Rationally comparing financial risk – nuclear versus natural gas (#1 of ??)

Yesterday I wrote about the need to rationally compare the physical risks associated with producing energy by burning natural gas against the similar risks of producing energy by fissioning uranium in a nuclear power plant. However, even when decision makers includes some reasonable estimates for those kinds of risks, they are still often choosing to build natural gas infrastructure instead of nuclear infrastructure.

They do that because they have run the numbers using todays rules and their normal investment time horizons. Under those initial conditions, analysts can rationally determine that the financial risk associated with building machines that are technically capable of burning only natural gas or distillate fuel is more acceptable than the financial risk of building, owning and operating a nuclear fission power plant.

Part of the multifront approach I would take in an effort to market fission energy – if that was my job – would be seeking to change the rules of the game. If you happen to be a Star Trek fan, you please recall the story of Captain Kirk’s solution to the purposely unsolvable Star Fleet Academy test scenario called the Kobayashi Maru. If you’re not a fan or have never heard of the story, it is best summarized by this short interaction:

Saavik: “Sir, may I ask you a question?”

Kirk: “What’s on your mind, Lieutenant?”

Saavik: “The Kobayashi Maru, sir.”

Kirk: “Are you asking me if we’re playing out that scenario now?”

Saavik: “On the test, sir. Will you tell me what you did? I would really like to know.”

McCoy: “Lieutenant, you are looking at the only Starfleet cadet who ever beat the no-win scenario.”

Saavik: “How?”

Kirk: “I reprogrammed the simulation so it was possible to rescue the ship.”

Saavik: “What?”

David: “He cheated.”

Kirk: “I changed the conditions of the test. Got a commendation for original thinking. I don’t like to lose.”

In order to successfully change the rules and model assumptions that disadvantage nuclear energy when compared to natural gas, it is important to understand how those rules currently work. (Kirk could not have reprogrammed the computer without first recognizing how it was programmed to force a no-win scenario in the first place.)

In rate-regulated utility markets, power plant owners bear virtually no risk of fuel price volatility. Nearly every one of those markets includes something akin to Kentucky’s fuel adjustment clause that can be modified as often as monthly to reflect variations in fuel prices. There was some logic associated with establishing that rule, but the effect has been to remove one of the largest financial risks associated with building a power plant from the entity that gets to choose which kind of power plant technology to build. Fuel price volatility risk gets covered by the customers – not just households, but large commercial customers as well.

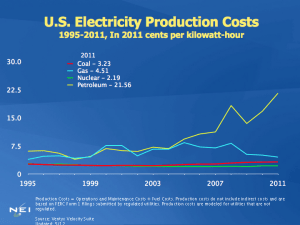

This graph of fuel prices for electric utilities demonstrates the stark difference between fuel price effects on total production costs between natural gas and the commercial nuclear fuel used in a fission power plant.

Though there are no fuel price adjustments in the unregulated wholesale markets, the way that the markets are structured to set the price based on the “last-in” supplier serves to mitigate fuel price worries — for power plant owners. The market price for natural gas will be roughly the same for all competitors for those last needed kilowatts of capacity, so there is little chance that large suppliers will be underbid by an independent power producer with substantially lower fuel costs.

A factor often referred to as sovereign risk also comes into play. In financial models for nearly all other industries, countries that are not the United States end up with a larger factor assumed for the possibility of negative actions or corruption associated with the country’s leadership. In the models for power plants, however, nuclear energy proposals include a large risk factor for the possibility that a local, state or federal government decision will have a negative impact on the cost and schedule for the project. In the worst case scenario, the project could become another Shoreham, where the owner completes the plant, tests it with commercial nuclear fuel providing the heat and then is forced to decommission the plant without ever generating any revenue.

There are other factors in the complex financial risk model associated with determining whether to build a natural gas plant or a nuclear plant, but I am running short of time, so this discussion will have to be continued. Once we’ve identified the risk factors that put nuclear energy at a disadvantage — in most of the United States — under currently existing conditions, I’ll write about how those rules and assumptions can be mitigated, altered, or overcome. Your comments are welcome and might influence the future posts in the series.

Interesting points, @Rod. This seems like a legitimate case of a seemingly innocuous issue causing a substantial distortion of market incentives. Cases like this make for an obvious test environment for seeking to attract free-market and anti-corporitist allies. In particular, it is a correction to a distortion which does not rely on “picking winners” (further compounding the distortion) or even having allies particularly sympathetic to nuclear itself. Getting rid of some of the rigged rules of the game would be a good start to giving nuclear a fairer playing field to compete on for investment.

I dont understand this post. Are we to assume that traditional financial risk assessment with regard to nuclear power was correct? Are we just going to make unscientific assumptions because of the “financial” moniker?

Like with Shoreham case mentioned from what we know now would a broad area evacuation EVER be prescribed in the remote possibility/event of a accidental venting/loss of containment?

@John Tucker

I am not sure I understand your question. Financial analysts don’t delve into science, they assign risk factors to events that are possible and they assign consequence numbers to those events.

For example, when building a financial model to decide whether to build a nuclear plant or a natural gas plant in the Northeast, the model might include an allowance for the risk of another project with the same kind of outcome as Shoreham.

If I was creating the model in today’s environment, I would assign a 25-50% probability that the project would be prevented from operating. The potential consequence of that occurrence might be a complete loss of $12 billion (Shoreham was $6 billion; I doubled that as a swag for inflation.) For the gas plant, I would assign a probability of about 10% that it would not be allowed to operate, but the consequence would be less than $1 billion.

With those factors, only a change in the rules of the game would work. The industry has tried to do that with “one-step” licensing, but I think that is an approach with its own uncounted risks.

My approach is to work to lessen the fear of radiation and increase the understanding of the benefits of emission free, reliable power enough to reduce both the risk that anyone would be allowed to toss a political monkey wrench into the process and to reduce the cost consequence if there is a project failure for other reasons.

Sorry – went out of town. I think the problem I had with it was that much of that risk was not dictated from reasonable modeling and is variable and dynamic.

With Shoreham I also kinda wonder why after that expenditure a more planned PR response wasn’t in place.

I wonder if the passion in designing it and building it (and money) wasn’t in the environmental argument in the beginning. That they really didint care if it ran or not. Could that be a reoccurring problem ??

Here are Burton Richard’sf Four Laws of Government Inertia. It is dead on for nukular:

1st Law: The future is hard to predict because it hasn’t happened yet.

This one is an excuse for inaction because we do not know enough yet.

2nd Law: No matter how good a solution is, some will demand we wait for a better one.

This is what some environmental organizations use to block sensible proposals like incentivizing the switch from coal to nuclear for electricity generation.

3rd Law: Short-term pain is a deterrent to action no matter how much good that action will do in the long-term.

This is the one that blocks things like cap and trade or carbon emission fees. You can always find a lobbyist to explain why hurting their clients hurts the nation (and maybe campaign contributions).

4th Law: The largest subsidies go to the least effective technologies.

This one keeps things like subsidies for corn ethanol going. (And solar and wind. Does not matter that Spain and Greece failed 10 years ago. Gotta do something stupid)

Rod, what is the exact source for the first figure of US Electricity Production Costs ?

It says NEI at the bottom, but if you have an exact link it would be great.

I see it’s at this location as an excel file, but not the picture :

http://www.nei.org/resourcesandstats/documentlibrary/reliableandaffordableenergy/graphicsandcharts/uselectricityproductioncostsandcomponents/

Lot of other interesting document, like fuel cost only, safety accident rate, etc. there

Demand risk is the largest risk for nuclear builds

In 1979 EIA projected 2010 US Energy consumption would be 124 quads. We only consumed 98 quads… the 1979 projection for 1995 was 96 quads, of that 9.6 quads was to come from nuclear, 8.2 quads currently comes from nuclear(The projection for nuclear for the year 1990). Coal was supposed to be 49 quads in 2010, it ended up being 21 quads, less then the projection for 1985.

http://www.eia.gov/forecasts/archive/aeo79/pdf/0173%2879%293.pdf

IMHO The ‘overbuild’ of baseload in the 1970’s and the lack of realization of ‘anticipated demand growth’ pushed utilities to natural gas as it had the lowest capital cost and therefore the smallest demand risk.

Even now, if I look at the fact that the average installed air-conditioning unit in the US has a SEER rating of about 10 and the best commercially available air-conditioner has a seer rating of 23 I really have to think twice about what ‘summer demand’ might look like in 10 of 15 years. It could be half of current demand if everyone decides to replace with the ‘best model’.

But then it’d be possible to try to convert as much some fossil use as possible to electricity. Even if the all-car culture of the US is a big problem there 🙁

France had a very similar problem with it’s nuclear capacity in the early 90’s, despite that we actually still have a lot of gaz and oil heating.

In the cold winter of last February, the energy use of gas heating was a little larger than the one of nuclear despite all the talk of massive electric heating use in France .

As someone who was against nuclear power in the 70’s

if this stage four is reality, sign me up ..

Thank You

Robert Burdin

The financial sector responds to risks as best they can and are responsible for allocating capital across diverse markets. I would not so readily discount their risk assessment. With that being said, what is the factor that is driving their assessments? I think the chief factor here is regulatory risk. It is the risk that eroded property rights of utilities so that others have diktat over the utilization of that capital.

Regulatory risk is what creates the space where those four laws hold sway. Without control of a third party, the laws that govern third parties hold no sway. The single justification of the amount of regulation is the application of the LNT theory as a regulatory basis. This will have to be changed if we are to see any meaningful reassignment of financial risk.