/fe/services/petroleum-reserves/strategic-petroleum-reserve/spr-quick-facts-and-faqs

https://www.spr.doe.gov/dir/dir.html

Regards,

Jim

To be faithful to their stated concerns (AGW) they really should be worrying about decarbonization not renewables. In that case Nuclear is a clear winner.

“Nuclear is not considered to be renewable under the dubious assumption that we will eventually run out of uranium.”

Seems to be plenty of Thorium and Plutonium in spent fuel and such that people have plans to use. The Thorium is basically tailings from Rare Earth mining.

Such faithfulness does not exist apart from the ecomodernists. So-called “environmentalists” today are almost entirely professional greenwashers for fossil-fuel interests.

We can make new fissile material … fast reactors can have a nearly inexhaustible fuel supply.

I’m suggesting we need to adopt this terminology for ourselves!

An immigrant to the US from an undeveloped country increases their “carbon footprint” by a factor of at least 3. Then consider that they tend to have larger families. Most of the “let them all in” crowd likely believe that CO2 is a significant problem. Logic be damned.

BWR Tech Spec LCO 3.8.1 requires TWO OPERABLE independent sources of Offsite Power. When less than two – the plant is in a 72 hour SHUTDOWN action.

Why?

BASIS 3.8.1 Two qualified circuits between the offsite transmission network and the onsite Class 1E Distribution System and DGs ensure availability of the required power to shut down the reactor and maintain it in a safe shutdown condition after an anticipated operational occurrence (AOO) or a postulated Design Basis Accident.

Degrading grid conditions are something to be avoided. Pump motor current (and internal heat) rise a voltage degrades. Left unattended, degraded voltage can damage important AC powered equipment. Undervoltage automatic protection is present these relays generate abrupt trips and load transfers to Diesels.

Controlled plant shut down involves a much gentler transition to shut down conditions than an automatic UV Loss of Offsite Power actuation.

Been there, done that, got the tattoo.

You’re not allowed to Notice this.

Noticing is racist.