How long before Wisconsin electricity customers regret loss of Kewaunee?

After a number of discussions with people in positions close to the decision to destroy the Kewaunee nuclear power station, I am now about 98% sure that it will be shut down as currently scheduled in May of 2013. I am also about 95% sure that the decision will cost electricity customers in the Midwest Independent System Operator (MISO) grid a substantial quantity of money during the 20 years that the plant could have remained in operation.

About the only thing that can save the plant at this point is the arrival of a well-capitalized white knight who recognizes the value of a licensed nuclear power plant, 900 acres of surrounding land, and the potential for finding electricity customers that will pay a premium for predictable energy prices more than 1 year into the future. It might also help if the white knight is an out of the box thinker who realizes that nuclear reactors can do more than just produce electricity.

Here are some of the things that I have learned in the past week, some of which I find rather disturbing.

- Kewaunee has enough fuel remaining to operate into the fall of 2013.

- In 2012, Kewaunee operated with an average capacity factor above 90% and produced 4.5 billion kilowatt hours of emission-free electricity.

- Entergy, Exelon and Next Era did not make offers, despite having performed some due diligence.

- A Wall Street mergers and acquisition (M&A) specialist stated that if those companies could not make the numbers work, no one could.

- No one I spoke to put any value on the emission-free nature of the power output.

- Everyone I spoke to was concerned only about current electricity market prices.

- No one recognized the opportunity associated with future market price increases.

- At least one decision maker at a major provider of cloud based services is firmly opposed to the use of nuclear energy.

- The employees at the facility have mixed perspectives on the closure.

- Some have few ties to the local area and have already found other jobs.

- Some are nearing retirement and see the buyouts as an unexpected windfall.

- Some are in the middle of their careers, are active in the community and have children in school. This is the group that is most unhappy about losing their job or the prospects for finding a new one in a different location

- Many people in the nuclear industry are happy about the immediate jobs associated with decommissioning the plant.

My contacts with the Nuclear Energy Institute have not responded to my emails asking if there is anything that the rest of the industry can do to change the situation. (I hope that is because my email got lost in a stack, not because they have no interest.)

One of the things that became abundantly clear is that many of the people I talked to are quite sanguine about shutting down a uranium fueled plant and replacing its output with either coal or natural gas. Some of the people talked about the low price and low risk associated with burning natural gas compared to the fixed costs of operating a nuclear plant and the liability risk associated with nuclear energy.

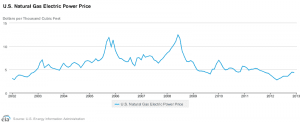

I have a difficult time understanding how anyone can consider increased dependence on natural gas to be a less risky choice, especially given the history of price volatility. Here is the chart from the Energy Information Agency of the monthly prices paid for natural gas by electric power producers.

After reading Mark Cooper’s paper criticizing the economic prospects of VC Summer and the Levy project, I contacted Geoff Styles, publisher of Energy Outlook. Geoff has professional experience in the fuel commodity futures trading market. One of Cooper’s assumptions is that it is possible for electric power companies to lock in natural gas prices on long term contracts at a favorable price.

I asked Geoff if it really was possible to purchase natural gas futures more than a few years into the future. He responded with some very useful information about the structure of the futures market.

It’s been a while since I was directly involved in the futures markets, but I still watch them fairly closely. It’s true that the NYMEX futures

contracts for gas extend out the ten years that Mr. Cooper claims–currently

through March 2023. See:http://www.cmegroup.com/trading/energy/natural-gas/natural-gas.html

However, if you take a look at the column labeled “volume”, you can see that

there’s very little activity out that far. (You can pull up volume graphs

for each contract by clicking on the chart icon in the column next to the

month column.) It’s not always zero, but whenever I’ve checked this in the

last few years, the volume typically falls off rapidly beyond year 2 or 3.

That means two things for anyone seeking to lock in a 10-year gas price:

- In order to entice someone to sell any significant volume in the out years, they’d likely have to bid well above the most recent settlement prices for those distant contracts.

- Just as importantly, the lack of liquidity, even if they could find a willing seller up front, means that it could be very difficult to unwind any of those distant contracts before they have advanced to within a year or two of delivery, except at a large loss by enticing a buyer via a very low offer price.

In practice, I assume that anyone actually interested in lining up a

sizeable volume over a ten year period or longer would avoid the futures

exchange and either try to deal directly with a large, stable producer, or

find a “market maker” like a big investment bank or trading house to do an

over-the-counter swap to lock in the price. In my experience those don’t

come cheap.

I checked the link that Geoff provided and found out that the situation is even less predictable than Geoff remembered. The most distant futures contract that has any reported volume is Jan 2014, less than one year from now. Combined with the recent price history since the market bottom last spring, that does not bode well for the stability of future gas prices.

My guess is that sellers are demanding a higher price than buyers want to pay. That often happens in a commodity market when the sellers know there are factors driving up the price and buyers look over recent history and believe they can comfortably just keep buying short term contracts.

I remain comfortable with my bet that there will be at least one month before the end of 2014 in which prices at Henry Hub will exceed $10 per MMBTU. I suspect that the natural gas price for electric power customers will exceed that number by several dollars during the same time period. I suspect that there will be plenty of customers who are not happy with the choices made for them during the temporary period of low natural gas prices.

On the other hand, I also suspect that there will be people who trade natural gas or who own substantial stakes in natural gas production, storage and transportation assets that gain a financial edge from the decision to remove 550 MWe (equivalent to about 100 million cubic feet of natural gas per day or 33 billion cubic feet per year at 90% capacity factor) of competitive supply from the electric power grid.

Send a copy of your post to Warren Buffet. April natural gas prices are already up to $4/MBTU. http://online.wsj.com/article/BT-CO-20130318-711511.html

Warren is building a new plant in south Iowa.

Here is one article on why nat gas prices are likely to be higher in the near future. Rig counts are way down, and drillers are switching over to finding more lucrative petroleum. One other point is the production decline rate for gas. They get lots of gas from a fracked well in the first year, but the production soon drops off, sometimes drastically so.

http://www.csmonitor.com/Environment/Energy-Voices/2013/0218/Investors-are-subsidizing-natural-gas-consumers.-But-it-won-t-last

Someone recently said on an Atomic Show podcast that utility company CEOs don’t stay around very long. Long term decisions, which might involve years of spending for new nuclear power plant construction, are frowned upon.

Rod,

How can low gas prices be driving out a fully paid NPP? What is their base cost / kwh? It must be much much higher than the 1.8 cents / kwh that we average for NPPs.

@David

Because it is a relatively small, isolated plant (in the sense that its fleet is distant) Kewaunee has an average cost per kw-hr between 3-4 cents. It has higher than average costs per kilowatt hour for licensing, security, operators, and outages.

This development at Kewaunee is a worry for me.

I agree with David’s concern posted earlier (which Rod valiantly tried to answer).

To have a safe operating nuclear power plants shuttered because it cannot compete on cost of electricity relative to fossil or renewable energy power plants is new, and bodes ill for nuclear power generation and the nation.

Nuclear power plants traditionally are expensive to build, but once built have been the most reliable and lowest cost electricity sources available. Rod suggests that Kewaunee is special and has an average cost per kw-hr between 3-4 cents, about double the average for nuclear power plants nationwide. Rod explains that Kewaunee has higher than average costs per kilowatt hour for licensing, security, operators, and outages.

Are there other smaller reactors in the US commercial nuclear fleet that are threatened in a similar way to Kewaunee and may have to within the next few years have to close because of economic reasons?

Robert,

There was a report written by UBS analyst Julienn DeMoulin-Smith (which I might have misspelled) that I saw get quoted by probably 10 different articles, where he speculated just that an named names of smaller capacity plants (including Ginna, Vermont Yankee, and several others).

A big whole I saw in that report, however, was that most of the other smaller-capacity nuclear plants here in America are owned by a few of the big-time nuclear utilities, particularly Entergy owning/running Vermont Yankee and maybe Exelon owning a couple “smaller” plants. Considering the number of overall plants that Exelon and Entergy own/operate, I don’t see either of those two companies closing down a well-run nuclear plant before its license expires (with the exception of Exelon agreeing to shut down Oyster Creek w/ 10 years left on its 20-yr extension).

In several of the articles that quoted the UBS report, I recall there being specific mention both from Entergy and Exelon that they do not comment on the financial performance of individual plants. The main problem with Kewaunee is that Dominion’s other plants were geographically so far from Kewaunee, and that the area near the plant up there has a not-so-great economic outlook for the near future. The inevitably higher electricity prices that will result from Kewaunee closing will not help matters in the economic regard.

@ Rod,

Then this has a direct effect on the cost basis for any SMR. Since the target market for SMR’s is this type of community, small, isolated, needing development, the cost / kwh of licensing could sink the market for SMR’s. However, 3-4 cents / kwh is the normal cost of operation for many coal plants and for a wood burning “bio fuel” plant the costs are around 5 cents / kwh. If Gas fired plants can supply electricity lower than that – they will replace all other forms of electric generation. I agree with your assessment that the price of Natural Gas will rise and that this decision will be seen as “foolish” in about 3 years. At the same time – loosing 50 million a year means an investor needs to cash flow about 150 million. Hum, 568 MW. Well I don’t have time this morning to run the numbers, but I did run the numbers for a 30 MW wood burner. We could make money and pay back a loan if wholesale electric was above 10 cents (like in CA) but once the plant was paid for we could make money at 8 cents just fine. In other words we could compete with the coal plants in the area who had a slightly lower cost basis.

So, this still does not make sense to me. Something else is going on here. I think it is the funds available for decommissioning. The large fund that a NPP has to accumulate to decommission seems to destroy the incentive to find cost savings to keep it going. Zion was essentially the same. I am thinking that once the cost of investing for the long haul drops below the level of available funds in the decommissioning fund the “economic case” is to shut the plant and use the funds. You would never do that with a coal plant since there is no fund available and you would have to ride out some lean years before you would go bankrupt.

It occurs to me that there *might* be an opportunity for a small/new player in the utility industry to adopt the ecological niche of “carion eater”. What do I mean by that? For these big utility companies, I suspect the numbers “don’t work” because they don’t want their plant lowering the price of electricity any more than it already is down, so that they can hope to make money off their gas plants, etc.

But, if there were a small company which didn’t have other assets in the same market it would be competing against itself with, and it had the financing to get started, you could probably buy these plants for pennies on the dollar (since nobody else is making offers, it occurs to me there is a “buyer’s market” for used nuclear plants – offer them 50 million for a plant they are planning to decommision anyhow, and they might consider that a good [short term] deal – they get 50 million dollars, and don’t have to deal with the plant ever again).

Then, operate the plant at break even until market prices rise (which they must – the oil-gas industry won’t be content to lose money on natural gas production forever). Once they rise, since you have low capital costs, low fuel costs, and moderate operational costs, you should be able to make some decent profit, no?

Of course, the key to that strategy is getting a good enough deal on the plant, and having enough cash on hand to survive until prices go up.

Sounds a lot like what Exelon did during the 1990’s and into the 2000’s to get to their substantial number of plants (prior to the Constellation merger).

Also, I’d like to make a point on the topic of Exelon’s corporate strategy in relation to Zion and to NextEra/FPL owning Point Beach within overlapping planning zones. The situation could very well be that any efficiencies that NextEra could introduce at Kewaunee by already having a nuclear presence in that region would be of too little financial benefit to outweigh the pricing benefits they would get for their power sales from Point Beach by not having Kewaunee’s annual 4.5 Billion kw-hr being sold into the same region’s power market. I am sure that was looked at by NextEra.

The saddest part in the whole deal is that the shutdown basically signals little hope of near-term economic growth in that region. If any substantive growth around there were expected or projected at all, there is NO WAY that the plant would be shutting down so soon with 20 remaining licensed years.

It occurs to me, also, that customers in the local area might be pursuaded to make a stake in partial ownership, to give them some control and guarantee on the pricing. Maybe make an offer which sells them electricity at a slightly higher than current market price (but at a price point which is sustainable for the plant), and a program where, like, for every 1000 dollars they spend on power, they get one share of ownership in the corporation you create to own and operate the plant.

So, they aren’t just getting expensive electricity (which might start to look downright cheap if the price goes up), BUT, if the power ever raises above that price point – they are guaranteed to keep getting that price (other, new customers who switch after the market price goes up would NOT get that benefit), AND they get a cut of whatever windfall profits might be made if the market price goes high enough to generate such profits.

In the three-year period of 2010 through 2012, Kewaunee had a DER net capacity factor of 93.4 percent, putting it in 19th place among the 104 licensed power reactors in the United States. (There’ll be more on this in the annual capacity factor article in the May issue of Nuclear News.) The people who achieved this performance will soon have nothing to operate; one hopes that they find work.

A couple years ago Dominion took the unusual step of announcing publicly its intention to sell the plant, and apparently there was no offer submitted that Dominion found acceptable. The Wisconsin utilities that had originally owned Kewaunee signed a power purchase agreement when Dominion bought the plant, but it ran only through the original license term. License renewal was approved in 2011, but utilities may not have favored another long-term deal at a price Dominion would accept. This is why it is presumed that cheap methane undercut Kewaunee.

FPL/NextEra owns and operates Point Beach, not far south of Kewaunee (the emergency planning zones overlap). Kewaunee is a Westinghouse PWR of about the same size and vintage as Point Beach-1 and -2. If there were a potential White Knight, it would be FPL/NextEra–yet the silence from this company and all of the other merchant reactor owners continues.

Unfortunately, why would any investor buy a nuclear energy plant with unknown future operational regulations and long term “used” fuel storage costs; until emission free is considered an essential requirement for energy production. Customers may complain, but they modify their spending habits so they can afford the increasing energy costs. As individual consumers, we have little choice when it comes to $4.00/gal gas or 30 cents/kwh electricity.

Dunno. Maybe it’s time to think wildly out of the box. There are nations who are looking favorably toward building a nuke but don’t have experience running and managing them. I assume it doesn’t matter that much of where their bucks are coming from, so long as they get paid, so I’m not against a foreign nation taking over a nuke here and simultaneously having the home crew here passing on their experience to foreign “interns” to take back home when their own plants are built and running. Just a wild thought.

James Greenidge

Queens NY

James- The NRC recently ruled that Unistar cannot proceed with a new reactor at Calvert Cliffs because Unistar is owned by EDF of France, and NRC rules preclude foreign ownership of US plants.

http://www.world-nuclear-news.org/NN-Regulator_rejects_Calvert_Cliffs_challenge-1203138.html

@Pete51

In this case the rules have their basis in the federal statue. There is a clause in the Atomic Energy Act of 1954, as amended, that prevents foreign ownership of nuclear power stations. Interestingly enough, since the Act is specific and limits that prevention to “power plants” the NRC has licensed the LES enrichment facility in Eunice, which is foreign owned (Urenco is the majority owner), and probably will license the Eagle Rock facility in Idaho, which is 100% owned by Areva.

Here is the quote in Section 103, which is the section governing commercial power plant licenses.

http://www.nrc.gov/reading-rm/doc-collections/nuregs/staff/sr0980/v1/sr0980v1.pdf

Rod

This is really depressing, but to some extent predictable. I noticed the following during recent power negotiations around here:

– No power generator wanted to bid a low fixed price for a solid long-term power contract, because the generators expect the grid price to rise with the natural gas price, and they want to capture that rise

– No utility will buy at a high fixed price for long-term power, even though they know it is fair, because after all “we can get it for cheaper on the grid right now, so why should we pay more, and how would we ever justify paying more to the regulators?”

The result is that about 65% of Vermont’s power supply right now is either direct short-term contracts or long-term “market-follow” contracts with HQ. In other words, our power prices are following the natural gas prices. Period.

I can see the problem, but I can’t see a solution.

Meredith

@Meredith

I see a solution. It involves getting people like Bill Gates, Sergey Brin, and Tim Cook to recognize that their money can make a substantial difference in breaking our fossil fuel addiction which is being pushed by other people with lots of money.

We have to find ways to let energy consumers – including very wealthy ones – know how much they are being bamboozled by hydrocarbon energy producers.

Rod and Cal

Cal’s energy storage may help, someday. For now, I feel that nobody ever got fired for buying natural gas-based power. It’s the “safe” choice. If the price goes up, the regulators allow you to pass the higher price on to the consumers. We are in a nation-wide “natural gas trap,” in my opinion.

I would like rich smart people to rescue the situation, but I think the problem is in the energy structure, not the people. Everyone can see that gas prices are going to rise, and that over-dependence on gas will be a problem. Everybody can see it, but nobody can do anything about it.

Sorry to be so negative.

Meredith,

Your concerns are one reason that I am glad I live in the Southeast, and also played a role in my decision-making with recent change of employer.

Meredith,

Energy storage. Pure and simple. Some storage capacity allows an arbitrage process that smooths out the prices. That is part of the reason why I’m working on adapting molten salt used in solar thermal projects for the S-PRISM.

In the short term we are stuck with what we have and are relegated to make short term decisions.

If proposed utility gas plants were required to include a guaranteed gas price over the life of their plant in their proposals to regulators, no gas power plants would ever be built.

Big Oil corruption of media and politicians is sadly commonplace in American public life.

In regulated markets, utilities can pass fuel costs directly to customers with simple rate cases that never experience a prudency review. Those fuel adjustment charges can often be varied every few months. That is a huge contrast with the care with which capital improvement rate cases, especially those for huge nuclear plant projects, are reviewed.

Remind me again why small modular reactor development is so great?

Here is a small reactor that is having problems because it is small.

I am in favor of modular building with modules built in a factory. But I prefer large modular plants like the AP1000.

That leaves finance charge during construction as the only benefit of SMRs. Another way to reduce finance charge during construction is to get really good at building the same design over and over. We need a way to pursue a learning curve benefit by building multiple large reactors.

It’s small, and subject to a per-unit annual fee for “regulation”, and in a hostile polity, and isolated and forbidden by agreement from combining buying power with other units to get better fuel prices.

Most of those issues have nothing to do with being small, it’s political.

I’m all for AP-1000s (and S-PRISMs and other things), but there are places where you couldn’t put an AP-1000 because the grid couldn’t absorb 1100 MW or provide enough spinning reserve if it tripped off-line. There are places that might be able to, but couldn’t take it all at once. The SMR does appear to have its place.

@martin burkle

Under today’s rules, single unit isolated plants of any size have cost issues because they have to provide the same level of site security as multiunit plants and cannot spread their costs. Smaller units have additional scale issues, like having exactly the same Price Anderson liability ($110 million or so) as large units and paying exactly the same annual licensing fee of $4.7 million.

One way that SMR designers plan to achieve scale economies is to build multiple units on the same site to take advantage of a single security force that does not need to double in size to accomodate a doubling, tripling or eight fold increase in the number of units and electrical power production.

For the second scale issue, the idea is to simplify the designs enough to justify a lower number of regulators because we plan to bore the heck out of a contingent of 2-3 regulators per unit on a site that has 4-20 identical, simple units. There is already some movement in the direction of a sliding scale license fee.

As you pointed out, there are savings associated with learning curves. The experience in a wide range of industries is that you can count on a certain percentage cost reduction for ever doubling of unit volume. In commercial aircraft and ships, the learning curve number is somewhere around 10-20%. Unit volume doubles a lot faster if each unit is 180 MWe than it does if each unit is 1100 MWe.

To be fair to the people at NuScale, it doubles much faster at 45 MWe than it does at 180 MWe.

20 Units @ 180 MWe each = 3600 MW for a site

That is about what Browns Ferry will be if their EPU can ever be finalized.

That raises a question I have always had about the SMR deal. And that is, will a license fee be assessed for each reactor at a mutiple-unit site, like it is now? I think Palo Verde, for example, pays a separate fee for each reactor at their site. If you had a site with, say, 20 SMRs, would the NRC ding you for 20 license fees, each costing the same amount? I can very easily see the NRC (and the federal government) licking their chops at the prospects of such a money-grab. If so, would this undercut some of the cost arguments of SMRs? If you’re paying the same amount for a license for a 1100 MWe AP-1000 as you are for a 100 MWe SMR, I think on a fee$/MWe basis, you’re taking a beating on the SMR.

@Wayne SW

Without a change in the existing license fee structure, SMRs are not viable alternatives in the United States. The unavoidable cost per megawatt hour goes up in a linear, no ceiling manner.

For a 10 MWe Toshiba sodium cooled slow breeder, for example, a $4.7 million per year license fee would equated to a direct charge of $53 per MW-hr even if the plant achieved a 100% capacity factor.

The NRC has been dawdling with making some adjustments to the rules for at least three years already.

I don’t see a strong prospect of that. They adjusted their fees for research reactors and byproduct materials users, but are not going to touch the fee structure for power reactors. That is the bulk of their revenue, something like 95% of their license fees are paid by power reactors. Once the federal government gets their hands on private money, they generally don’t let go.

Two issues here:

First of all, how can the electricity consumers regret the closure of Kewaunee? The last time I opened my electric bill I did not see a ballot asking how I would like to have my electric power produced (although I think that might be a good idea!). Consumers have NO SAY in what power stations a utility uses. Rod, maybe if the place will close it would not have to be as you put it, destroyed. Why not treat it like a classic car and preserve the machinery inside? That way, somehow, maybe it could be restarted if some other company decides to buy it.

Then there was my Fort Calhoun idea with the people who own it buying Kewaunee instead because it does not need all those repairs and then selling the electricity anywhere, eventually ending up in Omaha but I guess I make too much sense do I?

@BobinPgh

There are several factors that prevent preservation of Kewaunee for future use.

The license fee for an operable unit is $4.7 million per year. Keeping that license up to date also requires at least that much investment on the part of the operator in the quality assurance program that supports the regular inspections. There has never been a case in which new operating license was restored to a unit that had given up the license and halted the ongoing quality assurance program that supports its maintenance. The closest analog is the restoration of Browns Ferry, which cost about $1.8 billion even though they did not have to go through a complete relicensing effort.

The second factor is the decommissioning fund. It cannot be tapped unless the plant is being decommissioned. Once that process starts, there are a lot of corporate costs that can be charged to the protected fund.

Once a plant submits under 10CFR50.82, they are relieved of a number of requirements (a lot of surveillances, spare parts QA, vendor tech manual QA, insurance costs, etc.) but the license no longer permits operation of the reactor or even fuel in the vessel. It is a one-way street, which is why it is called “permanent cessation of operation.” I think if you wanted to restart the plant after 50.82 you’d have to get a new license. For an older (non-SRP) plant like Kewaunee (or Ginna or Vt Yankee) that would be near impossible, to say nothing of the storm the anti’s would raise in a place like Vermont.

Note that if Dominion was required by regulators to guarantee the price of the natural gas used to replace Kewaunee over its twenty years or so of remaining iife the shutdown would never happen. Once again corrupt politics at the state level no doubt funded by Big Oil

I just received mail this week from Dominion with an offer to lock in their “low natural gas prices through the next three winters.” How ironic.

Brian, despite it likely being fully ineffective (and not applying to a customer in Virginia, with Kewaunee being in Wisconsin), please attempt to respond inquiring about the possibility of locking in the low prices for the following 17 years.

He should suggest he’s ready to pay 20% more if it’s locked fro 17 years instead, of 3.

This is SO bizzare! Remember pre-Fukushima at all the Global Warming frenzy on movies and TV news and all kinds of Ads about polar bears being washed out by greenhouse gases generated by coal and natural gas then Fukushima happened — and “nothing” (Doomsday) happened — and suddenly all that frenzy over greenhouse gases suddenly died down to a whisper on TV and media! Wonder why? Could it be that because even the very worst of rare accidents at a nuclear plant which had three chances of harvesting FUD-vindicating megadeath even fudged at killing just one red shirt guy (WAY unlike way more common oil and gas accidents); that nuclear energy didn’t turn out the Darth Vader the antis screamed it was and so the last big excuse NOT to go pollutionless nuclear was swept aside? Gasp! The media was WRONG about nukes all these decades?? Quick! Better set up “clean” natural gas as a new straw shining energy knight — but pass whispers on the greenhouse gas please!

James Greenidge

Queens NY

@James

Just remember that the media earns a living by selling ads. If they have an agenda, it is one that suits the people who buy the ads.

Natural gas is the product that the multinational petroleum companies see as their way of maintaining energy market dominance.

Craigslist: “slightly used Nuclear plant for sale (carlton )”

http://milwaukee.craigslist.org/bfs/3700285560.html

I have been sharing that Craigslist ad everywhere since I spotted it. There are people that still believe kewaunee to be an important asset that someone needs to recognize. http://milwaukee.craigslist.org/bfs/3700285560.html.

@nuke roadie

Please have them contact me. I’m doing everything I can think of to raise awareness that Kewaunee is a valuable asset that should not be destroyed for short term or selfish reasons. I am getting the impression, however, that the nuclear establishment thinks it’s a done deal and that it is simply a pawn in a larger game. Either that, or they have decided to allow a sacrificial lamb from the herd to be given up to protect the rest.

Maybe you could use this :

http://www.greentechmedia.com/articles/read/With-Nuclear-Out-Power-Prices-Went-Up-for-Southern-California-in-2012

“With Nuclear Out, Power Prices Went Up for Southern California in 2012”

– for 2012, Southern California saw prices jump 12 percent higher than Northern California

There’s not a single reasonably close large industrial user who would interested in backing up financially an utility in exchange for a long term guarantee on price ?

I think the final death knell for Kewaunee was when the Public Service Commission of Wisconsin and then the Midwest System Operator declared that the area did not need the electricity if the plant was shut down. Combine that with a lack of a comprehensive national energy policy and you get a very short sighted decision to decommission one of the best running nuclear plants in the country.