Chesapeake Energy wants “five or six dollar” gas

CNBC’s Jim Cramer invited Aubrey McClendon, the CEO of Chesapeake Energy, onto his Mad Money show on June 28, 2011 to talk about the recent Ian Urbina articles (June 26, June 27, and June 28) in the New York Times. Cramer wanted to give McClendon a chance to tell the natural gas story from a different point of view – the headline of the online article describing the interview is Chesapeake CEO McClendon Defends Natural Gas.

For the past year, Cramer has been fairly negative about investing in the stock of natural gas focused companies because their return on investment has not been competitive due to the temporarily low sales prices that their commodity is receiving in the energy market. As he explains it in his introduction to the segment, that is why he was confused by the Urbina articles – if gas prices are low (today), how can Urbina truthfully claim that natural gas producers are exaggerating their reserves?

As noted in the Atomic Insights post titled Good for ExxonMobil does not mean good for American public, the story is a little more subtle than the one that the oil&gas industry (all one word because it is all one industry) is telling the public. To fully comprehend the issue, you have to listen to the tales that the industry is telling the public in its advertising, telling large customers – electric utility companies, chemical companies, fertilizer manufacturers – during its marketing presentations, telling local governments, telling state governments, telling the federal government, telling investors, and, perhaps most importantly, telling each other.

Each one of the stories that the industry tells has a slightly different slant, depending on the audience. I do not want to get too involved in recounting them here, but one example can be found by listening carefully to what McClendon told Cramer’s audience, a segment of the investment community. He told them that there is plenty of gas out there, but that Chesapeake is moving more of its resources into drilling for hydrocarbon liquids while waiting for prices to move up into the $5 to $6 per million BTU range.

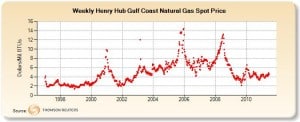

That might sound like a reasonable price to some people, but it is a 100% price increase over the level that existed just a year ago, when natural gas prices dropped below $3 per million BTU. McClendon probably expects that energy industry investors will be smart enough to realize that if an extraction company waits until after natural gas prices experience a sharp price increase to start a new drilling program, there will be an overshoot in the price, with good returns for many months before the new supply hits the market.

After listening to all of the stories that the industry is telling, you also have to watch their actions; those often provide a much better insight than listening to any selection of the various stories. One of the actions that the oil&gas industry has taken in recent years is to invest hundreds of billions of dollars into increasing its capacity to transport Liquified Natural Gas (LNG) around the world. From a long term perspective, it makes perfect investment sense for companies like Exxon, Shell, Chevron, and BP to overproduce shale gas in the US for a few years to keep prices low and build the market demand.

When production from the rapidly depleting “plays” falls off a cliff, the same multinational companies that influenced our entire political system because of an economic addiction to low extraction cost petroleum from the Middle East and Africa oil will add a dependence on Qatari, Australian, Azeri, Iranian, Russian and UAE natural gas.

The dependency relationship between supplier and customer when natural gas is the fuel is amplified compared to both oil and coal. Those fuels are energy dense enough so that most customers can maintain substantial inventories, giving them at least a little leverage and choice when they need to buy more fuel. With natural gas, it is close to impossible for an individual customer to keep more than a few days worth of supply on hand. For many non-utility customers, if there is any inventory at all, it is measured in minutes or hours.

I am fairly certain that Atomic Insights readers will quickly pick up on the elephant that neither participant was willing to notice – the focus in the interview was on the cleanliness and economic competition between natural gas and coal. The ‘N’ word never came up. One of the biggest impacts that temporarily cheap natural gas has had in the energy market has been to provide utility company decision makers with an excuse for not aggressively pursuing new nuclear power plants.

I can testify from personal experience that planning and licensing a new nuclear project is hard, time-consuming work whose end date gets farther away the longer you wait to start the project. (I do not yet have personal experience in actually building, but that is coming soon, I hope.) There are plenty of people who are capable and interested in the work, but they all have a wealth of other opportunities. Building a productive nuclear project design team takes time, especially if some of the most talented members have been discouraged by going through several cycles of hiring and potential layoffs.

Cheap natural gas is a chimera. Shale gas may be exciting and could prove to be relatively abundant for several years, but never forget that the industry has moved in the direction of hydraulic fracturing out of necessity; conventional reservoirs are rapidly depleting. Fracking is a more capital and knowledge intensive way of producing gas than operating productive wells in more permeable formations, but it is a way to overcome inevitable depletion to keep production up so that it essentially matches the production level achieved 45 years ago – for a while.

As is natural for any extraction enterprise, the gas companies are drilling in the most productive areas first. They are also drilling in places that are close to existing transportation nodes. As those areas deplete, prices will HAVE to go up considerably to support the additional investment required to drill in slightly less productive areas as well as the investment needed to add transportation capacity. In a stark contrast with oil, transporting natural gas can double, triple or even quadruple the delivered price compared to the extraction cost at the well head. Moving material that is naturally a vapor is a physical challenge that requires high pressures, refrigeration, and expensive infrastructure that can require as much political interaction as building a new nuclear plant. Earning a return on those investments often requires 20 or more years of steady sales (take or pay contracts) at prices significantly higher than today’s market price.

Bottom line – the interests of a guy like McClendon, or even a guy like Jim Cramer are not aligned with the overall interests of the rest of the population. They like high priced energy that provides the people who invest in energy production companies with higher rates of return. The rest of us want clean, cheap, abundant energy that will remain available for our children, grandchildren and even great-great-great grandchildren.

I agree with both Cramer and McClendon that wind cannot do the job, but I am positive that atomic fission has demonstrated that it has the potential to provide the energy supply that society needs and desires.

Don’t expect to hear that from oil&gas company leadership.

The idea of the oil&gas companies using this shale gas as a means to bridge the gap of maintaining a high level of demand for the future LNG installations they have in the works makes a considerable amount of sense strategically.

I hadn’t quite thought about that angle yet.

Also, I would guess that XOM and CHK would both be at least a bit (if not extremely) disappointed if gas is still at only $5 or $6 five years from now.

Rod,

It’s interesting that you point out that the industry has spent a lot on *international* LNG distribution capability.

One thing that has puzzled me over the last 5 or 10 years, whenever I hear the “Drill Baby, Drill!” crowd giving their spiel, is that they seem to think that if we drill for oil and gas in America, it will be sold and USED in America, resulting in lower prices for Americans.

It’s always seemed to me that if oil & gas companies are drilling in America, there’s nothing stopping them from selling the oil & gas to China, India, Europe, Australia, etc.

In other words, the oil & gas industry, I think, has no patriotic drive to lower fuel prices in America – they want to sell the oil and gas to the highest bidder, which still means we’ll have to outbid every other country for our OWN oil & gas.

So, how will “Drill Baby, Drill” do ANYTHING to help us with lower energy prices?

Some would probably argue that any time you increase production, it will increase supply, lowering costs. That has been true with Gas in the U.S., but I expect that’s because the infrastructure wasn’t in place to export the gas en masse? As more and more of that export infrastructure comes online, I would expect the price to rise up to that $5-6 range that Chesapeake predicts – after all, they should be in a very good position to predict such things.

@Jeff S

The domestic producers of gas (and somewhat for oil) have the advantage of lower transportation costs. LNG export facilities are expensive and require substantial energy input to liquify the gas. Add on to that the cost of the specialized ships and the energy consumed to get the LNG from origin to destination.

Domestic producers need only get their gas to an existing pipeline.

The long and the short of all this is that domestic producers can compete successfully even with a higher wellhead price than for gas in (say) the Middle East.

This points out the great advantage of nuclear, where the fuel costs are so low that the details about the origin of the fuel are not very important.

@don,

I think perhaps you are a bit confused about what I was saying, BUT perhaps your point is still valid. I wasn’t talking about the price of IMPORTING fuel from Middle East, Africa, etc. I was talking about the fact that, if Exxon or BP or Chesapeake is producing NatGas in Pennsylvania, they could just as easily EXPORT the fuel to other places, as to sell it to people in the U.S.

So, as long as China or India or Europe are willing to pay the high transport costs PLUS a higher price for the gas, the export market will tend to keep the price of natgas high here in the U.S. Higher than it would be if there were no exports.

However, since those transport costs *are* high, if it’s cheaper for, e.g. Europe to buy gas or oil from Russia or N.Africa, off a pipeline, then I suppose they probably would, which might make domestic gas cheaper.

The US actually exports a lot of liquid petroleum in the form of diesel fuel to Europe, which uses more dsl than gasoline. Something like 2 million BPD or some large figure. If the US were NOT allowed to export this, I suspect prices for gasoline would drop a lot.

@David Walters

If the US did not allow export of diesel fuel, I would expect the price of diesel fuel to drop (increased supply) but the price of gasoline to increase so that refiners could maintain profit margins. The other half of the diesel fuel trade with Europe is the importation of gasoline. The refineries in the US are optimized to produce gasoline but produce more diesel than is needed. The refineries in Europe are optimized to produce diesel, but produce more gasoline than needed. Those tankers hauling diesel fuel to Europe don’t come back empty.

@Jeff S

Yeah, I really didn’t say what I wanted to say very well. The point I was trying to make is that US natural gas production is not competative on the world market due to higher costs. But domestically produced gas IS competative with LNG because domestic gas does not need to pay the extra costs associated with LNG.

Clearly it is not the commodity but stock trading that is at issue! Stock trading is not going away anytime soon and whether it is water or fuel Wall Street drives the prices.

Can Wall Street control the price of steam production? They can control the price on almost anything. Whether is price controls on commodities or the technology of nuclear steam they control the price to the Utility rate payer. However, I note that the appeal is always to the rate payers and in turn to venture capital.

I think it is time to bring online a technology that Wall Street has not dreamed of yet. It would buy time for the rate payers from exploitation by Wall Street. If suddenly nuke plants converted to cavitation steam vs. the type “fallen out of favor” for no reason Wall Street would be blind sided. Simply go around the NRC using “Semi-Nuclear Cavitation Steam”. Beware of the DOE, also run by Executive Branch policy. This all begs the question do we, the rate payers, determine our destiny?

About ratepayers controlling their destiny: I’m convinced the conflict between anti-nukes and pro-nukes will never be solved until we put the decision in the hands of the consumers. In the same way that consumers can today opt for a “green” energy plan or “100% wind” energy plan, they should be able to choose any other form, coal, gas, and nuclear, aswell. Political decisions are fine as long as they are good decisions (such as in France) but they can turn quickly against the ratepayers. If consumers were choosing their source of electricity, and have to pay for it in full without subsidies, it would eliminate large numbers of hypocritical anti-nukes that “vote” against nuclear but want cheap electricity for themselves, and it would make it very hard for green organizations to interfere in energy production. The motto should be, if the people really want green energy, then lets put it to the test, let them vote with their wallets – we all what the outcome would be.

I recently called/emailed half a dozen power distributers that offer “green” energy plans and confirmed my suspicion that none of them offer a 100% nuclear energy plan. If anyone knows of one, please let me know. I’d like to throw money at them.

@Chuck, I know, it’s not being offered anwhere I know of either. I don’t know the exact details, but they have a scheme for green energy that involves renewable energy “certificates”, so for example, when the wind farms in Texas don’t produce enough to supply all the customers that have a wind power plan (actually some web hosting datacenters in Texas advertise they are wind powered), they have to buy certificates instead, and these are supposed to fund more wind power. Now, while this isn’t ever going to work because wind power needs backup and is too expensive without subsidies, it CAN work with nuclear, coal, gas, hydro.

@Jerry, Chuck – I presume you’re talking about the situation in the US for voting with your wallet and buying nuclear electricity. The situation is the same in Alberta. Bullfrog Power offers

Curse you, Environment Canada! Someone’s head is where the sun doesn’t shine… 😉

Seriously, though, it’s great to hear that other people want to put their money where their mouth is in support of nuclear energy.

Free kownlgede like this doesn’t just help, it promote democracy. Thank you.

I had an idea for a “Nuclear Power Switch” program (loosely similar to TVA’s Green Power Switch program) about 9 or 10 months ago.

The response the idea got was basically that such a program wouldn’t be a very good way to fund nuclear projects and that it wasn’t needed to fund nuclear projects. I agreed with that response, but those were far from the reasons I had the idea. One primary reason behind the idea was simply to gain some positive PR in regards to nuclear power.

A large portion of my idea was to use the money paid into this hypothetical nuclear power switch program as a substitute for a fuel cost adjustment that is variable month-to-month to hedge against huge fuel price swings for the nuclear power switch customers’ bills. This aspect of the idea was not specifically responded to.

I was a Chesapeake shareholder for about 10 years; it put my daughter through college. It is a well run, conservatively managed company that sticks to business and does not look for favors from the government like the “green” industry or tragically corrupted GE.

I have held my tongue as long as possible. Your recent demonization of shale gas and the fracturing breakthrough that has changed the energy market has discouraged me from continuing to follow your blog.

I am most of the way through a Masters in Nuclear Engineering and I’ve applied to jobs at B&W, Dominion, and Newport News Shipbuilding. I had an internship with Dominion last year working with nuclear plant safety. It is indisputable that the fuel cost of nuclear will make it the cheapest power source once the capital costs can be brought down.

However, the problem with nuclear in the US is all about the government’s adversarial attitude. We are doomed to struggling against the parasites in government that arrogate power to control business for their own gain. You believe that if other businesses were similarly burdened that nuclear would get a bigger share. I think the nuclear industry will do much better if it stands up for fairness and realism with the fossil fuel industry. The real threat to nuclear progress and international development is the same as ever; there are always con men that wrap themselves in whatever fashion is handy to steal by deception. Environmentalism is just the latest excuse to indulge the tendency of the mob to steal. We should join together to fight the dishonest regulators, legislators, socialists, and crony capitalists and green energy fantasies should be at the top of the list.

I have had a long career in all sorts of traditional and alternative energy production and am considering working in gas development now. I would like to share some facts about shale gas economics and environmental impacts.

The NYT article was particularly bad journalism and the “documentary” you cite (Gasland) is pure propaganda.

Here are the crucial facts about shale gas that I am happy to amplify.

1. Production is growing rapidly at current prices

2. The price of gas is stable as far as anyone contracts, typicallly ten years.

3. There is no documented aquifer contamination from thousands of fracturing operations.

4. Horizontal drilling allows development of square miles of resources from a single pad and with a deliberate program of radial wells, staged to the needs, that pad can produce steady gas flow for decades.

5. There is so much gas production in the Marcellus shale that capacity is limited by pipeline and processing capacity

@Peter – BTW – I was also a Chesapeake shareholder for many years. It was a profitable learning experience as I read the communications to investors and watched the share price increase as natural gas prices rose rather steadily from 2000-2008. Fortunately for me, I needed to sell to pay tuition bills before the crash of 2008 when the price of gas fell by a factor of 3-4 and the price of Chesapeake stock tanked from $60 to about $15.

That personal experience is part of my knowledge base indicating how the interests of oil&gas company executives is not well aligned with the interests of customers, employees of other energy intensive industries, or the national interest. Those salad days as a CHK stockholder did not do other parts of my portfolio any good as nat gas prices rose so high that it forced some good materials company stocks into the tank. It also did not do consumers any good as they watched their disposable income disappear into heating bills that were 2-3 times as high as they were in the 1990s.

I remain convinced that one of the initiating factors in the housing market collapse was the rapid rise in energy prices during the construction period. As commuters paid higher gasoline prices, owners of new suburban homes also started paying higher and higher power and heating bills. Those energy costs often helped prospective buyers to determine that they really could not afford the payments required to buy a new, well appointed home in a more distant community.

The first communities to fall victim to lack of sales were often located in new subdivisions in places with high average energy costs.

@Peter – we will simply disagree on this topic. If you have been reading Atomic Insights for very long, you will know that I strongly suspect that the government’s animosity toward nuclear energy is largely a result of many decades worth of campaigning and lobbying efforts by generous donors who like competitive energy sources for a variety of reasons.

It is interesting to me that you so strongly defend natural gas by pointing the finger at a number of villains including socialists. Are you unaware of the importance that the Russian natural gas industry has had in European energy supplies for the past several decades? The last time I checked, Gazprom, the natural gas monopoly in Russia is a state owned enterprise.

You also have apparently not taken the time to listen to my last Atomic Show Podcast. It includes a talk given by a senior VP for Chesapeake Energy that clearly lays out the company’s strategy of partnering with environmentalists to attack it’s coal competition. Like nuclear, the vast majority of the money associated with coal will remain in the US. I cannot say the same about money extracted by the multinational oil&gas industry.

We will have to disagree. Never attribute an action to malice when simple stupidity will do. I believe that government is intrinsically stupid since it has to manage with so many different influences. Your suspicions that the burdens placed on nuclear arise from competitive fuels is a poor model of the history of nuclear regulation and a poor guide to what we should expect in the future.

“Activists”, like our current president, get power by agitating envy. They cannot produce anything for themselves, so they extort what they can. More laws give them more power to selectively steal from whoever is most successful. They are all parasites masquerading as protectors. Not at all different from the small time thugs that walk into a shop and say “Nice business you got here, sure would be a shame if something happened to it”. All that lobbying money is the cost of doing business when we gave government the power to destroy by regulatory fiat

Although it is entirely appropriate and necessary to point out favors granted to competitors at your expense, unjustly injuring them is a strategy that just makes us all poorer. There is plenty of demand for energy all over the world. We will all do better if we work to bring reason back into government and stop accommodating environmentalism, which is an irrational belief system. Note the “ism” at the end of the word. There are many spoiled Americans out there that do not care about the people who have to work for a living, much less people cursed by being born in misgoverned lands. They will happily pull up the ladder to paradise and leave everyone else behind if you let them.