Twitter conversation about energy sources and free market

On April 8, 2011, Alan Nogee, Director of Climate & Energy Strategy and Policy for the UCS posted the following on Twitter.

Cato’s Jerry Taylor takes #nuclear power 2 the free market woodshed. Ouch! Forbes.

He repeated that tweet with a better link and called Taylor’s opinion piece a “must read”. The article that Alan was recommending is titled Nuclear Power In The Dock: Nuclear power quite simply doesn’t make economic sense. Here is a representative quote from that Alan Nogee-recommended article (I almost wrote “UCS-recommended”, but then remembered that Alan tweets for himself, not for his organization.)

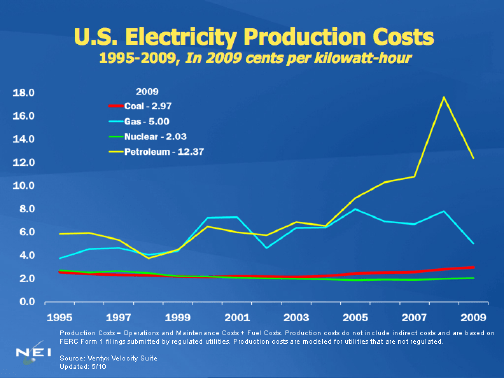

First, nuclear energy is not even remotely competitive in power markets with gas-fired or coal-fired electricity now or in the foreseeable future. Even the more optimistic projections of new nuclear power plant costs–such as those forwarded by MIT–find that nuclear’s production costs over the lifetime of a new facility are about 30% above those for coal or natural gas-fired generators. So while we can only speculate about new plant construction costs (we haven’t tried building one for more than 30 years) and estimates vary a great deal, all parties agree on one thing: Nuclear is substantially more expensive than conventional alternatives at present.

That’s particularly the case when one figures in the revolution in natural gas extraction, which has significantly lowered the cost of gas-fired power.

Alan works for an organization that has devoted several decades to adding as many layers and as much cost as possible onto nuclear energy plants. He often advocates for subsidies and mandates that attempt to force wind and solar energy systems into the market despite proven unreliability and excessive costs. It seems to be the height of hypocrisy for praise of an opinion piece touting the cheapness of coal and natural gas compared to nuclear to come from a man who often advocates for even more expensive energy sources whose only advantage is something that nuclear plants do with far greater reliability – produce power without producing CO2.

I decided to challenge Alan. Here was my first response tweet:

@alannogee Taylor is a known natural gas advocate. We’ve gone around & around re: nuclear several times – one ex: http://bit.ly/9DtzIq

Nogee came back with the following:

@Atomicrod I’ve known Taylor 4 years. Disagree on many issues. He’s right on this one tho. Facts speak 4 themselves 2 those willing 2 hear.

That gave me the opportunity to show that I had actually read the article and not just the headline. Taylor might be saying that nuclear was “too expensive” but he is comparing that to coal and natural gas. Expensive is a relative word – it has no meaning in isolation without an understanding of the comparison basis.

@alannogee The fact in Taylor’s article is that he believes fracked natural gas & coal are better bargains than nuclear. You agree?

Alan’s comeback:

@Atomicrod Gas yes, coal no. But looking primarily 2 expand efficiency & RE. Thoro analysis in R Blueprint, only gas even cheaper now.

The claim of cheaper gas “now” offered another opening. I am no fan of hydraulic fracturing and not a believer in the myth that 2074 trillion cubic feet of proven, probable, possible and speculative resources in the United States as of the end of 2008 is a game changer. We use 23 trillion cubic feet per year already. Even if we are able to extract and transport every last puff of the known gas in every single reservoir, it would only last for about 88 more years. That would only be true if the marketers do not succeed in their current effort to grow their market share. Here is my brief comeback to Alan.

@alannogee So, UCS has no problem with hydraulic fracturing? “Cheap” partially results from the Clean Water Act exemption & unreg dumping

He took offense.

@Atomicrod Ridiculous. So U support absolutely everything nuclear industry & NRC does? Oh, wait….

My response:

@alannogee No. Like #nuclear due to emission-free (subs), energy dense fuel. Clean, cheap, natural are marketing words from oil&gas ind.

It got a bit more entertaining:

@Atomicrod As w/so many things, gr8est strngth is also gr8est weakness. Nuclear energy density is Y costs so much 2 control & contain it.

I continued thrusting, enjoying the discussion and hoping that people were watching.

@alannogee #Nuclear costs driven by capital expenses engineering & multiple barriers that save lives. Gas costs lowered by cutting corners

Alan is most likely not an engineer. Here is his response.

@Atomicrod But capital, engineering & barriers driven by energy density.

Energy density allows smaller machinery and smaller infrastructure to do the same job, especially when the entire fuel cycle is considered. A compact and low capital cost gas turbine placed in New England is not worth much unless there is a lengthy pipeline infrastructure that continuously delivers gas from the well to the turbine. If the deliveries stop, so does the turbine – in a very short period of time. Coal and oil are a bit better – plant owners can store up to a few months supply that is accessible as long as the coal piles do not freeze.

Here was the final post in the series before moving on to other topics.

@alannogee #nuclear capital, engineering & barriers driven by quest for perfection – coming close. Coal, oil, gas standard is far lower.

Nuclear energy is economically competitive, even with a far higher standard of performance. It is emission free and has amassed an amazing safety record. The facts are pretty clear, it is the opinions that can get really muddy, often based on financial rewards that can be obtained by slowing the introduction of a very competitive and very clean power source.

Rod,

If you’ll permit a relatively brief response, I’d be happy to fill in cites and links later.

First, UCS doesn’t seek to add layers of costs to nuclear plants. Our interventions have been very limited in scope, to where Dave Lochbaum or Ed Lyman see very specific safety or security issues. They seek only to hold the industry to the high standards you claim credit for, which are essential to operating this technology safely. Most people in the industry understand this. One CEO wrote Dave a personal, handwritten thank you note, for example, for his constructive role in the process of ID’ing and ensuring correction of problems at his plant, even though it took more than a year-long shutdown to resolve them.

All industries have players that try to cut corners. That includes the Davis Besse near-miss, for example, but also fossil fuel and renewable industry players. They all need regulation.

UCS puts a lot more organizational resources into reducing the environmental damage from fossil fuels, especially coal and oil, the two biggest problems, than it does on nuclear safety and security. We’ve been very clear that the routine consequences of coal are much worse than nuclear. We’ve also spoken out in favor of disclosure of fracking chemicals, eliminating Clean Water Act and Safe Drinking Water Act exemptions, and more regulation. Substituting natural gas for coal, however, would clearly reduce overall environmental impacts, and the more so if the industry cleans up its act. UCS is also working on reducing the impacts of wind and hydro, on promoting sustainability criteria for biomass, and on opposing ethanol subsidies.

UCS has clearly prioritized efficiency and renewable energy over natural gas or other low-carbon solutions. (And you won’t find us arguing against nuclear belonging in that category.) But we think efficiency and renewable sources have the lowest environmental impacts and risks, and the potential for the long-run lowest costs.

Existing nuclear plants are very competitive. We don’t argue with that and don’t advocate shutting them down, except in a few rare cases where specific safety problems have existed.

The economics of new plants are very different. Free-market advocates, like Taylor and Exelon’s John Rowe, recognize that. Partly it’s because of the decline in natural gas prices. But it’s also largely because nuclear construction cost escalation has priced it out of the market. Go look at how new nuclear plants have slid from the center to the high end of Rowe’s low carbon supply curve, while gas has slid to the low end.

Taylor and Rowe also oppose renewable energy subsidies. We support them. Why? Because new industries need support cracking a market dominated by huge, entrenched, and heavily subsidized incumbents. And renewable energy has many unpriced external benefits.

With renewable energy, those subsidies have worked. Wind and solar costs have declined 80-90% over the last two to three decades. Nuclear, on the other hand, has recieved large subsidies for about 50 years. Over the first 15 and 25 years of their respective lifetimes, nuclear subsidies/kWh far exceeded those of renewables, even using fairly conservative subsidy definitions.

But the nuclear subsidies have failed to reduce capital costs, which have steadily risen. Two recent studies have found no evidence of nuclear cost reductions through industry learning, either in the US or in France.

I think you know as well as I do that as long as the fate of the nuclear industry is tied to very large complex construction projects, the industry’s economic future is grim. Even if it were able to control average costs, there would be outliers scaring away utilities and investors. Force-feeding new Gen III plants into the mix, in my opinion, is only going to create backlash and set back alternative nuclear strategies.

Small Modular Reactors face a lot of challenges, but may offer the prospect of breaking out of that cycle. There’s a range of views within UCS on the likelihood of that occuring. I’m actually among those who think there’s a pretty good shot.

Many people remember the mid-80s Forbes article labeling nucler the largest managerial failure in U.S. business history. Fewer remember that Forbes’ analysis found that nuclear industry growth was killed not by its enemies, but by its friends. Nuclear’s friends might do better this round focusing on strategies that might break out of past cycles of failure than trying to prop them up.

@alannogee

The UCS is dishonest in its portrayal of the subsidies that are available for nuclear power. This sentence is from the executive summary of “Nuclear Power: Still not Viable without Subsidies.”

“This means that buying power on the open market and giving it away for free would have been less costly than subsidizing the construction and operation of nuclear power plants.”

1) From where exactly in the open market would the federal government have purchased this extra power had nuclear power plants not been constructed?

2) The subsidies mentioned come in many different forms, most of them aren’t direct payments, but instead measures to help the nuclear industry avoid costs. This means there really wouldn’t have been extra money sitting around to buy power on the open market.

3) All other forms of electricity generation also receive similar subsidies so back to #2

4) I don’t know of any electricity “open market.” It’s not quite like deciding between Starbucks, Seattle’s Best, or Caribou Coffee now is it.

@PoloniumMan

@alannogee – thank you for the detailed response. As you have noted during several Twitter conversations, there is the possibility that you and I agree on more topics at a fundamental level than it might seem. However, the lenses through which we view the world are quite different.

While David Lochbaum appears to be a reasonably well versed nuclear engineer who occasionally introduces some useful topics for discussion, there are thousands of other nuclear engineers who often disagree with his interpretations. That is not surprising; nuclear engineers tend to be a contentious bunch of people who often question and doubt and strive to improve. That is a good thing, but there comes a time when engineers need to make decisions based on best available data with some consideration of the cost and complexity that their proposed solution imposes on the rest of the system. It is not always safer to add another layer, another protective system, or another set of procedural steps because there might be some unintended consequences.

You claim that nuclear subsidies failed to reduce capital costs, but from my point of view, that was never their real intention. The best way to reduce capital costs for any constructed or manufactured product is to settle on a design and then produce that design repetitively. Many of the “subsidies” provided to the nuclear research and development communities over the years have been aimed at satisfying the desire of engineers and scientists to keep designing new things and to come up with exotic solutions. Vendors had no real incentive to seek to lower prices – especially during the era when sales were drying up. In order to keep from laying people off, they sought to maintain their revenues by adding to the price whenever possible.

Wind and solar are not new. They are energy sources that humans have known about and understood pretty well for millennia. Clipper ships had some very sophisticated designs and a massive infrastructure of talent, but they still lost out to primitive coal fired ships. The difference was the ability to schedule and provide power on demand. The main source of the decline of wind and solar is the same source that many people like I.C. Bupp and Charles Komanoff disliked about the great bandwagon market in nuclear plants – the price per unit capacity has been reduced by building ever larger units.

I also have to chuckle a bit at your characterization of John Rowe as a free market advocate. He and his lobbyists spent the better part of a decade pushing cap and trade rules that would specifically benefit Exelon because of its large, established fleet of nuclear power reactors. Their communications with stockholders – I was one – used to talk about how the rules could result in a $1 billion per year windfall. They would get that cash even without doing anything to change their emissions profile. He is also the man who is pressing forward with decommissioning an already built and formerly licensed plant at Zion whose two units ran for less than 25 years before they were shut down – initially to teach a recalcitrant union a lesson. The reason for the press to decommission is to make sure that Zion’s production never gets introduced into the market because the shift in supply versus demand would lower prices for the output of all of the other plants in Exelon’s fleet.

If the real opposition to nuclear energy is that it costs too much to build and finance new plants, let’s work together see where the costs are and find out if they can be reduced. In 30 years of association with nuclear energy, I have seen hundreds of ways in which costs have been allowed to reach excessive levels with little return in additional safety or reliability. Even with my insider’s knowledge of places where costs could be reduced, the fact remains that, once built, a decently managed nuclear energy plant can pay back their capital cost and operate at a very competitive ongoing cost.

The biggest hurdle to obtaining affordable financing, however, is what I call the Shoreham Syndrome. I spend years making presentations to potential financial sources and the final sticking point, the one that I could never overcome, was the question – What guarantees can you provide that you will be allowed to operate the plant and earn revenue even if you can manage to complete it?

@alannogee —–

I’m rather surprised that you or the UCS seem to have no point of view on the risks (to workers and the public) and environmental consequences of hydraulic fracturing.

Also, you seem to have no consideration of future climate impacts when you compare carbon-based technologies with nuclear. Some of the most “concerned scientists” regarding the ‘big picture’ on energy are _climate_ scientists.

It seems that you are bending over backwards to attempt to find a point of agreement with the Cato Institute rep, when the reality is that ALL energy sources have health and environmental consequences, and thus need to be regulated in one way or another.

The nuclear industry has long been accustomed to working inside of regulations, but it strikes me that some of the other energy technologies constantly seek exemptions, cf. the Clean Water Act exemption for hydraulic fracturing.

You may want to look into how they make Synthetic Natural Gas (SNG) from coal, very enlightening. Public Service Electric and Gas has been using it for years. That is how they have enough gas to keep the pressure up on the very cold winter nights. Now it is considered the “new” way to have “clean coal.” They can make gas from the dirtiest of coal, coal to dirty to burn otherwise. Do you want a “coke” plant in your back yard?

Is 30% more costs really an issue? Pretty much everything humans make come in a range of prices. Cars for example. I can go out and buy a brand new Kia for $9,000 or a BMW for $54,000. One is 500% more than the other.

You also have to take into consideration that a utility has many plants producing many GW of power. A very simple math example to show the small impact is as follows.

A utility owns 10GW of plants and wants to add 1GW more. It charges 6cent/kwh. The utility needs to seek a rate increase for the project. Lets say that to build natural gas they need an increase of 0.5c/kwh. So a NPP at 30% more they would need to ask for a rate increase of 0.65c/kwh. So for the consumer even though the NPP is 30% more expensive they only see a 0.15/5.5 = 3% increase is rates.

What do they get for that 3% premium? Price stability. I think it is worth it, other may not believe so.

I think that points to a problem in the way electric utilities are regulated.

If fuel costs can be passed straight on to the consumer, while increased interest charges or other financing costs cannot, that is an incentive to choose technology dominated by fuel cost (gas) rather than capital cost (nuclear).

Rod,

I am a bit surprised that you didn’t mention that the authors of the initial article linked by Alan was written by 2 Fellows from the Cato Institute and the that the Cato Institute was founded by one of the Koch brothers whose company derives most of their profit from fossil fuel-related sales. That couldn’t possibly cause any anti-nuclear bias to be present, could it?

(Note: sarcasm in question at the end of the previous comment.)