Should customers allow natural gas to push nuclear out of market?

Rebecca Smith asked an interesting question in a recent Wall Street Journal article titled Can Gas Undo Nuclear Power? She describes how financial analysts are wondering whether or not certain nuclear plants are at risk of being shuttered as being uneconomical in an era of cheap natural gas.

It is a legitimate question for people who have a shallow understanding of the way that markets work. However, people who understand a little more and think about the long game might want to ask the question in a different way – Should gas be purposely enabled to undo nuclear power? It might even be useful to ask a related question – What can nuclear energy fans do to change the game and encourage owners to keep their plants running?

I was happy to note that the Nuclear Energy Institute’s Richard Myers responded to Ms. Smith’s article in a reasonably forceful manner with a post that was published both on the NEI Nuclear Notes blog and as a comment on the Wall Street Journal article.

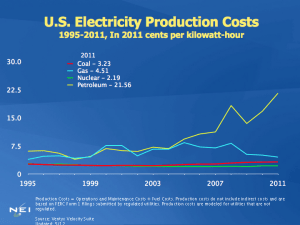

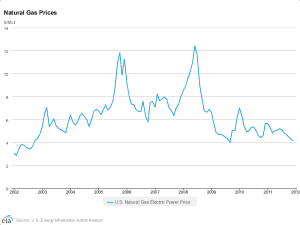

Making long term energy decisions based on today’s North American natural gas prices is a bit like swinging a hockey stick under the assumption that pucks don’t move, even when they are placed on slick ice. The Great One (Wayne Gretzky) would remind anyone guided by that false notion that skating to where the puck is going to be in five years is likely to be more rewarding than swinging your stick at the place where the puck was reported to be last month. Here is an important graph to keep in mind when asking if nuclear energy can compete with natural gas.

It is also worth keeping this graph of prices for natural gas sold to electricity producers near the top of your decision support material.

Everyone who is interested in energy decisions should either know or learn that it takes roughly 5 years from the time that a combined license is issued for a new nuclear plant until that plant enters commercial operation. The license application process requires an additional 42-48 months with a steady investment in both personnel and money in order to keep it moving on that schedule. It is therefore short-sighted to make any decisions about whether or not to pursue a nuclear power project based on today’s market prices. Take any point on the above graph, draw the local slope and see how close it comes to predicting the price of natural gas nine years later.

Companies that are building nuclear plants today are benefitting from the low prices that their future competitors are offering and from our rather sluggish economy. The material and labor inputs to the construction process are cheaper in times of low energy prices, low inflation and and low interest costs.

There is no doubt that companies that are operating smaller, individually located nuclear units and selling electricity in competitive wholesale markets are not big fans of low electricity prices enabled by low gas prices. Their stress, however, is not solely due to low fuel prices for their competitors. Electricity customers at the retail end of the business are not necessarily obtaining much benefit from temporarily low wholesale market prices. Some items that neither Rebecca nor Richard directly mentioned are just as important as low natural gas prices.

For example, every nuclear power plant in the US that is maintaining an operating license must pay an annual fee to the US Nuclear Regulatory Commission for the regulatory services associated with that license. The fee is a flat rate that does not vary depending on the power output of the reactor, so a plant that generates 1,200 MWe pays exactly the same $4.7 million per year as a plant that only produces 600 MWe.

Every nuclear power site in the US is required to provide the same, often excessive, level of security; sites with only one small reactor thus have higher costs per unit of marketable electricity. There is financial uncertainty associated with additional costs that are going to be imposed by the Nuclear Regulatory Commission in a cosmetic response action to Fukushima; even landlocked plants in Nebraska or Illinois may be forced to show that they can withstand natural disasters on the level of a 9.0 earthquake and a 45 foot high tsunami.

The high cost of repairs at a nuclear plant are not driven only by the factors that Rebecca Smith mentioned in the below quote:

Nuclear plants also spend heavily on security and other safeguards, and their equipment costs are higher than those for other kinds of generating plants because they handle radioactive material and operate at extreme temperatures.

The temperatures at nuclear plants are less extreme than those experienced by their fossil fuel competitors. The radioactive material has proven itself to be less hazardous than the explosive and flammable hydrocarbons fueling natural gas and coal fired power stations. Nuclear equipment costs, especially for the single unit facilities are more driven by the “one of a kind” nature of the technology. They are also increased by the unique, often obsolete quality assurance rules imposed by licensing commitments and the high cost of getting the NRC to change its mind once a rule has been written.

Did you know, for example, that many of the units in our existing fleet are still imposing ANSI 45.2-1977 (Quality Assurance Program Requirements for Nuclear Facilities) on their suppliers? That standard was written while I was in high school and published the year I graduated. I’ve been a grandfather for three years. It is extraordinarily expensive to find and qualify suppliers willing to meet a standard that is not even available in a reasonably high quality, searchable format. When I ask colleagues why they have not updated to more modern or more universal quality assurance standards, they describe the minimum of 2-3 years worth of delays and requests for additional information associated with any license change and the subsequent cost of updating all of their existing documentation.

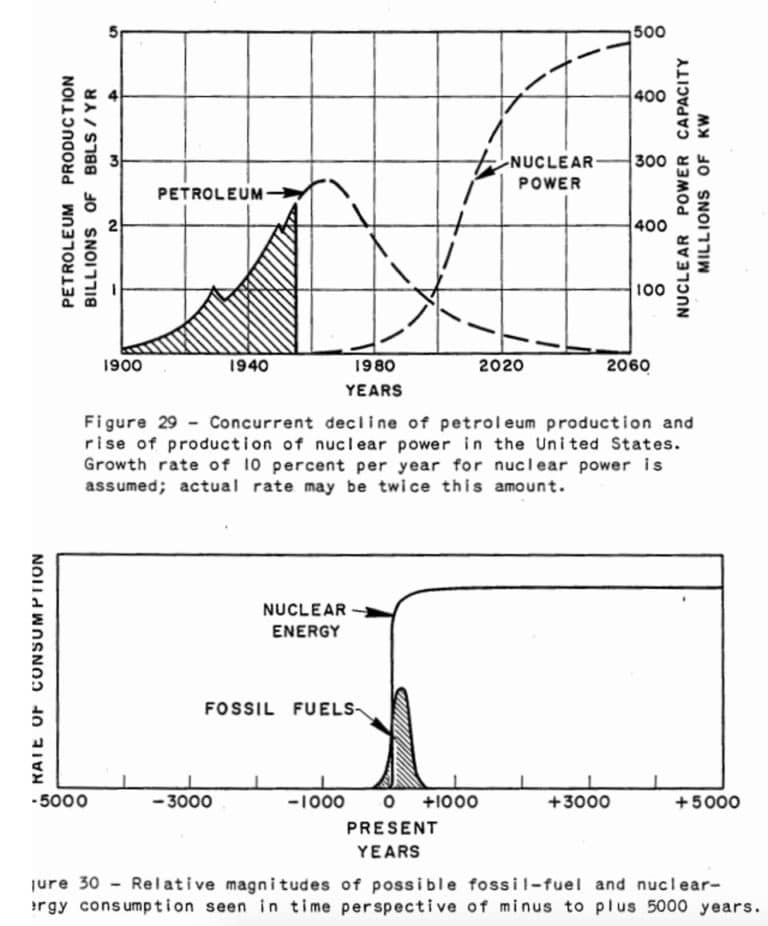

There should be no question that higher natural gas prices are the inevitable result of shutting operating nuclear plants, exporting liquified natural gas, and reducing drilling. It is no secret for anyone who listens to earnings calls for natural gas production companies that they are hurting and doing everything in their power to push prices to more profitable levels.

If you are in a business that is enjoying low natural gas prices or if you are a consumer who owns a home that uses gas for heating, you should consider joining forces with the owners of any of your local nuclear power plants. Help them advocate for changes that will reduce the externally imposed costs of keeping them running so that they can help keep the energy supply abundant and favorable to consumers. Please understand that the issue is not like mothballing a coal plant; if a nuclear plant owner gives up the plant operating license in order to save the $4.7 million per year in fees to the federal regulator it can take many years to recover that license. There is only one instance that I know of where a shuttered plant was brought back to life, and I am not even sure that plant gave up its operating license.

Frequent advertisers in the Wall Street Journal like Shell, Chevron, BP and ExxonMobil might not be very happy if their efforts to expand the use of natural gas do not result in bullish profits. I say tough noogies; they are not looking out for consumer interests or the interests of those who would prefer to leave the earth’s atmosphere to their descendants in a cleaner condition than it was when they were born.

I was just at a lecture on how to make antibiotics cheaper (yes this is germane!). The reason we are running out of antibiotics is not merely the bugs are getting resistant: drug companies need to make enough profit off EACH antibiotic rather than being paid to keep up with the bacteria.

We have a systemic issue with energy in that life cycle cost (where nuclear is a clear winner) matters so much less than initial cost (natural gas plants are cheap to build). We have systemic issues (e.g., different regulatory models for the same thing [radiation from nuclear power vs radiation from oil and natural gas], financial incentives for maximizing fuel volume sales, etc.). As the medical industry needs systemic and technological shifts and refocus, so the energy industries and their regulators need to be focused more on long-term energy supply and environmental health.

Every time I think of natural gas my nerd-brain recalls Yoda from “Empire Strikes Back”. Natural gas is the quick and easy path, and consume us it will if let dominate our energy destiny we allow. 😉

@ Robert,

A new generation of nuclear technologies is around the corner with SMRs and GEN IV designs.

It is the same thing with bacteria and anti biotics. These little suckers have a voting system. If you mess up with it, you win. Just like the Borgs on Star Strek next Generation. You put them to sleep with a low level security command and boum, you’re in !

For more, you can read this bit here that I took from TED.COM

In 2002, bearing her microscope on a microbe that lives in the gut of fish, Bonnie Bassler isolated an elusive molecule called AI-2, and uncovered the mechanism behind mysterious behavior called quorum sensing — or bacterial communication. She showed that bacterial chatter is hardly exceptional or anomolous behavior, as was once thought — and in fact, most bacteria do it, and most do it all the time. (She calls the signaling molecules “bacterial Esperanto.”)

The discovery shows how cell populations use chemical powwows to stage attacks, evade immune systems and forge slimy defenses called biofilms. For that, she’s won a MacArthur “genius” grant — and is giving new hope to frustrated pharmacos seeking new weapons against drug-resistant superbugs.

Bassler teaches molecular biology at Princeton, where she continues her years-long study of V. harveyi, one such social microbe that is mainly responsible for glow-in-the-dark sushi. She also teaches aerobics at the YMCA.

Yes, at the lecture today the subject was on the new methods to synthesize compounds and test many more sets than can be done robotically.

To bring this back to nuclear, the FCC does not have the same “neutrality” foisted on it by statute as the NRC does. Nobody at the FCC talks about being neutral on the question of whether or not we will use medicine. The NRC always points out that they are neutral on the question of whether or not to use nuclear energy (maybe the Dept of Agriculture should become neutral as to whether we will grow our food on farms…). This paradigm at the NRC hampers the development of nuclear energy. I am not calling for a return to the AEC, but we need our government agencies to regulate risks using a single yardstick and provide the support we need for the next generation of nuclear energy technologies.

Did you mean to say the FDA?

Yes, and OOPs!

Of course, the FCC has not stated neutrality on whether we will use telephones or cable TV…

“We have a systemic issue with energy in that life cycle cost (where nuclear is a clear winner) matters so much less than initial cost (natural gas plants are cheap to build).”

This is, in part, a human nature problem.

In the early 90s, the Zip disk drive took over the removable media segment of the computer market. A Zip drive cost around $150 at entry and later about $10. The disks cost $10 – $15 at entry and around $5 at maturity. Each disk held ~120 MB of data. The Zip disk enjoyed a brief (long in computer time) period when it was almost as ubiquitous as the floppy drive and the CDRW drive in different times.

However, at the same time as the ZIP became so popular, there was another removable technology. The disks were physically the same size, and cost about the same amount, but they held 640MB. They were also much more robust and reliable than Zip, which became notorious for its clicking failure. The performance of the two drive types was about the same.

So, why did Zip take over the market? The other technology with the better disks and better reliability had a drive which cost about $300 at entry and around $200 at maturity.

The disks were almost 1/6 the cost on a capacity basis, and were virtually indestructible, but the cost of entry was twice as high.

Doh. That should be, “$150 at entry and later about $100.”, not “$150 at entry and later about $10.”

The trick about present relatively low natural gas prices is that competitive electrical generating capacity from nuclear is one of the reasons that the gas price is as low as it is. Take away that competition, and that alone will cause gas prices to rise. The double whammy is that if nuclear should go away, the demand for gas will then increase as well. Higher prices from reduced competition and increased consumption will certainly put a smile on the face of gas producers, at the expense of the rest of us.

I wouldn’t worry about this too much Rod. Nuclear plants already built have such low running costs (under 2 cents/kWh) that it’s usually cheaper to keep them running even if natural gas costs 1 cent/kWh, than to hedge prices long term. Utilities that own nuclear plants have a long term perspective. Besides, a nuclear plant is a long term hedge asset that has real value to a utility. It increases the worth of the utility (in the case of eg a merger). Having combustion gas turbines is nearly valueless in this respect. They’re so cheap to build that you could simply build more of them if gas prices are low and close them if they are high (in which case they turn into a limited liability).

Ok, the delivered natural gas price seems to be hovering around $2/GJ which is 0.72 cents/kWh thermal. With a typical average CCGT efficiency of 55% (newer ones are 60% but most are not new) this gives 1.3 cents/kWh. Typical variable O&M would be around 0.7 cent per kWh. So the marginal cost to generate with gas is currently exactly as high (2 cent/kWh) as the marginal cost of nuclear. As other commenters have noted, this is probably not a coincidence.

One thing with nuclear power is that O&M costs are basically fixed, so they increase with throttling down the nuclear plants… hence the gas plants will have to throttle down before the nuclear plants would.

Delivered to whom? The Henry Hub price for NG is about $3/mmBTU (roughly 1 GJ), and delivered price to consumers is multiples of that. Landed price of LNG in Japan is around $16/mmBTU.

Ok, so $3/GJ for the gas. Do you know the delivery charges for powerplants? For small users such as myself the delivery is $6/GJ but for industrial users its much lower.

Japan’s a good example of what happens when nuclear plants are shuttered. Expensive LNG must be bought in stead. I think this proves the point that someone else here made, that gas wouldn’t be cheap without nuclear plants around.

There was a recent blog post I read which went over delivery costs, but it’s not something I thought to bookmark. I recall that NYC’s charges were in the tens of dollars per GJ.

At $9/GJ delivered, a gasoline-gallon-equivalent of natural gas (~120 MJ) costs roughly $1.10. We are far better off heating with nuclear and driving with methane.

Agree! We are currently wasting perfectly good natural gas transport fuel for baseload power. While we have low cost clean nuclear to do that, and expensive oil for vehicle fuel. This is not sensible.

With simple ductless air to air heat pumps, a nuclear kWh electric can provide 3 to 5 kWh of space heating. This puts the advantage further towards nuclear.

If extensive use is made of electrified rail, nuclear electric big ships, and plugin hybrid commuter car travel, the US could probably produce all of its remaining transport fuel from its own natural gas sources.

Electricity from natural gas is not carbon neutral. Therefore, it is contributing to global warming, global sea rise, and the acidification of the marine environment.

It should be mandated Federal law that all US utilities should produce at least 50% of their electricity through carbon neutral resources or technologies by 2020 (several US utilities already exceed this standard), and 90% by the year 2030.

Utilities that fail to reach these levels should be charged a 15% sin tax– on all– of the electricity that their utility produces in the US until they reach Federal standards.

Its that simple, IMO.

Marcel F. Williams

As I never get tired of noting, natural gas makes good motor fuel. We should be pushing NG prices up by running our cars and trucks on it instead of buying OPEC oil. That would price natural gas out of the base-load electric market and make the gas drillers happy. The electric generation should go from gas to nuclear, including for space heat. We could easily have a “smart grid” retrofit for older furnaces, where electric heating elements substitute for the burner when electricity is available and the burner is used when it isn’t. Natural gas at 80¢/therm in a 90% efficient furnace is equivalent to 3¢/kWh electricity. With fuel+O&M running 1.7¢/kWh, the nuclear generators could make money even selling at 3¢/kWh (interruptible rate) to compete with natural gas furnaces.

Natural gas can also be converted into methanol which can be converted into gasoline. New Zealand use to do that back in the 1980s and 1990s using the Mobil Oil methanol to gasoline process.

The energy efficiency of those conversions is around 50%. That’s a luxury we cannot afford, when the NG can be used as-is.

Its the ultimate cost to the consumer that matters, not the efficiency of the process.

Most methanol comes from natural gas and the cost of methanol is currently about $1.13 per gallon. With about half the energy content of gasoline, an equivalent amount of methanol would cost about $2.16 per gallon.

Converting that methanol into gasoline through the MTG process requires approximately an additional 10% in energy cost. So we’re talking about $2.38 per gallon before taxes, not including the capital cost of the MTG process.

Using natural gas directly in your automobile requires the additional cost of converting your vehicle to use natural gas or buying a new vehicle that can burn natural gas plus. Plus you have to try and find natural gas fuel stations than can refuel your vehicle.

Good article on this subject can be found at:

http://www.popularmechanics.com/cars/how-to/maintenance/should-you-convert-your-car-to-natural-gas

Converting natural gas to gasoline, on the other hand, simply adds to the domestic gasoline supply. Converting urban and rural– biowaste– into methanol and then into gasoline would also add to that supply.

Eventually, mass producing floating and coastal nuclear power plants to manufacture methanol from seawater, could replace all of our transportation fuel needs and peak load electricity needs.

Marcel F. Williams

Would you also agree that the ultimate cost hinges on the supply/demand balance, and how hard the production capacity is pressed and how fast reserves are depleted?

Doubling the rate of consumption is going to be bad for the consumer on all of those counts.

At current Henry Hub prices of about $3/million BTU, the NG equivalent of a gallon of gasoline costs about 34 cents. If N. American prices went up to the $15/mmBTU world price (which they spiked to just a few years ago), that gallon-equivalent of NG rises to only $1.73; converting to synthetic gasoline at 50% efficiency costs $3.46/gallon for the feedstock alone.

Natural gas can be carbureted into the intake air of both Otto and diesel engines. A new vehicle with a dual-fuel option could just back off the fuel injector pulse width while adding NG to the air. Retrofits might not be worthwhile, but the vehicle fleet covers half its lifetime mileage in its first 5-6 years anyway so the value of retrofitting older vehicles may not be there.

If you can save $2.50/gallon by using NG for 80% of your fuel supply, a 25 MPG vehicle driving 13,000 miles a year slashes $1040 off its fuel bill. You could do this with small natural gas tanks filled daily at home. Eaton has a natural gas compressor headed for production at about $500, and 80 cubic foot SCUBA tanks cost less than $200. A pair of tanks, a compressor and the balance of system would pay off in about one year.

US natural gas consumption is about equal to US transport fuel consumption. There is clearly room for direct substitution; all we need is something to substitute for NG in electric generation, home heating and whatnot. Nuclear electric power is the obvious option.

Rod, not related to this post, but here is an article mostly about your employer that includes entirely too many quote from Ed Lyman (“Lie-man”).

http://www.npr.org/2013/02/04/170482802/are-mini-reactors-the-future-of-nuclear-power

And the &*^% reporter used the UCS as the additional viewpoint. Grumble. I’ve already sent NPR a complaint about that. I think everyone should. If their goal is to inform their listeners, there’s no reason to ever use the UCS as a source.

I read today’s story from Morning Edition with a sense of deja vu. It sounded really familiar and then I realized that NPR had simply repurposed a story that was produced by a Charlotte affiliate station more than six weeks ago:

http://wfae.org/post/charlotte-firm-takes-lead-smaller-factory-built-nuclear-reactors

Re: “Should customers allow natural gas to push nuclear out of market?”

Well, if we had an educated public which would they chose? #2. Who should do all the educating? I just can’t begrudge oil and gas TV ads. They’re just getting the word out — as business ought to live and prosper. Nuclear’s choir seems sealed and entombed in a techie church.

James Greenidge

Queens NY

“Nuclear’s choir seems sealed and entombed in a techie church”

Well said James.

Rod, the cost of nuclear power is largely from depreciation of expensive capital equipment — a sunk cost. Shutting down a nuclear power plant only reduces the variable costs, which I estimated at roughly 1 cent/kWh. Is there a better estimate with breakdown for security costs, NRC fees, fuel costs, operational labor, etc?

Secondly, Margolis introduced the idea that FDA regulators DO include benefits in their decisions, but NRC regulators only include risks of harm. Is there more you can do with this?

Facts and figures about gas vs. nuclear of Ontario’s situation well outlined in Steve’s latest blog How much should carbon cost