Like cheap gas? Enable new supplies & stop rattling swords

The world would be a better place if more people thoroughly understood how the balance between supply of a commodity and demand for that commodity worked to establish market prices. The improvement would be even more impressive if customers learned how to take action to shift the balance into their favor instead of allowing the producers to have most of the fun and profits.

Successful businessmen know that the “law of supply and demand” is not a passive law, but one that needs to be actively managed in order to optimize production at a profitable level. If they produce too much, there will be so much supply that all customer needs will be served with product left over. For most commodity products, all it takes is a few days or weeks in which production is higher than demand before all of the storage bins are filled to overflowing.

At that point, the solution is usually a combination of marketing and lower prices to stimulate demand and along with slower production to reduce the rate of overflowing in the storage tanks.

During the winter that never was – 2011-2012 – the US natural gas industry ran into exactly that problem. It had planned its production for a normal winter, yet months of mild weather in key consumption areas slowed down the rate at which their customers burned up their product.

In the winter of 2010-2011, natural gas retailers and wholesalers had to pull 2 trillion cubic feet (TCF) of gas out of storage, in addition to their continued daily production, in order to meet customer demands. In the winter of 2011-2012, the pull from storage was only 1.3 TCF, 37% less.

Because market demand is so dependent on weather, the gas industry has developed enough storage to buffer seasonal variation. Because natural gas fuel is, by definition, energy diffuse, explosive and flammable, there is a lot less storage capacity than some observers realize.

Natural gas in storage in the US might end up at a record level at the end of the winter heating season. However, the record-breaking total for natural gas in storage will be on the order of 2.2 TCF, barely enough to supply the nation’s gas consumption for a month. (In 2010, total natural gas consumption in the US was 23.7 TCF.)

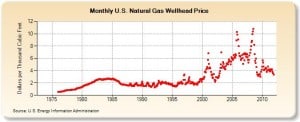

With the heating season ending with record levels of gas in storage, there is not much demand for newly produced gas, so the prices for near term delivery have fallen to levels not seen since February of 2002, when the monthly average price dropped to $2.19 per million BTU.

It is worth noting that the monthly average price in March of 2003 was $6.96 per million BTU, a price increase of 317% in just 13 months. Gas is a commodity with a history of price spikes. As people often say about the weather in New England, if you do not like gas prices where they are, wait a little while. They will change.

Natural gas demand is not only dependent on the weather and hard to store, but it is also hard to move from place to place. Pipelines and liquified natural gas (LNG) systems have limited capacities; moving gas from an area that is over supplied to one that needs fuel is a real challenge. That can best be illustrated by learning about the wide differences in the price of gas varies around the world.

Another factor that contributes to natural gas price volatility is the relatively long lag between price signals and changes in the production level. Once a company commits to drilling a well and bringing into production, the die is cast. It is hard to stop that process in the middle, if price signals indicate there is little demand, the drilling still continues.

But traders said a stubbornly-mild winter has slowed heating

demand and helped build a huge inventory overhang that could

keep gas prices on the defensive for much of this year.“Producers are making attempts to reduce production, and the

power industry has increased demand for gas, but weather

forecasts remain bearish,” said Kyle Cooper, managing director

of research at IAF Advisors in Houston.

In contrast, if there is a significant draw on storage due to colder than normal weather, it can take many months to ramp up production to fill that new demand. Though some pundits have described drilling in shale as a manufacturing process with lower risk profiles than drilling in unproven territory, there are not many manufacturing production lines that have such a combination of difficulty in maintaining a significant inventory and difficulty in adjusting production to meet demand.

That is why I have continued to point to natural gas interest motivation to do whatever they can to alter the demand side of the equation by campaigning against gas competitors – both coal and nuclear energy.

Chesapeake Energy’s contributions to the Sierra Club’s “Beyond Coal” campaign are well known, but many of the engineers working in the nuclear industry reject my assertions that gas interests are also motivated to take action to force nuclear plants to shutdown and to stop new ones from being built.

When nuclear plants produce power and heat that might otherwise have required burning natural gas, it forces prices lower than they would have otherwise been. When there is an overhang of too much supply already, both producers and traders (aka speculators) have every incentive to support actions that push nuclear out of the market so they can sell more product. The people in the game know the score and many of them know what they need to do to influence the eventual outcome.

Traders note nuclear plant outages are running well above

normal for this time of year and could boost gas demand by as

much as 1 billion cubic feet per day…

Here is another example of a push to replace nuclear output with natural gas. (I wonder if anyone out there has a good source of information about the donors who helped this particular politician get elected.)

Rep. Paul Ralston, D-Middlebury, questioned whether the state really needs power from VY and urged the state to explore more opportunities to use natural gas. He noted that while the cost of other energy sources has been increasing dramatically, natural gas prices have declined to the tune of 37 percent during the past year.

“There are natural gas generating electric plants that are providing plenty of inexpensive energy that Vermont is tapping into because we are part of a New England-wide grid,” Ralston said, while acknowledging the need to ensure the state does not support the process of hydrofracking in the search for natural gas.

(Note: VY is Vermont Yankee)

However, despite a considerable amount of angst in the gas industry about lower prices, consumers are enjoying the benefits of the oversupply situation.

But this year, the bill is lower still — thanks to more natural gas from new sources and a slump in consumption tied to warm weather. The National Oceanic and Atmospheric Administration says Americans enjoyed the fourth-warmest January since officials began keeping records in 1895. The average consumer is projected to spend only $643 this winter on natural gas.

And another help: Electric bills are down, too, thanks to the unusual winter. The EIA says the average wintertime residential expenditure for electricity was $938 in the 2008-09 season. This winter, it will be $918.

Bottom line: Consumers will have a couple hundred dollars more in the piggy bank as spring arrives, compared with three years ago. Those savings will be augmented by the payroll tax holiday, which put another $160 on average into workers’ paychecks over the months of January and February.

If consumers understood how markets work as well as the traders do, they could turn the knowledge into pricing power. Knowing that less nuclear power increases the demand for gas and pushes prices up, they could start agitating for more nuclear power to push prices down. They could support efforts to build new nuclear power plants, supply pressure for more efficient nuclear power plant inspections and license application reviews, and encourage their representatives to assist researchers to develop even more productive new technologies.

More supply means lower prices. That happy situation allows most of us to keep more of our money or to spend it on things other than our power and heating bills.

One more comment about the above blog headline – any political leader who publicly frets about high oil and gasoline prices at the same time as they are layering ever more sanctions and implying a threat of military aggression against a major oil and gas producing country exposes the fact that they are completely clueless about the impact of supply and demand (both real and perceived) on the price of a necessary commodity product.

In contrast, political leaders in a tiny little country that recently discovered a major new natural gas field and want to make money by selling that gas in the international market are providing evidence that they have a sophisticated understanding of market forces when they rattle swords and demand ever tighter sanctions against a energy market competitor.

I’m a strong advocate of the idea that we should be using less natural gas by using more efficient furnaces and tankless water heaters. Now, we all know the pitfalls of efficiency, however this kind of efficiency – using less natural gas – is the right kind of efficiency. Preserving this resource for a longer term should be the primary objective, not inventing new ways to burn it.

I thought those agitating for war with Iran were motivated almost exclusively by a desire to protect Israel.

“The world would be a better place if more people thoroughly understood how the balance between supply of a commodity and demand for that commodity worked to establish market prices”

Indeed, but do you claim to understand it yourself? The word “speculators” appears only once in the entire post, yet I believe most readers are aware that speculation controls the price more than anything else.

The real cost of oil is estimated to be about $40, but the current spot price is just over $100 ($120 for Brent). It is widely believed that 60% of that price is speculation:

http://www.globalresearch.ca/index.php?context=va&aid=8878

To bring this a little closer to home, the contract price of nuclear fuel has dropped by about 30% in the last three months, in spite of supply remaining flat and rising demand (for the future):

http://www.uxc.com/review/uxc_Prices.aspx

Actually, if there’s any fair market to be found, it’s the gas stations in your town. They follow the age-old maxim of “charging what the market will bear”. If their neighbour can charge $4, so can they.

Maury, I think you underestimate just how tight the global oil supply and demand balance is.

If that high a percentage of the price of crude was mere speculation, wouldn’t the price spike to ~$140/bbl back in 2008 have prompted a much bigger crude oil production increase rather than acting as the match triggering a world-wide recession?

Also Maury, considering that globalresearch link you provided is from May of 2008, I would have to consider it to be of very close to zero value today considering the historical price, consumption, and production data that is now available from the past almost 4 years.