GA Power And Westinghouse Extend Temp Vogtle Nuclear Plant Construction Agreement Through May 12

Late Friday evening, Georgia Power issued a terse press release. Thousands of people who have been tensely anticipating a crucial decision regarding the fate of the Plant Vogtle expansion project cannot stop worrying yet. We will now mark our calendars for May 12 as the next deadline for announcing a decision about whether the massive project will be continued through completion.

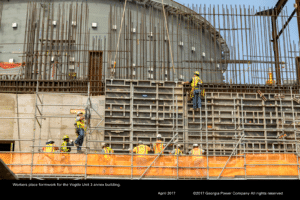

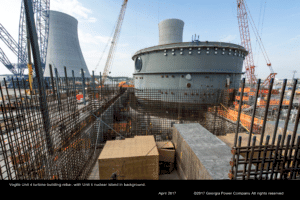

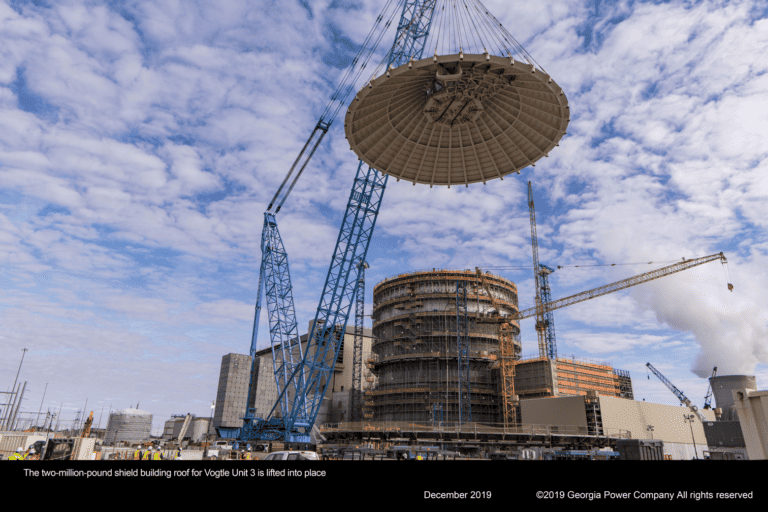

During the wait, Georgia Power employees will continue their efforts to produce a detailed project schedule and a credible cost-to-complete estimate that can pass muster with its partner companies (Oglethorpe Power, MEAG and Dalton Utilities) and the Georgia Public Service Commission. While planning, budgeting and accountability negotiations continue, skilled workers – like the ones pictured above – will continue pressing forward.

Westinghouse will continue providing design, engineering and procurement services for Southern Nuclear while that company is assuming control over management of the enormous project.

How Solid Is Westinghouse’s Credit?

Southern Nuclear might want to assume procurement responsibilities as quickly as possible. As a result of its March 29 Chapter 11 bankruptcy filing, Westinghouse’s material, component and services vendors are rightfully concerned about whether or not they will be paid in full.

Some have already asked the company to return products that have not yet been used or installed. As often happens when multibillion dollar companies seek protection from the bankruptcy courts, there is a long line of large, medium and small companies whose invoices for already-delivered products and services will not be paid without court approval.

Westinghouse spokespeople are, unsurprisingly, trying to reassure their creditors and persuade them to continue business as usual. They are also reminding contracted vendors that they need to carefully review the provisions of their signed contracts and note that most of them have clauses requiring continued performance in the case of a Chapter 11 reorganization.

During the 30 days since the initial bankruptcy filing, the owners of the Plant Vogtle project have been paying Westinghouse $5.4 million per week. Those payments primarily ensure that the workers assigned to the project continue receiving paychecks that do not bounce.

Battle To Maintain Access To Required Intellectual Property

After the bankruptcy filing, Westinghouse arranged a debtor-in-possession (DIP) loan of $800 million from Apollo Global Management LLC, but that money cannot be used to pay for expenses related to the Plant Vogtle project. It is limited to providing the working capital required to keep the healthy parts of the Westinghouse enterprise operating. The bankruptcy court has until May 10 to decide whether or not to approve the loan’s terms and conditions.

On April 27, attorneys representing Georgia Power formally filed a protest with the bankruptcy court. According to their analysis, there need to be additional safeguards inserted in the agreement before the court approves it to ensure that the lender cannot obtain control over the intellectual property required to complete the construction projects.

The lawyers representing the project’s lead utility, one of Westinghouse’s largest creditors, acknowledged that the DIP lender should be able to obtain an appropriate share of the proceeds of any sale of the IP to another owner, but it should not be allowed to gain control of the IP the owners need to complete the project so they can recover at least some of their massive investment.

It would be a gross injustice for a private equity firm to win control of the IP needed by creditors who are already owned several billion dollars in return for lending Westinghouse a few hundred million dollars.

It’s probably no coincidence that the May 12 date selected for the next decision announcement comes just two days after the bankruptcy court is scheduled to approve or disapprove Westinghouse’s DIP loan. If Southern Nuclear has any concerns about whether or not it can readily access the information it needs, it seems unlikely that it will invest any more resources into completing the project.

Note: A version of the above was first published on Forbes.com. It is reprinted here with permission.

I imaging that the building of the Vogle reactors must be of a national importance for the look of US abroad. If US cannot build there own reactors who will trust them building abroad? What do the Trump-adm make of this?

Have you seen our roads? Third world countries have better infrastructure. Yet the military gets every dollar asked for.

But the fact that the AP1000 reactor vessel, steam generators, pressurizer, PRHR heat exchanger etc. were not domestic and the poor labor productivity on site do not speak well of our industrial future.

Rod, Is there any estimate of just how much money, in total, Westinghouse would need to finish the project and pay anyone? Just how shot is the original budget for building the plant?

Not to worry, WEC sold (gave?) everything to China in return for China buying four AP-1000 plants. I’m sure the Chinese will sell GA Power anything they need.