Shell executives should give themselves permission to discuss clean nuclear energy

Climate Action’s July 16 webinar announcement caught my attention and generated some surprised commentary among people who discuss energy and climate on Twitter. The headline for the event wasn’t all that special. “Rising to the Net-Zero Challenge.” Neither was the subtitle. “As we emerge from lockdown following the global health crisis, can leaders from across all sectors rise to the challenge of greening the recovery?”

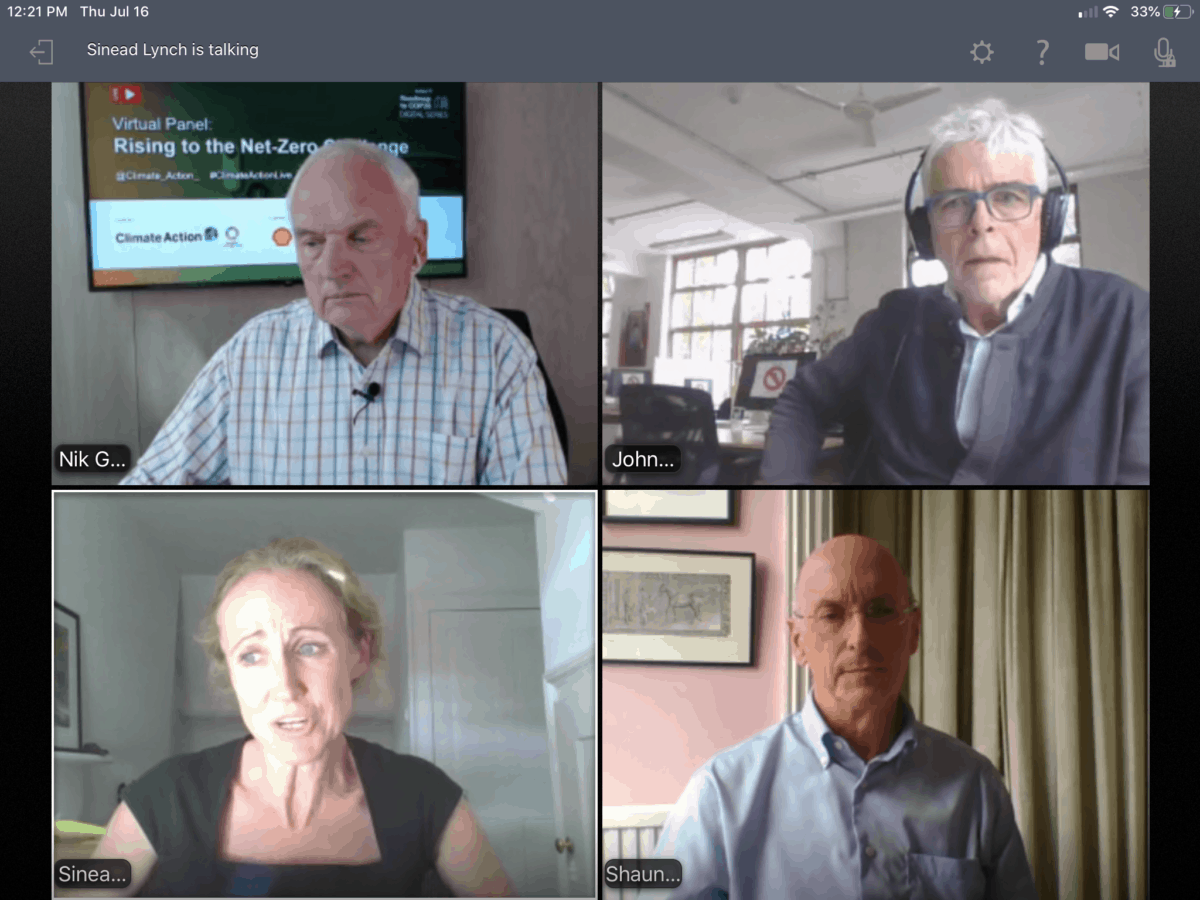

The panel participation and corporate sponsorship generated most of the discussion. Appearing on the panel were Sinead Lynch, UK country chair for Shell, Shaun Spiers, Executive Director of Green Alliance and John Sauven, Executive Director of Greenpeace. Nik Gowing, Founder and Co-Director, Thinking the Unthinkable served as the panel moderator.

Shell sponsored the event and received the right to decorate the associated media materials with its familiar corporate logo.

Several people wondered why Greenpeace had agreed to share a stage with an executive from one of the world’s oldest and largest multinational petroleum companies. Others wondered why a Shell executive was willing to be grilled about her company’s business plans and growth prospects in the context of a net-zero [CO2 emissions] target.

I suggested what some believe is unthinkable. I wondered if Greenpeace and Shell would finally acknowledge that clean atomic fission has a key role to play in what almost everyone agrees is the important and difficult task of decarbonizing our global economy.

No mention of nuclear during Climate Action’s webinar

Sadly, those who dismissed my suggestion with comments like “it will never happen” turned out to be correct. During the 90 minute event, none of the participants broached the topic of nuclear energy.

There were several occasions during the event that offered the opportunity to discuss atomic fission as a reliable heat source useful for both industrial processes and electric power generation. Both of those commodities are in high demand now and both are major sources of greenhouse gas emissions that need to be eliminated.

All panelists, including Sinead Lynch, supported the premise of the webinar – they agreed about the importance of expeditiously moving to a net-zero economy. Ms. Lynch even surprised her other panelists by stating that Shell was in favor of moving the expiration date of the internal combustion engine for personal automobiles from 2035 to 2030.

She indicated that her company is planning and investing in a substantial expansion of its vehicle charging network at its retail locations and at parking sites. It also has investments and partnerships in hydrogen production infrastructure, especially in Germany were the consortium to which they belong has built about 90 installations. She reminded the audience that “Shell has been investing in hydrogen for decades.”

She also said that Shell could not move significantly faster than its customers. Businesses cannot survive by suppling products for which there is an insufficient demand.

Because you can provide supply, but if you don’t have demand, if you don’t have the vehicles, if you don’t have incentives for customers to use the product then you don’t have a business case.

Sinead Lynch “Rising to the Net Zero Challenge” (33:35)

Shell supports policy initiatives that will help motivate consumers to purchase electric or hydrogen-fueled vehicles. Shell also understands the importance of decarbonizing the electricity supply used to charge EVs or to produce H2.

We believe we should accelerate the decarbonization of the energy system where we have the technologies ready to deploy. You can see that now very clearly in the power sector in terms of we can bring on renewables. We have some work to do on a smart, flexible system to manage the intermittency.

Sinead Lynch “Rising to the Net Zero Challenge” (40:09)

Despite the fact that nuclear power stations are proven workhorses that reliably produce carbon-free power with no intermittency, no one mentioned it. It did not appear as one of the multiple choices for a rapid response poll conducted during the event, even though the poll question offered a perfect opportunity to broach the subject.

The poll asked, “In terms of achieving net zero, in which area would Energy company action make most impact.” The four possible answers were:

Invest in UK CCUS projects (8%)

Invest more in renewables (37%

Invest to accelerate e-mobility (6%)

Stop producing oil & gas (48%)

It didn’t offer “Invest more in nuclear” or allow write in answers.

During the event, I used the available Q&A feature and hash tagged tweets to ask questions about nuclear energy. They were not selected by the moderator.

Learning more about Shell’s position on nuclear

Following the event, I made contact with Shell’s media relations and spoke to a cheerful and helpful spokesperson. She indicated that she had seen my questions during the event. She told me that her team had dealt with the topic in the past. She asked me to send an email so that she could reply with their prepared response.

Here is the email I sent.

We spoke a moment ago about Sinead Lynch’s participation on the Rising to Net Zero Challenge webinar.

Shell once invested in a nuclear reactor vendor called Gulf General Atomics. For about a decade, Shell was a 50% owner in a reactor vendor. In addition to that investment, Shell had a division in the US called Scallop, which was involved in uranium mining and exploration.

There is no doubt that uranium fission is a well proven source of heat that is capable of directly replacing combustion heat sources in both electrical power generation and industrial heat application. Emission-free industrial heat would be a particularly useful input for energy intensive processes like refining oil.

Ms. Lynch described how Shell was supporting efforts to eliminate customer demand for internal combustion engines for personal automobiles by improving access to capable charging stations and by ensuring that the electricity supply was appropriately green. She mentioned how difficult it was going to be to produce sufficient quantities of “green hydrogen” because of a lack of a sufficient quantity of green electrons.

Is Shell considering a return to investing in nuclear energy? Or is it considering becoming a long term customer for some of the exciting new nuclear technologies being deployed in the UK already? Is Shell aware of the current efforts to use nuclear electricity to produce green hydrogen?

Shell has meany core competencies that would help ensure success if it decided to return to a field where it was once a leader. Nuclear projects demand skilled project management, attention to detail, a focus on worker training, skilled marketing, and high quality standards. They also benefit from capable capital partners and credible customers that understand the value of long range planning and steady execution.

Please send me whatever information you can about Shell’s interest in using this capable, but undervalued tool for achieving net-zero – or even net negative – emissions.

Thank you for your time and attention.

Email from Rod Adams,

Publisher, Atomic Insights

Host and producer, the Atomic Show podcast to Shell media relations

The Shell spokesperson promptly replied to my email with the following:

Thank you for your call just now and for listening in yesterday.

Please find our line here:

In the energy transition it’s not either/or. Different sources of energy will be needed to meet global energy demand. Shell produces energy from a wide range of sources but not all.

Nuclear is one example. It doesn’t feature in Shell’s portfolio but the Shell Sky Scenario report shows that the share of nuclear in the global electricity mix could remain steady at around 10% to 2070.

For your information, please find our Sky Scenario here: https://www.shell.com/energy-and-innovation/the-energy-future/scenarios/shell-scenario-sky.html

Email from Shell UK to Rod Adams

Shell’s acceptance that nuclear’s share of global electricity “could remain steady at around 10% to 2070” is an example of what Navy promotion selection boards might call “damning with faint praise”.

I took the spokesperson’s advice and visited Shell’s Sky Scenario pages to learn more about scenario creation and its role in the company’s planning and investment practices.

Here is one of several videos about the scenario development process.

Shell’s Sky Scenarios are not predictions of the future. The company describes them as stories about possible future pathways, but it also states that their stories are a way to help their colleagues understand what the future might hold and to adjust their behaviors accordingly.

An energy company that seriously proclaims its intention to rise to a net-zero challenge and that understands the scale of development needed to achieve aggressive targets should seriously consider all available tools.

Shell executives like Sinead Lynch must take action to enable their scenario developers to consider the benefits of increasing nuclear energy use. They should apply what they know about the importance of customer demand. They could become leaders among energy intensive industries and suggest that clean electricity is a better goal than “100% renewable.”

They might even become early adopters in fission-powered heating systems that enable dramatic emissions reductions at their heat-consuming refineries.

I hope other writers, reporters and journalists join me in continuing to ask energy companies about their investments in nuclear energy every time they take the stage to proclaim their support for decarbonization.

It might be too optimistic to believe that ideological groups like Greenpeace will grasp that decarbonization numbers don’t work without nuclear, but energy companies like Shell employ armies of numerate engineers and scientists who probably already know the truth.

They need to be enabled to freely think and speak about what their calculators, spreadsheets and understanding of physical systems are telling them.

Thanks for the article. From Above:

“She also said that Shell could not move significantly faster than its customers. Businesses cannot survive by supplying products for which there is an insufficient demand.”

I guess that sort of means that these big companies want to play it safe and will not invest or develop new nuclear energy unless there is a “bottom up” demand. A lot of big social changes have been bottom up. I didn’t think this applied to consumer products. If capitalism is working properly, I would expect at least one of these big energy products to be developing newer types of nuclear energy.

But selling nuclear generated electricity doesn’t require customers to take any action. They will still turn on the same switch and plug their devices into the same receptacles.

Of course, there might be some programs like those offered by Karnful Energy that allow customers to indicate a preference for cleanly produced power, but for the most part a change in the method of supplying electricity is transparent to customers.

Rod – Thanks for attending the webinar, your very attentive listening, and your diligent work to insert mention of nuclear. I’ve spent some time searching for a watchable video, but I don’t see it either through Climate Action’s site, their Twitter feed, or on YouTube. That seems like an oversight to me.

Thanks also for getting in touch with Shell and attempting to start an actual conversation. The video is also very interesting – the graphics have been scrubbed clean of nuclear fission symbols. “Approximately ten percent” of electricity production went missing – not much of a depiction.

The only good thing IMO is that Greenpeace and a fossil fuel major were in the same forum. It’s going to be necessary to get organizations working together. Although, looking through Shell’s published information on the Sky Scenario, it’s pretty much aligned with Big Greenism’s doctrines. It does offer some material that can examined critically and with numbers, which could be actually compared with alternatives that include fission.

My quick skim through the scenario says it’s not very imaginative.

Rod, congratulations on your well written thoughtful interactions with Shell. Scale and mission are the unifying concepts between an oil company and a nuclear company.

Both the oil and the nuclear companies must see their mission to be providing energy. The oil company must not see their mission as supplier of oil because non-carbon energy is the future. The nuclear company must not see their mission as supplier of electricity because supplying heat is also needed to decarbonize. The combination company is not an oil company and not a nuclear company but the energy company of the future.

Nuclear is the only energy source that can match the scale of oil. The oil company is the only organization that can manage the scale of deployment needed to decarbonize the whole world in the needed unreasonable time frame. The nuclear development and deployment costs seem insurmountably large to everyone but an oil company. The financing of the first 10 plants seem insurmountably difficult to everyone but an oil company.

Imaging this, “I have proposal with a high degree of success but I need 13 billion dollars and 10 years to prove it. If successful, this company can grow larger than it is today.”

To the energy company of the future.

Thank you Martin. You’ve expressed this very important idea much better than I have done. It’s the challenge for an entire industry.

I would love to see a syn fuel competitor for the drilling industry.

I don’t think that’s necessary; it’s easier to cut demand than replace supply. You can displace over 6 million bbl/d of US petroleum demand just by making all LDVs into PHEVs.

It seems to me that the EU wants to use the health crisis as opportunity/excuse to spend big money on some kind of hydrogen infrastructure. The idea seems to be to produce hydrogen somewhere (e.g. some desert) from newable sources an ship it in liquid form to Europe. Most of this money will likely end up in the pockets ot the fossil fuel companies because they already do something similar with LNG and producing hydrogen from fossil sources is still cheaper for the foreseable future. Greenpeace is probably very happy with such a plan because finally they can show some “solution” to the storage problem of wind and solar.

“Please find our line” ?!!

Who communicates like that? I’m assuming that the PR staff is outsourced to people with English as a second language or the “line” is reference to cocaine.

Maybe it was an abbreviated way to say “please find our corporate (party) line?”

In my dealings with PR folks, I’ve learned that they are carefully trained to adhere to approved talking points and to remain on message. Maybe some are trained to stay within the party line.

Oh, I agree that they are carefully trained to stick to approved material. Even technical guys like me are required to stick to the corporate line when discussing anything related to the company.

Nevertheless, “please find our line” sounds very strange. It is uncommon usage.

The large scale production of renewable hydrogen, methanol and ammonia through nuclear energy would pretty much mean the end of the multi-trillion dollar fossil fuel industry. So why would the global fossil fuel industry be interested in that???

Its economically better for the fossil fuel industry to promote and invest in solar and wind where they know that fossil fuels will be required to provide back up energy when the sun doesn’t shine and when the wind doesn’t blow. This allows the fossil fuel industry to produce at least 70% of the electricity generated for solar and wind facilities.

And that would even be true if 100% of the vehicles on the road were electric vehicles. Of course, less than 1% of road vehicles in the world are powered by electricity.

The fossil fuel industry will never significantly invest in nuclear energy unless governments– clearly mandate– that a gradually growing percentage of electric energy, transportation fuels, and industrial chemicals be produced from carbon neutral resources. And it also has to be mandated that at least 90% of electricity, transportation fuels, and industrial chemicals be carbon neutral by 2050. Such legislation would pretty much give the fossil fuel companies no choice but to invest in nuclear energy.

A substantial increase in the production of nuclear power at existing sites (up to 8GWe per site) through the mass production of SMRs for the production of electricity and synfuels combined with the mass production of small floating nuclear power plants– at remote ocean locations– for the production of renewable synfuels is the only way the world is going to totally replace fossil fuels by the year 2050.

Marcel

@Marcel Williams

You wrote

“The large scale production of renewable hydrogen, methanol and ammonia through nuclear energy would pretty much mean the end of the multi-trillion dollar fossil fuel industry. So why would the global fossil fuel industry be interested in that???”

I disagree. Those fuels and ingredients would make use of a major portion of the capital investments made to refine, transport, market and deliver hydrocarbons. Even the human capital of skills would be mostly transferable.

The exploration and extraction portions of the industry would be made redundant and some of the geographical concentrations would be made irrelevant, but it would not be a complete loss.

Though conventional wisdom has been that RE helps fossil fuels maintain some of their existing market share, experience should be showing global hydrocarbon companies that the match is not always good for their bottom lines. Massive, heavily subsidized RE construction efforts produce systems that can supply vast quantities of low marginal cost power on an unpredictable basis. Even gas, which is quite responsive on an individual machine basis, suffers system stress when storm fronts pass through and large geographic areas connected by pipelines must all throttle back and open wide in synch. When large solar capacity exists, as it does now in California, that cyclic stress happens almost every day. There is an economic penalty associated with dramatically changing market prices that can dip into negative territory.

No. I believe nuclear can be a better, more reliable, and more profitable partner for global energy companies. The mandates you suggest would help, but companies like Shell that have made public pledges to decarbonize can start moving in the right direction even without being forced to do so. There are numerous ways to improve nuclear, and they already have many of the tools required to make those improvements happen.

You guys are thinking of the fossil fuels entity as a monolithic entity. Well – What keeps it going? It makes money for people. If some entity could begin to build nuclear energy in a manner that makes a decent return, the folks that support fossil fuels, i.e. the money people would drop it like a hot potato and chase after nukes. The money people owe no loyalty to anyone but themselves.

If you could build a facility that produced synfuels with a cost advantage the investors would come.

That cost advantage could be produced by regulation and why not? Ain’t saving the Earth worth it?

You can’t have fossil fuels in a carbon neutral economy because it doesn’t make environmental sense to put the world’s coastal cities and nearly the entire state of Florida– underwater– for future generations.

However, the fossil fuel companies are really not worried about the long term environmental future of the planet just like the cigarette companies weren’t worried about the health of the users of their deleterious product. So they’re going to continue to drill for oil and gas until governments finally tell them that they can’t do that anymore.

If the fossil fuel companies were actually concerned about the environmental future of the planet, they’d be investing hundreds of billions of dollars annually in nuclear power.

Marcel

It doesn’t have to be monolithic to have a common enemy.

Indeed it does. And if you look at the cost per million BTU, you’d realize that there is a great deal more money changing hands for fossil fuels than anything involving uranium. Therefore, the fossil fuel interests have NOTHING to gain by moving to uranium. Nothing.

Indeed they don’t, and that is why they hate nuclear energy: not enough money in it.

The problem is that uranium is dirt cheap and a nuclear economy has a lot less use for chemical fuels, period; a lot less money changes hands to there is less profit to be made outside of construction. Even a nuclear PHEV economy slashes petroleum demand by at least half and eliminates coal entirely. Rail, barge and pipeline interests are bankrupted. Natural gas interests are affected differently, but nuclear heat is ideal for supplying whole cities cleanly; that destroys NG interests.

I’ve been making this argument for some time, but it gets nowhere with most “environmentalists”.

Try envisioning a different paradigm that might better suit the core competencies that multinational petroleum companies have been developing [refining] for about 170 yrs.

Adopt systems designs where the safety case rests on the fabricated fuel.

Use cheap machines to turn heat into useful products. Take back the residues and extract all valuable materials that have been produced during operation.

I introduced this paradigm back in 2018.

https://atomicinsights.com/turning-nuclear-into-a-fuel-dominated-business/

Let me translate her message from corporate to English.

“Our job at Shell is to make as much money as possible for our shareholders. We are happy putting a couple of solar panels or wind turbines on top of one of our refineries for public relations purposes. However, we have already invested trillions of dollars into our current energy infrastructure and have no plans to create a new and competitive technology that would upset our current business model”.

Trillions of dollars – I guess they would want that investment paid off before attempting a risky venture like nukes.

But if they see they cannot stop others from making their investment worth far less, perhaps they will realize the benefit of having some skin in the transition.

Thanks for trying, Rod. I think Shell’s strategy to simply to harvest good will by implying promises they will never fulfill. They believe (correctly?) that all the wind/solar/battery nonsense will come to naught, because competition among nations will select the cheapest sources for energy. I’m puzzled as to why sensible strategic planners in Shell can’t realize that fission energy could be much cheaper than now. We got hints that suggesting this was not viewed as good corporate citizenship.

Nuclear power suffers from a couple of disadvantages.

First, the fuel is too cheap for anyone to make much money supplying it. Unlike coal and natural gas, where the fuel suppliers (and the railroad companies) made/make fortunes extracting the fuel and delivering it to the power plants, nuclear fuel supply is by comparison a cottage industry. This is seen as a huge advantage by engineers, while business types don’t even stop to look.

Second, an operating nuclear unit can be unexpectedly shutdown at any time, when some engineer discovers an error in a calculation somewhere. Maybe even at a different plant. Even if the error is ultimately trivial or even benign. It can even be a question, “hey why is this OK?” Sometimes hard to answer within the allotted time, when it was deemed “OK” 50 years ago, by engineers long since retired or dead.

Third, the operating expense of a nuclear unit is almost unrelated to its current power output. Full power or shutdown, the security staff payroll alone is a huge ongoing expense. Not to mention the debt service, or the army of engineers stumbling upon trivial errors.

Don’t get me wrong, I think nuclear electricity is a great idea, and I have spent the last 40-plus years doing my part to keep the plants running. But these issues (and more) are baked into the system now. Maybe there are ways around them, but I doubt anyone at Shell Oil is going to be the one to figure that out.

@gmax137

While you are correct about the past and present state of nuclear, there is a path to a different paradigm that builds off of a well-proven model for a successful energy enterprise.

It’s a paradigm that discomforts the engineering types who have typically dominated nuclear, but the financial types should find it familiar.

https://atomicinsights.com/turning-nuclear-into-a-fuel-dominated-business/

@gmax137 First, thank you for your long hard work keeping NPP’s open.

The two costs that you mention – security and errors in calculation causing plant shut downs are both a part of a regulatory environment that has little to do with actual safety but a great deal to do with “perception of danger.”

From the NRC’s report. There is little public danger from any potential accident.

https://atomicinsights.com/nrc-releases-draft-of-reactor-accident-consequences-study-for-public-comment/

In your opinion are the security forces actually needed? Could terrorists actually use fuel to make a bomb?

Continuing with what David says about security. The security was ramped up after the the 9/11 incidents. How many real problems were there in the 40 operational years that nuke plants had prior to this? Is this another example of solving a problem that doesn’t exist to the extent of the protection? I guess the security folks would say they can’t tell us how many actual problems were seen by the nuke plants. They’d smile and use the old joke, “If I told you I’d have to kill ya!” Someone did a real good job selling security to the regulator.

In a way it’s kind of like the mob offering protection. “You really need our protection as we wouldn’t want anything to happen to you.”

Those planning for physical security (safeguards – SGI) for the mPower reactor, were attempting to make it defensible with an order of magnitude less armed security than was back fit to the existing US LWR fleet. The lead of that team, a long-time company guy, told me that BWXT NOG (DOE/DOD) security in Lynchburg consisted of a guard at a desk with a shotgun back in the ’70s. I believe that new plants can be made more defensible (access control/denial – kill zones) with perhaps 25% armed complement – assuming they actually fire when needed.

The problem is the existing plants were built as plain industrial sites, without security in mind. Security was backfit..

@David

I think some security is necessary, but the level it has been taken to following the 9/11 terror attacks is, I think, unnecessary.

The idea that someone would steal reactor fuel and use it to make weapons is pretty far fetched, for a number of technical reasons. If there is anything attracting terrorists to a nuclear plant, it is the extreme attention they would get by doing so. While they might be able to do some damage to the plant, it would be pretty difficult to affect anyone offsite.

@gmax137,

Thanks, that confirms what I was thinking that the funds are mostly wasted on these high power security forces. We would be much better off spending money to tell the truth about the actual possible results.

Not to mention the used fuel from a commercial nuclear power plant is TERRIBLE for weapons production. We burn our plutonium 239.