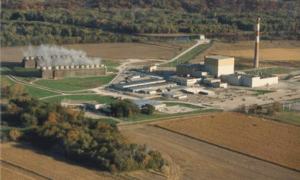

Digging into NextEra’s decision to close Duane Arnold Energy Center

On Friday, July 27, NextEra Energy Resources issued a press release titled NextEra Energy Resources and Alliant Energy agree to shorten the term of the Duane Arnold Energy Center power purchase agreement; Alliant Energy customers to save hundreds of millions of dollars.

Aside: While researching this article, I learned that the word “will” is considered to be a forward looking word expressing uncertainty about future performance, at least in the eyes of the Federal Trade Commission. The effect of that interpretation of the word is that a statement that sounds like a promise, like “These transactions will save Alliant Energy’s Iowa customers nearly $300 million in energy costs, on a net present value basis, over 21 years” is within safe harbor provisions. “Will save” really means that “if markets behave as we expect…” or “customers may save as much as…” End Aside.

As a result of cancelling the power purchase agreement that guarantees NextEra a predictable income stream from selling its 70% of DAEC’s capacity and energy produced, NextEra will be closing the plant by the end of 2020. The current power purchase agreement runs through 2025.

Just before telling the press, NextEra informed its 550 plant employees that many of their jobs would be eliminated at least five years earlier than previously expected. Though the company stated that it will do everything that it can to smooth the transition on its valued employees, Duane Arnold is a major employer in a rural area. Fortunately for DAEC employees preferring to remain in the area, Cedar Rapids, the home of such high technology employers as Rockwell Collins, is about a half an hour away.

Meredith Angwin at Yes Vermont Yankee has documented the local effects of closing Vermont Yankee, a similar plant with a similar work force in a similar small town that was also owned by a large merchant power generator with a reputation for taking pretty good care of employees. Reading the below listed posts might provide a more accurate picture of what the future might hold for those people who are intensely interested because they or their loved ones are directly affected.

Other affected entities

Also on the same morning as the employees and press were informed, the two electric power cooperatives that together own 30% of the plant and distribute 30% of its electricity output to members were also informed that their members’ investments in the plant would be worth less than originally expected. Instead of owning part of an asset providing 184 MWe roughly 90% of the time, their members would share 30% of an unknown liability.

The cooperatives would also have to find other sources of equally reliable power or depend on the fluctuations of the wholesale power market. Most likely, they will have to do both to some degree.

Neither of the two partners, Central Iowa Power Cooperative and Corn Belt Power Cooperative, were a part of the power purchase agreement. As a result, neither of them was invited when Alliant and NextEra agreed to stop power purchases from DAEC to make room for subsidized wind. According to Peter Robbins, a spokesman for NextEra, his company has “a close relationship with CIPCO and Corn Belt and are sitting down with them this week to talk about the path forward.”

Under currently announced plans, there will be no advance payment for the cooperatives. They will also be unable to take advantage of any tax deductions associated with the early closure of a not yet fully depreciated asset. Recently made investments in upgrades and repairs associated with the 2014 operating license extension and the Fukushima response actions required by the NRC will be paid off over years, even after the plant has stopped operating.

Kathy Taylor the Vice President, Corporate Relations for Corn Belt Power Cooperative provided the following comment.

Corn Belt Power sells its share of the output of DAEC to our wholesale power supplier, Basin Electric Power Cooperative, Bismarck, N.D., and therefore has informed Basin Electric of Next Era Energy’s announcement. Any negative impact of the 2020 closure has been mitigated to our member cooperatives through Corn Belt Power’s membership in Basin Electric, which has adequate supplies of generation to cover all of our member cooperatives’ needs.

With an immediate focus to minimize any financial impact that early closure may have on our membership, Corn Belt Power plans to modify its internal accounting procedures to reflect the change in the plant closure date. The cooperative is still studying the financial impact.

The Central Iowa Power Cooperative (CIPCO) issued a press release on Friday expressing some concerns about the decision to close the plant.

Leaders at Central Iowa Power Cooperative (CIPCO) expressed guarded optimism about today’s announcement by Florida-based NextEra Energy Resources (NEER) and Alliant Energy that a 2020 closure of the Duane Arnold Energy Center (DAEC) will result in a win for the state of Iowa.

With earlier than anticipated decommissioning costs and the loss of a key source of clean, reliable, and safe energy, leaders at CIPCO are concerned about the near-term, adverse effects to consumer-members for many of Iowa’s electric cooperatives and municipalities. CIPCO is 20 percent owner of the nuclear plant at Palo.

Earlier in the year, NEER [NextEra Energy Resources] announced a likely 2025 end to energy production when Alliant Energy’s power purchase agreement (PPA) with NextEra Energy comes to an end, despite being licensed to operate until 2034.

…

“DAEC has been a valuable economic engine in this state for over 40 years. We recognize economics are driving NextEra Energy’s decision to prematurely close the plant. The immediate impact on our member electric cooperatives and municipalities as well as the state’s economy remain a top concern for CIPCO,” said CIPCO’s Executive Vice President and CEO Bill Cherrier.

Why are the economics favorable to closing Duane Arnold?

Fortunately for the electric cooperatives that have been partners in the plant since it began operating in 1974, their local region is oversupplied with low-priced wind most of the time. Partly encouraged by the deadlines in the 2015 plan to phase out wind energy production tax credits, there has been a recent boom in Iowa wind projects. In order to earn the generous federal tax credits, owners of the new or repowered projects need room in the market for their output. They find it by offering power for less than its full cost of production.

Though NextEra is one of the primary owners of that new wind energy, Warren Buffett’s MidAmerican Energy is another major player. In 2016, it announced that it would be investing $3.6 billion in new wind projects in order to maximize its harvest of production tax credits before eligibility expired.

Duane Arnold, a mature nuclear plant that reliably produces 615 MWe of emission-free electricity, is apparently considered to be a grid block that is in the way of fully using the cheaply priced wind power.

Alliant Energy, which transmits and distributes the electricity it purchases to nearly half a million retail customers, had filed an integrated resource plan last year that did not include Duane Arnold as one of its contracted power sources. That document signaled to NextEra that the power purchase contract that currently keeps Duane Arnold operating profitably by providing a guaranteed price for energy and capacity wasn’t planned for renewal.

Facing the prospect of having to compete in the wholesale market for sales and recognizing the oversupplied nature of that market whenever the wind is blowing, NextEra indicated to Alliant that it was open to an offer to forgo part of its future income. The two parties agreed that a September 2020 payment from Alliant of $110 million would be sufficient for both parties to agree to stop buying and selling nuclear electricity generated in Iowa.

Alliant has applied to the Iowa Utilities Board for permission to recover the cost of the cancellation payment in its rates. It believes that the new arrangement should save each of its customers a little more than $3 per month in the fuel adjustment portion of their bills over the next 21 years – as long as natural gas prices and availability follow current predictions.

Is there any chance of saving the plant?

Plant closings are never final until the fuel is removed, the NRC has been notified that the owner intends for the shutdown to be permanent, and the operating license has been amended to be a possession-only license. However, once an owner has announced its intention to close a plant, there have been few instances so far of a decision reversal.

This case may be a little different due to the presence of minority owners who are only guardedly optimistic that the closure will be financially beneficial and due to the fact that the Iowa Utilities Board is unlikely to be as biased against nuclear energy as the California Public Utilities Commission. Before the deal goes through, the utilities board must approve the contract cancellation payment and the minority owners should have a voice in the proceedings.

It’s also possible for the markets and the regulatory environment to shift enough during the next two years to make it economically beneficial to keep Duane Arnold operating, perhaps under a different ownership structure.

In the meantime, I want to express my sadness and empathy for the people who are employed at Duane Arnold and who had every reason to believe that their jobs were secure and that their families would have long term stability in their chosen homes.

I agree 100% with the sadness & empathy. I experienced the loss of the Kewaunee Nuclear Plant just a few miles north of my former employer. It left a huge hole in the local economy & affected hundreds directly and many thousands indirectly.

Think you’re missing a “be” there.

Thank you. Corrected

All of this is due to the regularly-oversupplied condition of the Iowa grid.

I’ve got to get cracking on my idea to eliminate these oversupplies. I’ve been remiss.

I’ve lived about an hour south of DAEC for a couple decades, in Iowa City. This will no doubt further Sen Grassley’s legacy of “bringing clean energy to Iowa”. Along with wind & biomass, solar is also enjoying a subsidized sales boom in Iowa.

A few local environmental groups are less opposed to nuclear energy than in the past, in part because Iowa born & educated James Hansen (U of Iowa) returns occasionally to speak.

I would disagree with Mr Adam’s portrayal of DAEC as being in a small, rural area. While technically correct with the immediate surroundings, downtown Cedar Rapids is barely a half hours drive away. The major employer in Cedar Rapids is Rockwell Collins which makes electrical components for NASA, the military, & civilian applications (like those black boxes on commercial flights!). Non-rural communities are well within commuting distance.

Needless to say, I’ll be following this situation with great interest. I’m hoping that this is merely a negotiating tactic, but fear it’s not.

@Chris Bergan

Thank you for visiting Atomic Insights and sharing your valuable local insights. Since I spent 9 years commuting to a job more than 40 miles from my house, I tend to agree with your position that a 30 minute drive is practically next door.

I have a quibble with your comment about Sen Grassley’s legacy – clean energy development that forces closure of a clean energy production source is one step forward and several steps backward. That is, if the true goal for clean energy advocacy is reducing pollution and greenhouse gas emissions.

I suspect that there is plenty of land available near the plant site and I know that there are several energy intensive industries in Iowa, including ethanol distillers. I wonder if anyone has considered the financial opportunities of attempting to attract energy customers to build facilities close enough to the plant to engage in direct power purchase agreements?

Perhaps not yet, because the current owners would have no interest in such a development.

Thanks for the kind response.

My comment about the senator was meant to be sarcastic, hard to do in print sometimes. Personally I feel that a CIPK above 100 isn’t so clean.

Here’s a statement from Grassley made a decade ago, which may well be ttweaked & rereleased in the near future. Though he has thankfully been voting in favor of advanced nuclear- in other states AFAIK.

https://www.grassley.senate.gov/news/news-releases/grassley-senate-passes-tax-incentives-renewable-clean-burning-energy

Forget electric power, think steam. The major energy needs of a distillery are for mashing the grain (hydrolyzing starches to sugars) and distilling. Both of these are fully satisfied with low-grade heat, roughly the boiling point of water if not less for a vacuum still. They could be fed with steam tapped off the low-pressure turbines.

DA is rated 1912 MW(th) and either 601 or 615 MW(e), depending on the source. That means there’s in excess of 1300 MW(th) of thermal power (4400 mmBTU/hr) potentially available for distillation. At 84,000 BTU/gallon of thermal input for all processing steps, DA should be able to support the production of 52,800 GPH of fuel ethanol. At 90% capacity factor this comes to 417 million GPY. This is more than 10% of the ethanol produced in Iowa and it would have by far the lowest carbon footprint.

Displacing 4400 mmBTU/hr @ $3/mmBTU and 90% CF is $104 million in displaced fuel per year. This looks like it could be wildly profitable.

If the stills can tolerate rapid variations in steam flow (and I don’t see why not), the steam taps could be throttled to ramp the electric power output rapidly. This would allow DAEC to enter the market for balancing power and spinning reserve. That could be worth quite a bit more than mere energy and keep the plant profitable (maybe $5 million/yr for 200 MW of fast-ramping power). That’s not nearly as profitable as the displaced natural gas for the stills, but a nice chunk of change anyway.

The one fly in the ointment is that DA is a BWR and there are issues with N-16 in the steam. The hot ends of the stills will be off-limits to humans while in operation and shielding will be required in the plant design. Is this a problem?

@E-P

There’s a reason I wrote “energy customers” and not “electricity customers.”

The comment has been suggested to use the steam from the DAEC. Being a BWR, won’t the steam be slightly radioactive? May be a tough sell w/o additional heat exchangers.

But you wrote “power purchase”.

I like to spell out some of the alternatives, get the inside-the-box types to see what’s outside it.

Rod, please delete or repair my post above. I have no idea what the hell happened.

@Bonds 25

Deleted. I wasn’t confident that I could repair it to what you intended. Please resubmit if possible.

I consider myself moderately well-informed, yet I don’t get a good picture of how these boilers work: what supplies their heat, what supplies their feedwater, what makes one radioactive and one non-radioactive. Care to elucidate?

“I consider myself moderately well-informed, yet I don’t get a good picture of how these boilers work: what supplies their heat, what supplies their feedwater, what makes one radioactive and one non-radioactive. Care to elucidate?”

Our “A” Seal Steam Evaporator supplies sealing steam for the various turbine components and uses condensate water (contaminated) which is heated via main steam at low reactor power and 4th stage extraction steam at high reactor power.

Our “B” Seal Steam Evaporator supplies heating steam (when needed) to our power block and general service building (non-RCA) and uses demineralized water (non radioactive) which is also heated via main steam at low reactor power and extraction steam at high reactor power.

They are both u-tube, kettle type boilers. Kinda like how PWR’s steam is non radioactive while using radioactive water as the heat source.

When we are offline our Aux boiler (diesel) can supply heating steam and during start up it will supply seal steam until main steam is available. The “B” Seal Steam Evaporator and Aux Boiler only use demin water, so the water becomes part of our contaminated water inventory when being used for actual seal steam purposes.

We went through a similar situation with Palisades in Michigan a few years ago. The utility and Entergy agreed to a $172 million buyout and early closure. The Michigan PSC only agreed to have $135 million paid for by ratepayers and the parties eventually dropped the early termination of the PPA. So I would say that if the Duane Arnold situation still needs to go through the regulators then there is a lot that can happen. If the Michigan deal had stayed in place then Palisades would be closing this September.

I also wonder if the local grid operator, MISO, has weighed in on Duane Arnold yet. They would probably want to see a capacity needs analysis and a determination of whether the plant is needed for voltage support or reliability, etc. I suspect this announcement is new to MISO as well and they are just beginning to examine the consequences, so there is also a lot that could happen in this process too.

Looks like they are still to be the victim of bizarre economics.

http://www.wndu.com/content/news/Palisades-power-plant-to-undergo-accelerated-decommissioning-after-sale-489949701.html

I don’t care if they did create ACEMAN. I still hate to see them shut down.

Yes and no. They won’t make it to the end of the license because Entergy does not want to renew the PPA, which ends in 2022. They were going to retire four years earlier based on the proposed agreement, which was subject to regulatory approval. Entergy could probably be persuaded to operate the plant to end of license if the right PPA offer came along, but the chances of that are extremely slim.

I remember the days of “ACEMAN”! Good times…

To paraphrase H.L. Mencken, we deserve the energy policy we get. Good and hard.

This reminds me of a blog post I wrote when the VT government was pushing for contracts with Hydro Quebec.

“Vermont couldn’t qualify for a fixed rate contract with HQ. We couldn’t qualify for a better deal. We had to take whatever they would give us, and they are giving us market price power. (By the way, HQ says they will give us more of the same, if we shut down Vermont Yankee and need more of their power. You can take the words “give us more of the same” any way you choose.)”

https://yesvy.blogspot.com/2010/12/bad-deal-with-hydro-quebec.html#.W2HziC3MzUI

Your post gave me a chuckle on a dark day! Thank you.

It’s a tiny plant – single unit – its days are numbered – end of story.

Maybe they can burn subsidized ethanol – or better yet, just burn the corn – whichever games the subsidies better for the farmers.

The claim in the article is that wind power is killing the DAEC. You can’t have wind without backup natural gas power plants. So is it actually a combination of wind and cheap natural gas?

The cheap natural gas is made possible by oil shale. I’ve heard there is a lot of oil shale left to be exploited. Are the larger nuclear units at risk of early shutdown?

@Eino

Cheap wind in large enough chunks is enough to make nuclear uneconomical, even if there is an occasional need to use expensive natural gas burning inefficiently in simple cycle gas turbines. The periods of low wind and/or really high demand can drive electricity prices to extremely high levels, but nuclear plants have no ability to ramp up above their rated power limit to take advantage of the peak and sell a lot more of their product. When the high price period ends, wholesale prices crash back down and remain low as long as there is a lot of wind available. Remember, a lot of the capital costs of a wind turbine get paid for by tax credits, RECs and accelerated depreciation (as long as the owner is a taxable entity or can arrange for a swap of the tax benefits in exchange for cash from a profitable entity – like a bank.)

Check out this explanatory presentation from the National Renewable Energy Laboratory. https://www.energy.gov/sites/prod/files/2016/09/f33/Schwabe.pdf

As they are building more wind machines, I suspect the same thing may then happen with larger units. The exception could be if stability studies mandate their continued use. However, backup gas can quickly be constructed to fill the gap when the wind turbines are not available.

@Eino

Yes. If the trend continues, a much larger set of nuclear plants will be at risk. As the number of units spirals down, remaining units will experience upward cost pressures as the number of viable suppliers for fuel and other services will fall.

We’re in a crisis and there’s not enough effort being made to avoid the tragic end–yet.

We must be vigilant and ensure that there are no additional extensions of the debilitating wind and solar (or any other “renewable” energy) production tax credits.

The industry MUST avoid the seductive trap of aligning itself politically with renewable advocates. We must not make a self defeating deal to allow their credits to be renewed in return for getting a ZEC for ourselves. History has proven that the credits aimed at nuclear are always more restrictive and less generous than those aimed elsewhere. In some cases, they have been cleverly promised to happen only after a very lengthy delay or upon completion of a project that may never achieve completion.

The NREL explains why Warren Buffett’s American Electric Power (AEP) is trying to build a 4.5 billion dollar wind farm in Texas. As he said in Omaha in 2014: “For example, on wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.” And this following article explains how he saves $Billions on tax credits.

http://nlpc.org/2014/05/22/how-warren-buffet-fleeces-consumers-taxpayers-through-wind-energy/

Note that these are “Tax Credits” not tax deductions. A Tax Credit offsets real dollars owed.

Have to wonder what the estimated TWh of the ‘replacement’ wind turbines are compared to DA. Could be a good data point for arguing for retention.

Does NRC even have a process for permitting the sale of steam from a nuclear plant? If they don’t have a chapter-&-verse, they charge YOU for the work involved in developing one, which strikes me as seriously unfair.

Practically speaking, even forgetting the radioactivity, if you want to tap heat off, you’re going to need a steam transformer like the one they had at Kahl, just in order to avoid surges in makeup feedwater requirements. That’s going to be a costly piece of equipment, although nothing like the steam generator in a PWR.

There certainly is, otherwise the original Midland nuclear cogeneration project could never have been planned. Time to dust it off and see if it’s usable?

I have no idea what was at Kahl, but externally heating a still, externally heating a mashing tun, heating a bed on which distiller’s grains are dried, etc… these are all non-consumptive uses of steam and would condense it back to feedwater.

Microchannel heat exchangers are fairly cheap these days and I suspect would meet the definition of your “steam transformer”.

The Poet: “what makes one radioactive and one non-radioactive. Care to elucidate?”

BWR and Steam radioactivity from Wikipedia:

Steam produced in the reactor core passes through steam separators and dryer plates above the core and then directly to the turbine, which is part of the reactor circuit. Because the water around the core of a reactor is always contaminated with traces of radionuclides, the turbine must be shielded during normal operation, and radiological protection must be provided during maintenance. The increased cost related to operation and maintenance of a BWR tends to balance the savings due to the simpler design and greater thermal efficiency of a BWR when compared with a PWR. Most of the radioactivity in the water is very short-lived (mostly N-16, with a 7-second half-life), so the turbine hall can be entered soon after the reactor is shut down.

From Wikipedia: https://en.wikipedia.org/wiki/Boiling_water_reactor

I guess Midland reactors never produced the steam because it was converted into a gas plant. It was to be a PWR. Quite a while ago. I believe Bechtel and Consumers began to close the doors on that project around 1982.

That still doesn’t explain the 2 sets of boilers, what heats them, why the difference, what is seal steam used for, etc. I have looked at the cost of heat exchangers to put an extra barrier between turbine steam and a downstream heat load, and with the microchannel technology that cost is greatly reduced over conventional shell-and-tube.

I gather that Midland collapsed because of slipshod soil compaction under the diesel generator building, and it was tilting out of spec. They switched to gas with the heat-recovery steam generators feeding the chemical plant as the reactors had been intended to. One of the RPV heads later went to replace a corroded one at Davis-Besse.

The Poet:

“That still doesn’t explain the 2 sets of boilers, what heats them, why the difference, what is seal steam used for, etc.

I can’t help you there. BWR steam is “wet” steam at about 1000 lbs so you’d have to contact a vendor to see what kind of heat exchange unit would be needed.

https://www.tu-chemnitz.de/phil/english/sections/linguist/independent/kursmaterialien/TechComm/acchtml/compx1.html

I’ve only heard of seal steam in a turbine.

https://www.quora.com/How-does-the-steam-turbine-gland-sealing-system-work

I’m 0 for 2 but there are a lot of smart people that read this site that can tell you more than you want to know.

I’m obviously not a mechanical engineer.

It’s a lot less complicated than that. The steam we’re interested in for running the world’s greenest ethanol plant is tapped off the LP turbine at maybe 100-120 C and 1-2 bar absolute, maybe lower for mashing. This is pretty much bog standard stuff.

Obviously that’s where it’s going, and I suspect that it’s to prevent air from infiltrating the shaft seals which have vacuum on the other side, but I’m intensely curious about this now because I’m sure there’s interesting quirks to it.

I’m not either. I don’t let things like that stop me.

EIA’s recent transmission report from June 2018, states that MISO’s variable energy resources are expected to increase from 17.1 GW in 2016 to 32.6 GW by 2020, with the vast majority of the capacity coming from wind. Figure 11 in the report illustrates MISO’s wind capacity over time – the dramatic uptick of installed wind by 2020 correlates well with the timing of this recent plant closure announcement.

https://www.eia.gov/analysis/studies/electricity/hvdctransmission/pdf/transmission.pdf

I encourage all to visit the websites for National Wind Watch and Wind action. It will show you the vast number of allies we could work with to put a halt to subsidized wind. We need a national umbrella group in the U.S. to support anti-wind efforts , this does not really exist yet although the organizations above do what they can. The number one priority would be repealing these subsidies and lobbying against wind on range of issues.I urge you to help support local anti- wind groups with your time and money but it seems the anti-wind movement needs a true national group and we could help organize it, it would organize legal challenges , provide a information service and stage large protests and citizen as well as professional lobbying efforts , media efforts would boost awareness and it might increase fund raising through centralized and nationally directed campaigns. We would also have a PAC to assist anti-wind candidates.

The wind and solar subsidies are due to expire in 3 years. All we have to do is make sure they don’t get extended again.

The real problem is state/regional, in the form of portfolio standards and REC credits. If we could sneak something into a bill which requires nuclear to be given the same REC status as wind and PV and also cover it under RPSs, it would turn the playing field around overnight.

And get the feds to change the licensing rules for nuclear electricity generators, so even if they are shut down, it is not a build-a-new-one expense to open them back up again…

I agree that the RPS is a problem, but I think there is another facet that you are missing. Many Fortune 100 and 500 companies are adding corporate sustainability goals. I wish that these goals were carbon free electricity, but they are not. They are usually 100% renewable electricity goals. Municipalities are making similar commitments. While morphing RECs into ZECs and including nuclear could be a good thing, I would prefer to see a carbon tax. RECs and ZECs could be easy to manipulate, as pointed out earlier. While a carbon tax could also have loopholes, I see it as a simpler solution with less potential for fraud.

You go to the climate war with the policies you have, not the policies you wish you had.

We have RPSs and sustainability standards. It will be VASTLY easier to simply mandate that nuclear be included as zero-emission power than to get a carbon tax, and any outrage from the Greens will reveal them as the tools of the fossil lobby that they are.

@E-P

Rummy, author of the quote about going into war, wasn’t much of a historian.

With few exceptions, the armaments used to win wars have often been produced and sometimes even invented after the war began.

So, Rod… how’s the development going on that carbon-tax weapon? Will it be ready for the field any time soon?

I would say that the development of the “carbon tax weapon” is going quite well.

Citizens’ Climate Lobby (CCL) , one of the main groups working for carbon pricing, is growing rapidly (see link below). Two months ago, ~1400 of us met in Washington and had lobby meetings with almost every congressional office. California’s state legislature passed a resolution endorsing the carbon pricing policy proposed by CCL. The CCL-sponsored, bipartisan Climate Solutions Caucus in the House now has 43 Republican members on it.

https://citizensclimatelobby.org/about-ccl/accomplishments/

Exelon, along with several other major energy companies, decided to throw their support behind the lobbying efforts of the Climate Leadership Council, which is run by several former Republican leaders. Exelon alone is contributing $1 million to the effort. The CLC’s proposed carbon pricing policy is very similar to that proposed by CCL.

https://www.eenews.net/stories/1060085977

Seven bills that put a price on CO2 emissions have been recently introduced in the House or Senate. A month or so ago, a CO2 pricing bill was introduced by a Republican congressman.

In policy circles, policies that put a price on CO2 emissions a pretty much all policy wonks are considering and talking about, with respect to serious, effective climate policy. After all, economists agree that such policies are, by far, the most effective, lowest cost way of reducing emissions.

I was part of the local CCL chapter for roughly a year. They are organized top-down, no input from the plebes wanted. Never once did anyone on the monthly teleconference so much as mention nuclear power (wind got a lot of air time), and when I kept mentioning it I was told to shut up.

If CCL is actually pro-nuclear it is a total stealth operation. Carbon taxes will operate to the advantage of nuclear, BUT as with RPSs we can expect our opponents to try to write nuclear out of the eligibility criteria or even tax it as if it burned FF.

Unless they are also accompanied by import duties to price in the emissions of foreign producers, they will also have the effect of moving energy-intensive manufacture overseas. Given that a large fraction of the particulate pollution in the western states comes all the way from Asia, increasing such incentives is a really bad idea.

tl;dr It’s not enough to do something, you have to do it right.

“Exelon alone is contributing $1 million to the effort.”

Search “Exelon Wind Turbine” the number of hits with all three words visible in the few lines given are staggering. Exelon is probably a proponent of Warren Buffett’s adage “Wind is good for the bottom line”

I worked at Duane Arnold in Ops Training as a BWR SRO Instructor.

The plant is small compared to most operating plants, it is the only 89 Control Rod BWR that I know of. That said, it has always been well ran by some rater outstanding staff. Back when I worked there, Alliant Energy owned it. This was when deregulation was fairly novel and wind power was insignificant. When deregulation changed the utility industry, “next decade” power was supplanted by “current quarter” earnings.

Decommissioning offers a lot to the bean counter’s mind. 1) Access to Decommissioning Funds is current year cash flow. 2) Write off of existing capital is a tax advantage. 3) Future budgets for expanding Spent Fuel Cask Storage Installation capacity goes off the books. 4) Higher spot market prices accommodated by reduced base load in the market makes “other assets” more profitable.

Sad to say, but I’ve always looked at the technological aspects of the industry, and the folks I talk to have mentioned a whole lot of financial factors that are external to the Main Control Rooms I grew up in.

I will miss Duane Arnold. The nicest people in the whole Midwest. The story of Tripod the three legged deer. Waffles on Friday morning. There’s a lot more going away than most people know.

Rob –

As a former employee of Point Beach during Wisconsin Electric, Nuclear Management, and NextEra days, I spent a bit of time at DAEC & always enjoyed it. The drywell, not so much, but the people were great – just like “The Beach.”

You’re absolutely correct re: decommissioning funds and spot market prices. NEE has built heavily in wind in IA & MN, and will benefit from the increase in prices for that power once DAEC is shuttered. I suspect that they’ll also go the route of Entergy & sell the place to someone like Holtec for decommissioning.

The sad thing is that I read that once the site is reverted to “greenfield”, the intent is to put wind or solar generators in combination with a grid storage system. What a waste of an approved power plant site with a heat sink included. Those will be increasingly rare in the future as greenies use “heat pollution” as a tactic to stall all non-renwable energy projects. Even if San Onofre and Diablo Canyon were not closed for the reasons given, they would have eventually faced prohibitively costly backfits by the California Coastal Commission.

I suspect that 5 or more years from now when the site will be able to host such a facility, the attitude towards wind and solar will be, “What were we thinking?”

DAEC won’t be decommissioned for a long time unless there’s a financial incentive to do so. Dose rates are very high in the beltline region of the vessel and won’t delay quickly.

The concern isn’t time to decommissioning. It’s the reversibility of the surrender of the operating license. It should only require a return of the plant to its previous operating condition, but I’m told the NRC simply doesn’t allow that; it has to meet new specs.

Maybe if there’s a repeat of this year’s NE cold snap which actually results in blackouts, this issue can be brought to the fore WRT Vermont Yankee and the rest of the retired-but-not-dismantled fleet by extension.

Only hope is state ZEC like NY, NJ and Il or some intervention by the Feds through the FERC. Same with the plants in OH and PA.

At this moment its the only game in town to counteract the wind/solar subsidies.

Quite frankly I have more hope for OH/PA plants than Duane Arnold.

The states of NY, IL, NJ and CT are not in great financial condition.

Then they’re not in good shape to lose the tax base and payrolls of their nuclear plants, are they?

But some of the people living in all of those states have substantial means.

Rod, do you expect those people to subsidize the general public?

Why not? Many of them have been subsidized by the public for years.

I don’t know if the financial support to keep the nuclear plants in those states is paid for by taxpayers or ratepayers. But if there is a financial squeeze on either state finances or a general economic downturn (and at least one, perhaps both are likely in the next few years), there will be tremendous pressure to reduce or eliminate this support. Counting on politicians or voters to make rational decisions under these circumstances is expecting a lot.

As far as I know, the zero emission credit programs obtain their funds from rate adjustments, not taxes.

Yes, I realize that the ven diagram of taxpayer and ratepayer is roughly two identical, overlapping circles, but government finance challenges shouldn’t affect the programs.

I very much doubt that the people who’ve been leeching off the public for years are in any mood to “give back”.

You guys are looking at some sort of support to keep the nukes going. The nukes paid for themselves in the past. The ratepayers have kept the nukes going in the past. Other than bloated security, I am not aware of any significant programs that have caused the nukes to have their prices rise much over the rate of inflation. So, wouldn’t the difference to the ratepayers simply be the difference between the nukes cost and gas plants? I’ll bet if there was a small nuke surcharge, most ratepayers would hardly see much of a difference in their bill.

The argument to support it could be diversified energy. It does seem that a lot of utilities are going heavily on the wind / natural gas option. Having diversification smooths the energy ride into the future.

Just don’t call it a nuke surcharge. Call it a clean energy surcharge.

The response to Sept 11, 2001 terrorist attacks & the melt-downs at Fukushima-Daiichi have drastically affected the bottom line of the plants in the U.S. Both events caused a large amount of spending with no additional generation capacity. No other form of electrical generation in the U.S. had to respond anywhere close to the level of nuclear power.

In both cases, these responses were driven by the NRC (or by the industry’s attempt to stave off even more onerous requirements).

Just imagine if same capital outlay had been usefully invested in power uprates or new capacity additions.

Could have been a possible game-changer, especially for single-unit sites in smaller required staffing levels.

Note that MISO is not “stellar” when it comes to CIPK.

Shutting Duane Arnold will just mean more gas.

This link is great.

https://www.electricitymap.org/?page=map&solar=false&remote=true&wind=false

MISO as I post this is at 574g

Ontario is really the model at 66g and it of course is heavily nuclear. Really have to get on the CIPK limit bandwagon long term. Federal probably a little rough today but state level may have more success.

I’d like to follow up on a comment made by @JamesEHopf concerning CCL’s policy for advocating its version of a Carbon Fee and Dividend. And I bring this up for the purposes of discussion and clarification. My understanding is that the fee is to be imposed on the extractors of carbon and not the entities that actually refine or burn the carbon. The current proposals seem to be focused upon the taxing the production of CO2/CH4 that ends up in our atmosphere. I agree that the ultimate goal is to keep CO2 and CH4 out of the air, but I was under the impression that it was easier to do that by measuring carbon at the point of extraction or importation than to measure the stuff coming out of smokestacks or tailpipes. Is that true? Is this distinction relevant or not?

Thank you for the explanation.

It raises further questions. This contaminated (radioactive) seal steam… what besides N-14 are the contaminants, does it contaminate the turbine building in general or do you have mechanisms to prevent that, and is its purpose to prevent air from leaking past the sub-atmospheric seals as I guessed or does it have another purpose?

@E-P

N-16 has an 8 second half life. It does not contribute to concerns about contamination in BWR’s, though it is a source of general area radiation during reactor operation at power.

Don’t you mean N-16? N-14 is stable and the most abundant nitrogen isotope.

I believe both you and Rod are referring to N-16 which during operation is the contributing factor for high energy gamma radiation dose rates inside the turbine building. With just over a 7 second half life…..its gone very quickly upon plant shutdown. As far as seal steam contamination is concerned, its minimal due to the condensate which feeds the seal steam evaporators having been significantly cleaned up via condensate filter demineralizers (ion exchangers using resin) following its journey through the reactor core. Most likely very low levels of residual Cobalt-60 and other activated corrosion products.

The purpose of the sealing steam system is: 1. Prevent air leakage into and the steam leakage out of supplied components 2. Supply steam to the auxiliary steam system (heating steam) when needed.

ZEC are a means of rewarding generators who do not emit GHG. Solar/wind are already rewarded and would not exist without such credit. So I see no rational argument against ZEC for nuclear in today’s market. It just levels the playing field. It does not skew it. It unskews it.

That’s if you think zero emissions should be rewarded. If you don’t just remove all subsidies. There will be no more solar/wind but that also levels the playing field.

Another option is a CIPK limit. We limit other emissions so why should carbon not be limited the same was as sulphur dioxide emissions are for coal plants.

I like this option because it gets government out of the technology picking business. They protect the environment with a CIPK limit. Engineers then pick the technology to comply with the limit.

Since wind and solar have only 30% capacity factors, the natural gas generation required to back them up should be factored in their carbon emissions.

Of course, once Chinese solar panels and wind turbines are no longer cheap and natural gas returns to historical prices, green power will no longer be cheap.

Some of these things have capacity factors substantially under 30%.

I hope to use this to make points.

I’ve worked at DAEC almost a decade and I just wanted to mention that when the anouncement was originally made, it was found out through a local news release on KCRG and it took almost two days before the company (NextEra) even bothered to address it to us. We had been told that the plant was no longer viable…after several years being forced to spend millions on costly security and FLEX upgrades. Its been ridiculous.