Nuclear jobs, jobs, jobs

As much as I like reading Bill Tucker’s generally pronuclear articles, I recognize that he sometimes gets the details wrong. In a recent American Spectator article titled Nuclear’s Dilemma: Few Jobs, Just Energy, Bill overlooked some important details about nuclear energy’s ability to generate good jobs in comparison to its competitors in wind, solar, coal, oil and gas.

This is a subject where I have some personal, direct experience and some industry data worth sharing.

Without getting into too many sensitive corporate or personal information, here is my personal testimony. I retired from the US Navy after 33 years of service – including my time at the Naval Academy and some time in the Naval Reserves – a little less than two years ago. During my transition phase from that job, I attended several seminars and courses about the process of obtaining a civilian job. I had a leg up on my fellow attendees; I had been studying the nuclear industry for several years and had a pretty solid idea what I wanted to do and where I wanted to work.

I might have been overly optimistic about my prospects, but I only sent out one resume. That resume helped me land a job supporting B&W’s category-creating small modular reactor (SMR) – the B&W mPowerTM reactor. I started my civilian career almost exactly two years ago. The project had started just a year or so earlier, beginning with a group of less than 20 people. By the time I arrived, the project head count was above 50; it is now more than 100 in our location plus another 200-300 in other offices.

Something close to 10% of the work force at my location has chosen to live in the same neighborhood where my wife and I purchased our home. All of the houses occupied by B&W mPower, Inc. employees in our neighborhood were built in the past 5 years. The total real estate investment by that small segment of the project group in the local community is probably between $3-4 million. Since arriving in our new home, my wife and I have purchased a couple of cars, a lot of restaurant meals, plenty of groceries, some clothing and a few nice pieces of furniture. We do a pretty fair job of recycling my salary into the local economy.

The jobs that my colleagues and I fill were recently created by visionaries who recognize that there is a huge need for reliable, ultra low emission nuclear energy in the United States. They have stepped out to take a leadership role even though there is a well-organized opposition and a general misunderstanding about the longevity of current natural gas prices.

The group of focused professionals that the leaders have put together has developed a number of technical innovations worthy of patent protection. We are working diligently on the lengthy process required to solidify our design into an attractive product and to apply for permission to build the machines that we are sure will provide valuable service to our customers and our country. Most of the components in our products will be built in North America.

Some people love to criticize nuclear energy because our durable plants are not cheap to build, but they fail to give the technology credit for the destination of the dollars. Nearly all of the money associated with the high initial cost gets distributed into the pockets of the people who are doing the difficult, painstaking work of developing the designs, forming the tight tolerance machinery, pouring the high strength concrete, laying out the reliable electrical power infrastructure, and ensuring that each step is completed and documented accurately.

The people whose salaries are part of the “high cost” of designing and building new nuclear power plants could be your neighbors and may very well be the people sitting at the nearby table at a local restaurant or in the bleachers at a local high school football game or in the desk next to you at the local PTA meeting.

In addition to my personal testimony, here are a few excerpts from the Nuclear Energy Institute publication titled Nuclear Energy’s Economic Benefits – Current and Future.

The nuclear energy industry can play an important role in job creation and economic growth, providing both near- term and lasting employment and economic benefits. The 104 nuclear units in the U.S. generate substantial domestic economic value in electricity sales and revenue – $40-$50 billion each year – with over 100,000 workers contributing to production.

…

Each year, the average 1,000 megawatt (MW) nuclear plant generates approximately $470 million in electricity sales (economic output) in the local community and more than $40 million in total labor income.1 These figures include both direct and secondary effects. The direct effects reflect the plant’s expenditures for goods, services and labor. The secondary effects include subsequent spending attributable to the presence of the plant and its employees as expenditures filter through the local economy (e.g., restaurants and shops buying goods and hiring employees).

…

The average nuclear plant pays about $16 million in state and local taxes annually. These tax dollars benefit schools, roads and other state and local infrastructure. The average nuclear plant also pays federal taxes of $67 million annually.

…

A recent analysis found that nuclear plants create some of the largest economic benefits compared to other electric generating technologies due to their size and the number of workers needed to operate the plants. Operation of a nuclear plant requires 400 to 700 direct permanent jobs. These jobs pay 36 percent more than average salaries in the local area. These opportunities will be available to new workers since 39 percent of the nuclear workforce will be eligible to retire by 2016 (about 25,000 employees).

…

A new nuclear plant represents an investment of $6-8 billion (depending on plant size), including interest during construction. New plant construction creates demand for skilled labor such as welders, pipefitters, masons, carpenters, millwrights, sheet metal workers, electricians, ironworkers, heavy equipment operators and insulators, as well as engineers, project managers and construction supervisors.In anticipation of new nuclear plant construction, U.S. companies have created in excess of 15,000 new U.S. jobs since 2005. Manufacturing and technical service jobs have been created in Virginia, North and South Carolina, Tennessee, Pennsylvania, Louisiana and Indiana. These jobs include engineering services and the manufacture of components including pumps, valves, piping, tubing, insulation, reactor pressure vessels, pressurizers, heat exchangers and moisture separators.

Construction of a new nuclear power plant requires up to 3,500 workers at peak construction. Construction will also provide a substantial boost to suppliers of commodities like concrete and steel, and manufacturers of hundreds of plant components. A single new nuclear power plant requires approximately 400,000 cubic yards of concrete, 66,000 tons of steel, 44 miles of piping, 300 miles of electric wiring, and 130,000 electrical components.

…

U.S. companies and workers also benefit from the expansion of nuclear energy underway worldwide. American companies have already booked export orders for billions of dollars in equipment and services, including generators, reactor coolant pumps and instrumentation and control systems. U.S. workers in 25 states – including Illinois, Ohio, Pennsylvania, South Carolina, Virginia and Tennessee – are beginning to reap the benefits of reinvestment in the U.S. nuclear supply chain.According to the Department of Commerce, every $1 billion of exports by U.S. companies represents 5,000 to 10,000 jobs. The four Westinghouse AP1000 projects underway in China support over 15,000 U.S. jobs. The direct jobs generated from these exports had an average salary of $84,000. These jobs include design and engineering, manufacturing, information technology and transportation.

(State pride emphasis added.)

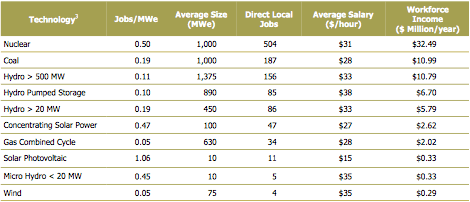

This table from the NEI publication provides some direct comparisons on various measures of effectiveness between nuclear energy and other energy technologies that compete with nuclear for customers and for investment dollars – both private and public.

There are several things about those nuclear jobs that are quite different from the types of jobs created in the fossil fuel extraction industry or the unreliable, weather-dependent energy flow capture industry. Our jobs tend to require hard working, dedicated, high integrity people who do not want to give up their family lives. They tend to concentrate in areas where life is pretty pleasant, with plenty of water resources, and satisfactory local infrastructure. We do not need to go where the oil, coal and gas happens to be. We do not need to build our machinery on vast open deserts, in the frozen Arctic, on mountain ridges or in a challenging off-shore location.

Though it may have once been true, the following statement from Bill’s article would never be made about the currently available jobs in the nuclear industry:

Let it be said first that the other players missing in action here are gas and oil. New drilling techniques for shale gas and tight oil are now creating more jobs and useful energy than all the other technologies combined. Production from the Marcellus Shale in Pennsylvania and Ohio is up 82 percent over last year. North Dakota’s Bakken shale has created the lowest unemployment rate in the nation. Oklahoma gas fields are complaining they can’t find enough workers. Any healthy, working-age male could head for any of these states and find themselves making close to a six-figure income.

(Emphasis added.)

There are plenty of jobs in the nuclear energy industry for females, for people with disabilities, for people of advanced age (one of my colleagues at B&W is still going strong in his 80s because he is excited to be designing something completely new) and for people who have never had much desire to relocate to a boom town like Williston, North Dakota to live in a “man camp”.

Rod,

I think you meant William Tucker …. That’s how he calls himself.

Daniel – I know him as Bill. His publisher might prefer William. Some people call me Rodney; some call me Rod. I am the same person no matter which name people use.

I also think William Tucker should write a column in the ‘American Spectator’ regarding Mr Rockwell’s debate with the NYAS.

That is a low hanging fruit and a quick win to jump start the matter.

Hello Rod,

I don’t understand this table at all and I would disagree with the implications.

This table implies that a worker in the wind industry is ten times more productive than a worker in the nuclear power industry. That is nonsense, of course. It’s more the other way around.

@perdajz

The table is per MWe capacity, not per MW-hour of actual energy produced. It certainly is not in per MW-hour of reliable power to the grid – since wind turbines rarely produce any reliable power.

There is a lot more overhead associated with nuclear energy plant operation as a result of 50 years worth of effort by both nuclear energy competitors and the natural efforts of nuclear professionals to protect their jobs.

However, overhead is not such a bad thing when you are producing a valuable product. It keeps down the wealth concentration effect of not having overhead and keeps good people busy doing important work.

So we could stretch and apply this to solar as well….

But solar is a dangerous profession. Rooftop jobs kill.

Meanwhile it’s safer to work in a nuclear plant than in a bank.

Excellent post!

Here are some other interesting articles regarding energy jobs:

http://www.forbes.com/sites/jamesconca/2012/08/21/what-do-energy-sector-jobs-do-for-us/

“But unrelated to the energy jobs themselves is the more important point of having reliable, affordable energy in a region, which is necessary to attract large manufacturing or production growth. A large automobile plant is not going to depend upon wind-buffered-by-gas for its energy needs. It will locate in a coal, hydro, or nuclear-supplied region. And these jobs are much more important to the regional economy and tax base than the relatively few energy jobs.”

This article does a great job of picking apart the obsession with NON-nuclear “green energy” jobs:

http://depletedcranium.com/new-york-times-reports-on-rush-for-us-renewable-subsidies/

“These projects will not result in the shutdown of a single fossil fuel power station. They never have and never will. There are only two emission-free methods of generating electricity that are actually capable of pulling their own weight and providing large amounts of power at a cost that is economical. One is large scale hydroelectric* and the other is nuclear fission. If you don’t have enough suitable rivers to build dams on, that only leaves one. That’s it. Everything else is expensive window dressing.”

There is a problem with nuclear jobs. They don’t already exist. I’ll conceded they create more jobs than other industries, but they are paper jobs that don’t pay taxes. The adage is a bird in the hand is worth two in the bush. Friedman referred to this as the “tyranny of the status quo”. The question for the ones desiring change becomes, how do we change energy production and minimize the impact to existing social structures? Hopefully, I will show an answer to this question.

The first step is to recognize who the consumers of primary energy are in the country, my discussion here is limited to the US it has foreign analogs but those will be for the reader. There are three main consumers of primary energy: the electric utilities, industry, and transportation. The market for transportation fuels is absolutely massive. I mean massive, from production and maintenance done on ICE to fuel production, distribution, and conversion. I did a quick check of my little .2 acre lot and I have 2 diesel engines, three four cycle gasoline engines a two cycle gasoline engine and am lucky enough to have a flat 6 that burns 100LL. I am not alone by any stretch of the imagination in the level of investment I have in liquid hydro carbon fuels. I am bucking the norm of suburbia, I have an electric lawn mower and a leaf blower. What’s in your garage?

The liquid fuels industry is heavily underserved, The price volatility with little change in global production should be a good indication of how underserved the market is. Here we have the single largest opportunity for market expansion and where there is a great deal of political capital that can be used to hold off the barbarians and those whom Rod loves to point out have a vested interest in preventing a drop in fuel prices because it hurts their bottom line.

We will leave the industrial sector alone and focus on the utility sector. Electricity once produced is indistinguishable from any other form of electricity. Wind and solar may be very different in this regard because of their inherent volatility. For now well assume all generation is equal downstream of the breakers. The electric utilities sell electricity. They do not sell coal, nuclear, natural gas, wind, solar, hydro, biomass, or any other form of primary energy. They sell electricity. They are in competition with one another and are heavily interested in preserving their share holders equity so they can stay in business. Here is where the real opportunity lies.

We saw when Exelon had to divest 3 coal plants as part of its conditions of purchasing Constellation Energy a drop in value of the coal plants by 40%. Reporting on this sale identified, correctly I think, the underlying reason, MACT (Maximum Achievable Control Technology.) This consists of removing the grandfather clause of existing coal plants on their compliance with SOx, NOx, PM 2.5, and Hg controls. The Clean Air Act had been only applicable to new construction facilities and major conversions or power uprates. These standards are leading to an abandonment of just about every coal plant under 400 MW(e) and with natural gas prices where they are utilities are looking at even replacing these. The other regulation that is pinching coal is the regulation of new construction coal plants with a cap on the permissible CO2 emitted.

Living in Atlanta, I am concerned as to what this will do to my electric rates. As Southern needs to stay in business they can’t let their share holders take the hit. To get a feel for the amount of equity at risk I took SO share price at $46 and then based off of an estimate of their capital holdings in real assets calculated a new share price of $33. They will have to close old plants walking away from perfectly usable capital structures and have to replace them with new ones. They also have to justify maintaining their share price to their stockholders while doing this. Without forcing the stockholders to take a loss SO is left with only one choice. To pass the loss onto the rate payers. Granted SO is a regulated utility, so they won’t loose market share… They will loose market share. By being regulated they are tied to the success or failure of their service area. If prices go up here, but go down in say Texas, then we will see business move from the south east to the south central or heaven forbid to the TVA. Industrial rates, due to existing regulations, are going to increase from $40/MW-hr to $53/MW-hr. Residential would go from $113/MW-hr up to $145/MW-hr. All just to maintain existing capacity and maintain sufficient capitalization of SO to prevent bankruptcy or sale.

To say this will be a hit on the economy is an understatement and will be felt across the entire US. The contraction due to price increases in electricity will reduce the tax revenue received by the states and federal government, making an already bleak fiscal cliff worse. This will require more budget cuts and more taxes acting as a further drag on the economy. I hope my read on this is very wrong, but based off of the current trend I doubt any meaningful action will occur. Bottom line, we have not caused ourselves to suffer enough and as a society are not thinking hard enough to develop solutions. Instead our entire political and economic focus is on protectionism and is bred almost entirely by the culture of cronyism that both the left (OWS) and right (TEA Party) are getting up in arms. Both I think have policies that will only entrench cronyism, just of different brands.

Rob Gauthier challenged some of the idealism I held on the democratic process. I am grateful for his making me think about my assumptions. Our government is set up to perpetuate cronyism. That being said, I’d still rather live here than just about anyplace else, Canada may be an exception, but my warm Northern blood is cooling off in the tepid south. So how do you work within cronyism? First lift the veil and see how ugly the bride is, because now that your married your stuck for life, divorce is possible but the available selection of brides ranges from the same or similar to worse, much much worse. Ok so let’s work within the confines we have. The bride expects payments for her services. If you do not pay for those services then well, she will crucify you to make an example to her other husbands. It is a protection racket. Treat it as such. Direct forms of payments while they do occur in legal and illegal forms can have a limited impact, because of the sheer number of politicians that require campaign financing and funding for their affiliated PAC’s. Utilities are actively involved in this as is just about every other industry and special interest. Sorry to be so blunt.

Politicians hate making tough decisions even more than they love spending other peoples money. Fortunately they are short sighted enough to frequently paint themselves into corners that are difficult to get out of, requiring rescue by those who create our prosperity. I watched Milton Friedman’s Donahue interviews recently and except for the bad hair, big glasses and a different Chicago skyline that could have easily have been Oprah instead of Phil. The Talking Heads hit it in “Once in a Lifetime” singing “same as it ever was” over and over.

I can’t wax on with such cynicism without proposing some form of solution, not to the politics, but for the utilities. The existence of underserved markets and the pressure to maintain the status quo and need to enact change, there are very few options that fit the bill. We need to get nuclear out of competing directly with coal for producing electricity. That competition will earn the criticism of coal producers and political machinations to erect artificial barriers. Coal is a valuable feedstock, that when consumed directly is very polluting, but can be readily refined. Here is where the nuclear comes in. Focus nuclear heat on creating a market demand for coal through gasification and liquefaction. This will allow the electric utilities to use as much of their existing capital including permits for water, air, pollution, and transmission along with physical assets such as transmission lines, rail lines, coal yard, etc.

The technology exists to capitalize on the market opportunity today. The issue is how to minimize the political interference of building new reactors and heavy chemical industry. Simple, taxes. I modeled repowering a 1200 MW(e) coal plant and over a 40-year period it generates the present worth of $17 billion without affecting marginal tax rates. This breaks down into 15 for the feds and 2 for the state from the tax on the direct sale of products: diesel, gasoline, natural gas, and electricity. All of which tie into our existing distribution and consumption infrastructure. All of which comes from maintaining coal jobs and creating new local jobs, broadening the overall tax base and lowering the overall price of energy into the economy.

There is a difference in acknowledging our political structure and working within tight ethical guidelines to perpetuating political graft. Here the rent payments come from problem solving, creating jobs, and increasing tax revenue while not being a threat to the existing infrastructure. There will be significant pushback from the oil and gas industry because it cuts into their profits and benefits the consumers. Give the ugly bride a big fat dowery to stave off the crucifixion.

@Cal – my job and those of my colleagues exist. So do the jobs of the more than 100,000 people in the industry that supports currently operating nuclear plants.

That is enough people for a vocal pro nuclear movement to start, especially when people realize that the Waste Confidence turd left by the former Chairman threatens the basis for the license extensions for the current fleet.

Rod,

Nuclear does play and will continue to play a vital role in our energy or so the party line goes. The purpose of such plattitudes is to prevent significant changes in the market, to keep te jobs where they are in politically unfavored technologies to prevent alienation of those representatives whose districts depend on those jobs. While favored industries are handed growth. The question is can nuclear break the mold of limited penetration into the electricity market? I presupposed the desire was to increase market share of nuclear energy. I wanted to show what the policy risks are as I understand them as well as the economic risks that utilities are facing as a result of existing regulations.

Coal is on the ropes and will fight tooth and nail to prevent loss of market share. Utilities are limited significantly by NG pipelines with where new plants can be sited. Only about half of the coal plants being retired in the next 8-years can be repurposed to natural gas.

Where will new growth come from? From some of what I picked up at the coal conference that will be met with reactors like mPower. However there are limitations associated with this path, waste confidence and lack of a long term repository as well as licensee requirements, licensing fees, and security requirements.

I hope we will wake up soon. The path we are going on is by no means sustainable and carries a great risk to our economy.

@ Cal

Your comment:

I hope we will wake up soon. The path we are going on is by no means sustainable and carries a great risk to our economy.

I sincerely think that the hegemony of the US is at stake. China will embrace nuclear and finance the world expansion of nuclear plants with its vast US currency reserves. China has been looking to diversify away the risk of holding so much US currency and they have found a way to do it.

Thank goodness that I’m not the only one here who realizes this.

Cal, considering that the Navy is such a huge customer of fossil fuels and that they have actually helped fund some biofuels research, I can’t help but think that they SHOULD have interest if adequately briefed. The need of a different type of reactor seems the biggest hurdle of that development path.

@Joel – The Navy has been adequately briefed. The person who is in charge of the Navy’s energy and environment budget fully understands nuclear energy, but he is also a sycophant who wanted to get promoted and recognized what the SECNAV wanted to hear.

Used to work there. Retired earlier than I had to because I could not continue.

Briefed on the potential of using mid-grade nuclear heat (500 deg C coolant temp.) boosted by a heat pump to produce liquid fuels from coal feedstock (Cal’s patent application)?

For DV82XL:

Your dreams are materializing:

http://www.flickr.com/photos/75530607@N07/7296984646/

And none too soon.

@Daniel – whose Twitter feed provided that link? 🙂

@ jmdesp

In what sense ?

They are less injuries per worked hour inside a nuclear plant than inside a bank.

From the death by TWh analysis :

http://nextbigfuture.com/2011/03/deaths-per-twh-by-energy-source.html

“Roofing is the 6th most dangerous job. Roofers had a fatality rate in 2002 of 37 per 100,000 workers.”

And here :

http://www.forbes.com/sites/jamesconca/2012/06/10/energys-deathprint-a-price-always-paid/

“According to OSHA, the non-lethal accident rate in the US. per 200,000 worker-hours is 0.26 for the nuclear industry, 0.70 for Finance, Insurance and Real Estate, and 4.0 for Manufacturing.”

And if you think about it, the fire risk is certainly higher in an office than inside a nuclear plant. Workplace rage is also much less likely to take inside as controlled an environment as a nuclear plant.

Rod,

Good column. I’m glad mPower is revving up both in jobs and in output. I hope you didn’t miss the irony in my story, however. I wasn’t criticizing nuclear or making a case against it. I was saying, isn’t it ironic that it is precisely because nuclear has almost unbelievable intensity and DOESN’T require moving around massive amounts of fuel (like the coal train that now leaves the Powder River Basin every eight minutes) that it can’t enlist tens of thousands of voters to its cause. There are 88.000 coal miners in the country and 1360 uranium miners, both producing roughly the same amount of energy. If we took a vote on which to expand, who would win? How many “coal states” are there? About ten. How many “nuclear states?” Zero. Success will come when the public realizes that nuclear is not about “creating jobs” in energy but about creating ENERGY to provide cheap, clean power to other parts of the economy.

@Bill

Thank you for the kind words. As you say, there are few jobs in the fuel cycle part of our technology. It is the total, though, that matters and the type of job. Nuclear professional jobs are not limited to “able-bodied males“. They are family wage jobs for people who have integrity, a work ethic, a desire to save the world, and often require people who have worked hard to master complex subjects.

I guess one of the big reasons that the first nuclear age did not result in a strong constituency for nuclear is that most nuclear trained people did not become unemployed as the industry shrank; they simply moved to other fields of endeavor because they were the type of employees that are almost always in demand. (There were a few exceptions that I can think of who did not do so well in the transition to other industries. Some of them found that being a professional antinuclear activist was the only way to achieve the kind of income they commanded in the nuclear industry.)

That said, I think we have sufficient job opportunities and a sufficiently important mission to command a growing and active constituency that should be able to pierce through the misinformation campaign that our competition has been waging for so many years.

Arnie, of course.

Bradford also?

I wonder if Caldicott’s medical career was somehow derailed? I am pretty confident that she would fail the MMPI miserably (as would many other anti’s) and would guess she hasn’t treated an actual patient in well over a decade, if not 2 or 3 decades.

Tamplin, Gofman, Gregory C. Minor, Richard B. Hubbard, and Dale G. Bridenbaugh (GE Three)

One enigma is David Lochbaum, who actually seems to be pretty competent and honestly questions areas that need to be addressed – though he does it for a group that has been opposed to nuclear energy development for nearly 40 years.

I actually almost said something very similar about Lochbaum, but left him out because he actually does make good points. Arnie may have had a blind squirrel moment with the SONGS steam generators’ computer simulations being inadequate/incorrect.

@Bill – I also wanted to mention that one of the reasons that uranium does not provide all that many jobs in the US is that we only produce about 10-20% of our current needs here. We import all of the rest. That situation has nothing to do with our lack of resources and everything to do with silly laws like Virginia’s total ban on uranium mining (I might be attending a meeting on Tuesday night in VA Beach on that topic), the Department of the Interior ban on U mining near the Grand Canyon, and the Navajo Nation ban on uranium mining to protect their coal related income.

Gee, sorry I will be unable to attend the forum in VA beach to support that silly ban in VA. I totally respect your nuclear generation expertise, but fear your mining and milling knowledge is totally informed by supply interests like VUI. I didn’t notice if you attended the NRC meeting in Chatham, but the speaker on containment and storage trotted out such sad examples as Cannonsburg, PA. All post UMTRICA sites have been a continuing problem with liner breaches and overflows.

Once someone can produce a successful example of containment, maybe my heart will soften, learning to embrace a toxic waste field with 8 – 40 acre ponds full of radioactive and leaching chemicals. The rain (we only got 0.1″ here) down the road flooded Roanoke Rapids with 11.5″ in four hours. Wonder how those folks rowing around the front yard would feel about adding some caustic radioactive substance to their flood distress.

According to the live DEQ Drought Map: http://www.deq.virginia.gov/Programs/Water/WaterSupplyWaterQuantity/Drought.aspx , we were in the red on groundwater here as my shriveled garden and stinky carcass can attest. That rain this weekend brought us up to warning instead of emergency level. I shudder to think what the giant incursion of a mine down the street would do to our already stressed groundwater situation. Sure they plan to treat and release the constant flow of water filling the mine into the creek to go downstream, how does this affect me? Well, with even less groundwater, I would be screwed. Those damn greeners, wah, wah! We can’t take a bath, we can’t sell our house, me, me, me!

That’s right! Your grandiose water sucking mines and reactors, for that matter, boiling fish and leaving them laying on mud…how are good Americans to buy your fancy electricity and goods manufactured with it when we are left penniless by being screwed out of our lifetime investments in our homes and businesses? I have nothing to offer VUI or B&W. We moved here to be retirees, not to work at McDonalds serving uranium miners just to buy enough water to go back the next day after a piddle bath.

Let Borat and his folks sell you their uranium, screw them. The Aussies and Canucks have to dig for their bloody Queen, buy theirs. Leave our uranium in our parched ground.

@K Patrick

Nice to see you are so rational about this issue and refraining from unsupported hyperbole.

Just out of curiosity, why do you think that the Coles, whose family has owned their land since 1800 are seeking to destroy the neighborhood? Do you realize that they intend to continue occupying their historic home, which is only a few hundred yards away from the area that will be developed for the mine and mill? I cannot think of a more thought provoking testimony about their intent to do the job carefully.

Mining is not a foreign activity in Virginia. There are perhaps 150 active coal mines in the state, dozens of rock quarries, and several other types of materials mines.

The Coles are not bringing some kind of nasty materials into the area; the uranium is naturally occurring and it is already in formations that have been exposed to rain water for millennia. When I visited the farm, I saw a scintillation detector go from about 300 counts per minute to more than 14,000. Logically, it seems to me that the contamination you fear might happen in the future should have already happened – but it did not. There are chemical and physical reasons why it didn’t and ways to ensure that it never will.

I support uranium mining in my home state because I recognize that modern living depends on reliable energy. I want that energy to be as low impact as possible, but I recognize that zero impact is impossible. Therefore I think we morally have to accept some of the impacts ourselves and not always depend on others bearing the burdens.

Uranium mining in the US is a safe endeavor with plenty of professional oversight. It is hard to understand why there is so much opposition to someone wanting to take advantage of a relatively compact formation of rocks on a large tract of privately owned land that contains at least $7 billion worth of material. The owners know how to carefully extract that material with as little disruption as possible; they are planning to do it at a rate that will provide a hundreds of jobs lasting for 30 years, and they will restore the land to a useful condition when the task is complete.

Sure, Coles Hill will not solve American’s energy supply challenges, but it is big enough to make an impact.

Rod – I doubt that K Patrick cares. It’s pretty clear to me who this person is.

He/she’s one of those jerks who spent his/her career working in a city (living in the ‘burbs, or course), buys up some cheap land out in the country to retire to, moves in, and spends all of his/her copious retirement time bossing others around and telling the locals — many of whom have lived in the area for generations — what they can and cannot do and what they can and cannot develop.

I grew up in a county that was (and still is) a fairly popular retirement destination and watched people like this stifle as much local economic development as they could get away with.

What amazes me, however, is how someone can be old enough to retire yet childish enough to produce an immature rant like this.

One of the most important aspects of the whole “jobs jobs jobs” bandwagon is missing.

It is called secondary economical effect.

Cheap electricity results in more competitive heavy industry and manufacturing. Thus, more can be produced in those sectors due to the improving global competitive position, and that means more jobs can be attracted in industry.

There have been quite a few studies on this. All agree that the secondary effect is larger than the primary.

In plain English, a job less in energy means more than a job extra in other industries.

Energy is the enabling sector. It can’t have high margins, high prices. It must serve the rest of the economy.

So, the fewer the jobs in electricity, the better.

Solar is pathetic in this regard. It’s expensive electricity hurts the rest of the economy. Meanwhile it’s unreliable so we still need all the fossil plants to “back them up” (the energy understatement of the century).

Interestingly, from the table of the NEI study, nuclear has the same jobs $ as solar (solar is twice per MW put half the $ per hour). That means they both have about the same expense for jobs. But since nuclear MW produces 5 to 10x more electricity than a solar MW, it needs 5 to 10 times as much job expenditure!!!

This is not a good thing. It is like only working 20% of the time so your boss needs to hire another 4 workers that also work 20% the time, but pay them fulltime, and then claim you’ve produced jobs. No, you’re being ineffcient. It’s absurd.

I don’t understand why people can’t understand this basic truth of productivity. The solar PR campaign is clearly very effective in keeping peiople stupid.

Rod,

That is a really inspiring story.

B&W developed powerful DA (Design Automation) software packages. One version was marketed to the general public as “Concept Modeler”, much superior for my purposes than Dassault’s Catia or IBM’s many products. Twenty years ago, the B&W software enabled one person to design a 10 ton electrical machine in a day, something that previously had taken 13 labor intensive weeks.

Ooops! Off topic. For a start, the name of the project is wonderful. SMALL! MODULAR!

In my mind I am seeing seeing a reactor built in a factory and shipped to site on a single truck. Even with my “Optimism” circuit at maximum I don’t see a market for such a thing in the USA but it will surely be a terrific product for export. Given B&W’s experience in the field it has to be a true “Gen IV” reactor capable of consuming the waste from Gen I & II reactors.

You point out that there are plenty of jobs in nuclear power. In the design phase we are talking several hundreds even with the huge productivity boost that your company’s Design Automation software provides. Setting up a small factory will require a couple of thousand more people just to build the first few reactors. If the product is well received in the market you can multiply that by 10 or even 100.

So far we have only considered design and manufacturing. Once you start spitting out reactors like shelling peas you need people to operate them. When it comes to “Labor Intensive” nuclear power is the clear leader. I visited a 3.8 GW natural gas plant operated by <200 people (190 MW per person). Later I spent a week at a 2.8 GW nuclear plant. I was staggered to find hordes of people rushing about. The plant head count was 1,400 (2 MW per person).

To help your readers get a feel for how this could be so, on arrival at the gas plant the main gate was closed because the plant does not employ a gate keeper! Contrast that with the nuclear plant that has a main gate manned 24/7. The security is more intensive than you will find at most miliary installations; when they searched my car very thoroughly I was reminded of Northern Ireland during the troubles. The security head count alone is 350 (8 MW per person), many of them armed and dangerous!

The huge head count and equally huge paranoia found at a US nuclear power plant supports the notion that our government is trying to take nuclear power "off the table" by imposing onerous regulations. Even so NPP economics remain amazingly favorable.

Let's look at the head count in relation to the sales. The plant I visited generated $6.1 million sales each day assuming a load factor of 0.85. A loaded cost of $100,000 per employee per year works out at $384,000 per day (6.3%). The cost of the fuel was $450,000 per day (7.4%). The plant I visited was a PWR that would cost $15 billion to build today. The "overnight" amortization works out at $103,000 per day (1.7%) over 40 years (modern plants are designed for a 60 year life). Where do the remaining the sales dollars (84.6%) go?

The potental for "Obscene Profits" seems so great that one would expect private investors to be falling over each other in their haste to build new plants. Could it be that the government's licensing minefield and the horrible example of Shoreham trump all other considerations?

How is it that NPPs could make a profit selling electricity at $0.05/kWh and yet the UK government subsidises solar power at a rate of $0.25/kWh? No wonder so many governments around the world are going broke!

http://www.guardian.co.uk/environment/2012/may/24/solar-power-subsidy-cut

Clearly you can't tell us much about the SMR until B&W is ready to reveal it. However I am pretty sure it is not an LFTR given what you have written over the last year or two.

I just noticed an error in my calculations. The 190 MW per person for the gas plant I visited should read “19 MW per person”.

I also forgot the $240 million annual taxes paid by the nuclear plant. That works out at $637,000 per day (10.4%) which leaves me asking where the other 74.2% of the sales dollars go to?

Jeff,

The numbers you quote for building large plants in the USA are highly inflated. Westinghouse AP1000s can be built for $2 billion. Amortizing this over the 40 plus year life of the reactor works out at $0.012/kWh.

http://diggingintheclay.wordpress.com/2013/06/02/electric-power-in-florida/

Molten Salt Reactors can be built for much less than $2/Watt as there is no need for an elaborate containment structure. Such “Generation IV” reactors have the ability to “Burn” the “Nuclear Waste” that was destined for Yucca mountain while releasing 100 times more energy than the Generation I & II reactors produced from the same material. Enjoy this video:

http://www.youtube.com/watch?v=P9M__yYbsZ4