What is behind the natural gas hype?

Waiting for something to take shape is simply not in my nature. I was trained to look ahead, bring some technology to bear, sense the rocks on the radar and note the shoal water warnings on the chart.

Gail Marcus at Nuclear Power Talk recently published a post titled Natural Gas: A Flash in the Pan? in which she points to two recent articles (Rise of natural gas may mean fall of alternative energy and Is Natural Gas the Next Bubble ? Has Fracking Promised More Than It Can Deliver?) that describe our current energy supply situation as a natural gas bubble. She concludes by wondering what the rest of us should be doing in case those articles are correct and the current oversupply of natural gas is not sustainable.

Still other recent items look at the same problem from other angles. One, for example, notes that many wind farms have long-term power purchase agreements (PPAs). These could keep costs low and exert a downward pressure on rising gas prices. While the article is focused only on wind, the same should, of course, be true of PPAs for other energy sources. I am not sure what the terms are for PPAs, so wonder if these could possibly hold prices down for the longer term, but it may be one way we can buy time as the full dimensions of the gas bubble begin to take shape.

Waiting for something to take shape is simply not in my nature. I was trained to look ahead, bring some technology to bear, sense the rocks on the radar and note the shoal water warnings on the chart. When I see that we are “standing into danger” (to use some more nautical terminology) I must advocate or take effective action to avoid calamity. That need is even more imperative when I realize that the obstacle ahead is not necessarily natural “rocks and shoals” but a high powered, very large ship that is purposely building ramming speed with the intention of harming all of us.

I know Gail on a personal level and believe that she is wonderfully incapable of seeing purposefully destructive marketing behavior. Like many technically-trained nuclear professionals, she projects her natural integrity onto others who do not deserve it. Here is the comment that I left on her blog, which, by the way, is a terrific resource with a unique perspective on energy technologies and politics.

@Gail

As I tried to imply here quite some time ago in response to your review of “Why We Hate Oil Companies”, I see a purposeful marketing strategy behind what has been painted as a spontaneous, technology-enabled shift in the supply picture for natural gas. In my analysis, one of the factors behind the natural gas bubble is a purposeful effort to derail the nuclear revival.

The oil companies – which are also the natural gas companies – have taken some pages right out of Rockefeller’s dusty old Standard Oil book. They have invested heavily into the infrastructure required to extract and deliver gas, driven down the price and are capturing market share.

As gas producers drive out their competition – primarily new nuclear power plants that do not burn ANY natural gas to supply electricity, which is their most lucrative market – they will act surprised as demand for their product increases faster than their ability to increase production. That process will inevitably lead to an imbalance between the rate at which customers want their product and the rate at which they can deliver.

Prices and profits will rise. Since gas infrastructure is notoriously difficult to build because of the nature of the commodity – it is a low energy density gas at STP – the price increase will be rapid and sustained.

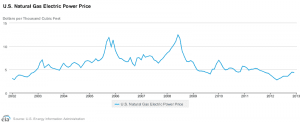

People that extract and sell gas understand its price history. They have very fond memories of the “good old days” from 2001-2008 when their wells were incredible cash cows because they were extracting with essentially zero marginal cost, but selling for $6, $8, $10, $14 or even $25 per MMBTU.

There was a brief period last winter in New England when natural gas prices exceeded $30 per MMBTU. That should have been a clear warning, but it does not seem to have been heeded.

Unfortunately, many of the most powerful influencers in the nuclear industry also remember the last gas price mountain with fondness. When you are operating nuclear plants with a marginal cost of 2 cents per kilowatt-hour in a competitive market where the “last-in” supplier sets the price, skyrocketing natural gas leads to high priced electricity.

Every commodity supplier likes high prices for their commodity, especially when they already know that their production costs are far lower than the market price in a supply-constrained environment.

Rod Adams

Once again, I think it is important to try to burn the below graph into the collective consciousness of all energy decision makers. (That includes all of us, we make energy decisions every day, though most of them are a bit on the automatic or unconscious level.)

Please do not take this as investment advice, but I feel the need to tell you that one of the things I have done to protect my personal savings against the inevitable rise in natural gas prices is to buy stocks in companies that will benefit as those prices increase. My portfolio is overweighted in nuclear focused engineering firms and competitive market nuclear power plant operators like Exelon.

Now that gas in storage is below the 5 year average and the price is rising fast I think it is time to stop using terms like gas glut and oversupply. It looks to me like the bubble has already burst.

From $4.02 yesterday to $4.18 today at the Henry Hub according to the site I have bookmarked (might be a day lag there, however). Appropriate increase for the day this was published.

http://www.wtrg.com/daily/oilandgasspot.html

And I will be a bit disappointed if there isn’t a good Jaczko article within the next 2 days here at Atomic Insights, Rod.

No pressure 🙂

^^^^^ This! But to repeat, no pressure. 🙂

But you know, hype or not, the public’s mostly positive real-life perception of natural gas doesn’t change via their world reality lens of the mass media and ads. And give the devil his due, the gas/oil industries are only rightly doing PR-wise what nuclear’s been anemic at for generations. I just can’t begrudge them their success at pulling the wool over everyone’s eyes. It’s nuclear’s total PR inaction at even defending itself, much less attacking, at fault not them. Even if there’s no true “nuclear industry” you still have 104 plants with 104 general managers and 104 community PR offices and 104 site unions which could all bother to form a nuclear brotherhood outside their different energy parents and for their mutual benefit start promoting nuclear in “generic” national educational pro-nuclear ads to at least tread gas’s media turf. I mean really, this isn’t rocket science. They gotta hawk nuclear’s virtues as though their and future jobs depended on it, forget an entire nation’s clean environment and energy security.

James Greenidge

Queens NY

Bloomberg just published an article about a study from Cornell stating that NY state could go all unreliable by 2030 for $382 billion. I posted a comment showing how they could be completely CO2 free by 2028 for less than $100 billion.

All I can say is that I sure hope you (Rod) are right concerning the trajectory of gas prices, with respect to investments. For people with uranium and nuclear utility stocks, etc…, it has been absolutely brutal, for several years, and the main, single reason is low gas prices. Nuclear/uranium stocks fell even more in 2012 than they did in 2011 (the year of Fukushima)! Can’r really figure that one out.

Hmmm. The link I thought I posted seems to have dropped off. The article title was “New York Renewable Power Plan Would Cost $382 Billion by 2030” – Bloomberg.

Simple to figure out, Jim. Low NG prices = low electricity prices. Go look at the early-March Henry Hub price (or just look above to that chart). It dropped below $2.00/MMBtu. When I looked today, it was up to $4.18/MMBtu.

Re: “Hmmm. The link I thought I posted seems to have dropped off.”

Huh. Why does such an omission/bad input/dumped post/preemptive censorship on media sites sound TOO familiar? Another reason the nuclear community must aggressively take self-promotion and ads into its own hands! Someone should send Greenpeace Louise Downing there in London the hyperlink to that fabulous YouTube clip of how much pristine scenic real estate is ruined by wind farms vs one sole nuke, though I’m pretty sure her readers won’t see it. Personally, I’d like to grab such folks by the scruff of the neck and “ask” them to print in black and white just why they’re so hell-bent on dismissing nukes so their readers can get a wind of where their heads and prejudices and maybe purses are.

James Greenidge

Queens NY

With an almost perfectly regular growth since one year, thank you for the link.

An interesting point is that gas usage was down in January WRT January last year, and coal was up, see http://www.eia.gov/electricity/monthly/epm_table_grapher.cfm?t=epmt_es1b

Electric Utilities

% change 2013 YTD 2012 YTD

Coal 7.2% 103,762 96,778

Gas 3.6% 36,509 37,033

Does this means gas is already at the stage where it’s use is more expensive than coal ?

Your wish is my command. https://atomicinsights.com/2013/04/jaczko-comes-out-as-avowed-antinuclear-activist.html

I meant that the link I tried to put into my comment here. It disappeared but the rest of the post showed up. I used the a href tag listed below the comment text window, with the carrots on either side, but the html did not make it into my comment here for some reason. My comments on the Bloomberg article are still there as far as I know.

If you botch an HTML tag, the editor will strip it out.

Here is a link to Atomic Insights

In the comment box, it looks like this:

<a href=”https://atomicinsights.com”>Here is a link to Atomic Insights</a>

Thank you, Engineer – Poet. Let me try again, using the information you have provided.

http://www.bloomberg.com/news/2013-04-08/new-york-renewable-power-plan-would-cost-382-billion-by-2030.html

New York Renewable Power Plan Would Cost $382 Billion by 2030

jmdesp, I believe it is dependent on a given generator. Many combined cycle NG plants, approaching 60% thermal efficiency, are likely still lower cost than coal even after the recent rise to above $4.00/MMBtu.