Kewaunee needs a “deus ex machina”; rising natural gas prices not quite enough

On May 7, 2013, the Kewaunee Nuclear Power Station is scheduled to stop generating emission free electricity for the last time. The plant is one of the better run and maintained facilities in the US, it has an operating license that is effective until December 2033, and it generates electricity for an average cost of about $30 per MW-hr.

That generation cost number does not tell much of the story for Kewaunee because it implies that each MW-hr has a similar cost. If that was true the total ownership cost could be reduced by reducing operations. The reality is that, Kewaunee’s cost of ownership as an operable nuclear power plant is almost entirely fixed; my best guess for the annual cost is approximately $135 million whether the plant produces no power or 4.52 billion kilowatt-hours, which is what it produced in 2012.

The only part of the plant’s cost that is variable is fuel, but that is such a small portion of the cost that the owners selected a shutdown date that leaves about six months worth of fuel unburned and destined for eventual long term storage in a dry cask.

According to some news reports, the biggest driver for the low market price in Kewaunee’s service area has been the low market price for natural gas. Company insiders believe that another factor is MISO’s proximity to the Powder River Basin where there is an abundant resource of low sulfur, low heat content coal. That fuel sells for something less than $2.00 per MMBTU; unlike many other coal burning facilities, MISO located generators do not have to pay much to transport the fuel. They are not very far from the Wyoming mines.

A third factor contributing to the low price is a rapidly expanding inventory of subsidized wind generators that can make money producing electricity even when demand is so low that prices fall below $0. Corporations that operate wind turbines erected with the past 10 years get paid $23 per MW-hr by federal taxpayers for all the power they can generate. The final factor in the low prices is the long term slow down in energy intensive manufacturing and other economic activity in the MISO service region.

All four factors combined to form the basis for the spreadsheet calculations that made Kewaunee a loser for Dominion and for the other power generation companies that kicked the tires during the year or so that Dominion quietly marketed the plant for sale before announcing its closure in October 2012. One of the most important lessons I have learned as a nuclear professional decision maker is to record and understand the basis and assumptions used in support of any major decision. It is only through that process that one can effectively make changes and reevaluate decisions. If the basis shifts, the final decision may change if recalculation warrants that action.

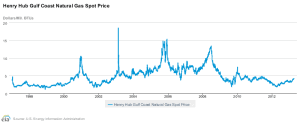

The first factor noted above has shown the most change. Since reaching a nadir of $1.88 per MMBTU almost exactly one year ago (week of April 16-20, 2012) the New York Mercantile Exchange (NYMEX) price for natural gas at Henry Hub has increased by 133% to close at $4.42 on Friday, April 19, 2013.

According to a number of investment oriented web sites, the glut in natural gas that filled all available storage reservoirs and caused the price to fall so dramatically is officially over. However, at least one major drilling company, France’s Total, that has available leases to exploit in North America, has stated that it will not even begin a new drilling campaign until prices are above $6.00 per MMBTU. (Note: That last link is in French, but the magic of Google Translate is available.)

As regular readers know, I never pass up a chance to publish a reminder copy of the price chart for natural gas that should give any decision maker a reason to worry when her analysts tell her that they know what the price of natural gas is going to be at any time in the future beyond a few months.

The second factor stressing Kewaunee continues unabated; wind power capacity continues to grow and new wind turbine projects continue to receive federal subsidies for every kilowatt hour they generate – at a projected cost to the budget of $12 billion for 2013.

The third factor is a wild card. Powder River Basin coal prices remain virtually unchanged over the past year, but they have gone up about 10% since October 2012. In addition, new regulations continue to add unpredictable costs to coal burning facilities. There is little doubt that the environment suffers when the replacement power for a 560 MWe nuclear plant is produced by burning coal.

The relatively slow pace of energy consumption growth in the Midwest should be improving as manufacturing recovers and as energy intensive users recognize the opportunities presented by power costs that are significantly below the world average. I have not yet found any definitive sources that support that assumption, but I will keep looking.

If I was making the Kewaunee decisions at Dominion, I would ask for a final run of the numbers by my spreadsheet wizards. I would want to know if the decision made a year or more ago to either sell the plant or shut it down still makes sense. Even though there are balls rolling, contracts being executed with destruction companies and people arriving on site with decommissioning expertise, the plant is still operating today. The irreversible state happens when the operating license is revoked; there has never been a plant relicensed after permanently ceasing operations.

However, I don’t work for Dominion and have no say in their decision process. Since I feel so strongly that the plant is a valuable asset that should not be destroyed, I’ve had conversations with a variety of people including investment bankers, lawyers, utility executives and others who have all expressed a sense of regret at the loss of a valuable asset, but they have accepted the results of decision process. I’ve even approached a few financially strong companies that purchase hundreds of megawatts for servers and famously tout their desire to buy clean power, but those companies currently have policies that do not consider nuclear as being clean power.

None of the people I contacted share my judgement that shutting down a well-run, well-maintained nuclear facility is fundamentally the wrong thing to do. They have faith that the company has diligently run the numbers and is doing the right thing for its stockholders. Some of them agree that the plant could be a valuable asset in a few years when power prices rise, but they do not know who has the stomach or the financial capacity to accept annual losses for an unpredictable amount of time before the value is recognized by the market.

One of the facets of the issue that continues to frustrate me is the lackluster response by the people at the plant. Someone started a Keep Kewaunee Open For Business page on Facebook. I’ve made comments there and shared the supportive articles posted here, but not one of my posts generated any comments, personal inquiries or comments on Atomic Insights. Perhaps the employees there have the same accepting attitude that the decision was regrettable, but inevitable.

Before giving up, I want to point out that instead of generating about 4.5 billion kilowatt hours of useful electricity with no emissions for the next 20-40 years, the Kewaunee Nuclear Power Station will be undergoing a $1 billion destruction effort that might linger on for 60 years.

Is that really the right course of action for the prosperity and environmental cleanliness of the region and the rest of the United States? Is there no capable investor in the US who can help to maintain the operations of a plant that prevents the emission of roughly 4.5 million tons of CO2 every year. During the 20 years remaining on its operating license, Kewaunee would prevent 90 million tons of CO2 from entering the atmosphere.

(Note: That number is based on assuming that all of the replacement power is produced by coal. A good thumbrule for coal fired power is a kilowatt-hour produces a kilogram of CO2, so a billion kilowatt-hours produces a million tons of CO2. Quibble all you want, the resulting round numbers are close enough and really easy to compute.)

Rod,

I think you have a typo, you meant France’s Total not Frane’s Total …

Ciao

Daniel – Thanks for the proofreading services. Much appreciated.

Destroying an asset with at least 20 years of remaining lifetime due to conditions that are likely to last less than 2 years is extreme short-termism. Do the execs of Dominion Power get bonuses based on quarterly targets?

Not sure, but such bonus systems are not uncommon in the utility industry. They sometimes lead to extremely illogical and short term decisions, like when TVA execs decided to sell off some important Bellefonte components a year or so before the company determined that it would be a good idea to finish the plant.

All Dominion employees share in bonuses based on meeting annual EPS. The higher up the ladder you go the larger the payout as a percentage of your base salary.

From what i have observed Dominion may be pulling back it’s interest in merchant power and remaining in regulated markets where profits are more stable.

Perhaps Dominion Power should trade their PWR for one of the US’s many Mk I or II BWRs to achieve a generally higher level of safety.

I hope you are just being silly.

If that “silly” was aimed at me, then no, I was not trying to be silly. Why would you think that?

What makes you think a Mk 1 or 2 BWR is safer than a PWR?

“The only part of the plant’s cost that is variable is fuel, but that is such a small portion …”

… that in practice it isn’t. Matthew Wald made the point that plant operators run 18 months, scheduling refueling for the spring or fall, when demand is lower. So if, e.g., North Anna is knocked off-line for a few months by an earthquake, the operator could elect to run a few months longer, but will keep on the original refueling schedule and remove the not-entirely ‘spent’ fuel anyway.

Rod- In the first paragraph, I think you meant to type that the Kewaunee license is good until 2033. This point greatly alters the meaning of that sentence, and is why shutting down the plant is such a terrible shame.

http://www.nrc.gov/info-finder/reactor/kewa.html

@Pete51

Thank you for the correction. I don’t know where my head was this morning – that is two errors detected by the terrific contributors who read my apparently unfinished works.

One thing that is being used against us, and it was never intended to be this way, is the decommissioning fund. This is happening at CR3 also. The owners can “get access to” the decommissioning funds by announcing that they will decommission their plants rather than keep them running. That generates a revenue stream that they otherwise would not have. If this in fact is what is happening, it is ironic in the extreme that a mechanism to assure proper cleanup of plant sites would be misused in this way. Plant owners were never intended to place themselves in a position to “mine” the decommissioning fund to generate revenues. It was intended to be used only at the end of the useful life of the plant. Like most engineers, my thought on “useful life” was when the system was physically unable to continue functioning because of age. I guess the bean counters have a different view.

Wayne,

If they were to chose the ‘Safestor’ approach, we would see the reactor in a 40-60 years in configuration that requires only limited staffing, while levels of radioactivity fall due to decay.

That would not suck up too much costs. I think this is the way to go for all decommissioning undertakings.

Ciao

My idea was that Dominion or the next owner use the Safestore approach but do more to preserve the place, the way you would preserve a classic car and kind of “put it up on blocks”. That is, drain all the fluids, remove the fuel, use dehumidifiers to keep the place dry, maybe wax everything, so that when the area needs energy it can be started up again. I would also think the office buildings could be used for other functions. But Rod doesn’t seem to think this is possible. Meanwhile, why is “the ball rolling” that demolition companies are ready to wreck it so soon?

If you are thinking that the plant can be placed in SAFESTORE and then be restarted sometime down the road, that won’t work. Once the company gives up the operating license the plant can’t be restarted without getting a new license. the plant would have to be brought up to modern standards. It is too expensive to maintain the license because the cost is the same whether it is operating or not.

The virtues of SAFSTOR probably won’t matter in this case. If the company goes ahead and wrecks the plant on the fast track, they can draw more from the decommissioning funds. That looks good for quarterly revenues, stock options go up, and people who hold them can cash them in and make out like bandits. We have to read between the lines here. I have a feeling that those in charge view the decommissioning fund as kind of a gold mine, or equity to be tapped to make it look like they are generating revenues without selling product. It reminds me of when my wife quit her job and cashed in all of her IRAs and annuities. She was rolling in cash for a little while and felt great, had all these dollars to spend on herself for doing little work other than signing the forms. But we paid a price in the end. We took a tax hit and now in retirement she has to come begging to me for an allowance. I have a feeling this company (or maybe the people whom live there) will pay a price in the long term for throwing away a perfectly good asset.

If the top dogs are getting big bonuses for closing the plant, do they have to pay back the big bonuses they got for being smart enough to buy the plant in 2005, or for successfully managing the license extension work in 2008? /sarcasm

“There’s no reason for it, it’s just our policy.”

Joris – where is your quotation from? What is the topic?

It is a text on a wooden pen-holder that my father has in his study. I rememer it because when I was a child, I couldn’t figure out what it meant. When I got older, and started my career, I learned what it meant.

I posted it here, because reading your articles on Kewaunee, it came to mind.

I no longer live in the area of Kewaunee, but I can still have an opinion. Keeping this plant running provides electricity at a constant and reasonable cost for a long time to come. The public will not be slapped by the invisible economic hand as they will be when the price of natural gas rises as it inevitably will.

It is so hard to build anything in this country today that these plants should be considered valuable resources. One should shed a tear when such a clean, reliable and reasonably priced source of electricity is eliminated by the Wall Street gang.

We had something like that happen here in Pittsburgh. The Civic Arena was a hockey and concert stadium with a unique retractable stainless steel roof. There was an architect who tried to get people to save the structure but the Pittsburgh Penguins and Mayor Luke were the owners and would not hear of it and refused to sell the facility to anyone else. Turns out Circe Du Solei was interested but soon the place was wrecked and is no more. Was Dominion actually willing to sell the place at all? Turns out many midcentury facilities are in danger of the wrecking ball.

One of the reasons why the CA was wrecked is that the demolition company was allowed to sell all the stainless steel. Would a demolition company want Kewaunee to sell off all of the parts? or can they, with each nuclear plant being unique?

We had something similar also in my country. A large phosphorus factory was closed because it couldn’t compete with a (heavily state-supported) Kazach phosphorus plant, so rather than impose import tariffs on the Kazach imports, they closed the plant in the Netherlands, which turns out to be a significant part of European phosphorus capacity. Now with the plant closed, there is a 100 to 500 million polution remediation job for the Dutch tax payer. Additionally, the plant was a quite modern facility with high efficiency and low environmental impact (the pollution at the site was from earlier times).

As usual, some of the so-called Greens celebrated the closure of the ‘dirty, energy intensive’ factory. But the Greens never seem to realize that world phosphorus demand does not decrease, so whenever an efficient, clean, modernised factory in a country with strict environmental regulations closes in this way, a actually dirty, inefficient plant such as the one in Kazachstan is going to increase it’s capacity. Far from improving the environment, closing a factory in an environmentally conscious country is a big loss for the environment.

One of the things I always try to bring into discussion with Greens about environment and industry is that if anything, the Greens should make sure to *attract* energy intensive industry to our country, rather than cheer-on its demise, because whatever such industries we can keep in our (heavily environmentally regulated) country, means that this industry will be relatively clean, and not be substituted by a far worse version in a non-environmentally regulated country. Of course, this concept is often completely lost on many Greens who tragically equate energy intensive industry with unsustainable industry and try to fight industry with everything they’ve got. Some of them literally claim that energy intensive industry is inherently unsustainable, ‘because there will be an energy crisis’ or other such doomsday beliefs.

They’re newest plan is to force increased energy taxation of energy intensive industry in order to ‘stimulate investment in energy efficiency’. What these Greens forget is that in the Netherlands, decades of efficiency drives have improved the energy efficiency of chemical and metal industry sector by over 60%. As usual, some Greens labor under the impression that no engineer ever thought of increasing energy efficiency, and that the government stimulus/enforcement of energy efficiency investment by the industrial sector has never yet occurred before the Greens started their cheap rhetoric about so-called ‘inefficient and polluting’ heavy industry.

Joris van Dorp wrote:

Some of them literally claim that energy intensive industry is inherently unsustainable, ‘because there will be an energy crisis’ or other such doomsday beliefs.

I always find it amusing how these “Greens” will decry energy intensive industry, but seem to have no problem benefiting from those same industries in their use of transportation, housing, food preservation, medical technology, entertainment, etc. Even if they are using these benefits in more energy efficient forms, energy is still required. And those more energy efficient devices usualy require more material and energy to manufacture in the first place. But I guess it is ‘OK’ if all that happens on the other side of the world

It’s such a pity that it’s difficult to convert vehicles to use CNG as a gasoline substitute. The potential market for CNG is on the order of the market for gasoline (16.6 quads) which would soak up the “gas glut” overnight, and even at $10/mmBTU would be far cheaper than imported petroleum. Running NG up to $10/mmBTU delivered would also make the shutdown of Kewaunee an obvious act of economic idiocy.

We suffer from a deficit of arbitrage.

The difficulty is not with the motor, tank is most of the cost, but with the lack of autonomy and the need for very frequent refueling.

Read the interesting discussion here, it’s easier said as done :

http://www.theoildrum.com/node/9526#comment-921485

Neither energy density nor frequent fueling are big issues. Anyone with natural gas delivered to the home can refuel at home, and dual-fuel vehicles can fall back to gasoline once the NG tank is empty. The median commute is 22 miles a day, and by coincidence this is about the mean fuel economy of the US LDV fleet in MPG. If people carried even 1 gge of natural gas, fully half of all commuters could nearly eliminate their gasoline consumption from their daily commute.

2011 US gasoline consumption was 8.7 million bbl/d, about 367 million gpd. Cut consumption by 150 million LDVs times 1 gallon/vehicle/day and you’ve made a huge dent.

@engineer-Poet

The difficulty comes back to energy density. Gasoline naturally contains about 36 kw-hrs of heat for every gallon (0.134 cubic feet). Most cars come with a simple, rather thin walled 12-40 gallong tank for holding the fuel. It only takes 2-5 minutes to refill that tank from a normal pump. The gasoline station also has simple underground, atmospheric pressure tanks and the trucks that flexibly deliver the fuel, on demand to tens of thousands of different facilities that are conveniently located for customers also use simple, large capacity tanks.

Compare that to the infrastructure needed to deliver a vapor that occupies 122 cubic feet (917 times as much volume) at standard temperature and pressure (STP) for the same 40 kw-hrs of heat.

(Note: I know, I need to convert all of those numbers to SI units, but I am running late and will do that later. I admit, I am a 50 something American who thinks in a strange system of measurement first and then has to do a manual translation later.)

The transport problem is one fo the reasons the likes of Shell are using gas to liquid to produce diesel and jet fuel. Shell Ultimate Diesel is a blend of conventional and GTL.

http://en.wikipedia.org/wiki/Gas_to_liquids

During WWII, British cars and buses carried bags of town gas to run engines in lieu of liquid fuels. If practical results can be obtained with such crude means, what do you think we could accomplish with even slightly greater sophistication?

What’s workable as wartime make-shift may not be the best guide for what people will find acceptable under normal circumstances.

As I said… “even slightly greater sophistication?”

Even wartime make-shift might be very attractive to people faced with a choice of buying gasoline or paying their mortgage. I’m paying about 90¢/gge for natural gas delivered to my house; unleaded regular is about $3.70/gallon around the area. People switching even 1 gallon/day at $2.80/gallon substituted save significant amounts of money.

If you really want to be upset at a company, you should look to Alliant’s subsidiary (Wisconsin Power & Light) as well as Wisconsin Public Service who had power purchase agreements with Kewaunee for around $36/MWh. WP&L is the company who didn’t want to renew its PPA with Kewaunee in 2013 and WP&L would have let their PPA expire with Duane Arnold in Iowa in 2014 if the state officials hadn’t stepped in. Dominion, of course, wanted to keep the plant running, no one wanted to buy power from it, however.

I’d be curious where you found that Kewaunee was producing power at $30/MWh. The data I have from the company which we can’t share publicly is much higher. If it was $30/MWh, they would have easily kept that plant running because I’m sure they would have been able to find new buyers for its electricity.

@David Bradish

I am upset at those companies. I am also upset at the way that the federal regulator keeps adding more and more costs to nuclear in the name of making what is already the safest form of power generation “more safe”. When those costs break the camel’s back and lead to shutting down a plant that is as well run and well maintained as Kewaunee, a less safe technology is going to be the source of replacement power. Somehow, the agency needs to understand that result violates their core mission statement.

“The NRC licenses and regulates the Nation’s civilian use of radioactive materials to protect public health and safety, promote the common defense and security, and protect the environment.”

Regulations that add cost without benefit to the point where they result in safe, reliable nuclear plants being permanently destroyed because they cost too much no longer protect the public health and safety. They DO NOT promote common defense and security and they certainly DO NOT protect the environment.

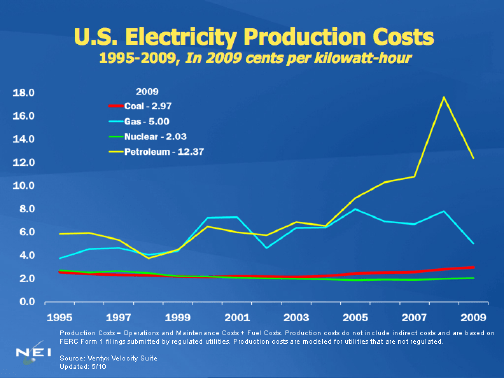

My cost numbers were a guess based on your organization’s U.S. Nuclear Industry Production Costs by Quartile in cents per kilowatt hour. According to that slide, the highest cost quartile in the period from 2009-2011 was 2.71 cents/kw-hr ($27/MWhr). I’ve also been told that, generally speaking, plants with the highest costs tend to be those that are under special scrutiny by the NRC, though individual units with small capacity are also on the high end of the scale.

Are you telling us that Kewaunee has excessively high costs as well as selling its power into a very low priced market? What are the main cost drivers? Why can’t they be addressed? I am not trying to be critical, I am trying to get to the root causes so that I can try to help find a solution to the problem.

Rod, my husband is an employee at the Kewaunee plant and I want you to know that people have noticed and very much appreciate your support and ideas. I think most of the employees are resigned to the closure because it seems the choices are limited and without much hope, everyone is pouring their energy into finding new employment, which is a very stressful process. Could the plant still be saved at this point? If so, I think there is a lot of interest.

@Gail – thank you for visiting. I apologize for taking so long to respond. The chances are probably quite low, but saving the plant is not impossible until such time as the company turns the operating license in to the NRC. That is the point of no return.

It might help to take a few minutes off from the job hunt to write a few letters. I would suggest that mayors, congressmen, senators, the governor, and local newspapers should hear from the employees and the families of those who will be impacted by the decision.

If you have more time, it might be instructive to find out how the employees at Vermont Yankee have been struggling to keep their plant operating. In their case, the company is very supportive; it’s the state and the antinuclear activists that have been trying to shut the plant down. Here is a link to a book that a friend of mine recently wrote titled Voices For Vermont Yankee. http://www.amazon.com/Voices-for-Vermont-Yankee-ebook/dp/B00BJ7KSTQ

My message, I suppose, is that the first step is to tell as many people as possible that there are some important negative consequences from shutting down the plant. The next step is to tell them that there are alternatives that can save the plant with a team effort.

It was a couple decades ago when utility executives extolled the virtues of deregulation.

At the time, I worked in the control room at Clinton for Illinois Power. Our CEO stated at a meeting that “electricity is generic, white box, black letters – people have no brand loyalty nor source preference – all they consider is cost.”

I found that part of his statement to be true.

The regulatory infrastructure is not equal between the various sources. The regulatory compliance costs of nuclear (Security, B5b, Appendix R, Maintenance Rules and MSPI etc) compound with th present economics of natural gas to tilt the scale of costs.

Today, that scale is not in our favor.

Tomorrow, that scale likely is in in our favor.

The shift to natural gas has two prongs. People heat homes and hot water with it. People will buy electricity from it. That well, pipeline, generation, and delivery network has to maintain load growth and expand even further to replace the sources being decommissioned now, such as Kewaunee and Crystal River.

To me, this indicates that the odds that naural gas remains near $2 or $3 in the long run is very low. World prices for it indicate the likely trend as market forces draw the asset offshore.

Because natural gas companies consider money generic. white box, black letters, with no regard of national loyalty nor source preference – all they consider is revenue.

All the more reason to use it for motor fuel. Why compete against a world price of $15/mmBTU when it can be priced against ULSD at $30/mmBTU?

Would there be infrastructure issues associated with a large-scale switch to compressed NG in the transport sector? Right now, all I do is pull up to a gasoline pump, switch it on, swie my credit card, and fill my tank. It is at zero gauge pressure, a device that transports a fuel in liquid form into an unpressurized container. Like most citizens, I very rarely handle pressurized, inflammable gases myself. The furnace and hot water heater more or less run themselves. I don’t handle the fuel directly.

On the operational side, any kind of pressurized gas system I have worked with (mainly helium and nitrogen) occasionally has issues with leakage. Would the containment system for a mobile CNG engine have any problems? Would such a containment system have issues with weight and/or reliability? Would the existing NG transport infrastructure have to be upgraded? Would their be concerns with that? Right now there is a (small, so say they) gas leak under the sidewalk in front of my house that I can’t get the gas company to fix anytime soon. More gas transport might have problems.

I’m not saying its a bad idea. I’m just trying to work through the issues and see if those would impact public acceptance of such a change. Right now its easy to refuel your car and most people don’t give it much thought. I’m guessing they’d expect likewise with any kind of replacement fuel.

If there will be, we’ll see it soon; today’s news on GCC includes an item about UPS purchasing 700 trucks that run on LNG, and building 4 refueling stations. LNG dispensers have been going in at Flying J and other truck stops for well over a year.

One gge of natural gas is about 120,000 BTU. Lots of home furnaces can burn that much gas every hour. Doing nightly fillups with 1-2 gallons-equivalent wouldn’t tax a local gas distribution network, and increasing summer demand would use the infrastructure better.

I’m sure there would be occasional problems, and methane detectors would be de rigeur. But people operate LPG vehicles and we don’t see frequent headlines about garages exploding, so I doubt the problems are insurmountable.

I was thinking more of the refueling issues. Now everything is at zero gauge pressure. Working with inflammable gases at high pressure may pose challenges to ordinary folks hooking up the lines. Maybe a swap system could be used, like is done now with gas grills.

Our steam lab used NG-fueled towmotors, but they were all ME types who used them, and didn’t have any problems.

I thought downstream of the meter was 6 inches water gauge, upstream quite a bit higher.

I’ve seen CNG pumps at an ordinary gas station, so it must not be too difficult for the hoi polloi. Of course, if you are only trying to offset the first gallon or two of liquid fuel per day instead of running exclusively on NG (the PHEV approach but with NG instead of electricity), you don’t need really compact storage so your pressure can be a lot lower. I think we can assume that any pressure used in a bicycle tire is manageable by technical unsophisticates.

@Engineer-Poet

You only save a useful amount of money if you consume a lot of fuel. It may be easy to displace the first gallon or two of liquid fuel per day, but that means that your maximum benefit is worth less than 10 minutes of my time even if the replacement is absolutely free.

How can such a savings repay ANY capital investment?

Consider someone who drives an F-150 13,000 miles a year at 16 MPG (812 gal/yr). At $3.70/gallon, this costs them almost exactly $3000/yr. If they can displace 2 gallons/day at a savings of $2.80/gallon, they can save over $2000/yr. This would pay off a $5000 investment in under 3 years. It may be possible to build low-tech systems for a fraction of that price.

Most people’s time is not as valuable as yours. Also, other people’s ability to convert extra free time to income is probably not as good as yours.

For a large vehicle, the potential savings approach the payment on a new small car.

I guess I was thinking more about the pressure at the point of exchange, where the gasoline exits the hose and enters the tank opening. That is essentially at zero pressure. Most people can handle it, although I guess in NJ you still need the attendant to pump the gasoline.

I was trying to inflate my son’s bicycle tires the other day, it was something like 60 psig. I had a devil of a time unsnapping the pump hose from the tire valve. It just wouldn’t release correctly. I had to re-inflate the tire three separate times before I was finally able to unsnap it properly. I’m not sure I’d want to be messing around like that with methane.

A CNG filler fitting doesn’t have to double as an exhaust valve as a tire valve does, so a one-way check valve could easily be incorporated. Just blow down the transfer hose back to storage after the filling operation and your connect and disconnect can be done at zero gauge pressure.

If you run at ten bar gauge pressure, it takes about 11 cubic feet of tankage to hold a gallon-equivalent of methane. A couple gallons’worth fits easily in a pickup’s cargo box with plenty of room left over.

@engineer-Poet

I am sure there are urbanites that simply like driving trucks, but a decent percentage of the pickups I see on the road here have CARGO in their box. Why bother to drive a truck if you have to waste all of that space carrying fuel tanks?

I think it would work if you could come with some kind of isolation from the tank volume once the filling was complete, then some kind of quick disconnect. You’d have to have seals during the filling operation, which you don’t have now with gasoline, but I guess eventually you’d have people be able to do it.

The volume equivalents concern me, and I guess that gets us back to the “energy density” argument. How well would CNG conversion work for my Corolla CE? Would it work for the requirements of a weekly commute of maybe 25 miles round trip? Would it be a daily fill-up to cover that? Would I have much trunk space? How about extended range? I often take the vehicle down to the beach, maybe 700 miles from here. Could it handle that in a reasonable manner?

It depends how much you need, and if the tankage is removable. The CNG trucks sold by GM and Chrysler have high-pressure tankage at the front of the box. I’m sure this is not removable, but there appear to be companies which find the tradeoff attractive.

That’s the difference between a low-tech 10 bar system and a high-tech 250 bar system. At 10 bar, you can fit enough fuel for your 25-mile commute in your trunk and refill it daily (the car would be dual-fuel and fall back to gasoline when out of NG). At 250 bar, your tank would probably be good for a week.

You can go down further in sophistication. At atmospheric pressure you could put a bag in some kind of fairing that goes from the roof backward; you might even be able to use the fairing to improve the car’s aerodynamics.

Not without taking the tank out, but if all the connections are low-pressure it might not be a big deal to make everything with quick disconnects. If you needed the space for cargo, just pull it out and set it aside. The car runs on gasoline when it doesn’t have NG.

Fall back to liquid fuel. It doesn’t matter which miles are driven on NG, just that you get a lot of them.

@Engineer-Poet,

This is being done all over Asia. In the Philippines the conversion kits only cost about 50 dollars. In Thailand the trucks in Bangkok have about 6 large tanks that ride behind the cab and replace the diesel. In Asian cities the quality of the air has greatly improved due to this change. Nearly every taxi has switched over to LNG. Luggage is a challenge but the taxi drivers save a bunch of money. I don’t know why it would cost $5,000 in the USA to make the switch.

Let’s call that the price floor. I’m sure that anything that could meet US emissions would be ten times that.

The EPA charges an absolutely outrageous fee (mid-6 figures, IIRC) to certify a shop to convert vehicles to NG. This fee is applied separately for each car model and each model year. I have never seen an explanation for this. The Honda Civic GX is also priced at a large premium over the gasoline model; I have no idea why.

One of the advantages of a low-tech system that can be installed by shade-tree mechanics is that it bypasses all the certification authorities and the anti-competitive fees they’ve been lobbied to add to everything that lets people go non-petroleum.

@Engineer-Poet

I started to wonder why there would be such an effort to discourage using methane instead of gasoline since both commodities are extracted and delivered by the same companies, but then I thought about all of the rest of the interests in the supply chain. Then I remembered a chapter from a business book I once read advising MBA students about strategies for preventing substitution of premium priced products with lower priced products, even if the lower priced product could do the same job. Those strategies were being aimed at people who were seeking to lead companies that had a complete product line – even if the substitution occurred within that product line and they did not completely lose the customer, the total revenue would drop.

Then I more fully understood and agreed with your point.

BTW – as gasoline is dropping in price due to easing of crude prices, natural gas at Henry Hub has increased by 133% from this time last year. The price war seems to be nearly over and the historic delta between buying heat in the form of liquid hydrocarbon and vapor hydrocarbon is being restored. That delta has been reasonably consistent over the years (roughly 20-40%) and simply accounted for the physical difference in effort and compactness required to deal with gaseous fuel compared to liquid fuel.

Is the switch between running on NG and gasoline essentially transparent as far as the engine is concerned? Are there any adjustmnets that have to be made in terms of ignition timing, etc.? I guess if those fall within the adjustment range available for the engine computer, you’d be okay.

Are there issues with the fuel transport? I know the liquid fuel line is designed for that kind of fluid. I guess you’re thinking the NG tank would have separate feeds to the engine fuel distribution manifold.

I guess the only other concern I would have would be storage of the vehicle in an enclosed space over a long period. I occasionally have to keep my car in the garage for weeks at a time because of travel. No one is around to open the doors. Right now I don’t worry about is because the gasoline doesn’t leak. If there were even minor leakage of NG during that time you might have safety issues. You’d have to remember to vent and purge your NG prior to going away and I guess that’s not a big deal, as long as you remembered to do it.

I’m not trying to be picky here, just trying to anticipate any issues that might come up. I’ve seen a lot of disasters occur with NG transport and use, seemingly moreso than with things like nuclear-generated electricity. I sure hope there is some way to harness that potential for use in the (ground) transport sector for individual users (not mass transit, although I don’t have a problem with that if it’s done right).

What are your views on the environmental effects of released methane (e.g., fugitive emissions) to the biosphere when weighed against CO2 releases?

@ Engr and Wayne SW,

Wow, that is a really restrictive fee that obviously has NOTHING to do with the ability of people to install or with the safety of the process.

The vehicles I see all the time have a separate line for the LNG to flow to the engine. If there are timing or other related issues, they must be fairly minor to the actual functioning of the engine. Several of the taxis I ride in can do both LNG and gasoline. They sacrifice trunk space for the fairly large LNG tank.

How it affects the air pollution, I don’t know, except that the Air in Manila and Bangkok are MUCH cleaner now that people are making the switch. Moving away from Diesel to LNG makes the air a great deal clearer.

As to the LNG fuel leaking – yep, there are parking lots that forbid these converted vehicles from parking in their lot. I guess they are worried about the leaking LNG.

Rod, I think you are spot on – why sell LNG for vehicle fuel when you can sell much more expensive gasoline? All this shows that there is not a real competitive market for fuels in the USA.

Methane has a substantially lower flame speed than gasoline, and I understand that it does work better with greater ignition advance. It also displaces air from the intake charge, decreasing peak engine power. (IMPCO, a mfgr of NG and propane fuel systems, has used turbocharging to make up for this loss. Methane has such a high octane rating that pre-ignition is not an issue in gasoline engines. It doesn’t even ignite by compression in diesel engines, allowing it to be fumigated into intake air with ignition provided by a small amount of injected oil.)

There are mfgrs of dual-fuel systems which do have a seamless switchover. This is a solved problem.

Actually, it does; you have evaporative emissions from the tank which are pushed out with changes in temperature and the barometer. Activated-charcoal canisters are required to capture this stuff. The stuff which diffuses through plastic fuel tanks is not captured at all.

These losses are so small that combustible concentrations are essentially impossible to create.

I suspect that there would be environmental issues from atmospheric CH4 buildup long before you’d have a problem with combustible mixtures in anything short of sealed rooms.

In the long run, CH4 oxidizes to CO2. In the short run, CH4 has a GWP of about 73, but considerably less CO2 per MJ than petroleum. If losses are well under 1%, even the immediate GW contributions seem to be less than petroleum. The clincher for me is that NG is a domestic US product, which offers far greater economic and military security than imported petroleum.

My new car is running partly on natural gas, indirectly via gas-fired generators on the grid.

Rod, unless we really get serious about the value of clean energy, there are markets where well operated nuclear plants like Kewaunee will continue to close. By serious I mean implementing something like a carbon tax to level the playing field with electrical generation from fossil fuels.

It is well known that Dominion never made a profit any year from Kewaunee. Their average annual loss was ~$30 million. Just as you would never go year after year with an investment draining your portfolio, you can’t expect Dominion to keep something that continues to lose money with no end in sight (especially when they can immediately show a profit by shutting down and accessing the decommissioning fund).

Of course, implementing a carbon tax would instantly and dramatically improve the financial outlook of operating and new construction nuclear plants. Can’t imagine (sarcasm here) why anyone would be against a carbon tax that would encourage clean energy and go a long way towards alleviating rapid climate change.

As long as the fossil fuel industry has no charge assessed on their waste effluents, we’ll be at a disadvantage. Until now our advantage on the fuel side has saved us, but with the (temporary) gas bubble, such is not the case. My concern is that a free market really doesn’t find the optimum solution, only a local maximum based on the most heavily weighted parameter. Cheap gas isn’t going to last, and if we’ve thrown away all of our “unprofitable” nuclear plants, we aren’t going to have many options other than more and more coal burning.

@Wayne SW

I do not believe in the invisible hand of “the market”. I think that term is a euphemism for purposeful actions by extremely wealthy and powerful organizations and individuals. In Adam Smith’s day, markets might have been led by invisible hands, with today’s concentration of wealth and modern computers/communications, there really is no longer a market that moves without the influence of key players making choices.

The temporary natural gas bubble was, plain and simple, a price war designed to drive out competitors and create a highly profitable situation with high prices and customers with fewer choices. The decision makers know that such a situation will not last too long, but they also know from history just how profitable it will be when it happens.

Inhofe and others are trying to establish LNG export terminals which would drive NA gas prices to within a few $ of the world price. Worse, they’d be under contract for specific volumes and the rest of N. America would be stuck with the spot price.

In this case “the market” has failed in that it hasn’t placed a cost disadvantage on fossil fuels for uncontrolled and unconstrained releases of pollutants to the biosphere. It has also failed, as an alternative, to price in a cost advantage for emissions-free electricity production.

The “market” doesn’t do that. Only policymakers can, who might deem unconstrained releases of pollutants to the atmosphere as detrimental to the public good, and emissions-free production a benefit. But then free marketers will level the accusation of introducing “distortions” into the marketplace, not recognizing that in some cases those distortions are already in place.

We have always lived in a mixed economy to varying degrees. I guess the closest we came was the beginning of the industrial era, but when monopolies and trusts grew out of that, the political realm stepped in.

What Rod wrote indicates that we do NOT have a free market – and we truly don’t. If the market were truly free and government did its job (Rod noted above how the NRC doesn’t even follow its own mission when it stifles nuclear energy with overly burdensome regulations), then the regulatory playing field would be level and fossil fueled power plants would be held to the same standards and criteria as nuclear power plants: no waste refuse release into the environment. If such were the case, then Kewaunee and every other nuclear power plant would win hands down because waste dumpers such as coal, oil and gas would be too expensive, and so-called renewables like solar and wind would be abandoned for their need to have constant spinning reserve backup. Therefore, I agree completely with what Rod wrote: “…with today’s concentration of wealth and modern computers/communications, there really is no longer a market that moves without the influence of key players making choices.” If the market were truly free and the government leveled the regulatory playing field, then we would have “the invisible hand of ‘the market'”. But as it is, that hand has been amputated by big corporations who hate competition and by government politicians interested in only the next election. 🙁

Sorry I am so negative. I find it frustrating that a perfectly well-working nuclear power plant like Kewaunee will likely get shut down not because of real economics but because of market manipulation designed to keep in office power-hungry politicians and enrich selfish, greedy corporate executives alike. The problem isn’t capitalism, but rather the emasculation of capitalism because what we have is not capitalist. 🙁

Paul – We share your frustration.

It is a travesty. There are two valuable pieces of infrastructure (KNPP and CR3) that are about to be tossed onto the scrap heap because of the short-term nature of the economic model we are dealing with. What doubly gets my goat is that the same policymakers who could influence this for the better (saving those assets) instead turn around and pass laws mandating that companies must purchase much higher-priced energy from unreliable sources (wind and solar) to make them look attractive. That is precisely the opposite of what should be done. If there are to be policies in place that tilt the market one way or another, we should place our bets on the one reliable source that has the most stable price structure over the long run, that provides the most energy security and has the most benign environmental impact per unit output.

@Wayne SW

Don’t stop now, keep writing! Address brief letters to congressmen, senators and even the president.

One question I have that maybe needs to be answered: They say Kewaunee had about 600 employees. Every time I have seen a picture of a nuclear plant there are no people. I know of water and sewage plants that have less than 10 at a shift. What do all those people do all day? Could Kewaunee be made more automatic so as not to need so many people? Does this number count the office buildings at a nuclear plant that might have things like billing and accounting which would be needed if the plant closed anyways? But unlike you, I am not a “people person” and maybe cutting this expense has never been considered.

I was wondering that, too. 600 seems a lot for a unit this size. A $30 million loss means about 300 employees, assuming an average cost of $100K/year/employee, salary and benefits. Could they run the place with 300 employees? Another option might be paycuts combined with staff downsizing. It wouldn’t be the best for those getting the axe, but at least they could keep the place from being wrecked.

Whilst nothing could save Kewaunee, it sounds like a deus ex machina may come for the apparently similarly doomed Santa Maria de Garona unit in Spain.

Opposite to Kewaunee, Santa Maria was still economical to run under the existing regulation. But the Spanish government desperate to find money, decided on a new regulation that would add €100 millions of taxes every year, therefore the owners concluded the best option was to close it in time to not have to pay this new tax, before 1st January this year.

However the government is since several month having second thoughts, suddenly realizing pushing the unit to closure made him lose all the existing taxation instead of bringing more money, has put out of jobs several hundreds people in a country where unemployment is at absolute record level, and meant more money spent into buying power from fossil fuel (no cheap gas in Spain).

And here comes the possibility of an exceptional retroactive license extension together with a modified legislation, that probably would still increase taxation, but leave it at the stage where it doesn’t make the unit unprofitable :

See : http://translate.google.com/translate?sl=fr&tl=en&js=n&prev=_t&hl=fr&ie=UTF-8&eotf=1&u=http%3A%2F%2Fwww.nuklearforum.ch%2Ffr%2Factualites%2Fe-bulletin%2Flautorite-espagnole-de-surveillance-soutient-garona