Will North Anna 3 be lead ESBWR?

There is a growing perception that the Nuclear Renaissance in the U.S. is dead, killed off forever by low natural gas prices. Some members of the American Nuclear Society (ANS) are not so sure.

At the June 7 President’s Reception for the 2015 ANS annual meeting, there were several intriguing discussions about new projects that might achieve final investment decision and physical ground breaking in the next couple of years. I was allowed to listen on condition of non-attribution and anonymity.

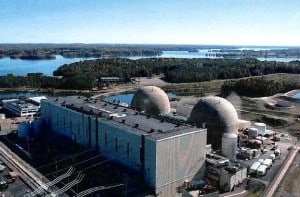

One of the more logical and intriguing prospects for near term new build is North Anna unit 3. Over the past ten years, Dominion, the site owner, has continued to push the project forward.

Progress has not been steady; there have been bumps and jolts along the way. Those include changes in the specified technology from ACR-700, to ESBWR, to US-APWR, and back to ESBWR, which recently received a design certification document from the Nuclear Regulatory Commission.

A sharper-than-expected shudder from the earth happened on August 23, 2011, in the form of an earthquake centered just a few miles from the site, which also inserted a substantial delay in the combined construction and operating license (COL) review.

I carefully used the word “sharper” because though the peak acceleration from the Mineral, VA, earthquake exceeded the expected value documented in the safety analysis, it was a short-lived peak—a spike, if you will—that didn’t contain enough energy to do any damage.

I’m no seismic expert, but those who are have convinced me—and are making good progress in convincing skeptical NRC regulators—that structures like those used in the construction of nuclear power plants don’t get damaged because of short-lived peaks; they need sustained shaking.

The revised site-specific seismic analysis for North Anna 3 is not yet complete and approved, but it has apparently reached a stage where it seems unlikely to prevent the issuance of a COL in 2017.

The NRC COL decision is one of the last remaining “necessary, but not sufficient” conditions for Dominion to make a final investment decision. Other conditions that seem likely to be met at this point include the following:

1. The electricity market in the regulated commonwealth of Virginia will have to remain relatively well-behaved and not experience a decrease due to a strong economic recession ap- proaching a depression.

2. Dominion must complete the addition of a $3.8 billion liquefaction facility at Cove Point, the company’s lightly used LNG import facility. That addition will give the facility the capability to export LNG.

3. The ESBWR vendor, GE-Hitachi, will have to make sufficient progress on the detailed design work that is being done with Dominion funding, to support a positive board decision.

When those conditions are met, probably by the end of 2017, North Anna 3 will likely become the lead ESBWR. Unlike the market near Fermi 3, the designated ESBWR lead plant, Virginia already needs the power.

After California, it is the state that makes the second highest volume of electricity purchases from the open market outside its borders.

Virginia’s need for reliable electricity supply will continue to increase as coal plants retire. The state corporation commission has already indicated that it will ask hard questions about capacity plans that replace all of the coal generation with natural gas, because of a deep concern about the impact of over-reliance on a single fuel source.

It’s worth a little extra space to explain why Dominion chose to invest $3.8 billion into turning Cove Point into an LNG export facility as a more immediate spending priority over North Anna 3, and why the company is unlikely to stop that project even if markets change.

Cove Point, built and placed into service before the Natural Gas Act of 1978, has received far fewer cargoes than expected.

The owners haven’t worried too much because the facility generated solid returns on investment even when there were no ship arrivals.

During periods when natural gas prices were high and imports seemed economical, salespeople successfully obtained long term, “take-or-pay” commitments from well-qualified customers.

Even though Cove Point customers often decided that domestic gas was a better value than imported LNG, they have continued to make their obligatory payments.

Taking advantage of conditions from 2011-2014 that included low domestic prices in the U.S., high prices in Europe, supply uncertainty from Gazprom, an already developed pipeline net- work and U.S. foreign policy, Dominion successfully found long term customers for LNG produced from domestic natural gas.

Even if future market conditions change Dominion will receive an excellent rate of return on its investment, as long as the liquefaction facility is completed.

Take or pay contracts, however, cannot obligate a customer if the service provider is incapable of delivering contracted product because it doesn’t have the capacity to deliver on its promise. That’s why the liquefaction project will be completed.

After that has happened, Dominion will be well positioned to begin an ESBWR at North Anna unit 3.

The above first appeared in Fuel Cycle Week No. 619 • June 11, 2015 under the headline “Whither North Anna Unit 3?”. It is reprinted here with permission.

During the period since I wrote the above article, I received some confirmation that my interpretations were correct. A different person than the people I spoke to at the ANS meeting pointed out that North Anna Unit 3 is in Dominion’s 2014 Integrated Resource Plan as an open option. My source indicated there is a good probability that its planning status will be upgraded in the next version of the plan.

A small nit in the fourth paragraph.

It should read: “…from ACR-700, to ESBWR, to US-APWR, and back to ESBWR…”. The US-APWR was Mitsubishi’s ill-fated foray into the N. American nuclear power business.

They also had a 2-unit project at Comanche Peak in TX that was suspended when Mitsubishi pulled out of N. America in 2013. It didn’t help that Luminant Power, the operator of Comanche Peak, was owned by a utility that later declared bankruptcy.

@Tom Bearden

Nit corrected. (For the record, I also received a correction request from a friend in Canada. The early version of the article said CANDU-6 instead of the correct ACR-700.)

Interesting – I remember hearing years ago about the ESBWR design, but it didn’t seem, at the time, like GE had any interest in marketing it. This is the first I’ve heard of any activity for ESBWR builds.

By the way – regarding Cove Point – could Dominion also use it as an EXPORT facility for LNG? It would seem like, right now, the profitable path for gas is through LNG *export* terminals, to Japan, Europe, and elsewhere. . .

Of course, if Dominion has customers paying them to not grow corn, that’s a good business too, for as long as it lasts. . .

@Jeff S

Thank you for your question. It helped me realize that the following statement from the article is not as clearly stated as it should be for non specialists in the field of LNG.

2. Dominion must complete the addition of a $3.8 billion liquefaction facility at Cove Point, the company’s lightly used LNG import facility.

A liquefaction facility is the modification required to turn an LNG import facility into an LNG export facility. Facilities for importing LNG simply heat and expand the liquid into a pipeline quality vapor and then compress it for transport. A liquefaction facility takes delivered gas from a pipeline and compresses/cools it to turn it into a liquid that can be loaded onto a ship for transport.

As indicated by the $3.8 billion price tag, it’s not a cheap facility. It is, however, a known technology with a reasonable chance of on time, on budget (or close) execution without too much regulatory interference.

Rod,

Thanks for the clarification – I was confused because I kind of thought that a Liquefaction facility was used for turning gas into liquid, which seems like what you’d do to export. So, sounds like Dominion will use the profits from selling gas overseas to pay for building a new nuclear reactor in the US in order to use cheaper and more abundant nuclear energy, and profit off of premium prices abroad. That’s smart.

It’s interesting that LNG exports are one of the things that could drive N. American NG prices up close to world levels, which would destroy the cost advantage that NG-fired plants have over nuclear.

Not only that, but for those seeking to profit off LNG, and who are involved in both markets like Dominion is, it may make more sense to build nuclear plants for domestic power, and sell the gas elsewhere at significant markup.

Oh. You mean like Saudi Arabia, and UAE?

Unrelated, but what does the market potential need to look like in order for GE-H to commit to the lead ESBWR? Will they know it when they see it?

The Bard (EP) wrote:

“which would destroy the cost advantage that NG-fired plants have over nuclear.”

Is that an example of necessity being the mother of invention and spurring full development of nuke plants? Alternatively, from previous postings on this site, there appears to be ample supply of natural gas. It just may be at a higher price.

The time it may take to build a nuke plant may still favor natural gas even at a high price. Gas plants can be built more quickly.

The distance from the electrical market (load) may favor a natural gas plant. Siting nuclear plants has got to be quite difficult these days. Longer transmission lines are also more costly. If I remember correctly, they try to site them 40 miles from major population centers

The regulation may serve as an almost impenetrable barrier or shield to building a new nuke plant. In conjunction with this, of course, is the public fear which will be very difficult to overcome.

Michele Kearney has linked Energy rules have Virginia weighing new nuclear reactor at North Anna, from the Richmond Times-Dispatch. Towards the end are some interesting quotes from Walton Shepard, an attorney with NRDC:

I think we’re all in favor of increased energy efficiency where practical. But I’m somewhat troubled (alternately amused) by this underlying “environmental” meme that the Clean Power Plan is something to be barely met by the skin of our teeth, rather than a first baby step on a long road toward drastically decreased emissions. I realize Dominion probably thinks they can make more gas money by buying low and selling high than they can by buying high and burning it, but who’s exerting the environmental leadership here, anyway?

Re:

“A sharper-than-expected shudder from the earth happened on August 23, 2011, in the form of an earthquake centered just a few miles from the site, which also inserted a substantial delay in the combined construction and operating license (COL) review.”

Wow!! What fragile gigantic eggshells all these nuclear plants are! Pad ’em up quick!!!

Er, no oil and gas and chem facility checks?

James Greenidge

Queens NY