Nuclear proponent versus free market advocate for natural gas

My continuing discussion with Robert Bradley at Master Resource provides an opportunity to concisely document information about energy market competition gathered over several decades. I hope you continue to enjoy it, but part of the reason for publishing it here is to add to a growing web log (blog) about the topic that may be repurposed some day.

This is a continuation of Debating a natural gas booster about nuclear competition.

Robert Bradley { 12.05.11 at 8:26 pm }

Rod:

What inspires the statement above ‘… for the fossil fuel-funded opposition to nuclear energy.’? I do not know of any ‘fossil fuel interest’ that is paying a free market group to oppose nuclear. I’ve never ever had a discussion with a fossil fuel interest about working against nuclear, and I would bet that my counterparts at Cato, AEI, CEI, would say the same thing. We free market types are against uneconomic government-dependent energy, whether it is ethanol or whatever.

A historical note: the prolonged high natural gas prices occurred because of maximum price regulation, ironically, which caused shortages in interstate markets … and thus desperate fill-in gas at name-your-price. Free market periods of no price regulation (such as today) have never encountered the high prices of the 1970s. Winter peaks maybe, year-round no.

Let the market decide…. I would not pick any fuel as an inherent winner, much less nuclear in our lifetimes in the US.

Robert Bradley { 12.05.11 at 8:30 pm }

Yes, natural gas interests have tried to get special government favor to increase demand, whether the anti-coal campaign of Price and Chesapeake some years ago or Boone Pickens against oil today. Good point–but nuclear is still way out of the ballpark at gas prices that can be locked-in today.

Rod Adams { 12.06.11 at 4:01 am }

@Robert

My statement about the fossil fuel funded opposition to nuclear energy is based on numerous hints and documented pieces of evidence that can be found on Atomic Insights by searching with the term “smoking gun”. The series includes such evidence as an ad paid for by the Oil Heat Institute of Long Island promoting “Solar not Nuclear” during the period when the Shoreham nuclear plant was being constructed and a more recent advertisement from the coal miner unions in Australia claiming that allowing nuclear energy would lead to massive job losses.

The series includes some information on the fossil fuel funded history of Cato and an explanation of the concept of “damning with faint praise” that I learned during my service in the US Navy. There are at least two dozen smoking gun articles; the series remains open for more evidence.

Your statement about the tie between price regulation and natural gas prices ignores the price history of natural gas during the price deregulated period between 2002-2008. Gas prices for commercial electrical power customers rose rather steadily from about $3 per million BTU to a four month period between Apr-Jul 2008 with monthly average prices exceeding $10 per million BTU. (http://www.eia.gov/dnav/ng/hist/n3045us3m.htm)

It was not a dramatic technological innovation that caused the price to fall from those levels – it was a collapse in the demand due to a deep recession. Even with all of the highly touted shale gas, US natural gas production today is only a few percent higher than it was in 1970.

I would “let the market decide” if I was not well aware of the ways that thinking individuals who are motivated by earning money for themselves can manipulate that market by influencing behavior.

There might have been an “invisible hand” in Adam Smith’s day, but in a world full of high speed computers and enormously concentrated wealth and power, the hands working to tip the scales are a lot more visible for those who take the time to look.

In a discussion about the “uncompetitive” cost of nuclear energy, when a free market advocate like you or Jerry Taylor refuses to admit or address the massive cost burden imposed by layer upon layer of regulations that have nothing to do with safety, I become very suspicious.

Sure, let’s compete on a level playing field – allow nuclear energy to adhere to the same safety standards as its competition.

One more thing – what is the longest term gas future available on the market today? How long can today’s prices be locked in?

Rod Adams { 12.06.11 at 4:14 am }

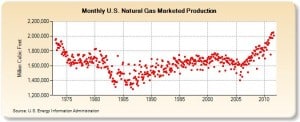

To put numbers on my statement about natural gas production levels – in 1973, monthly US marketed natural gas production was about 1.9 trillion cubic feet per month or 22.5 TCF per year. In 2010, monthly US marketed natural gas production was virtually identical to those numbers.

(http://www.eia.gov/dnav/ng/hist/n9050us2m.htm)

I realize that there was quite a bit of variation over the intervening years, but a “best fit” line through the production data would show that production has been essentially constant, with increases from newly developed technology and newly drilled wells just barely making up for the depletion from older sources.

George Monbiot continues to demonstrate the value of a fact based approach to the nuclear versus anti-nuclear argument. He is an aggressively rational man who has clearly recognized that the anti-nuclear community has been dishonestly spreading misinformation specifically designed to advance an agenda. I highly recommend reading his most recent blog post titled A Waste of Waste. My favorite quote from the article is the following:

Anti-nuclear campaigners have generated as much mumbo-jumbo as creationists, anti-vaccine scaremongers, homeopaths and climate change deniers. In all cases, the scientific process has been thrown into reverse: people have begun with their conclusions, then frantically sought evidence to support them.

I just learned that the same article was also published in the Guardian under the title of We need to talk about Sellafield, and a nuclear solution that ticks all our boxes.

Trust the market ? In 2013, 50% of the Uranium supply will most probably be taken off the market when the megaton for megawatt program will come to an end between the US and Russia.

Some say it will be renewed or extended. The CEO of Cameco yesterday said ‘not bloody likely’.

He, as I, does not understand how the market is pricing Uranium today.

85% of the cost of the electricity generated in gas-fired power plants is the cost of the gas.

Less than 5% of the cost of the electricity generated in nuclear power plants is the cost of the uranium.

So even a large rise in uranium prices wouldn’t be a killer for nuclear energy.

This would seem to be an argument for keeping very low cost natural gas “capacity” on the grid, and building out low cost renewables to very high energy output (in 40-60% range). If this “stand-by reserve capacity” is so cheap, what is the drawback of adding this low cost of “reserve capacity” (not energy output) to the already low (or decreasing) cost of renewable generation to make a best economic case for wind and solar having high capacity credits, and displacing baseload coal from the grid (which clearly seems to be happening in Germany, according to this very interesting visualization tool from GE ).

I don’t think you understand the magnitude of the overall physical plant that would be needed to provide 60% renewable AND the gas-fired back-up you suggest.

What most proponents of renewables don’t seem to understand is that the grid needs far more stability than they think. It is all very well to look at averages and assume that these indicate that flatting will come as a consequence. However unlike a water supply, the grid is far more sensitive to sudden change, and the apparatus and architecture that would allow it to cope is just not in place.

Converting the grid would be a staggering expense and it is not clear that it would remain scalable enough to permit future growth afterwords.

The point here being that the cost of pursuing an “anything but nuclear” path will be far more expensive and leave the grid far more vulnerable, and (in the context of this thread) sill doesn’t preclude a massive increase in the price of the back-up gas.

That is an excellent point, it is very difficult to compete with the low cost of coal and fossil fuels (and to some extent with the once through fuel cycle for nuclear on a baseload generation basis). But has anybody done a cost projection for closed fuel cycle, Gen IV reactors, including additional costs (regulation and otherwise) of spent fuel reprocessing and plutonium stockpile management. We know there are some fairly serious challenges to the once through fuel cycle, but we are also told that fast reactors (when they can be built to scale) will save the day.

We don’t have to go back and forth over conventional ground on renewables, storage/capacity alternatives, grid management (demand response), and other techniques for integrating intermittent resources … we both know we have done this endlessly before. But I am curious about the technology pathway promised by advanced reactors, and cost comparisons. Do we have any at this point … and how do they match up with current or future alternatives?

This study looks like a credible look at this question:

http://www.mit.edu/~jparsons/publications/FuelRecyclingReprint.pdf

We are pretty much looking at cost escalations in the 213% – 240% range when compared with once through cycle (and cost projections for nuclear are notoriously inaccurate at this early stage of development … before regulators have got a hold of design plans, and no research plants have ever been built to a commercial scale).

I agree that we don’t have to go over old ground here over renewables and the grid, but that should also hold true for that flawed report you linked to which was raked over the coals in several forums earlier this year. In short this report uses worse case assumptions and should be placed in the same class as studies that predict that uranium supplies will be depleted in a few decades.

Having said that however, I happen to think that current reactor technology is more than sufficient for the near to medium term, and that there should be no delay building out with these designs while a clearer picture develops on which Gen IV ideas will be best to go forward on.

Here is a reference for you that looks at other reprocessing methods that aqueous. Also The MIT study did not do a very large review of other papers and is really focused on maintaining the once through cycle.

The Advanced Fuel Cycle Intitiative has a massive paper on this too, referenced by Shropshire. The costs are much less than what MIT put out.

D. E. SHROPSHIRE, et al., “Advanced Fuel Cycle Economic Analysis of Symbiotic Light-Water Reactor and Fast Burner Reactor Systems,” Idaho National Laboratory, (2009

@Cal. Thanks for that. Reducing costs are very promising, but the authors seem to envision these advanced reactor designs mainly in terms of baseload power: “This analysis also improves the AFCI Program’s understanding of the cost drivers that will determine nuclear power’s cost competitiveness vis-a-vis other baseload generation systems.” Don’t we need a great deal more than baseload power? I thought one of the main advantages of Gen IV designs were going to be cost effective and “real world” load following, beyond the current approaches of overbuilding, low capacity factors, and reliance on a grid for exporting surplus power (which is not a particularly cost effective approach). If Gen IV isn’t going to do load following, I really don’t see the benefits of moving advanced reactor designs to the head of the line (if only to cover just 20% of energy production)?

They are envisioning baseload for good reason. Although nukes can load follow (even Gen II), it kills the capital recovery, and when the plants are paid for it is the lowest marginal cost of production of any source, so it would be economic suicide.

Another way with higher temperature reactors 450C+ is to use salt storage to level out the demand on the reactors. It also increases grid stability because the availability of cross connected reactors supplying heat to a common header makes an almost uninterruptible power supply. As for the economics of this, I don’t have a model yet. It will have a premium and carries a thermodynamic loss.

The trick with the model is to have the work horse running all out all the time. If you can store the energy from that work horse (it really isn’t all that much that needs storing) you get load following with enhanced capital recovery.

Baseload is much more than 20% Depending on the region and season it is on the order of 40-70%. As an example of a existing reactor that load follows is Sequoyah. It runs all out all the time. When the price of power is cheap, Sequoyah powers Raccoon Mountain pumped storage, just a few miles down the Tennessee River. When the price is high TVA reverses Raccoon Mountain and generates more electricity.

If the US went to 60% renewables wind farms would cover an area the size of Minnesota. Welcome to the lower 47! This does not include the additional right of way for transmission lines.

@Cal – using more sophisticated modeling and markets where generators are paid for providing valuable grid services other than just a flat rate per kilowatt hour generated, load following does not kill capital recovery.

@Cal. First off … how did you know I was born and raised in Minnesota 🙂 It doesn’t’ sound very good when you put it in those terms, but we’d be building a lot of this capacity off-shore in the future (in some 10 MW turbines), so this would cut down on land use some. We also have lots of farm land available (with little impact on crop yields), and farmers seem to enjoy the annual lease payments from wind developers. I don’t see this as a HUGE challenge (but that’s probably for another thread).

Storage looks like it will be needed in both generation portfolios (renewables or nuclear, which seems reasonable to me). If it’s cost effective, storage makes sense regardless of the generation source. I agree with you, making this work with very concentrated energy plants and limited land use seems attractive, and I’m all for anything that works.

@Rod … what do you mean by “sophisticated modeling and markets where generators are paid for”? I haven’t heard you describe this before (a link would be fine). Since financing is such a major concern with nuclear (it has nothing to do with nuclear, per se, but just having such large up front costs), I’d be interested in other approaches to minimizing this. You seem to be suggesting something that is unfamiliar to me.

Storage would be of some value to nuclear, but it is far from necessary. Wind and solar, on the other hand require storage, or thermal back-up. That’s a rather profound difference.

As for what Rod was referring to look up: “Ancillary services, electric power grid”

That’s a stretch, ancillary services are among the most flexible of the energy services. Nuclear plants are last in the black start-up sequence, their response time is in range of 1 to 3% per minute (leading to lost loads if not managed correctly with intermediate, peak, and ancillary services), slow to provide reactive power support (when compared to faster alternatives), plant trips and voltage excursions are a concern, and more. We were starting out so well, and now you appear to be making things up. Please describe what you mean by nuclear, and it’s capacity to provide ancillary services!

Gotten into the Xmas cheer a little early EL. Maybe that’s the reason you don’t seem to be reading for comprehension of late. I made no such claims for nuclear.

So you’re passing the buck off to Rod, then? That’s fine. If load following places additional demands on ancillary services, how is this “unrelated” to capital recovery for nuclear? This makes no sense to me. Wind generators are charged a mandatory $5.70/MWh fee in BPA (and increasingly in other service locations) for balancing and ancillary services, why would this not be the case for nuclear?

Nuclear plants are the last to start up because of procedural restrictions that evolved over the last 30 years. The lack of reactive load support is due to the load dispatchers not having control over the excitation voltage on the generator, thus a phone call has to be made. This is a procedural and I think perhaps regulatory issue. The power ramp is more on the tune to 4-5%/hr until the last 10% then it falls off to 1-3%, and is refferd to as fuel conditioning. It came from a series of EPRI studies on how to reduce leakers, and is a proprietary report. This problem only exists in oxide pellet fuel. Other fuel sources do not have such restrictions. The existing fleet has to trip on a loss of offsite power (Kit will argue this point with me but as of yet has provided insufficient reference.)

The fundamental reason why existing reactors can’t be used to bootstrap the grid is for overblown concerns of the risk to a critical reactor. From my experience a self sustaining reactor is a safe reactor. Gen IV reactors with entirely passive DHR features should have no restrictions for loss of offsite power (see NUREG-1368 for more details at least on PRISM).

As DV82XL will point out the problems are not technical they are procedural and policy driven, what he refers to as a “non-problem”. They do however provide very real constraints on what nuclear power can do on the grid and only act to restrict its effectiveness. The salt storage adaptation for >450 C reactors that is my thesis is targeting these “non-problems” and to add additional benefits that I laid out here. Like load dispatchers having full control over the electrical turbines. The stored heat in the vault would give the dispatcher energy to buffer the grid even on a reactor trip, the goal is on the order of 15-30 minutes at 100% for them to either turn off somebody’s power or purchase power from somewhere else.

A non-energy related market example where a seller uses the power of government regulation or taxation to reduce the competitiveness of their competitor is the cable vs. satellite TV market. Cable companies are always trying to convince state legislators to add taxes to satellite TV broadcasts in order to increase the price of satellite. Cable companies don’t wan’t to add programming or improve their customer service so they just help draft laws hurt Dish or DirecTV. It’s examples such as this that make me laugh at this statement from Mr. Bradley:

Companies don’t want free markets, they want to create a business climate that gives them an advantage over their competitors. Government regulation, subsidies and taxation are very effective tools at shaping this climate.

The main beneficiaries of a free market approach are energy resources with very high marginal costs or price volatility (such as natural gas). This allows a completely new business model to be built around energy arbitrage, rather than kWh generation costs and high rates of energy consumption.

How do you think the electric power market works now?

Yep, I agree. Why nuclear isn’t in cahoots with renewables (on a fully sustainable energy model with zero marginal costs), and a little bit of natural gas and hydro thrown in, is beyond me. But such are the dividing lines these days.

The only renewable that is compatible with nuclear is hydro, and there is more than ‘just a little bit’ of it around. In fact hydro is the only renewable that can be taken seriously in any discussion, and there is no question that it can be integrated into power networks with nuclear generators since it all ready is.

The problem is that good hydro sites are getting scarce, or are so far from markets that the economics become questionable and hydro is far from environmentally benign. This would be particularly true in the Far North where most of the real hydro potential exists.

EL,

I’m from Wisconsin, so it’s an upper midwest thing. I have not been home in a long time. I’m from around La Crosse, so I grew up hiking the bluffs and the coulees of that area. I have a hard time imagining the beauty of those lands spoiled by wind farms for political expediency. It seems very wrong to me.

Concentrated wind is an industrial activity. The land use that is around them is limited. There can be no grazing operations because the noise causes premature death in cattle, they cannot be located near population centers because the noise prevents people from sleeping, which leads to depression and increased rates of suicide.

True the marginal cost of wind energy is zero. The problem that wind faces is that it has to have its capital recovered in some fashion. On average you get more wind power when the demand is less. Thus when demand is low and there is an oversupply the price plummets and wind can’t make money. The other problem that it has is that it uses existing grid infrastructure (coal and natural gas) to act as its backup or offset. This comes at a premium and prevents effective capital utilization of the thermal assets.

The thermal storage I am researching is a way of expanding the market for nuclear power into new areas, without sacrificing capital recovery of the nuclear asset. The overall effect that I think it will have is to reduce the overall marginal cost of electricity for peaking and load following, not just baseload. I also think it will serve to be able to back itself up. I have to look at FERC requirements and then see what adaptations the system will need. If it can serve to reduce the rolling reserve requirement, then it will enhance the utility’s capital recovery of all of its assets, through more efficient use of capital. The final benefit is that it inserts a time delay between heat load transient to kinetic response of the reactor. By limiting the reactivity feedback from load to reactor, I think it gives a solid argument to not regulate the heat loads under the NRC, allowing a more predictable regulatory environment for process heat applications.

@Cal. Thanks for that, I could talk to you all day, and I would be very interested in your replies. You have a very thoughtful way of putting these matters into perspective, and focusing on the most relevant issues. Your research sounds terrific, and also perhaps a great benefit to resource planners, policy makers, and utilities. I hope you can make some significant headway with it, and also find an audience for your work. I’m also a researcher, and am completing a PhD in anthropology. So energy issues are not my primary concern, but I have worked on climate change issues for different agencies in my city.

On your wind energy comments, I hope you aren’t giving too much credence to the fringe perspectives around high frequency noise. I know of no serious study concerning cows, and I would be pretty confident stating we will likely not see any anytime soon. The issues regarding siting of wind farms are real, and we need thoughtful standards, but I don’t see a problem with this. Everybody is free to make comments in a public setting when seeking environmental reviews and permitting for wind farms, this does not mean opponents to wind farms always chose the best argument (or have a scientific leg to stand on). I am encouraged that people are able to voice their concerns over wind developments in their local area, and that these comments are given full consideration. I think this is one of the attractive features of wind for me, that people get to have input and be a part of the process, and make informed choices about costs/benefits. It’s a technology that people understand, and can have easily explained, nuclear is not so easy or confidence building when you look at regulatory concerns, or environmental permitting for mines, conversion plants, enrichment facilities, waste storage, water usage, power plants, etc.

FERC does indeed seem to be making some progress towards energy storage (which is long overdue), and this is encouraging. I think if we can get costs down low enough, we’ll have a very reliable grid and a lot of flexibility build into the system (and this helps everyone in managing costs better, and also minimizing the impacts from outages). The costs of outages alone costs businesses upwards of $80 billion/year (Berkeley National Labs study), and much of this from interruptions in the less than 5 minute range. We’ve been long overdue in making these changes. You might also want to follow the work of the newly established NREL lab on GRIDs (Energy Systems Integration Facility). It might be worth a visit, just to get the tour and talk to anybody there who might be working on similar issues. Just a thought.

I look forward to reading more of your comments on the site.

There is a definite concerted opposition to nuclear on the part of fossil fuels, especially noted by the examples that Rod shows, but I have a slightly different spin on how this opposition operates.

Fossil fuel companies operate a little bit like bee hives. The worker bees of the hive don’t contemplate or understand why they instinctively do what they do, they just do it without question. When an invader comes to the hive, they all send a signal to attack and sting. The queen didn’t have to give marching orders to attack, they instinctively react to an invader.

When a nuclear plant gets close to being built or is being considered, we see the attacks, but otherwise the hive is happy carrying on paying no mind to potential invaders. Being that nuclear expansion is so tied up in knots here in the USA, the “hive” has made a successful attack in keeping the invader at bay so they don’t need to do much in the way of overt attacking, the environmentalists seem to be a good job of doing their daily bidding anyway.

One should ask though why Chevron is posting TV ads that show their support for renewables and no mention of nuclear is made? Is it because the incentives for renewables makes this an affordable “hobby” that looks good for their PR? It’s examples such as these that are very subtle and maintain complete deniability that the fossil fuel company could be up to something. But don’t count on the worker bees of the “hive” to tell you the full story, they’re just busy doing whatever it is they do.

You have to remember that the marginals in Europe join the Green movements. The governments encourage this as it keeps those extremists off the real issues.

This way, they can have their violence outburts, their picketings without really bothering the big boys in power.

From Dr J

Limited staffing at the U.S. Nuclear Regulatory Commission may slow the agency in renewing licenses for existing nuclear power plants, the agency’s chairman said.

Wanna bet now that Vogtle will be delayed.

Rod mentioned in a recent post that the industry has to pay $270 per f!king hour for each staff member on the file for the privilege of being regulated into oblivion, making what should be cheap power as expensive and as unavailable as possible. So, how the hell is it possible for them to not have enough money for staffing to process applications within half-a-f!king decade?

Does the average NRC staffer take home $360,000 per year or is this a joke??? (this assumes NRC takes 50% overhead factor and a 40 hour/wk x 50 wk year).

WTF is going on?

The only explanation that makes any sense is that lobbyists are applying pressure from corporate paymasters to slow down the only serious competition to fossil fuels. There is a racket to protect boys…

When Exxon alone has annual revenues approaching $400 BILLION, is there anyone they CAN’T afford to buy off?!?

This is political BS from a corrupted political system that is *supposed* to serve the people according to the Constitution of the United States of America.

Obama: TEAR DOWN THIS WALL (Street). The people need good local jobs that flow from cheap, reliable power. Standing in the way under the self-serving behest of private corporations, against the public interest, is corruption of everything America is supposed to stand for.

Vive Le 99%!

Well said — down with corporate rent seekers! (Including the banks too, most of whose profits came from home mortgage interest payments, which are just rent by another name.)

Article just posted on NY Times, pertinent to discussion.

http://www.nytimes.com/2011/12/09/us/epa-says-hydraulic-fracturing-likely-marred-wyoming-water.html?_r=1&partner=rss&emc=rss