I have recently been introduced to a fascinating energy industry information source called European Energy Review. It is useful to find new perspectives on a topic as broad and as important as the large and lucrative energy supply business. The situation in Europe has always been substantially different from that in the US, because it is a more densely populated area with fewer internal natural resources and because it is much closer to suppliers in the Middle East, North Africa and Russia.

The Russians are also concerned… They want to be sure they are part of a bullish market in the coming decades.

On May 9, 2011, European Energy Review published an interview of Jean-François Cirelli, President of Eurogas and President of French energy company GDF-Suez. The text of the published interview was interesting on the surface, but even more interesting to me was the information that could be gleaned from the white space between the lines. The interview was titled ‘Shale gas will not be as important in Europe as in the US’.

Cirelli based his analysis regarding the smaller potential role of shale gas on several factors:

- Europe is more densely populated, so there is less potential for finding places to drill that do not have a large number of nearby neighbors.

- Europe has stricter environmental laws aimed at protecting water supplies.

- Europe has a different kind of minerals ownership law that apparently makes it less attractive for extraction companies to accommodate the additional expenses associated with hydraulic fracturing.

- Finally, Europe has access to affordable supplies of gas from neighboring countries or more distant suppliers that are building new pipeline or LNG delivery systems.

Towards the end of the article, the discussion revealed some market assumptions that I wish the interviewer had probed a bit more. Here are some brief excerpts:

Is the development of unconventional gas undermining the profitability of investments in gas production and pipelines, such as South Stream? Does it make the need for a Southern Gas Corridor superfluous?

As I said, the potential of unconventional gas in Europe is not likely to be as important. It is not yet known and will take time to come onstream. As we expect demand for natural gas to continue growing in the future, all new gas is needed. No, as I mentioned, investment in diversified supply routes is essential.

Notice how the interviewer and Cirelli recognize and understand that new supplies of energy fuels can affect the market, but a growing demand ensures there is room for all suppliers without “undermining the profitability of investments”. Let me translate that for you – as long as demand grows as rapidly as supply, selling prices will remain high and allow the cost of expanding capacity to be recouped by the difference between cost and price. Here is another one:

For the international oil companies, like Shell, BP, Total and ExxonMobil, gas is rapidly becoming more important, perhaps even more important than oil. How does this impact the midstream energy companies in Europe like GDF Suez, Eon, RWE and Enel? And how does it impact the work of Eurogas?

BP, Shell and Total are members of Eurogas. They have brought a new dynamism to our work. They are large producers and when they take major investment decisions they have to be sure that the demand will be there in future. They share concerns that the current political declarations at EU level tend to underestimate the role of gas after 2030, which in turns puts their major investment plans into question. This makes them more vocal about the role of gas in the energy mix. The Russians are also concerned about this. They want to be sure they are part of a bullish market in the coming decades. If you look at the energy roadmap and scenarios under discussion in the EU, the importance of gas starts to go down around 2030. We say, hang on there, gas will become more important in power generation. And we don’t really accept that it will become less important for households.

(Emphasis added in the answers.)

That is a real shocker. The multinational petroleum companies that have become so wealthy and powerful by moving massive quantities of oil to market want to build on their core competencies in geology, logistics, and dealing with dictatorial governments to build up a long-term business that moves gas from underdeveloped supply areas into hugely profitable developed markets.

They expect part of the return on their hundreds of billions of dollars worth of investment in pipelines and LNG infrastructure to come from expanding their share of the electrical power generation market while not giving up any of their existing markets in supplying homes with piped natural gas. Hmmm.

The next selection brings even more food for thought.

According to the decarbonisation roadmap of the European Commission, by 2050 virtually the entire power sector must be decarbonised. What role will there be for gas then?

First of all, this roadmap was produced by the Directorate-General of Climate Action. DG Energy is also working on a roadmap that will come out after the summer. It is not yet clear what this will look like. But we may need to consider at what point some form of carbon capture and storage could be introduced for gas. It is still early for that. Until 2030 the best solution is to change from coal-fired to gas-fired power. After 2030 it is obvious that we will need new technologies to achieve these objectives, including perhaps some form of CCS for gas.

In a previous, not quoted section, Cirelli indicated that the gas industry has decided to work to eliminate the notion that natural gas is just a bridge to a utopian future where energy is going to be supplied by an unobtainable combination of smart grids and renewable energy systems that are sufficiently well distributed to allow “firming” of their inherent unreliability. He stressed the importance of fast responding gas burning systems in a grid system that has a lot of uncontrollable wind or solar supply components.

In that above passage, he lays the gas industry’s cards on the table. They expect to be the chosen replacement for coal and they want people to believe that carbon capture and storage will actually work on a massive scale sometime in the distant future.

Finally, the interview hit the topic that makes this a smoking gun. I can guess exactly what kind of serious and concerned face Cirelli must have been wearing as he responded in the following exchange.

How will the accident at Fukushima impact the role of gas?

It has been a terrible tragedy in Japan. The nuclear industry will have to take on board any lessons from these dreadful events. But it is clear that an energy-hungry world needs a mix of energy solutions. We also need to see the impact of this incident on public opinion. Investments in nuclear power are long-term decisions and as long as the public debate is going on, gas presents a quick and competitive solution for a low-carbon energy mix.

Do you think this will impact EU energy policy?

Well, if there is going to be a nuclear rethink, it is necessary to sit down again and have a dialogue on this with the gas industry. It would also tie in with the 2050 roadmap. The direction member states are going on nuclear will have big implications for gas.

So there you have it. The natural gas industry (also known as the petroleum industry) has expressed its human concern for the “dreadful events” that have not resulted in a single death from radiation. The same natural disaster destroyed a number of fossil fuel facilities, including one refinery that burned for 10 days after the earthquake and tsunami.

However, if the “terrible tragedy” that eliminated the energy supply competition from 6 emission free nuclear plants happens to cause European governments to completely rethink their interest in expanding their nuclear generation capacity, well, the gas industry is ready and willing to talk about taking on the challenge of supplying even more of the market. How nice of them – how many billions is that effort going to generate in revenues for them?

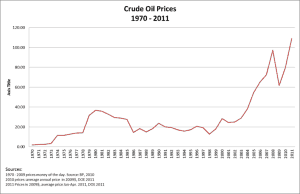

Just a reminder for you. Here is what happens to prices when companies like ExxonMobil, Shell, BP, Total, and Aramaco are in charge of planning production and controlling market supply and demand balances.

Can you see why I have a lifelong distrust of oil&gas company executives? (It started in late 1973, when the price of gas jumped from a quarter to nearly a dollar and we had to wait in line for hours for the privilege of buying that far more expensive product. I was not yet driving, but I sat in line with Dad at oh-dark-thirty on our way to swim practice.)

Rod – right on target as always. And I suppose it was inevitable that natural gas would get the CCS greenwash applied as well. I think the Next Big Future post The Case for more resources transformational technology rather than spending money to master hiding waste is right on target as well. Nobody seems to be asking what we do when we have no fossil carbon/hydrocarbon left and/or no more space under the carpet to sweep the waste. Where will the energy and money come from to build the next round of systems?

It’s a failure of both the politicians and the media IMO, and confirmation that businesses certainly do know how to manipulate both.

Given Europe’s increasing dependence on Gazprom for its gas supplies, I believe it is only a minor exaggeration to describe European opposition to nuclear power as treasonous.

In response to George Carty’s comment about European opposition to nuclear as treasonaous. It is a multinational market place anywhere in the world. Whether it is “Just the Idea” or products such as natural gas instead of nuclear, loyalty is a smoking gun. Recent Russian Energy “Exploration” may make this issue more evident to everyone involved in international markets. That is not to forget military posturing on this day honoring our armed forces. The smoking gun refuses to go away so be vigilant!

The statement about shale and other tight gas exploitation not having an impact on the gas market is something that should be looked at in a bit more detail. This attitude can only come from someone who is convinced that the gas market will continue to grow at such a pace that the introduction of vast new supplies will not have a major negative impact on profits.

That level of confidence on how firm the market is telling in itself.

@DV82XL try being even more suspicious. Perhaps he knows that shale is a mirage that is actually part of a plan to sell LNG. He might also know that the stricter enforcement of laws that protect water supplies in Europe adds enough cost to make hydraulic fracturing too expensive to compete.

I’m not so sure that tight gas is a mirage. The exploration side of the fossil-fuel industry has a history of dealing with environmental concerns over their activities, and I have no doubt that they will come up with process that is more benign than the current one. Keep in mind one of the early attempts to release tight gas was with a nuclear explosive. While this worked, the gas was a bit radioactive, and the public outraged and the experiment was not repeated (in the US, the USSR tried several shots to loosen up gas with varied results)

The point being that this field isn’t dead yet, even if they have to go back to the drawing boards.

While I wouldn’t put the scenario you’re suggesting out of the realm of the possible, given the industry in question, I more suspect that they think they can keep nuclear at bay indefinitely.

Time will tell. One of the things that makes me believe in the theory that I have posed is the incredibly steep depletion curve associated with tight gas wells. You get a big burp initially, but you have to keep drilling and fracking with depressing regularity to keep the gas flowing. I do not think there is anything that the extractors can do that will mitigate some of the surface disruptions from heavy truck traffic and high quantities of water usage.

Another thing that backs up my theory – at least in my mind – is totaling up the investments made in the LNG infrastructure. Making those hundreds of billions pay off requires high volume sales over a very long amortization period. That means there needs to be a large, highly addicted market that cannot easily make a different purchase decision.

I am guessing that delaying nuclear projects by a couple of years would be enough to make a new renaissance a distant dream because of all of the disillusioned young nukes who would be off in other lines of endeavor and reluctant to return right at the same time as the older generation decided it was no longer worth hanging around for a few years to actually build something.

Price wars seem to last forever while they are happening, but looking back, the period of low prices seems awfully short compared to the end result of destroying viable competitors.

Here’s an article about US nuke-fracking of natural gas fields in the 60’s:

http://www.kansascity.com/2011/04/24/2823225/detonating-nuclear-bombs-in-search.html

And here’s a Soviet propaganda film, complete with swelling orchestral strains, about nuking an out-of-control gas well to shut it down:

http://www.youtube.com/watch?v=CpPNQoTlacU

And if Germany continues on with their panic plan of shutting down their reactors based on the latest elections, Europe will have tied themselves to gas for a generation or more. Reuters reported Germany will face rolling blackouts this winter unless they buy Russian gas or over-the-border power. Power that will have to be bought at premium rates since Germany will have to buy power on the spot market as they do not have any long term contracts in place due to their panic over Fukushima.

Then the German businesses will ramp up their manufacturing exodus, German tax revenues will decrease and the German people will be asked to pay more and more to subsidize wind and solar.

The end of Germany as we know it.

US to follow suit if we continue to push more wind onto our grid raising our own power prices and taxes while falsely believing a few thousand manufacturing jobs at windmill facilities can replace several hundred thousand manufacturing jobs that have been lost over the past decade or more.

Bloomberg is reporting that major US corporations are not bringing jobs back here since we are in a no-growth period. Jobs are going outside the US and the companies are trying to keep the non-US income stream from being taxed.

And we have allowed ourselves to be scared of nuclear power which allowed a anti-nuclear politician to head the very organziation charged with monitoring nuclear power.

What a hole we are digging for ourselves.

RE: The Project Plowshare gas from underground nuclear explosions. I’ve read that this gas was finally released to market in the 90’s sometime, but I can’t find reference. Does anyone else remember seeing this?