Short Seller Attacks Continue Against Nuclear Project Promoter AEHI

Disclosure: I am long on AEHI.

One of piece of knowledge that I continue to struggle to share with the world is the recognition that there are sometimes large financial rewards available from going negative. Many people instinctively recognize a sales pitch and often discount the source as someone who is interested in making money by via persuasion. Those same people often fail to recognize that critics can also be making their statements for exactly the same kind of greedy reasons.

Sometimes, the rewards from going negative are a matter of direct competition. If a politician can convince voters that his opponent really is a flip flopper, a tax cheat, or a womanizer, the result of the “sale” of negative information can be an election victory.

If established energy suppliers can convince customers that a new, vastly superior form of energy is so frightening that it should be banned, the result can be several decades worth of a larger share of a higher-priced vital commodity market. Limiting supply to a level lower than demand always results in price increases. If a lawyer can convince a jury that his class action lawsuit clients have been wronged, the result will be the lawyer capturing 30-50% of the awarded damages. If a short seller of a particular stock can convince stockholders to sell, driving down the price of the stock in which they have a short position, the result can be a windfall.

I have written about what happened to AEHI (Alternative Energy Holdings, Inc.), a tiny little nuclear project promoter in Idaho, when trading in its stock was halted for two weeks. The stock price sank from 58 cents to 5 cents per share when trading was resumed. It stayed at or near that level for about two months while the company’s assets were frozen and they could not pay any of their accumulating bills or payroll. In early February, a judge lifted the asset freeze and the stock price jumped almost immediately to about 35 cents per share.

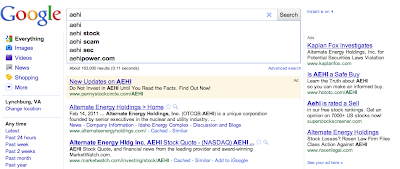

Over the past couple of days, with no news stories about the company or its projects, the stock price has again taken a dive to close yesterday at 16 cents. (Please understand me – I am not, by any stretch of the imagination, recommending trading in this stock. I am trying to tell a story about human behavior that has something to do with nuclear energy.) When I used Google News to try to find out what had happened to cause the dramatic drop, the search results were so interesting that I took a screen shot to share with you. If you have trouble reading the graphic, please click on it to take you to a larger image. I promise, the link does not do anything else.

As you can see, there are people spending money to purchase AdSense ads in hopes of persuading people to sell AEHI and to join in a class action lawsuit aimed at capturing whatever assets the company might have left in the name of “protecting shareholders.”

No matter what you might think of the possibility that a company with a handful of employees, a few million in the bank, and no continuing source of revenue can build a business by seeking all of the permissions required to build a multi-billion dollar asset like a nuclear power plant, it might still peak your interest that there are organized groups working hard to make money by forcing the dream to fail as quickly as possible. (Of course, there are also well-organized groups who resist any kind of nuclear project development that have taken credit for some of the negative publicity.)

There was one more interesting link that showed up a couple of places down on the Google News search, so it did not fit into the tight graphic window above. One of the class action lawyer firms issued a press release titled Robbins Umeda LLP Reminds Shareholders of Alternate Energy Holdings, Inc. of Upcoming Deadline. Here is a quote from that press release:

In particular, the complaint claims that Gillispie, with the aid of Ransom, engaged in a scheme to manipulate and artificially inflate the market price of Alternate Energy stock by (1) paying stock promoters to create artificial demand in the marketplace through end of day stock purchases; (2) misrepresenting that the Company’s officers and directors never sold any shares of the Company’s stock; and (3) misrepresenting the Company’s true financial condition and potential business prospects. On December 14, 2010, the U.S. Securities and Exchange Commission (the “SEC”) issued an order to temporarily suspend trading of the Company’s stock. Shortly thereafter, on December 16, 2010, the SEC instituted a civil action against the Company and Gillispie and Ransom, to prevent Alternative Energy and its executives from raising additional funds from investors.

If you purchased Alternate Energy stock during the Class Period, you have until March 8, 2011 to ask the court to appoint you as lead plaintiff for the class.

As I recall, one of the key complaints that the SEC made about Gillispie and AEHI was that they engaged in artificially inflating the stock price by issuing an unusually large number of “false press releases”. I guess that Robbins Umeda LLP recognized that using a press release to complain about press releases might have failed the laugh test; that could be why they left that part out of their summary of the complaint.

I’ll just drop this here.

Alternate Energy Holdings Announces Development of Lightning Into Electricity Technology

http://findarticles.com/p/articles/mi_pwwi/is_200610/ai_n16767493/

You have no clue about what AEHI is about. It has never been about nuclear power. It has been about pumping stock and illegal activities. Gillispie is simply a common criminal operating on your money. You are one of his illiterate dupes.

@Worse – your comment supports my contention that AEHI is being attacked by people with a financial motive for their attacks. Can you give me one good reason why I should accept lying insults from an anonymous commenter? (My proof that I am quite literate is pretty extensively documented.)

Rod , I standy by you.

Rod , I standy by you.