Environmental Defense Fund president has a fundamental misunderstanding of gas markets

Fred Krupp, the president of the Environmental Defense Fund (EDF), published a commentary in the Wall Street Journal titled How Local Utilities Gamed the Natural Gas Market. The article subtitle briefly explains his theory – They booked large orders and then cancelled at the last minute, which pushed electric prices up by 20%.

Krupp’s commentary did not offer much in the way of explanation for why local gas distribution utilities in New England might engage in this kind of behavior. Instead, he makes a vague accusation implying that the gas distribution utilities purposely acted to “limit the amount of gas available to the generators that produce half of the region’s electricity.”

Since gas utilities do not compete directly against electricity in New England, it’s not clear why the companies would want to limit fuel to electricity suppliers.

Though I am not a New Englander, I’ve lived in the region through a couple of winters. I also have some family members who either still live there or who escaped to Florida after living there for a number of years. I say that as a way of establishing standing when making a comment about winter weather in New England. From memory, from family stories and from reviewing data, I can testify that winter weather can be harsh while also being frequently unpredictable.

Firm Delivery Contracting

Weather fronts can be delayed or accelerated with little notice. It makes perfect sense for a gas utility company that is a regulated monopoly with an obligation to serve its customers to enter into gas pipeline contracts with firm commitments to deliver sufficient gas. Their definition of sufficiency would include meeting expected heat demand plus a bit of extra gas in case the demand greatly exceeds expectations.

If the weather front gets delayed and usage isn’t as high as expected, there might be a small cost to the company that gets passed onto customers, but the cost of having a buffer is probably far less than the potentially catastrophic inability to deliver enough gas to keep people from freezing and gas-dependent businesses from having to close.

Krupp goes on to offer a confusing condemnation of the fact that pipeline companies would be happy to build additional pipeline capacity if they could find enough qualified customers to enter into firm delivery contracts similar to those used by gas utility companies. Those contracts carry a moderate premium price over interruptible delivery. They also require a commitment lasting up to 20 years.

Krupp is dismissive of the pipeline companies and their traditional position of requiring that they have customers committed to paying for capacity before they will build that capacity. He writes “the developers want their investment to be risk-free.”

The truth is that the developers need financing from investors and banks before they can spend billions of dollars building a pipeline. Those financial backers are the ones that – rather logically – require pipeline companies to have bankable contracts before they will lend them the money they need.

Betting On The Spot Market

Even though more than 50% of the electricity production in New England now comes from burning natural gas, electricity generating companies are not interested in paying the higher prices and making the multi-year commitment. They are better able to compete by gambling on the spot market to deliver gas at the lowest possible price.

Since they are under no obligation to serve, they have a simple answer when pipeline capacity fills up and they either cannot get fuel or have to pay prices that are several times the normal price. They can bid up the price of electricity to levels approaching $1000/MWhr or they stop generating.

Neither of those options are particularly customer friendly. Generating companies work for investors and believe that their fuel contracting practices make the most economic sense.

Krupp Says He Understands Supply And Demand

It was also rather amusing to note the following quote in Krupp’s piece.

“Econ 101 teaches what happens next. When supply goes down, prices go up.”

Perhaps he should hold some in house training and discussion sessions that emphasize that keen understanding. That way, EDF might begin to rethink its opposition to FERC action aimed at keeping nuclear and coal supply in the market. Like other groups that oppose the action, EDF is claiming that efforts to keep temporarily uncompetitive capacity in the market will inevitably lead to higher prices.

Exactly the same page in the Econ 101 textbook that Krupp mentions tells us that the loss of reliable supply will more likely lead to higher prices since demand is unlikely to disappear just because owners of a few large power plants decide that running them is not profitable enough to cover the costs and risks involved.

One of the reasons those reliable generators are failing to earn enough revenue is that they are forced to compete for sales and prices against virtually “fly by night” generators that burn the cheapest available fuel whenever it is available and quit the market when the going gets tough and customers need them the most.

Krupp is probably right to note that if gas fired power generators purchased fuel with firm delivery commitments, wholesale prices would be likely to increase. Customer bills might even go up. Concerns about pipeline constraints and worries about severe supply shortages should also disappear.

A complete presentation of the real effects might enable customers to recognize that it might be worthwhile to pay a little extra for the security and peace of mind that capacity buffers can provide. It would not be surprising if Krupp and his economist friends resisted, system slack and redundancy aren’t aimed at maximizing efficiency.

PS In 2015, the Environmental Defense Fund paid Fred Krupp $545,000 and provided a benefits package worth $62,000. He is one of seven executives whose compensation exceeded $300,000 in 2015.

EDF collected $135 M in contributions and reported a net asset base of $204 M.

Among their numerous contributors are companies like Chevron, XTO Energy (Exxon-Mobil), Valerio, and Transcanada.

NGO’s like EDF may be ‘non-profits”, but they are demonstrably not altruistic organizations. It is possible that some of their positions are influenced by the interests of their donors.

Rod, thank you for the clarity. A person always has to be a bit suspicious when EDF portrays itself as a an expert on markets. Expert on subsidies, yes. Expert on markets…not so much.

One issue EDF doesn’t address is the simple fact that utilities generally have interruptible contracts with the pipelines. A gas-fired plant will take a grid operator capacity payment (“I’ll be there when you need me….the capacity of this plant is at your disposal”). But the plant’s contract with the pipeline is usually an interruptible contract. At peak times, for the power plant, gas may not be available or be too expensive to buy. So, the plant doesn’t go on-line when the grid calls on it (“I’ll be there if it works for me”).

ISO-NE has been twisting itself in knots to try to deal with this problem. See the section “Capacity auctions mislead the grid” in my post. http://yesvy.blogspot.com/2017/01/pay-for-performance-on-us-grid-no-help.html#.WhBVxDLMwUE

The WJS article requires a sign in, I assume this article on the EDF website from Oct. 2017, covers similar ground:

http://blogs.edf.org/markets/2017/10/11/dysfunctional-gas-market-cost-new-england-electric-customers-3-6-billion/?_ga=2.124003592.362793555.1511043103-1239072324.1511043103

Per this white paper, EDF’s proposed solutions for New England’s “fuel security” problem are “Alternative load service assurance solutions” which consists of batteries, LNG, Demand Response, Pumped Storage, Oil, and Energy Efficiency.

http://blogs.edf.org/energyexchange/files/2017/10/New-England-Energy-Challenge-EDF.pdf

A quick search of Fred Krupp reveals his annual salary is over $545k and EDF’s annual operating budget is well over $100 million. With such friendly oil & gas solutions openly on display, it appears Krupp’s stunted understanding of economics are driven by the fundementals of supply and demand after all.

“Krupp… makes a vague accusation implying that the gas distribution utilities purposely acted to ‘limit the amount of gas available to the generators that produce half of the region’s electricity.'”

At (possible) risk of gross oversimplification, it would at least superficially appear EDF has it’s hands out pleading for permission to burn more unnaturally fracked gas or, failing that and perusing Meridith’s link, fuel oil in it’s stead.

I’m shocked.

I have mentioned on Rod’s web pages that the pipe lines serving NE are just not big enough to supply all of the gas needed to the north eastern US when there is a long cold spell. Large utilities such as PSE&G alleviate the problem by storing NG and in really cold spells converting Coal into Coal Gas which is added to the NG. They did this several time during the few years that I lived in NJ. Smaller utilities will just have to pay the price and pass it on.

> Large utilities such as PSE&G alleviate the problem by storing NG and in really cold spells converting Coal into Coal Gas which is added to the NG.

Sounds like the cheap, partial version of IGCC plants, and a sneaky way to keep using coal. Storing coal at a gasification plant is apparently a good way to, effectively, store natural gas.

I think the consumers (you & me) lost alot more than we gained when we scrapped the old “regulated monopoly with an obligation to serve its customers” system. Deregulation was a big mistake, IMO.

Oddly enough, the regulated-monopoly areas still have less expensive electricity. Or maybe it’s not that odd. ;-

In this post, I have a graphic, from a report to NESCOE, which is the New England governors association to keep track of electricity issues. The NESCOE report referenced a paper from the business school at UC Berkeley. You can clearly see that the “restructured” RTO areas are have more expensive retail prices (upper red line) than the non-restructured states (blue line).

This report is two years old. If someone knows of an update, please post it here.

http://yesvy.blogspot.com/2016/03/the-oddness-at-heart-of-rto.html#.WhLeozLMwUE

> You can clearly see that the “restructured” RTO areas are have more expensive retail prices (upper red line) than the non-restructured states (blue line).

You can also see the RTO areas already had more expensive prices before the restructuring. The difference (lower dashed line) increased from around 1998, but after a peak in 2007 has decreased to about the same as in the early ’90s before restructuring.

Yes, the current RTO areas did have higher prices before restructuring. One major point of restructuring was that areas with high priced electricity would see prices fall, due to the effects of competitive markets.

The chart shows that, at least for the first twenty-some years of competitive markets, competition didn’t particularly lower prices.

The chart also shows that both regulated and unregulated market prices increased by similar amounts, and both seem correlated, more or less, with the natural gas prices shown. If this shows anything, it may be that regulation of markets makes no difference (or small difference).

@gmax137

Remember that Ken Lay and his “smartest guys in the room” at Enron were the creators of the electricity market restructuring movement.

Rod,

> rather rambling commentary

> I say that as a way of establishing standing when making a comment …

At least you’re aware of rambling. Being paid by the word is suspected.

> winter weather can be harsh while also being frequently unpredictable.

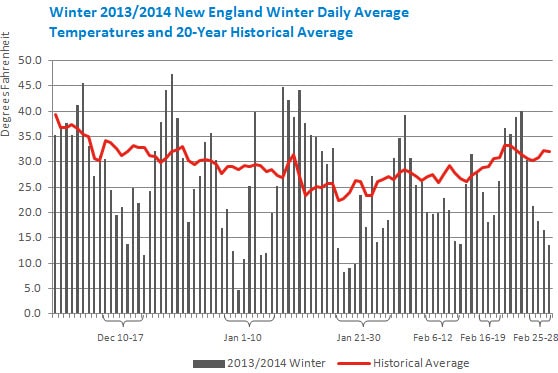

“Winter” is unnecessary here, but indeed the data chart alone shows this. Maybe someone can invent a way to increase those average temperatures. 🙂 It’s amazing how people can find ways to adapt to frequently unpredictable conditions or resources, like sun and wind.

> An complete presentation…

An or a? (nit)

@Pu239

Perceptive. Did you happen to notice the red text that provides a brief explanation of the Atomic Insights funding model. Certainly not paid by the word.

If I would have had more time, I would have written a shorter post.

People in general are quite resourceful about inventing ways to remain comfortable even if the weather isn’t cooperative. Some put on more layers of clothes or pull up a thicker blanket. Others turn to their thermostat so that they can keep on living and working without additional restraints.

> Did you happen to notice the red text

No, sorry, I didn’t have much time, and run some smart ad-blocking. 😉

> Others turn to their thermostat

Yes, I know even Jimmy Carter symbolically wore his sweater at the White House. There should be room for both types to choose their own way, rather than forcing one approach. Just because you think you’re on a mission from God, doesn’t make your way best for everyone.

See also: New Study Shows Total North American Methane Leaks Far Worse than EPA Estimates by Sharon Kelly | February 14, 2014

https://www.desmogblog.com/2014/02/14/new-study-shows-total-north-american-methane-leaks-far-worse-epa-estimates

More information is available via the Google query Frackademia site: DeSmogBlog.com