Why do nuclear energy developers ask for predictable market prices?

A recent European Wind Energy Association (EWEA) blog post about nuclear energy “subsidies” includes a statement revealing a common misunderstanding about energy system economics.

There is also a puzzling contradiction in Foratom’s blog. First it claims, “today nuclear energy is competitive in the internal energy market without requiring public financial support.” Later in the same article it says, “because the initial capital cost of nuclear power is relatively high, long-term guaranteed price for electricity are probably the best way to make investment in nuclear attractive enough”. Surely if it is competitive in the market it doesn’t need a guaranteed price?

The competitive problem is that “the market” generally favors sprinters when the real economy would do better if the energy market was set up to favor ultra marathoners who could keep steadily moving forward long after the sprinters have given up and faded out of the race. Because of the focus on short term profits and daily market swings, investors often make decisions based on rapid capital movements.

In the energy business, that set up favors fuels that can be used in cheap machines, especially when the fuels are sold by very large entities with at least one related and highly profitable product that can afford to establish low market prices that last long enough to drive out the competition. I provided the following comment on the EWEA blog post.

There is a solid reason why nuclear energy developers are interested in the establishment of a stable market price for their product.

The leaders of the nuclear industry can look at history to recognize that the competitive natural gas industry has the ability to sell its product at a loss for several years in a row in order to drive down market prices and disable its competition. That is possible because there really is no isolated “natural gas” or “methane” industry — the suppliers are also oil companies because both products come out of the same holes in the ground.

If the petroleum producers cannot find a market for their gas, they still have to get rid of it somehow. The cheapest disposal method is to simply burn it off; the most expensive approach is to inject it back into the reservoir.

When the gas industry is able to kill off its competition, it sets itself up for a boom in profits because customers, once hooked, have a hard time shifting to another power source once the price starts rising. Eventually, the high prices result in another round of investment in alternatives like nuclear, but the cycle can continue, resulting in large losses at the newly developed alternatives while the gas companies have their oil revenues to support the temporarily low prices.

Here in the US, we have had the “luxury” of about four years of extremely low natural gas prices. The nuclear renaissance that was gaining steam before 2008 has just about died out with only four reactors actually moving forward out of the 30 or so that were once in serious planning.

Surprise, surprise, natural gas prices have started to rise again, with a 75% increase from the low point. (The low was just under $2 per MMBTU, the current price is $3.52 per MMBTU at one of our largest trading hubs.)

Rod Adams

Publisher, Atomic Insights

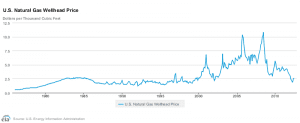

Whenever I get involved in a discussion about energy market prices, I like to point back to the graph of natural gas prices in the United States. As you can see, the most important feature is that the price is unpredictable and can vary by a couple of hundred percent over a relatively short time. Anyone who believes that natural gas prices can be predicted needs to try to buy futures that are more than two years out.

If nuclear plant developers ask for predictable market prices, there is a tradeoff deal that the public needs to better understand. When nuclear plants are provided price stability for their output in order to make the finances work out for the investors, customers need advocates that can ensure their interests are protected. If they agree to pay a price that might be higher than the market price at certain times, they should also ensure that the prices they agree to pay do not rise just because the market price rises.

In other words, the nuclear plant investors should not be the ones who profit by above market prices when the market price is low AND the ones who profit when the market prices increase. In the Southeast US, there are some excellent examples of rate regulation deals that have been favorable to the interests of both the sellers and the buyers. Each side of the deal also had to make some sacrifices in order to achieve the goal of predictable prices for a valuable commodity – reliable, emission-free electricity.

That commodity is the one that enables nearly every other facet of modern living, from the clean water piped into our homes, to the massive data streams available for our education and entertainment, to the reliable lighting, and to our ability to control our own indoor climate. Reliable, clean power is a product that is worth a considerable effort; it is also far too important to leave to the “market” decisions made by people who are mostly motivated by short term money-making.

Update (Posted October 25, 2012)

A post on the UK Nuclear Industry Association blog providing some details about the strike price negotiations underway with regard to EDF’s Hinkley Point C nuclear power plant construction project makes similar arguments to my post above.

It is worth reading if you want to understand a little more about the complex, but important decisions associated with building large, reliable, emission-free nuclear power stations that may very well be providing low marginal cost electricity into the 22nd century. (I mention that fact because the post compares the capital outlay associated with Hinkley Point C to the cost of the London Olympics, which was an event whose economic return on investment is over and done in just a few short months.)

Rod,

This is why I have been saying that the ability to load follow increases the capital value of a NPP. I understand that the maximum return on the capital is to run the plant at full capacity. However, the overall environment is not a “full capacity” environment. It varies greatly. The point of being able to load follow is to be ALWAYS online at the full need of the system. In other words – Nuclear will make every other power source irrelevant. Then we can have competition between different designs and investors. Or a local utility can install a LFTR, NuScale, or MPower to meet all the needs of the community. It is the ALL or NOTHING concept that kills the investment. Better to get an 80% return on capital and not be shut out of the market and loose 100% of the investment.

Right now the natural gas turbines are being sold on the basis of their ability to very quickly respond to an increase or decrease in load. Do that with a Nuke and you are shutting them out of the market.

Cal’s design for a temporary heat storage is also a good approach.

The problem though is still political – how to convince the NRC to actually allow new designs to come online in a reasonable time frame.

PWR’s can load follow to a degree. But really there is no need to have drastic increases and decreases in load if we stop feeding in unreliable power to the grid (aka solar and wind) which is what causes these big fluctuations. Some good articles on NPP load following (courtesy of “Lindsay” on the EfT forum):

http://www.vgb.org/hv_11_praesentationen-dfid-39890.html

http://www.oecd-nea.org/ndd/reports/2011/load-following-npp.pdf

Load following is a good technical feature and helps greatly for demand/capacity management and grid stability, but there is not a linear mapping into the economic realm, at least not a large one. NPP economics on the cost side are relatively inelastic. Capital costs are still large. O&M costs are relatively fixed. Throttling back nuclear plant output does not translate into reduced costs for construction debt or plant staff salaries. It helps the fossil burners because fuel costs are (can be) a relatively high percentage of the final cost of their product. That is not the case for a nuclear plant.

IMO the error is to build large reactor. It’s unfortunate that every effort to built smaller ones has currently always at the end fallen inside the “bigger is better” fallacy (his includes AP600, however I acknowledged it did not have much commercial success, and the decision to favor prismatic over pebble bed for the NGNP)

Also the best would be a reactor that can move in case the local economic environment changes. There will always be another place where energy is currently needed at a higher price.

And if concept of a moving nuclear reactor leaves you completely puzzled and you believe such a thing has never been conceived, you’re wrong.

See http://en.dcnsgroup.com/energy/civil-nuclear-engineering/flexblue/

The most influential factor, by far, in the decision on the choice of technology for the NGNP was that the people putting forward the pebble-bed concept (i.e., Westinghouse) dropped out of the program.

I didn’t know that, I had read otherwise on the nextbigfuture site, thanks for the correction.

Actually, PWRs can, and do, load following: http://www.oecd-nea.org/ndd/reports/2011/load-following-npp.pdf

I was surprised to learn of this, myself. I’m sure Rod can tell more about submarine reactors and their ability to load follow, but that is a significantly different design than a PWR for commercial power.

Hat tip to this thread: http://www.energyfromthorium.com/forum/viewtopic.php?f=2&t=3841

Actually, back in the seventies, one of the selling points of Babcock & Wilcox reactors was that their unique steam generator design allowed for better load-following capability. That’s a historical tidbit that is not mentioned in the report that you linked to.

The AP-1000 has the ability to load follow without chemical shimming. It is a design feature. The problem with load following in the US stems from the oxide pellets. The pellets tend to crack if heated up too quickly or too slowly. As a result of this utilities are reluctant to load follow because fuel conditioning (slowly heating and cooling the fuel) takes a long time.

The whole drive to zero leakers spearheaded by INPO is a misguided goal and restricts the value of the NPP’s by constraining what they can do, e.g. load following. If we were to give up the drive to zero leakers and follow the guidance of the FSAR for the plants, the improvements in fuel design allow for plants to load follow consistently and remain within the design basis. Other countries don’t have this constraint. It is in this regard that I think INPO’s initiatives to create arbitrary metrics and demand compliance is foolish and misguided. Metrics should provide value not restrict it.

Why we don’t see reactors load follow is because the marginal price of electricity is so low for nuclear reactors and the market share of NPP is so small (20%) that there is no incentive to load follow as the marginal price of electricity is well above that of where you would even consider load following.

If we abandon zero fuel failures then we would also abandon fuel clad as a fission product barrier. In today’s climate that is not going to happen. Also once fuel is conditioned you can load follow with little risk. I think the large size of the present reactors is more the issue than fuel integrity.

Thanks for this article Rod. I was pretty certain you were going to do a write-up about this issue. EWEA’s blogpiece was surprisingly obtuse. I guess they are getting desperate.

What’s funny is people are willing to shell out a lot more for bottled water over city water, buy premium toothpaste over generic and higher-priced/gourmet bacon over store brands all in the sworn belief that paying more is healthier and even wholesome. So why do people quibble when a nuclear plant outlay might run a little higher than oil and coal when you receive in exchange clean quiet historically safe pollution-less energy that doesn’t ruin scenery for miles around (except cooling tower types) and condemn scores of pristine acres with perpetually noisy railroad yards crammed with tank and dumpster cars?

James Greenidge

Queens NY

Midwest utilities lined up and supported electricity market deregulation, where lowest cost generation is sold first. Contracts began being traded, as if electricity were purely a commodity. California discovered from Enron that markets are not always transparent, and traders sell things they do not own or may not deliver.

The old axiom “He who sells what isn’t his’n buys it back or goes to prison” is not well enforced in the present day

To the consumer, electricity is generic. They don’t care which brand or fuel source runs the air conditioner.

To the traders, electricity is a deceptive commodity. Deceptive in that there is no bank vault, grain bin, or storage tank full of on demand deliverable Mw-hrs.

In the regulated days “spinning reserve” and “ready reserve” requirements assured the next load brought on could be supplied – Public Utility Commissions fined utilities for dropping below reserves, and also approved new generation capacity construction as needed.

I’m not a big government advocate. I will state that utilities sought deregulation with vigor. Now that the cheap frack gas combined with industrial and residential load loss from a historic economic rec(depr)ession has produced revenues below costs – we must live in the markets we have demanded. It’s not permanent. Coal mines close, nukes shut down, natural gas demand climbs. When natural gas prices return to decadal norms, new options will be demanded.

Just as voters, we get the government we deserve, similarly our companies get the market freedom they demanded.

What is “puzzling” to me is how anyone could think that a long-term price contract — the purpose of which is to limit the effects of short-term price volatility — is somehow outside of the free market. Contracts are a central, essential part of a free-market system. No free market can function effectively without them.

Then again, I’ve never been impressed by the intellectual rigor displayed by the EWEA. They’ve always been nothing more than a marketing organization, whose sole purpose is to pitch its nearly worthless wares to environmentalists, politicians, bureaucrats, and other dim bulbs in society. And wow, did they hit paydirt in the EU!

In the EU there seems to be a problem of politicians making decisions about energy policy without even using the research findings that they’ve asked for themselves.

I’ve tracked down the EU sponsored research preceding several of the key decisions (concerning biofuels, nuclear and sun/wind mainly) that were made the last decade, and I’ve consistently found that the EU commissioned research tends to advise pretty much the *opposite* of what EU commissioners and parliament, and also local politicians in member states, then go on to support and make into law.

I guess the anti-science way of running things is also popular in the EU.

I think the following study is a good example.

http://ec.europa.eu/energy/nuclear/studies/doc/2011_10_electricity_supply.pdf

In it, it is well explained why solar power and wind energy cannot be expected realistically to supply much beyond 40% of European (EU-27) electricity, because you will run into exponentially rising balancing costs from that penetration onwards.

Yet, judging from the energy politics since the appearance of this report, I see no hint at all that any politician ever looked at this report.

I think it’s one of the most concerning aspects of the current system, that politicians and lawmakers seem wholly unperturbed by – or even interested in – the results of scientific research. Not only are we on the Titanic, but the crew is wearing blindfolds and nobody seems to give a crap. It’s all good!

Methinks key EU energy policy decision makers are in Gazprom’s pocket…