Several important nuclear energy developments from the Westinghouse press office

On October 28, 2015, Westinghouse issued a press release titled AP1000® RCP REACHES FULL QUALIFICATION confirming a rumor I heard during my visit to Knoxville last week.

The release contained wonderful, sigh of relief, news indicating that the hard-working, under-the-gun engineers and technicians at Curtiss-Wright’s EMD division had achieved their task of building and successfully testing the first two reactor coolant pumps for the AP1000 reactor design.

“Successful completion of the extensive design verification program for this innovative large canned motor pump represents another significant milestone achievement for Curtiss-Wright and its employees, and demonstrates our on-going commitment to the AP1000 nuclear reactor program,” said David C. Adams, chairman and CEO of Curtiss-Wright Corporation. “Furthermore, as a key partner to Westinghouse and SNPTC, we look forward to the successful operation of the first AP1000 plant and we remain committed to supporting China’s growing nuclear power program.”

“Designing and manufacturing the technically sophisticated and demanding AP1000 reactor coolant pump has been a close, collaborative effort. After seven years of hard work among China and U.S. companies and a rigorous regulatory review and strong support of the National Nuclear Safety Administration (NNSA) and National Energy Administration (NEA) of China, development of the reactor coolant pump has succeeded,” said Zhongtang WANG, president of State Nuclear Power Technology Corporation. “This success will further accelerate China AP1000 project construction progress as well as boost advanced passive Generation III nuclear power development in China.”

I discussed the possible implications of failing at the task in a February 2015 article titled Diseconomy of scale – world’s largest canned-motor reactor coolant pump and again in an August 2015 article titled Reactor Coolant Pumps for AP1000 still a problem.

I did not enjoy writing either one of those pieces; nothing good would come out of failure or lengthy additional delays for the 8 AP1000 projects that are well on their way to completion and need their reactor coolant pumps to work as reliably as they were designed to work.

This update, on the other hand, is putting a smile on my face. I’m sure there are thousands of more deeply involved people who feel even more strongly about the news than I do. Congratulations to everyone who made it happen.

Westinghouse purchase of CB&I nuclear construction arm

A day earlier, Westinghouse had surprised the small community of nuclear news enthusiasts of which I am a member with the announcement that they had agreed to purchase the nuclear plant construction arm of CB&I.

This is the part of CB&I that was at one time the widely respected construction company known as Stone and Webster. Rights to use that name were auctioned off during a bankruptcy liquidation in 2000 and acquired by the Shaw Group, a financial conglomerate led by an aggressive, deal-making entrepreneur named Jim Bernard.

Shaw, which Bernard had founded in 1987, was growing rapidly through acquisitions. Some of the previous acquisitions were construction companies, but none with the name recognition of Stone and Webster.

Acquiring the Stone and Webster brand allowed Shaw to be pitched as an experienced construction company with deep roots. The financial engineering skills of the team that Bernard had gathered at Shaw enabled it participate in Toshiba’s purchase of Westinghouse with and investment that gave it a 20% equity in Toshiba’s new nuclear equipment supplying subsidiary. That arrangement came with an agreement to give Shaw the opportunity to build the early units of Westinghouse’s increasingly attractive new reactor offering, the AP1000.

In Feb 2013, CB&I (formerly known as Chicago Bridge & Iron) purchased the Shaw Group for $3 billion, mainly to buy its way back into the business of building nuclear power plants in the U. S. At the time of the purchase, analysts thought is was a good fit and increased their “target price” for the company’s stock.

Soon after the purchase, CB&I sued Westinghouse claiming that it was not fully informed about the progress that had been made at Vogtle and Summer or about the costs of the remaining work required to complete the projects. The legal battle was being fought off site and was mostly invisible to the workers trying to complete the project, but it threatened to sufficiently distract management and increasingly delay the project.

Westinghouse apparently decided to purchase its “partner” in order to establish clear lines of responsibility and enable the projects to advance to completion.

With this announcement, Westinghouse assumes both responsibility and authority over the nuclear plant construction activities at Plant Vogtle and V.C. Summer – under the direction, of course, of the owner groups that actually hold the NRC COL licenses for the plants and work under the regulations of their respective state public utility commissions.

Though I don’t yet have any information that is not published in Westinghouse press releases or various media sources like 5 things to know about Westinghouse’s deal with CB&I or Westinghouse Buys CB&I Division to Beef Up Its Nuclear Business, I’m as enthusiastic about this announcement as I am about the RCP test completion announcement.

From my point of view, it is the best available solution to years worth of finger pointing over responsibility and liability for delays associated with difficult, but important nuclear plant projects. Though some people might have thought it was going to be easy to begin building large nuclear power plants in the United States again, most experienced people knew that a lot of learning would be required to restore the construction and manufacturing prowess lost during a thirty-five year hiatus.

Consolidating project ownership and responsibility gives Westinghouse the ability to follow one of Admiral Rickover’s prime ingredients for success. As he used to repeat with great effect, “Unless you can point your finger at the man who is responsible when something goes wrong, then you have never had anyone really responsible.” That dictum can be expanded to corporate partnerships; they can devolve into litigious morasses when too many interests work too hard to CYOA.

Westinghouse leaders seem to have realized, a little belatedly, that one of the main lessons from the first Atomic Age that their predecessors should have passed down to them is the importance of aligning the interests of all of the parties associated with completing projects. One of the major reasons we slowed and then stopped building nuclear plants in the U.S. was that too many decision makers were spending too much time suing each other over issues like uranium market manipulation, steam generator longevity, and pressure vessel delays.

Westinghouse’s new structure has the potential to reduce infighting and enable Westinghouse to offer contracts for large, dual unit nuclear projects that are more competitive with the offerings from Rosatom, Areva, and KEPCO.

Though I often write about the potential benefits of smaller plants and projects, there are also advantages to big, centralized power plants that can serve millions of customers while keeping grid frequency steady enough for running clocks.

Plenty of people repeatedly criticize nuclear projects for being too slow and too expensive, but those same people conveniently ignore the challenging histories of projects like The Big Dig, Cape Wind, Keystone XL, the Polk Power Station Unit 1 and the Kemper County Energy Facility. Several of the projects on that list are still not complete, despite being many years overdue and millions to billions of dollars over budget. The completed projects have been beneficial, but not as cost effective as initially promised.

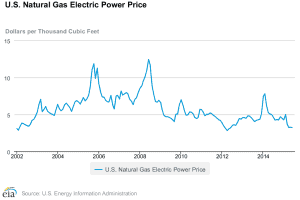

Other people blithely suggest that it would be cheaper to build natural gas power plants, but they conveniently overlook the costs associated with new pipelines, new fracked gas wells, and the potential price increases that would come with increased demand for a limited supply of natural gas. They also overlook the financial costs associated with depending on a fuel that is volatile in physical form, making it difficult to store and transport. That transportation and storage difficulty plays a big role in the volatility of natural gas prices and their sensitivity to a delicate balance in supply and demand.

It’s possible that many, if not most, of the people who repeatedly recommend that electric power producers choose natural gas over nuclear are aware of the impacts of increased reliance on gas. There are plenty of people who are somehow involved or invested in the continued growth of the natural gas industry.

I might as well make it clear once again. I am fully invested in the success of nuclear energy. Not only do I believe that increasing use of the power source will have great benefits for mankind, but it will give Atomic Insights plenty of material for many years to come. It will also help to increase the size of my personal investment portfolio.

Atomic Insights does not provide investment advice, but I can tell you that I purchased a moderate amount of Toshiba [the corporate parent of Westinghouse] stock this morning.

Post updated with more details about the Shaw Group, its purchase of Stone and Webster, its deal to be the construction company for Westinghouse, and its sale to CB&I.

No mention of Fluor taking over construction management of Vogtle and Summer as stated in the announcement?

@mjd

Not yet. I do not have a good understanding of that part of the deal, but I’m working on it.

Here is how I read the tea leaves

Three things happen at same time:

1. CBI purchased by Westinghouse

2. CBI replaced by Fluor

3. Legal suites resolved against Westinghouse and CBI.

I think CBI could not deliver modules on time and Westinghouse could not deliver AP1000 motors thru Curtis-Wright on time. The utilities basically won their suite agains Westinghouse and CBI about construction delays. Westinghouse agreed to remove CBI and bring in Fluor to satisfy the US utilities.

However, Westinghouse needs CBI to complete Chinese work and to get new work (up to 26 possible AP1000’s in China are now in doubt). So, Westinghouse buys CBI instead of CBI going out of business.

Suite resolved – Westinghouse better positioned for sales – big deal!

Now let’s hope the first AP1000 fires up and runs well.

Martin, probably as good a reading as any right now. And I agree it is probably a good thing for the current AP1000s, which directly affect any future for AP1000s in the US. There was a cryptic message in the press release about if CB&I would continue to be the module supplier. That is a tough read, but also a tough decision, as in who else is out there and up to speed. If CB&I is making progress, and understands their problems, it is better to stick with them on the module manufacturing. But if it is thought they are hopeless, well…

My first thought when I read this was Fluor is the deep pockets behind NuScale. I hope for NuScale’s sake Fluor does not get stretched too thin financially. The words in the press release were Fluor has a “cost reimbursable basis” contract. Maybe that’s just semantics in the story, but the usual wording from my experience is “cost plus.”

Note: I work at Westinghouse

Many of the modules being installed today are already coming from alternative fabricators like Newport News. Like anything, they’ve had teething pains, but they came up the curve quickly and I am hearing very good things from site.

Cory, thanks for that info. I’ve been saying for awhile that the only up-to-speed strict QA qualified experienced nuclear Management/Work Force that exists today is navy nuke shipyards and plant Outage/Mod support groups. If you can’t transfer that expertise/experience to a manufacturer, then transfer the manufacturing to the expertise/experience. So I’m glad to see this news.

BTW, CB&I has a Part 21 report today on the NRC Event Report web page, in a structural module CA01 for Vogtle Unit 3.

This type of thing has been problematic. It’s basically a resume problem; too many people who have been experiencing nuke power are claiming nuke power experience.

FYI, the word is “suit” (rhymes with “boot”) not “suite” (pronounced “sweet”).

I am honored to have you as my editor. I obviously need one.

Close Martin. If you look at the situation since CB&I bought The Shaw Group, it hasn’t been great from a financial standpoint. CB&I successfully fixed a lot of issues and made some great improvements but the new build projects were bleeding cash from the company. Additionally, the lawsuits and exposure (financially) were devastating the stock. If you look at the SEC filings, WEC is paying $0 in actual dollars. The lawsuits go away, CB&I washes their hands of all of the liability and financial obligations and so forth. This is actually good for everyone. CB&I never really seemed committed, nor really understood nuclear and it eliminates the finger pointing and back and forth between the partners. My speculation is that this sale/transfer was driven partly by the utility owners and mostly by the stock market. It’s a short term hit for CB&I but will be best in the long term for all parties.

CB&I is walking away from nuclear engineering and construction. WEC is buying that division of CB&I. CB&I is not necessarily being ‘replaced’ by Fluor. WEC is smart enough that they know what they don’t know. They don’t know construction. So they are bringing Fluor in to take over the management of the asset (CB&I) that they just acquired until they (WEC) can get a handle on the construction business. Smart move by WEC and great for Fluor.

Long term this is a good deal for all of the parties and for the nuclear industry as a whole.

I’m wondering if this deal wouldn’t eventually set up WEC/S&W for a Rosatom-type BOO (Build-Own-Operate) arrangement? The biggest missing component would be financing, but I’m sure Toshiba could backstop that.

I really hope things go better from this point forward. As a PSC regulator I was originally hoping these projects would stay on-budget and on-schedule. Since this has not happened my next best hope is that provisions in the contracts would protect the utilities and ratepayers from liability for the delays and cost overruns. I hope it goes more smoothly from this point so that the story could be we learned and improved. If there are more delays and cost overruns I am afraid the restart of the nuclear industry in the US will be short lived.

@Rod Adams

So another company is divesting from nuclear construction (because investment, management resources, earnings quality, and liability risks are too high). CB&I, once obligations are fulfilled, will turn it’s business to “liquefied natural gas, petrochemicals and fossil fuel power construction projects” (here). It sounds to me like you think consolidation of very large capital projects in a single company is a good thing for nuclear in the US (citing Admiral Rickover in this regard). It stands to be seen how consolidation of responsibility (i.e., risks) in a single entity helps the industry, and recruits new participants to make the same fateful first step (with the stakes so much higher as a result). This was an innovative model and it appears to have failed. While this places key stakeholders on firmer footing to complete the Vogtle and VC Summer projects (a good thing), I’m not sure this is a positive sign for the industry in the US (and future prospects for expansion). Do you really see it that way? The loss of a construction partner and a business model are two notable casualties (among the more positive indications that some very large debts and liabilities will no longer stand in the way of one company’s focus on markets “more strategic to our future growth,” as CB&I has indelicately put it).

Welcome back from vacation. I hope it was relaxing.

@EL

Not surprisingly, we can both look at the same information and read it in completely different ways.

As Danny Roderick has often stated, and Westinghouse is now more clearly stating in real commercials, Westinghouse is focused on nuclear energy. That is all they do. In my opinion, nuclear projects will be more successful when they are attempted by corporations or isolated segments of corporations that have no internal competing interests.

That is not really any different than what happens in other industries where disruptive products get developed. It is the solution to the “innovator’s dilemma” that results when the cash flow from an established product is threatened by a better product.

It’s not difficult for people whose careers are tied to the cash-flow producing, but potentially obsolete product to sabotage development of the replacement if they sit in the same meetings and compete for investments from the same decision makers. That behavior is perfectly understandable if you know human nature, but it often results in the innovation being developed by a different company.

Too many of the big, established construction firms that dabble in the EPC side of the nuclear business are irrevocably saturated with people that specialize in building pipelines, tanks, combustion power plants, and other projects that have little utility in the nuclear business.

One more thing – the solution to the issue of needing to be extremely large to succeed is to build expertise and organizational strength systematically, starting with small power plants.

@ Rod

“In my opinion, nuclear projects will be more successful when they are attempted by corporations or isolated segments of corporations that have no internal competing interests.”

Exactly. My company, SCE, had oil/gas fired plants along the coast of CA, Mojave Coal plant and I believe the first solar project, Solar 1; they appear to be mainly in the power distribution business now. Anti-nukes are often complaining about this or that in the nuclear industry and I have to wonder, who IS the nuclear industry if many companies who operate nuclear plants also have their fingers in other pies?

Rod,

While you could be right with the “internal sabotage” idea, EPC contractors are in it for the money and not any loyalty to a power generation source. Hereis a simpler explanation instead.

Companies that work on both the fossil and nuclear sides of the power business are often dominated by the fossil side (there is more money to be made there) and, as a result, those companies simply don’t have enough people with the right experience to do the nuclear projects. The nuclear project teams are a composite of nuclear experience and fossil experience, but the fossil experience is never enough. The result is the nuclear experienced people try to mitigate the continuing disasters caused by lazy or ignorant fossil experienced team members. So, everything goes slowly and when the project is done the fossil experienced people never what to go back to a nuclear project because of all the hassle. Repeat. Repeat. Repeat.

Unless you have a critical mass of nuclear experience on a nuclear project, you get stuck in that negative cycle. That’s been my experience.

For the last 8 years I have been saying that the Nuc;ear industry should not put all its eggs into the Generation III+ basket. I always thought that the AP-100 and the ESBWR were very promising designs, but costs were the potential killer problem. The AP-1000 looks like it will work for Asia, but its future in the United States and Europe is open to question. This is why the Molten Saltr Reactor is so promising. It offers a number of paths to cost lowering. I agree with Robert Hargrave, that MSRs can lower nuclear costs at least to the point where it will compete in manufacturing costs with coal fiered power plants, and perhaps even natural gas powered generators. I would be happy to see the AP-1000 suceed in North America and in Europe. But if it fails, or falls short of the market need for low cost nuclear, MSRs are still promising, Terrestrial Energy, ThorCon, and Transatomic all appearto aiming at developing marketable products within the next 10 years.

There is also development for our favorite, LFTR, and Flibe Energy: http://www.epri.com/abstracts/Pages/ProductAbstract.aspx?ProductId=000000003002005460

I am a proponent of “all of the above – nuclear power” but MSRs and particularly LFTR remain my favorites. With that said, I am very hopeful that the EPRI’s tech assessment will help move along small modular reactors that use molten salts and the Th-U fuel cycle. I can see the AP1000 being deployed in the near term, with these other reactors following on, just after them. Perhaps the future has the AP1000 as most of the base load power and SMR LFTRs picking up the rest of base load and also peaking power.

I must be feeling optimistic….

What basket is there currently besides the Gen III+ basket? Nuscale is the only SMR that is even talking about license applications right now, and they are at least a year away from submitting their application, which will then likely take 3-4 years at a minimum to complete at an unknown expense. There is currently no clear avenue for how licensing alternative designs not based on light water technology. The designs you mention are all promising concepts, but how can they be brought to the market or even further developed in the United States. Someone will have to pay NRC $270+/hour just so they can understand the technology, then spend a few years writing rules (likely with the help of many NGO’s and “concerned citizens” who’s only intent will be to slow the process and make it cost more money. Only then can designers make sure their designs meet those rules and apply for licensing approval.

@Timothy Wyant:

The rules have already been written for NuScale. In fact, the NRC had the rules out for public comments during the summer. Go to:

https://www.federalregister.gov/articles/2015/06/30/2015-16034/nuscale-power-llc-design-specific-review-standard-and-safety-review-matrix

or google search on “NuScale Design Specific Review Standard” to see all of the hits.

Enjoy!

The DOE’s Office of Nuclear Energy has hosted workshop(s) on Licensing Initiative for Advanced Reactors – Advanced Reactors Design Criteria, such as one April 15-16 2014. This will slow process, but every journey starts with the first steps.

The current plants are cost-effective, if you know where to build them. $2B and 6 years (or less) for the first few new Chinese plants that they are completing now (not the AP1000 or EPR). They will get that down, as they ramp up, either with CAP1400’s or the Hualong One design (that seemed to have been invented partly as a hedge after the delay in the AP1000’s).

More cost-effective plants (molten-salt probably as you suggest, and/or sodium fast reactors) are coming, but we CANNOT wait for them. Anything that delays the rollout of AP1000, ESBWR, etc. is bad.

Westinghouse, a major player in the nuclear industry for decades, has had its reputation tarnished recently due to revelations of accounting problems.

An independent audit requested by Westinghouse’s parent, Toshiba Corp., turned up irregularities, including overstated profits in the nuclear division, according to Reuters. Toshiba released the audit in July.

The Nikkei reported that Toshiba might sell all or part of its stake in Westinghouse, although a Toshiba spokesman denied it.

http://savannahnow.com/exchange/2015-10-31/settled-lawsuit-new-contractor-could-affect-vogtle-many-ways#

Most of the blame for the $1.2 billion profit-padding scandal at the computer-to-nuclear group has been pinned on its senior management following a review into its accounts by a panel of independent accountants and lawyers.

Japan’s financial regulator is expected to investigate the audit in the coming months …

http://www.reuters.com/article/2015/08/05/toshiba-accounting-auditor-idUSL3N10C02520150805

@jaagu

Thank you for being honest enough to include the links. I read both stories; I think you are wrong to interpret them as tarnishing Westinghouse’s reputation instead of recognizing that the problem seems to be a few conglomerate headquarters people who want to buff up their earnings reports by not fully accepting the loss estimates from a subsidiary company. As I read it, Westinghouse executives honestly and completely provided required financial statements to headquarters but the numbers in those reports were not acceptable to people who wanted better looking financials.

There is no doubt that progress at Vogtle and Summer has been difficult and more costly than initially estimated. That’s really no surprise given the fact that the first unit at both sites is a first of a kind and that both sites are in states where the entity that will own the facility is a regulated monopoly electricity supplier with an obligation to serve its customers. Under that regulatory model, the public utility commission takes responsibility for contingencies and requires the regulated utility to come back at regular intervals with a rate case explaining why they have spent more than initially estimated.

People who do not have much experience with big construction projects often misunderstand the concept of “contingencies.” Here is a best practice guide that helps provide some of the basics http://www.aia.org/aiaucmp/groups/secure/documents/pdf/aiap026970.pdf

In the case of monopoly electric utility companies, the “public” is also a party in the contract. The PUC represents the public. The normal policy is to prevent contingencies from being included in the initial budget because they can be the source of very rich rewards. Instead, the PUC makes a commitment to cover the reasonable costs associated with unexpected items and allows a fair, but not excessive profit.

The system, when operated by competent, responsible people works well, even though it lends itself to sensational headlines about cost and schedule overruns planted by professional opponents.