Correcting a journalist’s excessive pessimism about US nuclear industry prospects

This morning I found an article titled Builders pessimistic about new nuclear plants published in the Tampa Bay Times, one of my former hometown newspapers. (As a retired naval officer, I have about a dozen former hometowns.)

The author built his case about pessimism for new nuclear plant construction on the words of a single journalist for Nuclear Energy Insider and on the canned responses provided by several antinuclear activists who have a strong motive for raising doubts about the industry’s prospects for growth.

In Florida, both Duke Energy (which now owns Progress Energy, formerly known as Florida Power Corporation) and NextEra, which owns Florida Power & Light (which employed my Dad for 35 years) are collecting modest fees from customers in order to fund the preparatory work needed to build new nuclear power plants.

Neither corporation has committed to building new plants, but that does not mean that they are not serious about working through all of the obstacles along the way. It would not be prudent for any company to make a firm commitment to build a project costing tens of billions of dollars when there are many tasks to complete before they will even be given permission to start building. However, in rate-regulated environments, the companies have no real choice other than to make their planning case to the Public Utility Commission and obtain permission to charge existing customers.

Groups that want to halt nuclear energy development and deployment have filed a number of legal challenges to the fees that the companies are collecting. They have determined that if they can stop the fee, they can stop the planning for the four new reactors that the fee is currently enabling. If there is no planning, there will be no nuclear plants built.

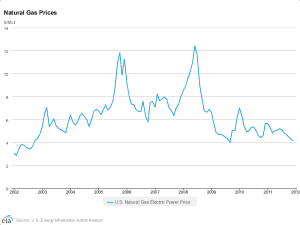

Though the groups try to wrap themselves in a consumer protection mantle, the fee that any individual customer is paying for new nuclear plants amounts to less than the price of a cup of coffee every month. It might rise to as much as $20 per month by 2018, but only if the project is actually started construction by that time. The risk of electricity bills rising at a far greater rate due to fuel adjustment surcharges with a rapid increase in the price of natural gas is far greater. The historical volatility of natural gas prices is clear and irrefutable.

One of the current strategies being used by the antinuclear activists is to sow the seeds of doubt that the plants being planned will ever get built. The organized opposition then tries to incite public antagonism to the power companies by claiming that those “evil” utility companies are collecting fees for plants they never intend to build.

Aside: In some places, “the power company” is the largest company in town and is a natural target of animosity because they seem so faceless, yet are the monopoly supplier of a vital product. Since I grew up in a household where the head was a proud power company employee, I have always had a completely different view. Dad was one of the most moral and caring human beings I have ever known. His friends from work were equally impressive role models. I have also celebrated – more than a couple of times – when heroic linemen from the power company restored our electricity after a bad storm. End Aside.

Florida’s utility companies are being placed into a difficult position; for a variety of regulatory reasons, they are not allowed to make a firm commitment to construction. For perfectly legitimate business reasons they also have no desire to borrow money to fund work that may not be allowed into the rate base for a decade or more. Utility company leaders and their analysts know that the nuclear projects are a good long term investment because they have a much clearer understanding of the risk of natural gas price fluctuation than journalists and antinuclear activists and the public that they are working hard to incite.

I decided to respond to Ivan Penn, the author of the piece for the Tampa Bay Times, to let him know that there is not universal pessimism about the prospects for building new nuclear plants in the United States. (If there was, I think I would be forced to look for a new job.) The letter turned out well enough that I thought it would be worth sharing here.

Dear Mr. Penn,

I read your recent article titled “Builders pessimistic about new nuclear plants”. Quoting a single journalist’s opinion about the prospects for the industry does not provide your readers with an accurate picture of an industry that has the potential for solving some of the world’s most difficult energy supply problems.

It might be worthwhile for me to start with a brief introduction: I am the publisher of Atomic Insights, a web log that has been providing information about energy from an atomic point of view since 1995. I also produced The Atomic Show, a podcast that has been on the web since 2006.

After I retired from a career as a nuclear trained submarine engineer officer, I started working for The Babcock and Wilcox Company on the team that is designing a new style of nuclear power plant that is smaller than traditional models and built in modules. The idea is to develop a finished product that can be built in factories and shipped in a much more complete state to plant construction sites. I remain on the B&W mPower team as an engineer/analyst; I have no role in public relations. I do not speak for my company, all of the views expressed here are my own personal opinions.

The people I work with on a daily basis are excited about the prospects for our product, so are the people who have expressed interest in the possibility that our units will be excellent replacements for old coal plants in the US that are being forced to retire due to age and the costs of keeping up with changing regulations.

Our systems will eventually be able to be built on a 3-5 year timeline (the variation is largely a result of the variety of the extent of site preparation work needed). They will produce electricity that will be competitively priced, especially when the customer recognizes the value of stability and the competitive restraint on natural gas prices that a viable alternative like nuclear energy can provide.

In contrast to natural gas, nuclear energy is not just 50% better than coal from an emissions point of view; it is clean enough to operate inside sealed submarines. It is mathematically impossible to quantify the improvement in a percentage; division by zero results in an undefined number.

Based on communication with many colleagues in the nuclear industry that work for other companies, the pessimism that you describe in your article is overstated. Our employers keep investing in the work we are doing to develop new power plants.

Though we are all having some difficulty competing against today’s North American natural gas prices, many of us have long enough memories to recall the late 1990s. During the years from 1995-2000 the natural gas industry and its mouthpieces were loudly proclaiming that cheap gas was going to be around for a long time. During those years, natural gas cost about $2.00 per MMBTU. By the summer of 2008, it cost 7 times as much, averaging about $14.00 per MMBTU and spiking to far higher prices at certain times when the weather was bad. The gas industry tells customers that will not happen again; I hear a different story when I listen to major gas companies quarterly earnings calls with investors and analysts.

We are well aware of the fact that prices in North America are substantially lower than world market prices; we know that the natural gas industry is working diligently to develop the capability to move gas from one market to another to take advantage of those price differentials. That capability will inevitably result in a leveling of prices around the world; they may fall in some high-priced markets, but they are likely to rise in the low-priced North American markets. That is a simple concept that nearly everyone should understand.

Our potential customers have similar memories and similar understanding of the impact of market behavior. They are spending a lot of time learning more about what we are doing. Please do not sell your readers short by emphasizing one observer’s view of a complex, exciting and high potential industry.

Sincerely,

Rod Adams

Publisher, Atomic Insights

Disclosure: I have a soft spot in my heart for FP&L that has been there for a long time and is unlikely to ever disappear. The company treated Dad well, bought me and my siblings Christmas presents every year, and continue to provide regular pension and dividend checks to my widowed mother. Mom occasionally attends stockholder meetings to keep reminding FP&L decision makers that nuclear energy is a good investment. Wonder where she got that idea?

Why should a FPL consumer be charged for electricity they will never use? If someone moves out of the area after five years, they will have been charged upwards of $20/month ($1200 total) for electricity that will lower the cost of electricity for someone else moving into the area after the completion date of the plants. Is it wise to re-design power plant financing along these lines … and why not do it for hydro, thermal, or large industrial renewable energy plants as well?

If consumers are going to bear a large share of the risk for the financing of power plants, they should be getting a financial benefit for having loaned out these funds in the first place. I don’t see this taking place here. If I’m going to invest $1200 in a future energy project, why not do this directly (and get an interest rate on my loan, or even better, an ownership share in the power plant).

FPL seems to be offering nothing along these lines (only to say they feel entitled to my money, and wish consumers to bear “at no charge to the developer” a large share of the risk of investment and construction). This sounds horrible. What is the argument in favor of this financing approach again?

Long term investments are often portrayed as being “unfair”. When living in Florida, I used to get really frustrated with people who campaigned against investments in schools because they did not have any children or because they had paid all the taxes they ever wanted to pay for schools to educate their children “up north”.

People who are consuming electricity in Florida today are paying much lower prices than they might otherwise be paying because my Dad and others in his generation paid for the construction of Turkey Point and St Lucie, which are the lowest cost sources of power on the South Florida grid.

On the other hand, I have often contemplated the notion of setting up special investment funds for people who specifically want to invest in nuclear power plants and obtain the kind of reliable, long term dividends that such plants can provide.

EL – Do you really think that it’s fair that a new FPL customer should get cheap electricity from assets that were paid for by rate-payers 30 years ago?

You appear to be under the delusion that the price of everything should be driven by marginal costs, which I suppose speaks volumes about your understanding of economics. In a free market, the price is decided by the delicate balance between supply and demand, not by cost.

This is a regulated environment, however. Instead of a free market with competition, a company is given a monopoly in exchange for being controlled by a government regulatory body. The regulator is charged with determining what is a fair price, and in that duty it must consider, not what is good for any specific individual, but what is good for the collective. A wise regulatory body does not consider any particular year or five-year period, but also includes long-term planning in its decisions.

Over the long term, it makes fiscal sense to pay off one’s debts sooner, rather than later. Thus, the rate-payers (plural, not any particular rate-payer) benefit from decisions like CWIP.

If you don’t like it, then perhaps you should start making arguments for deregulation.

If you don’t like it, then perhaps you should start making arguments for deregulation.

I hope if EL starts advocating for deregulation that he strives for intellectual consistency and recognizes the distortions caused by RPS, FIT and PTC.

I highly doubt it, Rod. EL is a solar advocate who thinks solar installations with average cost per Watt of >20$/Watt makes sense. Whereas a nuclear plant with 1/3 the cost per average Watt is too expensive for ratepayers.

Sadly, internal inconsistency is the hallmark of the typical renewable enthusiast.

Do you have any numbers or references to back this up? Because CWIP looks to me to be a total scam. Rate payers taking on investment risk (for no financial reward), and private developers and shareholders taking on profits. Is there a reason why FPL can’t do business like everyone else, and just go to private capital markets to get their nuclear plants built? Even if it’s just a low interest loan from the Federal Government (or subsidy support on electricity that is actually getting produced) … this is a heck of a lot better than fleecing ratepayers (and adding insult to injury by offloading lots of investment risk onto them at the same time). Yuck … and we thought the banks were bad.

I see nothing here but a failure to secure investment capital from private markets for new nuclear plants, and a cooked up scheme to get a wary and already over burdened third party (who has no say in the matter) to foot the bill. If the high cost of renewables worries many here, just wait until some CWIP gets added to the mix. How is $50 added to your monthly bill as a Progress Energy customer (see below)? Republican State Representative Mike Fasano (who initially supported CWIP as a State Senator in Florida) has made it a cause célèbre to try and get it repealed (with bi-partisan support). So much so, he’s been writing other State legislators warning them not to do the same.

Fasano writes: “I believe it is inherently unfair for utilities to ask their customers, our constituents, to front the costs of massive and expensive construction projects that are not even guaranteed to be completed. These risky investments ought to be the responsibility of utility shareholders and their investment partners, not the average ratepayer that [sic] is already struggling to pay their monthly utility bill or keep their business afloat.”

If anybody can show how investment risk is zero and how ratepayers benefit from CWIP by paying off debts sooner than from fixed income or equity loans from private markets (or even low interest loans from the Government at little or no risk to the taxpayer), please do so. Because this may change the issue immensely. And we’d also have to look at constitutional issues (and that not all ratepayers are being treated the same by this scheme).

El,

You should see NNadir’s latest posts. Nuclear plants are 100 year long gifts that we offer our children and you are nickle & diming the entire debate.

Let’s look at the big picture.

Ciao

@EL

Do you know anything about rate regulated electric power monopolies and “the regulatory compact”?

EL – “Numbers or references”? Are you serious?!

All it takes is a little common sense (something that you seem to be sorely lacking) and a little knowledge about how compounded interest works. This should be obvious to anyone who has ever held a mortgage or carried a balance on a credit card: the sooner you start paying off your debts, the less interest you end up paying.

It’s absurd that you talk about risk as if taking on loans that won’t begin to be paid off for years is somehow less risky. Are you high? Reducing the debt that you carry is the surest way to reduce financial risk and the easiest way to do this is to start paying off the debt sooner rather than later.

Do you really wonder why a 30-year bond yields a higher interest rate than a 10-year bond? Are you really that ignorant about how finance and economics work?!

Yeah, good luck challenging CWIP based on “constitutional issues.”

I guess that I sometimes have to remind myself why I normally don’t bother to read your idiotic blather. You’ve hit a new high on the stupidity meter with that one.

Since ratepayers are contributing billions through CWIP, where is their “compound interest” for taking exactly the same risk as shareholders and institutional investors in new energy projects?

You know exactly what I am talking about, but are too shameless to own up to it (and instead make merry with insults and malice in a feeble attempt at distraction). By your response, I take it you are saying there is not a single study or reference that makes a best case defense of CWIP as in the interest of the ratepayer (and not the developer who is unable to secure investment funds any other way). Amazing, this is how you chose to present your case?

You are aware that ratepayer rebellion is alive in strong, and there are several court cases challenging the constitutionality of CWIP working their way through the courts?

@EL

A press release from a group of activists is not exactly a credible link to prove that a rebellion is alive and strong.

There is a terrific defense of CWIP in the form of careful analysis developed by the applicants and presented to the regulators who represent the people of the state.

(I am pretty sure that the next thing that you are going to introduce is the notion that the PUC has been captured by the utilities.)

When you talk about risk to rate payers, riddle me this one – if utilities take the easy path and just build natural gas plants, who protects the ratepayers from the inevitable fuel price rises when the demand for gas goes up enough to exceed the productive capacity?

History is pretty clear that there is no protection; the increases in fuel prices are passed directly to the consumers even though they had no choice in the type of power plant that the company decided to purchase.

@Brian

Please remember that attacking other commenters is not acceptable. Attack the ideas, not the person.

EL fumed:

I’ll bet it never occurred to you that a return to the licensing schedules characteristic of the AEC (as little as 10 months) instead of the NRC’s current practice (on the order of 60 months) would slash those risks for everyone, investor and ratepayer alike.

Why are you only mentioning CWIP in reference to nuclear power, anyway? Why isn’t it just as bad when used to build coal-fired capacity?

Sorry Rod, but I thought that it would be clear that I was providing a (rather harsh) critique of the comment, not the commenter. In fact, I was fairly careful to phrase my comment that way.

Nevertheless, when something that is said is stupid, it’s not wrong to call it stupid. Consider this prime example:

“Since ratepayers are contributing billions through CWIP, where is their ‘compound interest’ for taking exactly the same risk as shareholders and institutional investors in new energy projects?”

This comment is almost too stupid for words, but I’ll try to address it anyhow.

The whole point of CWIP is that the capital costs incurred during construction can begin to be paid off immediately, rather than waiting until the entire project is finished, which is years later. The net result is to reduce the amount of interest costs required for these projects which reduces the cost of electricity to the rate-payer in the long term.

EL – Once again, if you have a problem with how sensible regulation works, then please start lobbying for deregulation.

As Rod points out, do you have any evidence that the regulators have not done due diligence before approving such rate increases? Where are your numbers and references?

@Brian

“Are you high?” is an example. (Aside – that exact question once landed me in really hot water when I was a young ensign. The Executive Officer did not take kindly to my questioning the state of his intoxication, even if the order he had just issued was really irrational.)

Sure. Let’s look at proposal for one AP1000 in Levy County Florida. When the CWIP was approved in 2006, the completion date for the single plant was 2016 and the estimated cost $4 – 6 billion. A year later, the price jumped to $10 billion (how do you think institutional investors, ratepayers, and company shareholders reacted). In 2008, a second reactor was added to the proposal, and the price estimated at $17 billion. In 2009, completion date was moved to 2018, and in 2010 it was moved to 2021 (and cost raised to $22 billion, including $3 billion for transmission lines). In 2012, a dispute over repairs to the Crystal River nuclear plant put construction contracts on Levy County reactors in jeopardy (but company claims it continues to seek a COL). Meanwhile, ratepayers have put in $545 million to the development of a project (440% higher than originally proposed), and may be on the hook for $550 million more. And the project may never get built.

I have no problem with financing new construction with “fair rate of return” values assigned by public utility commission, and AFUDC debt and equity accounts (reflecting the actual borrowing cost of capital). But CWIP is a boondoggle, and many laws have been passed against it (in the interest of the ratepayer). Fixed income and private equity investors need to take on this risk, not public customers who have few other options, have no direct access to normal dispute resolution mechanisms, and should be getting service for their money and not a lot of private investment risk at no rate of return.

Good question. An argument can be made that coal plants take some 1/3 the time to build as nuclear, and thus don’t violate the “used and useful standards” of public utility commissions for rate increases. That’s the case that is made for coal (although it seems AFUDC is a better approach to me). We also don’t get the same (or as large) cost overruns and construction delays (once construction has begun) as is sometimes the case with nuclear. But people can correct me here, if I am wrong about that?

You may have put your finger on the justification for SMRs. B&W is claiming 2 years to place an mPower in service versus 7 for a conventional plant. The entire reactor and containment unit, including steam generators, arrives intact by rail.

B&W is claiming 2 years to place an mPower in service versus 7 for a conventional plant.

That’s a bit of an exaggeration. What is your source for the 2 yr estimate?

I could have sworn I saw 2 years somewhere; maybe that’s from breaking ground, or from placing a deposit. If B&W is going to be building a unit a week I can’t see things taking much longer than that; what are they going to do, wait until they have money for each reactor before buying the machine tools and hiring the operators?

http://www.world-nuclear.org/info/inf33.html claims 3 years.

BTW, Rod, check your mail for this site; there’s an off-line discussion where your input is solicited.

In my country there is a diabolical mechanism for promoting solar panels. The feed in tariff scheme pays owners of such installations exhorbitant rates for feed in of power to grid when they are actually producing, and everyone else gets to pay for this scam, even though solar is a part time energy source and hasn’t led to any tangible cuts in emmissions. This money would be far better spent on direct heat applications using solar, as well as toward gas and modular nuclear plants to gradually replace our existing fleet of coal-fired stations.

Personally i am in favour of contributing a modest fee toward new large power stations, due the enormous economic benefits (monetary and physical) that such projects offer.

“Are you high?” is an example. (Aside – that exact question once landed me in really hot water….)

Context. We must have context! Sea story please!

@Reese

Point taken. I get a little overexcited sometimes. I’ll stick to the topic in future.

I got less surprised, and less annoyed, by the article when I saw that it was from a Tampa area paper. There is a big political push down there to reverse the policy of having the ratepayer pay up front for licensing costs (let alone construction), and many of the area’s papers are on board with that effort. At that point I recognized the pessimistic outlook given in the article as being part of the author’s agenda, and is thus to be expected.

I basically agree with Rod and others that putting such costs into the ratebase is acceptable and appropriate for a (regulated monpoly) utility under the ratebase system, especially if it will likely reduce overall costs in the long run. The luxury of longer-term thinking is one of the positive attributes of the rate base (vs. “free market”) system.

I also believe that if a regulated (rate base) utility chose to go all gas, and the price of gas goes way up, it should be slapped with “imprudency” penalties just as it would if a nuclear construction project goes way over budget, due to their incompetent management. Fuel (gas) price spikes are not purely an act of God, since being fully exposed to such risks is a choice. I think this is something that they understand in the financial sector, with failure to hedge against risks being considered unacceptable incompetence (i.e., negligence).

All that said (in my last post), most of these problems are a symptom of the rapid, and inexplicable escalation in nuclear plant construction costs, along with the absurd amount of time and money NRC takes to review an application (especially an S-COL application for a site that already has existing plants).

This is a real problem. I’m convinced that if not for these cost problems, the “battle” for nuclear would largely be over. The supposed (and hyped) issues of safety and waste are not nearly as significant as they’re made out to be, in terms of what’s really holding nuclear back. I’ve written a post in the ANS Nuclear Cafe on this issue, which I hope people read and discuss (when it’s published).

It’s true that $24 billion is simply an absurd, and unacceptable cost for the Levy project. In my view, anything over $4,000/kW (in terms of overnight capital cost) is simply unacceptable. It represents complete failure. It was not too long ago when the industry was discussing overnight capital costs of $1,000-$1,500/kW. At some point (price), we simply have to be willing to say no to the industry (a nuclear project), instead of justifying nuclear costs no matter how high they are. If they think we’re willing to pay for the moon, they’ll ask for it. Looking at it another way, it will (finally) force them to find away to do things at a reasonable cost, necessity being the mother of invention.

Then there’s the ridiculous amount of time and money that NRC is asking, even to review a carbon copy of a given, approved reactor design, being built on an existing nuclear site that has already had extensive environmental evaluations performed. Many of the issues here are simply over paying for the licensing costs! That is, these costs are so high that paying for them becomes one of the main items on the annual agenda of a state legislature (e.g., Missouri).

This is clearly absurd. Someone needs to pass a law, requiring NRC to review S-COL applications (for a reactor type that has already received a COL somewhere else) for sites that already have existing reactors, for say ~$50 million, and have it take no more than one year. (What are they even reviewing??) If the costs go over that amount, the government picks up the rest of the tab. That’ll give NRC an incentive to get the job done in an efficient, timely manner (finally).

The NRC’s charter is “nuclear safety”, without limit: the safest nuclear plant is one that never gets built, and the enemies of nuclear don’t care what hazards arise due to what’s built and operated instead.

Tragically, the exact opposite is true. The most *dangerous* nuclear plant is one that doesn’t get built, given that the alternative (fossil generation) is more dangerous than any nuclear plant ever will be. NRC should not be allowed to be blind to this (i.e., considering the impacts of the generation alternatives).

That’s precisely why the NRC supplanted the AEC, and those considerations are not within its charter.

Here’s what I want to know.

We used to be able to build nuclear plants for under $200/kWe (eg Oyster Creek @ $132/kWe).

Today we can’t build them for $4000/kWe.

Inflation explains a factor of 3-4, ok. But that leaves most of the cost increase unaccounted.

After the larger plant size economy of scale, further tech development, simplification (especially with newer BWRs), why can’t we build nuclear plants cheaply?

What’s wrong with us?

Cyril,

I’ve written a lengthy post for the ANS Nuclear Cafe website (will come out soon) exploring that very topic.

My opinion? NQA-1. A unique, excessively onerous and strict fabrication QA program that only applies for the nuclear industry, which not only is enormously costly to practice, but greatly limits the number of qualified suppliers for nuclear construction, which in and of itself massively increases costs.

Of all the aspects of the nuclear industry, I believe this is the single most costly thing, but it provides the least in terms of public health and safety benefit. It is primarily responsible for nuclear plant project delays and cost overruns (a QA program that is, frankly, not (humanly) possible for most/all suppliers to comply with). Safer designs, safety features, and good operational practices all deliver far more bang for the buck.

My provocative proposal. Have NRC thoroughly review reactor *designs* to verify their safety, but once a reactor design is certified, and construction begins, normal industrial fabrication QA requirements (i.e., the same as those used when they build coal and gas plants) apply.

Answered in Cohen Chapter 9, COSTS OF NUCLEAR POWER PLANTS — WHAT WENT WRONG?. TL;DR version, the NRC’s one-sided charter and the courts.

Thanks, I read that one already. Cohen claimed that most of the cost excursion paths would be closed with the standard licensing and design, preventing re-engineering and design changes later on. Ok. But we don’t really see this reflected in the numbers. Cohen wrote this at the time of the AP600, and the claim was that the smaller unit size and passive components would save costs and schedule. But Westinghouse declined on the AP600, ostensibly for lack of economy of scale (the US market is very competitive with big coal plants). So they switched to the AP1000 to get more economy of scale whilst retaining passive features.

The NRC was also touting its own horn with all the talk of combined construction and operating licenses. But again it’s not reflected in the recent experience at e.g. Vogtle. The rebar issue is shameful, signifying incompetent bureaucracy rather than a healthy safety-oriented regulator.

It looks to me that all the cost overruns and delays are still there.

@Cyril R.

You are correct that the sources of cost overruns and delays still exist, but so do the solutions. Part 52 licensing for a first of a kind unit is a very risky path, but there are other options.

What are those options Rod?

Traditional Part 50. Better yet, for an SMR that is not inherently a multibillion dollar facility, there are provisions under Part 50.21 for a class 104 licensed facility. That category includes demonstration facilities.

EL wrote:

So EL must feel the same about the Germany feed-in tariff scheme. Which is far worse in $/kWh than the most expensive nuclear plant, and all that for unreliable electricity with little fossil fuel reduction to show for it.

Yup, EL must be vehemently opposed to subsidizing solar panels.

Oh wait. He’s a solar proponent.

Is being internally inconsistant a condition for being pro-renewable, anti-nuclear?

I’m opposed to paying for something and getting no service in return (and getting no rate of return on borrowed capital).

Perhaps it’s worth looking at original 1976 rule by Federal Power Commission (now FERC) permitting CWIP financing.

It’s always been a controversial provision. Some see benefits to future ratepayers, others see benefits to developer (and violation of “used and useful” standards of public utility commissions dividing current ratepayers from future ratepayers). I haven’t seen much of a defense of it here (other than to suggest that access to free capital is good for private investors and developers, and benefits future ratepayers at a price penalty to current ratepayers … a “gift” as one person put it above). In fact, I might argue it may actually be hurting the industry (more than it is helping). Simply by the fact that it is a controversial provision, and is creating the perception that nuclear can’t pay it’s own bills (and needs additional price support in the form of lowing the cost of capital).

With FIT … the developer covers the full capital cost of equipment (including all of the investment risk). They are able to cover their costs and make a return on their investment only if they are able to provide a service to consumers (and many FIT contracts expire over the operating lifetime of the equipment). It works much like AFUDC, and much like negotiated PPAs at above market rate for nuclear during early start-up phases. Which is to say it’s normal operating procedure, and not an extra-ordinary provision (as FPC originally intended CWIP) for a cash-strapped utility or company in “severe financial stress.”

Uhm, no. They are able to “make a return” on their investment because of 500-700% subsidy rates, a “must-buy” obligation to any and all power delivered (even if there’s no market demand), and no penalty given for the extreme unreliability of photovoltaics and wind in Germany.

When will you get that you are not comparing apples to apples, you are comparing a rotten apple with a delicious fruit basket and complain that the fruit basket costs so much more than the rotten apple.

Can we make cider with the rotten apples, because many people seem to really like cider (according to most opinion polls). It’s useful on a seasonal basis. It’s also a good way to make use of apples that would otherwise go to waste. And it does typically cost a little bit more than conventional apple juice (because of the extra steps involved)?

No we can’t. Rotten fruit can’t be made into any tasteful beverage, including alcoholic. And you can’t survive on a cider diet. It won’t power the country either.

According to some opinion polls, pink bunnies and chocolate toffee should power the country.

Everyone has an opinion. Don’t confuse this with facts – what we can and cannot do. We are all entitled to our own opinions, but not to our own facts.

As useful as selling icecream in winter. Just when there’s the least demand for electricity, that little pathetic PV capacity factor starts to concentrate.

It’s different. You’re making rotten apples from the start. Better not bother at at and make better choices of seed – go for apples that won’t rot. Go for reliable productive power from the start.

Because cider is a valuable product. There is nothing inherent in PV that is valuable. It has poor productivity and reliability, poor correlation with demand, high land use, high materials use. Solar panels are cool, but that’s not value. It’s a thin shiny layer to cover the rotten fruit.

Oh please, let this be true!

Ok, I checked Vogtle costs. The most recent estimate is $14.5 billion for 2 units.

That’s $6500/kWe.

http://www.covnews.com/section/11/article/35335/

This story confirms that absurd quality assurance is a big factor in the cost overruns.

I think what we need to do is abolish the NRC, set up a brand new regulatory agency with a focus on expert panel review of safety of new designs. The focus will be on functional safety, and how to improve on safety robustness inherent in the design, rather than endless regulations and quality assurance.

This will result in a high level of inherent safety and great insensitivity to the human factor. The newest passive designs lend themselves well to this approach.

Cyril,

Consider the following article about Vogtle, especially the part about the enormous difficulty suppliers/fabricators are having complying with unique, onerous nuclear QA requirements. This is the source of most cost overruns, as well as the high initial estimates in the first place.

http://chronicle.augusta.com/news/metro/2012-12-18/documentation-problem-slows-vogtle-construction?v=1355857528

Thanks Jim.

This is pretty terrible. Documentation problems causing hundreds of millions in cost overruns… it’s shameful. The US is making a really bad impression here.

The subcontractors need to be a lot more involved in the process. “lean construction” I think is the popular term these days.

But now I understand a main reason why Areva’s historic builds in France were so succesful. Being a single large integrated entity, there is much less need for subcontractors and QA can be kept much closer.

EDF and Areva seems to be having some difficulty keeping costs under control in recent builds. It’s cost variability that makes for a challenging investment environment, and not absolute costs.

http://www.bloomberg.com/news/2012-12-06/edf-france-reactor-cost-rise-may-pressure-u-k-power-price-talks.html

In South Carolina and Georgia, both states with CWIP, where the semi-regulated utilities are pursuing new AP1000 reactors, least-cost demand-side management was only discussed after the PSC’s approved the reactor projects. You might rightly call this putting the nuclear cart before the wise energy-planning horse. In both states, if the reactors come on line, there will be a glut of electricity and the utilities will want no competition from alternatives and don’t want any meaningful conservation and efficiency. I live in SC and have seen the situation close up, from the PSC hearing room.

The pour of “nuclear concrete” for the basemats for both AP1000 sites has once again been delayed, by the way, to at least March. License amendment request (LARs) filed last week by both Georgia Power and SCE&G reveal another in a long and chronic string of delays.

And, Westinghouse/Shaw/Southern Company failed in the first attempt to ship the Vogtle 300-ton reactor vessel out of the Savannah port of December 15. It still sits there as of January 19 (when I saw the busted? rail car). How will the RPV be moved and why are the companies so quiet about the failed shipment and how it will be attempted the next time? See my Jan. 14 blog on this, with link to four photos of the Schnabel car that broke down:

“Vogtle AP1000 Nuclear Reactor Vessel Discovered Unprotected, Stranded in Savannah Port since December 15 Shipment Failure”

http://aikenleader.villagesoup.com/p/vogtle-ap1000-nuclear-reactor-vessel-discovered-unprotected-stranded-in-savannah-port-since-decembe/948156

@Tom Clements (sorry for the delay in approving your comment. It somehow got buried in the spam folder.)

If the economies in Georgia and South Carolina grow, there will be little to no excess capacity. I have a good friend whose family owns a commercial construction firm in Atlanta. They have been doing a booming business in international relocations of industrial firms from both Japan and Germany, two places where your philosophy of doing without energy as a way of getting rid of nuclear energy is prominently being applied. The energy intensive industries that are relocating to the Southeast US are doing so because there is a good workforce and a good plan for providing the reliable, affordable energy that they will need to prosper.

You might be one of the people who has no worries about jobs and future employment; I care more about those good people who will be able to beneficially put their skills to work because there will be plenty of low marginal cost power available as those four emission free power plants start up and begin their 60 plus years of operation. I could not care less if there is no room in the market for unreliable alternative energy systems like wind and solar that make no financial sense for developers without direct payments from taxpayers to subsidize their development and operation.

The “broken” rail car was simply misaligned. There is currently no rush to move the vessel; as you noted, there are more important issues to take care of at the site. Instead of paying attention to your antinuclear slanted interpretation, one can read a far more accurate account of the incident at

http://chronicle.augusta.com/news/business/2013-01-10/vogtle-reactor-vessel-slips-between-savannah-burke-county?v=1357846431

A large portion of the delays for these projects can be attributed to the fact that they are the first new nuclear construction projects in the US in more than 3 decades. Nuclear professionals recognize that they are doing tasks that have not been done in a very long time and are approaching the process with an abundance of caution – perhaps excessive amounts of caution that will lead to schedule delays and cost increases if not properly managed.

The work has not been made any easier or more cost effective by artificially imposed delays – like the 5 months that the ousted NRC Chairman made the application wait between the time that the staff work was complete and the time that he finally put the design certification vote onto the agenda.