Virtual silence at “Golden Fleece” award news conference for SMRs

Taxpayers for Common Sense (TCS) trace their heritage to William Proxmire, a senator famous for his “Golden Fleece” awards for wasteful government spending. Yesterday, the organization held a press conference to announce that they had decided to award a Golden Fleece to the US Department of Energy SMR (small modular reactor) program.

The press release for the event can be found on the Taxpayer.net web site. There is a recorded audio version of the event. It is worth listening to the 19 minute recording so you can hear the chirping silence and the repeated series of instructions for getting into the question “queue” in between the four or five questions that the organizers managed to pull out of the gathered teleconference audience.

In other words, the press virtually ignored TCS’s announcement; in the context of an agency whose budget runs into the tens of billions every year, a cost sharing program that may approach $452 million over a 5 year period does not seem worth much attention. Even if you do not like government spending of any kind, a “fix the big noise first” approach would put the SMR program near the bottom of the list of targets.

There were several interesting questions raised during the short Q&A period that exposed the extremely light research effort backing the TCS decision to select the SMR program for criticism. One reporter pointed out that TCS had come out strongly against the loan guarantee program that might eventually help Southern Company and its partners build the units 3 and 4 at Plant Vogtle and asked if TCS simply disliked any help for nuclear energy. Ms. Alexander took several minutes to explain that TCS dislikes all energy subsidies and to point out that the nuclear industry is a “mature” industry that should be able to fund its own research and development efforts.

She accused the industry of having a long history of “socializing risk and privatizing profit” despite the fact that no one has ever been hurt by radiation from a US nuclear plant and the fact that few individuals or companies have extracted much wealth from the technology. There are a few hundred thousand good jobs with some relationship to nuclear technology, but it would be difficult to name a single nuclear energy tycoon.

The benefits of the government’s early investments in developing atomic power technology have been widely distributed in the form of about $40-$80 billion dollars worth of emission free electricity produced every year. Most of that power is sold to rate payers at a price that provides a modest, regulated rate of return to the investors that provided the initial capital investment.

Another questioner pointed out that the DOE had subsidized natural gas and oil hydraulic fracturing research since the 1970s; it seemed to me that he was gently reminding the TCS spokespeople that some DOE funding programs have provided a good return on investment for taxpayers in the form of abundant, cleaner and less expensive energy. The TCS spokesperson did not get the nuance of the question and said that sure, they would oppose research funding for hydraulic fracturing.

I don’t think that Ryan Alexander, the TCS President and primary speaker on the call, recognized that the reporter was asking if TCS would have worked to halt fracking funding in the 1970s, when the technology was at a stage similar to that of SMRs today. It was being done by relatively small players in a “mature” industry (oil and gas). Like SMRs today, enhanced gas and oil recovery technology in the form of hydraulic fracturing of tight shale offered great hope for unlocking huge resources with a payoff that was known to be several decades into the future.

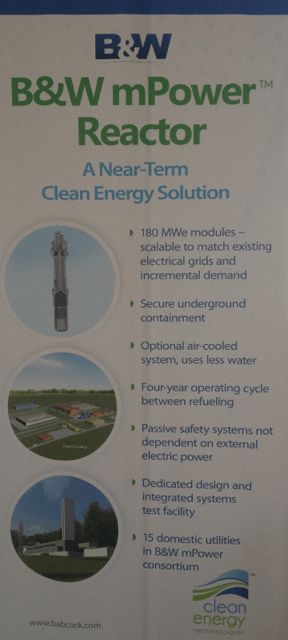

Though I am hugely biased, the B&W mPowerTM reactor program has many analogous features. (I have been working for B&W mPower for more than two years. My views are my own and do not necessarily represent those of my employer.) The technology is built on a sound technical foundation, but needs time and nurturing in order to succeed. Uranium is a proven energy source that contains at least 10,000 times as much energy per unit mass as oil; that energy is released in a process that does not release any polluting gases to the atmosphere or particulate pollution to surrounding land or water.

Aside: The “10,000” number for comparison is based on today’s inefficient, once-through, light water reactor technology that only extracts energy from U-235 fission. That isotope is just 0.7% of the total amount of uranium; extracting the other 99.3% requires the use of fast spectrum reactors. Of course, there is also the thorium option where the total resource is about 4 times as abundant as uranium and where most of the energy can be extracted using thermal spectrum molten salt reactors – as long as you have enough fissile material to start and maintain the reaction. End Aside.

Autumn Hanna, a senior program director at TCS and the other “expert” on the call, pointed out that the US has been manufacturing small, modular, factory produced reactors for more than 50 years for US Navy submarines and surface ships. What she does not understand is that the specific technologies and methods used in that program are not available to the commercial sector because they are classified and considered to be extremely important strategic assets that require a high level of information security protection.

As Chris Mowry told the Weather Channel during a recent visit to the Lynchburg and New London, Virginia facilities where the B&W mPower is taking shape, the reactor system is quite different from those used on board ships. It will serve many customers that each operate in different markets under a different set of government regulations. A large portion of the money associated with the DOE SMR program will not go to B&W or its partners to develop technology, instead it will instead go towards the government’s effort to learn how to license and inspect the technology. Modern SMRs will take advantage of technologies that are significantly different from the technologies commonly used in the large, 25-40 year-old behemoths the existing NRC staff is used to regulating.

There was another question that illustrated TCS’s lack of energy market understanding. Ms. Alexander talked about how SMRs could not hope to compete against the current price of natural gas, but that statement makes at least two incorrect assumptions. She assumes that natural is available in the locations that are already expressing strong interest in building small modular reactors and she assumes that the price of natural gas in those locations – if it is available at all – is similar to the price of natural gas at the trading hubs that is frequently advertised as the benchmark. Neither assumption is even close to reality.

As is often the case, the TCS press conference included several mentions of the insurance subsidies that the government supposedly provides to the industry. Price-Anderson is not a subsidy; it is a regulation-enabled risk pool that has never cost taxpayers a dime. Several decades ago, visionary thinkers recognized that the government needed to establish special rules for insuring nuclear facilities because the most cost effective way to protect the public from any risk of loss is for the industry was (and remains) the approach of “a nuclear accident anywhere is an accident everywhere”.

The shared liability approach, if taken without permission, would violate the anti-trust laws that prevent competitors from cooperating. Price-Anderson’s system rewards the industry for sharing detailed technical information that would normally be carefully protected trade secrets. The nuclear industry’s habit of widely sharing important information and lessons learned from experience is one of the foundations on which its excellent safety record is built.

Price-Anderson, however, is one example of rules that must be restructured in order to allow smaller reactors to have a hope of competing. Like annual license fees, the current liability computation for Price-Anderson is rooted in the notion that reactors come in one size. Every reactor unit, no matter how large or small, is currently assessed the same fee in the case of an accident that results in legal claims that exceed individual insurance coverage for any of the pool participants.

That results in a much higher risk per unit of electricity for smaller unit sizes and puts dramatically smaller units like the B&W mPower reactor design at a significant financial disadvantage. The restructuring effort will require government expense because making the change involves a lot of varied interests that must be addressed.

Michele Kearney’s Nuclear Wire has published B&W’s response to the TCS award along with a response from Will Davis who recently wrote about the B&W mPower reactor project on Atomic Power Review. Will is a frequent guest on the Atomic Show podcast. Will, unlike the ladies at TCS, has operated small modular reactors enough to know that they are real, that they have useful technical advantages over competitive sources of power and that they are something worth investing in because of their potential to make the world a cleaner, safer and more prosperous place.

Make that every commercial reactor unit. Educational and research reactors, which are small, don’t have to cover the same amount.

Politically, I’m a Libertarian (registered as an independent though). I truly believe the Federal government should only be doing what is spelled out in the Constitution. However, I also know that unwinding the mess that is the modern society isn’t as practical as some idealists would have you believe. I’m also just an observer/fanboy of the nuclear industry, not connected at all other than as a consumer of electricity who wants to maintain his quality of life and low energy costs.

We’ll never really know what would have happened if the nuclear industry would have developed in the late 19th century, when small government and huge trusts ran the show. For the whole of it’s existence, the overwhelming majority of the R&D of the commercial nuclear industry has been done by government. I know this is starting to change, but even the new designs have some DOE connections, if I understand some of the literature. I believe this is intentional since power plants take so long to pay back. Much longer, in fact than a modern Wall St (obsessed with pennies and days instead of dollars and years) is willing to stomach. In the absence of private R&D, government R&D is better than none. And it does produce results, some of which might not be expected. When you get strange results there’s usually someone who can find a use for it.

Please correct me if I’m wrong, like I said, I get my nuclear news from you guys and the mainstream, not firsthand.

Finally, why is the SMR considered Golden Fleece but the National Ignition Facility (which hasn’t produced anything but hyperbole) not?

Most people certainly would believe a value of 36$/MMTU as a natural gas price inside the US in 2013 *has* to be off by one order of magnitude. But it’s not.

http://www.eia.gov/special/alert/east_coast/ “Northeastern Winter Natural Gas and Electricity Alert”

Day-ahead spot

natural gas price

per MMBtu Thurs 1/24 Fri 1/25

New England $29.94 $34.25

New York City $33.96 $36.00

TCS is sounding alot like the (oil industry funded) Cato institute. I wonder if it’s a coincidence. Perhaps they just tend to borrow ideas from Cato, or maybe it’s another example of right-wing groups doing what the oil/fossil industry wants, as opposed to remaining true to any kind of fundamental principle.

Especially sickening is how they all the sudden wheel out environmental concerns, i.e., suddenly use language about unpaid external costs and socializing the risks that are generally used by the Left. If they simply staked out the typical right wing no govt. intervention and screw all environmental concerns position (that doesn’t recognize any external costs), it would be one thing. At least it would be consistent. But no, they’re all the sudden concerned about external costs, environmental impacts, and “socialized risks”, but ONLY for nuclear power. Much larger external costs from fossil fuels are completely ignored, I’m guessing. The only explanation for such behavior is that they’re doing the bidding of the fossil fuel industry.

The free pollution subsidy enjoyed by fossil fueled power generation is ~100 times as large as any benefit to nuclear from Price Anderson. According to EPA, pollution from fossil fueled generation causes ~$100 billion in economic costs and ~20,000 deaths ANNUALLY in the US alone. US nuclear has had no impact, and worldwide, the only event in non-Soviet nuclear’s entire 40+ year history still caused no deaths and is projected to have no public health impact. Fukushima’s economic costs are only about equal to the annual (external) economic costs from fossil generation in the US alone.

BTW, if you divide Fukushima’s ~$100 billion economic impact by the ~100 trillion kW-hrs nuclear has generated over the last several decades, you get an “accident cost” of ~0.1 cents/kW-hr. If US coal plants had to pay $100 billion per year to cover the just the economic costs of theri pollution (never mind the deaths), it would add over 5 cents/kW-hr, putting them out of business.

The arguments over Price Anderson are comical. The nuclear industry very rarely pollutes, and when it does so massive compensation is expected, and the issue is that it MAY have only partially paid for insuring the liability. Fossil fuel generation continually pollutes but never pays any compensation, to anyone, ever, so it doesn’t need insurance. In summary, fossil fuels cause orders of magnitude more harm, both health and economic, and those costs are fully external (they pay nothing), whereas nuclear’s much smaller external cost (accident risk/liability) is at least partially covered (paid for – insured against).

So, I wonder how TCS would respond to the following questions. Do you believe that fossil power plants should not be allowed to emit any pollution (like nuclear). If they ever do, do you believe that they should have to pay out large scale compensation. Should they at least be required to pay a heavy tax on any air pollutants that they emit, to cover the very clear and tangible health and environmental effects they cause? Do you not acknowledge that fossil fuels “socialize the risks, health impacts, and costs” to an even greater extent than nuclear.

@Jim Hopf

The recorded press conference that I linked to includes contact information. Ms. Alexander specifically invited the press to call her if they wanted to ask any additional questions. I think I might use your comment and craft a few questions. Then I will give her a call this morning.

I am a publisher and managing editor (and floor sweeper) of a respected on line journal, right?

Go right ahead, Rod. And yes, you should be allowed to ask them questions.

@Jim – It’s a typical “kitchen sink” strategy. No different than when the pro-renewables crowd mysteriously invokes arguments of the free market when they want to argue against nuclear, despite the fact that such policies are otherwise anathema to them (especially if applied consistently).

It’s unprincipled as hell, but since when has that been an issue with groups like this, especially those are pretty much conducting what amounts to a publicity stunt?

Your comment regarding the lack of a nuclear tycoon is interesting. There is no nuclear equivalent of Bill Gates, Marissa Meyer, or Mark Zuckerberg.

The info in your “Aside” is probably true for navy reactors, but is overly simple for low enriched commercial reactors. Their high concentration of U-238 and its significant parasitic radiative capture of neutrons results in breeding significant amounts of thermally fissile Pu-239 over the fuel cycle. Thus in every commercial reactor 30-40% of core power at EOL is coming from Pu-239 thermal fission. Since this is constant and on going, it may have been the source of “Electricity too cheap to meter”, as these reactors make considerable amounts of thermally fissile fuel during a cycle. This was known from the start, and was to be the source for “MOX” fuel, thus reducing the cost of future pure U-235 fuel. But we all know where that idea ended up.

@mjd

I’ll agree that U-238 is pretty good fuel; unfortunately, it usually takes two neutrons to fission it in a light water reactor.

The MOX idea has not died; I have visited La Hague and Melox where the process is working quite well. Our MOX facility in the US has not been going so well, but part of the problem is that the system has been set up from the beginning to be a failure with a limited scope mission.

Well, maybe that’s because it hasn’t been finished? Can we reserve judgment until it’s up and running?

@Brian – No need to reserve judgement till then. Way over schedule and budget already. Not criticism of MOX fuel, but of the politics associated with thinking that 34 tons of plutonium is something that should be disposed of instead of as something that is a valuable seed material.

Rod – So says the guy who works for the project that received part of the “Golden Fleece” award. 😉 This is also the project that optimistically claimed over three years ago that they were hopeful to go forward with getting some sort of licensing started in the next two years. I attended that presentation, and I recall that some of the “old-school” nuclear engineers in the audience expressed their deep skepticism, in some of the questions that followed, that the project schedule as presented could ever be met.

Based on what I heard in 2009, your project is “way over schedule and budget already” and now is dependent on life-support from the government to avoid being dropped altogether. (Or at least, this is what I hear through the grape vine.)

The moral of this story is that those who live in glass houses should be careful about throwing stones. 😉

By the way, what leads you to conclude that a facility built to convert weapons plutonium to MOX fuel could not be relatively cheaply refurbished to convert commercial-grade plutonium to MOX fuel? The company that is providing the engineering know-how to build the facility [disclaimer: I work for this company] already has considerable experience converting commercial-grade plutonium to MOX fuel, which is used to produce electricity in France today.

@Brian

No real argument. I’ve occasionally mentioned my frustration with the pace of nuclear development and the cost-unaware branch called QA which is focused on compliance with dumb rules instead of creating a true high quality product. However, at least our “over budget” situation hasn’t cost taxpayers a dime – so far.

The problem with an eventual conversion of the MOX facility being built at Savannah River is that the law was crafted to prevent that from happening. You’re the one who often points to the law of the land WRT Yucca. In the case of using MOX as focused disposal and not recycle, I think law is equally clear – and wrong.

Rod – In fact, you can get an update on the status of MOX in the US on March 21 at the Monte Carlo Italian Restaurant on Old Forest Road. Check the Virginia ANS website for more information. Hope to see you there.

Rod – I’d meant to comment immediately but I’d gotten somewhat waylayed in the process, but I wanted to say that you bring up some crucially overlooked points here, particularly about the regulatory barriers unique to SMRs in particular. (I think it would be a valuable service to lay out a series of posts looking at even just those unique regulatory challenges, inasmuch as it specifically highlights why it’s not so simple as, “Just build one / apply for an NRC license.”)

But I think it’s also important because it plays to some of the disingenuous “free market” rhetoric some of these groups play to – in essence, groups like TCS look only at one side of the equation (and superficially, at that), neglecting the unique and extreme barriers erected which leave a massively unequal playing field. In their cursory style of rhetoric (and that of others – I’m sure you recall your exchange with Jerry Taylor over at MasterResource, and I had my own exchanges with him offline), we’d have a “free” market if we did nothing other than remove all explicit government support without actually considering the implicit subsidies certain players get (like treating the atmosphere as an open cesspool) and the unique barriers to others (including, in some cases, explicit taxes – like the waste fee – but also far more onerous licensing processes and unequal standards for risk.)

This is what is personally aggravating to me (as someone who does identify as libertarian) – it’s basically a “vulgar libertarianism” that rather than serving the interests of creating genuinely free markets, only serves the interests of large, entrenched players – in other words, corporatism. In the long run, rhetoric like this does more to hurt their ostensible cause than it does to help.

I remain surprised at hearing that a 1000-foot to 2000-foot emergency planning zone around SMRs is being considered by SMR vendors. And, that the industry has discussed having as few as one operator to control 2 units (and these are not small research reactors).. Cutting corners to reduce costs is one thing but doing that when operational safety margins are lowered and public safety risks increased is another.

@Tom Clements

The EPZ will be established based on conservatively modeled analysis of potential releases. The NRC will demand convincing evidence to support the estimates.

As a guy who used to sleep within 200 feet of an operating reactor and knew he was safe, I am not worried.

I don’t know where you have heard the operator number you provided. It is substantially below the one we are designing to support at B&W mPower, Inc.

I can assure you that no corners are being cut. IMHO we are still being way too conservative, but then I am only a worker bee, not a company spokesman or decision maker.

@rod to @brian, Mar 1, 5:49 p.m.

“However, at least our “over budget” situation hasn’t cost taxpayers a dime – so far.”

I guess the recent DOE award of ~$250M to B&W mPower is really coming out of B&W’s checkbook?

@tom

If 1 operator/2 units gives you heart burn, look at NuScale web site. 1 operator/4units – times three, with 1 SRO/12 units. I think these SMR developer vendors are shooting for a market that really believes the licensed operator wages are what is breaking the bank!

All B&W mPower submittals to NRC are proprietary, so it’s hard to guess what they’re up to WRT manning. best guess can come from their simulator vendor (for HFE studies) publicity pictures. count the work stations.

Current NRC plans for operator licensing requirements for SMRs states use a simulator HFE analysis to apply for an exemption request from the 10CFR50.55(m) manning requirements. But that simulator does not have to meet the quality required by ANS requirements to give a prospective operator a license exam? An NEI victory for sure, but just which shell is that pea under?

@mjd

Not a dime has flowed from DOE to B&W as a result of the announced award. DOE is really good at making announcements related to nuclear; it is not so good about following through. For example – Southern Company’s loan guarantee, which was announced in March of 2010, nearly 3 years ago, has not yet “closed” because the T&C have not yet been agreed upon.

Even when (if) the SMR program money does start to flow, the amounts that have been discussed are spread over a 5 year period.

There is no certainty about any annual appropriation, especially in today’s Washington, where contracts are routinely violated by “budget cuts”.

100% agree on the money part of your comment. Strange that Southern’s official position is that the project will proceed even w/o the DOE loan guarantee, yet even knowing all the hassles they apply for it. Tells me Southern has to maybe play to a different audience that they feel is watching them? And I’m sure it costs Southern money to “play”. It’s all become a tough (and expensive) biz… well actually a game. When everyone can tell you how to fix a problem, yet that can’t happen… here’s a clue, the game is rigged.