The Frack That’s Going On – Short Cuts Lower Cost but Add Risks

The video and music were created by New York University’s Studio 20 in collaboration with ProPublica, which has been investigating and reporting on the effects of hydraulic fracturing for the past three years.

My view is that fracking can be safe, if done correctly, but there is a significant temptation for lightly capitalized companies to take short cuts that result in harm to the hosting communities. The heavy truck traffic associated with the drilling, fracking and waste water removal often damages rural roads. Improperly finished wells can have casing leaks. Waste water can be spilled into local streams and rivers. Waste water that is dumped into treatment plants that were not designed to handle it can pass through with less successful treatment than expected.

Despite the fact that geology rarely follows state boundaries and that water and air resources never do, the Energy Policy Act of 2005 put fracking regulation into the hands of the states, some of which were ill equipped to deal with the responsibility. In areas of Texas, Arkansas, Louisiana and Oklahoma, there might be experienced and sufficient regulators for the oil and gas industry, but that is certainly not true in Pennsylvania, Maryland and New York.

Taking short cuts and reducing regulatory burdens always reduces the initial costs. That cost reduction allows fly by night drillers to make a lot of money quickly, even if they sell their gas at a relatively low price. Those drillers may not be in business anymore once the real cost of their activity starts showing up; it is difficult to obtain compensation from a company that is out of business.

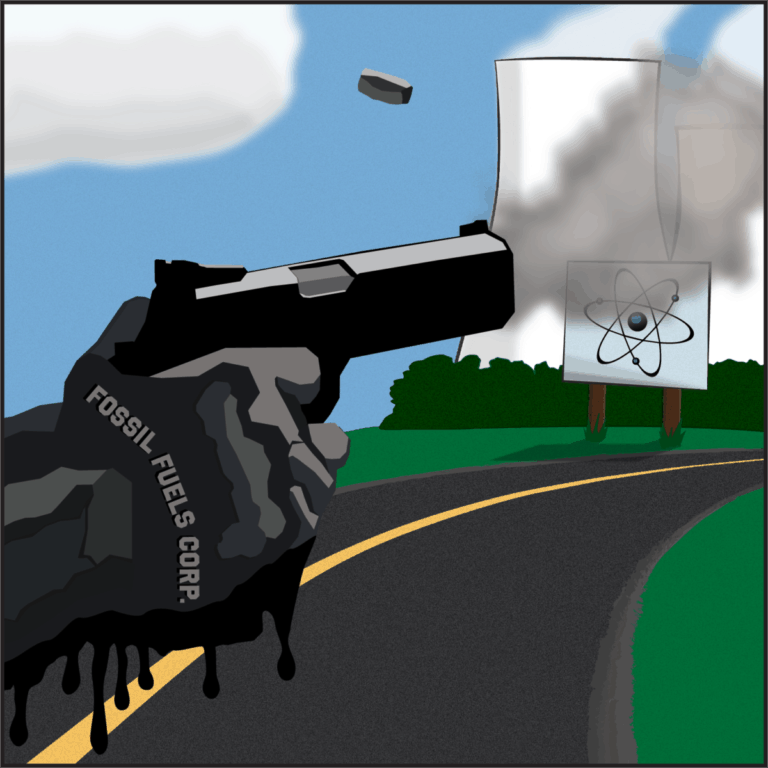

My view is that the apparent abundance of natural gas is a well promoted myth that was purposely designed as part of a price war against new nuclear energy plants. Just last night, I saw and ExxonMobil commercial touting hydraulic fracturing and claiming that it could provide us “fuel for 100 years”. (That is not true, by the way. The optimistic inventory as of the end of 2010 as determined by the Potential Gas Committee is approximately 2100 trillion cubic feet. At our current rate of consumption – 23 trillion cubic feet per year – the very last puff will be gone in 91 years. If we use more, it will last less time.)

So far, the sales job is working because many utility executives cannot look more than a few months into the future or a few months into the past for lessons learned. A number of nuclear plant projects that were announced in the heady days of late 2005 and early 2006 have been delayed or put on hold because of the current availability of “cheap natural gas”. I was heartened, however to read the following quote from Jim Rogers at Duke Energy.

The timing of new nuclear plants could also depend on the availability of natural gas, currently a cheaper option due to new supplies recovered from shale rock, he said.

“The shale issue — the question is, is it real or is it a mirage?” Rogers said.

Hydraulic fracturing or “fracking” used to drill natural gas out of the rock is controversial, with “unanswered questions” about its impact on water supplies.

“We need to get the answers to those” questions, he said.

I have waited in vain for people like John Rowe of Exelon or Mayo Shattuck of Constellation Energy to publicly ask that same question about the long term availability of “cheap natural gas”. Then I remember just how much their merchant generating companies with large nuclear fleets benefit financially when the price of gas goes up, thus driving up the settled price of electricity on the wholesale market. Those guys want others to believe that the shale bubble is real so that they can take bigger profits to the bank when the excess supply dries up.

Additional reading

Baffled About Fracking? You’re Not Alone

The above Greenwire post explains how the oil and gas industry spokespeople often seek to baffle people with ‘BS’. The wells are drilled for the express purpose of fracking. Without that technique of “completion” drilling into tight gas formations is worthless.

It is playing word games to then claim that the fracking is safe, but the drilling evolution sometimes has problems.

Interestingly, France is considering a ban on fracking:

http://www.france24.com/en/20110511-french-lawmakers-back-ban-shale-gas-tapping#

Better ideas exist above ground. Wet nuclear power may not light your water from the tap. Wet nuclear will fuse boron protons and hydrogen nuclei in aneutronic fusion in a reactor that squirts cavitating water jets.

I can see the look on the face of the Exxon Guy when my T shit says “It all starts with a squirt up here, not a big bang down there!”

Regarding the video – I’ve yet to see anything this clever, this catchy, done anytime, anywhere by any pro-nuclear advocate. This thing already has over 46,000 views and is probably becoming exponentially viral.

Public persuasion is not about technical nuts and bolts or statistics. It’s just the same as selling soap or soup. Be consistent, be persistent, but most of all, appeal to emotions. For all but the most incorrigibly left-brained out there (nuclear engineers, I’m talking to you) decision-making is done not with the pre-frontal cortex, but with the heart. Just look at how benign that row of white windmills looks compared to that scary-looking barbed-wire-bristling nuke plant.

Someone please, please, prove me wrong.

“Things couldn’t have been better for Russia’s energy giant Gazprom even before news came in over the weekend that curtains could be coming down on one of the keenest battles of the Caspian great game, and Moscow is on a winning streak.

Gazprom increased its gas supplies to Europe in April by over 21% on the same month last year. In 2011, Gazprom’s overall export revenue is estimated to be a whopping US$72.4 billion. In anticipation of increased supplies to Europe, the Russian company has begun plans to nearly double its underground storage capacities for gas by 2015 to almost 4.9 billion cubic meters (bcm) and by next year to 6.5 bcm.”

Source: http://www.atimes.com/atimes/Central_Asia/ME12Ag02.html

@DV82XL

Thanks for the link. It is interesting that there is not a single word in the article that explains that the market for all of that gas from all of those “great game” pipelines is partially being enabled by active opposition to nuclear energy.

If/when Germany shuts down 17 large nuclear plants, Europe will need about 4 billion cubic feet per day of additional natural gas to replace that generation. Just think how much less gas Europe would need if it actually added capacity instead of shutting it down.

I think the best investment that Gazprom ever made was when it found a that an insecure son of a former agricultural laborer had been elected as Chancellor of Germany and it decided to throw a bit of cash his way.

I happen to believe having studied the evidence, that the U.S.S.R. was behind (or at least financed) much of the Ban-the-Bomb protest movement of the 1960’s. This is the same group that later formed the core of the antinuclear movement that was later successful in shutting down the growth in nuclear energy.

I also believe that this same network was behind the massive protests against nuclear energy in Germany that we have seen over the last several years. The level of organization and sophistication is too slick, and the numbers of people mobilized too large, for me not to see the hand of Moscow directing from behind.

Dismiss this as the ravings of an old Cold War veteran, if you must, but the similarities are too great for me to ignore.

@DV82XL – I, too, am a Cold War veteran who sees the evidence. Remember, even during the days of the Berlin Wall, a very substantial portion of the Soviet Union’s “hard currency” came from selling oil and natural gas to the rest of the world. Unlike most of the rest of their non defense goods, those two products were actually worth something.

The importance of the oil and gas industry in Russia is nothing new; it dates back to the 1880s when the Rothschilds and Nobels who were extracting oil from the Baku region were the only competition in the world for Rockefeller’s Standard Oil. (By the way, contrary to popular mythology, the guy behind the Nobel Prize made the vast majority of his wealth from extracting and selling oil, not from inventing dynamite.)

That still doesn’t explain why far-left groups hostile to the Soviet Empire (such as the Socialist Workers’ Party) have been just as fervently anti-nuclear as the pro-Soviet groups.

Although perhaps the SWP in particular is trying to protect the oil and gas revenues of Middle Eastern countries. The SWP has always had a policy of outright anti-Zionism (even though its founder Tony Cliff was Jewish) and in recent UK elections stood as part of the RESPECT Coalition, which made very heavy play for the Muslim vote.

“It’s important to bear in mind that France (and the French government) have a deep vested interest in nuclear. Shale gas is very bad news for the economics of nuclear (and also for renewables) -therefore it’s not surprising that there is an interest in France in trying to kill off shale gas.

ExxonMobil and Chevron of the United States have secured land with a view to exploiting shale gas reserves. Chevron plans to drill its first well in Poland, where it has a leasehold of more than 400,000 hectares, one million acres, later this year, while Exxon Mobil has completed drilling its sixth shale gas well in northwest Germany since 2008.”

-Dieter Helm, Financial Times, 12 May 2011

I believe shale gas is a mirage, but it is a convenient one for the companies whose really big investments during the past half decade or so has been in liquified natural gas infrastructure. By using the special properties of shale gas wells – lots of early production with a very rapid rate of depletion – they can “hook” customers in with a promise of cheap gas. Once the regulations are tightened and that source is no longer so cheap, they will supply those customers with imported gas brought in with LNG tankers. The customers, with the needle dangling from their arm, will help add pressure to accepting LNG as the only available choice.

Does anyone other than the multinational oil and gas companies really want to add a dependence on imported natural gas to a dependence on imported oil? How much less control are will willing to have over energy supplies, one of the primary sources our economic well being?