Building New School Energy Wells

Petroleum – that term includes oil, gas and derivatives – wells have been going dry for more than 150 years. Until now, the solution to that problem of resource depletion has been to find a new place to drill. Though there is still a lot of oil left inside the Earth, there is a significant body of research that indicates that we have already found and extracted about half of the accessible stored resources.

Few people would dispute the fact that the oil and gas that have been discovered and extracted so far is the easy half. It was pretty easy to find and it was located close enough to human populations or transportation routes that it was reasonably easy to deliver to the ultimate customers. The petroleum that is still left underground – which includes that which is stored under water – is the hard half. It is not so easy to find, or it is located in areas that make it difficult to move to markets.

There are some alternative energy sources, but most of them – coal, wind, solar, biomass – have been available for hundreds to thousands of years and represent old school technologies that have not been able to compete against petroleum without massive government subsidies or laws requiring their use. (A little clarification on coal – though it is still a major source of energy, its market position is far lower today than it was before petroleum became widely available. No one uses it for home heating, transportation, or town gas production anymore.)

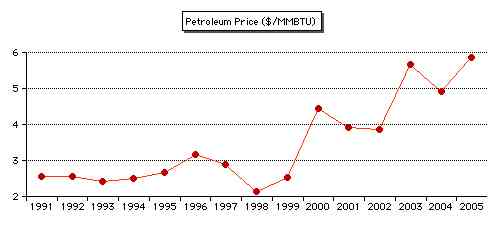

The realization that the easy oil is gone has led to a significant increase in world energy prices during the past five years. Those increased prices have put hundreds of billions of dollars into the hands of petroleum producers, but it has not led to a large increase in production. The producers know quite well that there are not many opportunities to make major new discoveries so they are focused on maintaining their current production levels. In many cases, there is a growing supply of unused capital waiting for an appropriate place to invest.

Source: U. S. Energy Information Agency – http://www.eia.doe.gov

Oil executives would be wise to consider investing their human and financial resources in nuclear power plants, which can be considered to be new school energy wells.

Short historical digression

When nuclear power first entered the energy market during the mid 1950s, a number of oil companies invested heavily into the uranium and fuels processing portion of the business. This was the portion of the new energy system that seemed to fit with their core competencies of finding and producing the raw materials needed to produce useful energy. For the most part, these investments were not successful.

Part of the problem is that the cost components for nuclear power are different from those historically associated with fossil fuel. With nuclear, a most of the cost and risk is incurred at the beginning of the project. Once the plant is fully operational, the recurring cost of fuel is minimal. With fossil fuel power plants, capital and operating costs are often minimal compared to the always necessary expense of purchasing new fuel to burn.

Building nuclear plants is analogous to drilling oil wells

The path that fossil fuel producers take between finding a promising new field and selling finished product from that field into the market is a tortuous one full of regulatory hurdles, government agreements, massive capital investments, and significant risk.

Once that path has been successfully negotiated, the producer and his investors can look forward to an uncertain number of years worth of selling the product at an uncertain price that depends on a number of external factors. The incentive for making those up front investments and taking the risk is that sometimes those factors lead to market price increases. For an already producing asset, there is little risk that the actual cost of operating that asset will change very much, so price increases due to market conditions fall directly to the bottom line.

Fossil fuel companies have the necessary assets to make successful investments in nuclear energy wells. They can raise capital from organizations that are comfortable with risk, work their way through the regulatory wickets, buy the steel and concrete, develop the necessary agreements with local governments and ensure that their suppliers meet exacting specifications. They live and breathe safety based on long experience with massive quantities of volatile materials. After their new energy wells begin operation, they can look forward to many decades worth of reliable production and sales – energy is not a fad and people will always find new ways to use whatever quantity is available.

Of course, these nuclear energy wells could eventually reduce the value of fossil fuel by lowering energy prices, but by the time that occurs the fuel will be almost gone anyway. We have reached the time when fossil fuel companies can legitimately meet their fiduciary responsibility to maximize their investor returns by spending heavily to build a new generation of energy production capability based on heavy metal fission instead of fossil fuel combustion.

Rod, FYI..the main source of home heating in the colder, northern parts of China is coal. It’s also the second largest contributor to particulate air pollution, vying with auto and coal plants for that spot.

David