Did the Republican tax reform bill add the last straw that halts large nuclear plant construction in U.S.?

Early this morning, Senate Republicans passed a tax reform package. Despite passing generous, deficit-increasing legislation that includes many provisions that favor corporations and most forms of energy production, it did not include an extension of the operational deadline that must be met to qualify for the nuclear production tax credit.

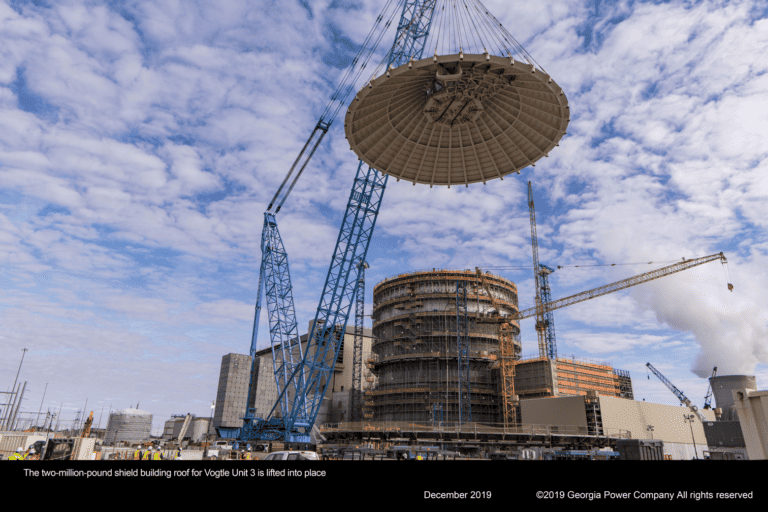

In my analysis, there is a high probability that the failure to extend that deadline will result in cancelling the Plant Vogtle Expansion project. The most immediate result will be several thousand layoff notices just a few days before Christmas.

The longer term effect of the decision might be the complete loss of the large nuclear plant construction business in the U.S.

A corollary effect should be the complete elimination of the myth that nuclear energy is a partisan issue that gets support from Republicans and opposition from Democrats. Not a single Democrat voted for a tax reform bill that clearly disadvantaged nuclear energy while every Republican senator that is not being treated for brain cancer voted for the bill.

Importance of the nuclear production tax credit

Way back in the summer of 2005, before the beginning of the Great Recession and before the revolution in natural gas production, Congress passed the Energy Policy Act of 2005 (EPA 2005). That sweeping legislation included several provisions designed to stimulate a revival of the large nuclear plant construction industry.

That industry needed help. It had atrophied and nearly disappeared during the three decades since the last nuclear power plant order. New orders had slowed in the early 1970s with some cancellations in the wake of the recession following the Arab Oil Embargo.

Before the industry could work off the construction backlog, Three Mile Island (TMI) happened. That event created a regulatory panic reaction that halted nuclear plant operating license issuance for three years.

Project delays combined with double digit inflation and interest rates approaching 20% added to the reluctance to make major investments in new projects, though some plants were eventually completed through the 1980s, with the last construction project – Watts Bar unit 1 – finishing in 1996.

EPA 2005 negotiators recognized that it wasn’t going to be easy to revive the nuclear plant construction industry after such a lengthy hiatus.

All potential customers recognized that there were going to be substantial costs associated with being in the first wave of new plant construction, before the supply chain had been restored and before work forces learned how to complete work to the exacting standards that the regulators required.

There appeared to be some advanced designs that were ready to go, but government support was needed to reduce some of the risks for the early adopters. One of the incentives included in EPA 2005 was the production tax credit (PTC).

It was structured to encourage leaders while not providing unearned cash payments to reluctant followers. Legislation drafters did feel the need to incentivize a wait and see approach that allowed others to make all of the mistakes and suffer through all of the start-up delays.

Only the first 6 GWe of new nuclear plant construction could qualify. Designs that had already been built and proven were not acceptable choices; the political decision makers had made a determination that they wanted to limit incentives to advanced systems that were designed to be less vulnerable to the type of event that resulted in a partial core melt at TMI. Only advanced systems approved after 1993 were eligible.

PTC Provisions

The PTC incentive was substantial, though significantly more limited per unit of produced electricity than the similar production tax credits that have been providing millions to billions in support for the wind industry since 1992.

Unlike the wind PTC, the nuclear PTC was fixed at no more than 1.8 cents per kilowatt hour. Wind had been set initially at 1.5 cents in the early 1990s, but the provision included an inflation adjustment that had raised it to 2.2 cents by 2005 (it’s now at 2.3 cents).

There was also a per unit cap put on annual payments. During years without any scheduled or unscheduled outages, the nuclear PTC cap would limit payments to about 1.25 cents per kilowatt hour. ($125 M for each 1,000 MWe of nameplate capacity.)

Even with the limitations, the nuclear PTC had the potential to provide $1 billion over an 8-year period for each new nuclear plant that qualified. It successfully helped to encourage the early start of four new plants – two projects with 2 units each.

Those plants were begun by regulated monopoly utilities whose rate of return and investment decisions are overseen by state level public servants. In all cases, the cash flows associated with the PTC were part of the utility decision to submit and the PSC decision to approve the final investment decision.

Why did Congress need to include a PTC extension in the recently passed tax reform bill.

As an additional means of encouraging an early revival, EPA 2005 included a qualification deadline. The deadline, however, was not put on the project start date, but on project completion as measured by the beginning of commercial operation.

Conversations with some of the people involved in drafting the legislation lead me to believe that there was some concern about using up the incentive authority on projects that were started without serious intention of dedicated progress towards completion.

From the perspective of 2005, the completion deadline of commercial operation before January 1, 2021 seemed entirely reasonable. It even appeared to provide some buffer for unforeseen delays.

Since no advanced nuclear plants have been completed, there has not been a single dime of taxpayer money transferred to nuclear plant owners in the form of a production tax credit as a result of the promises made in August of 2005.

One of the two 2-unit projects has already been suspended, and without the potential of qualifying for the PTC it is even less likely to be revived.

The other two unit project, the Plant Vogtle Expansion, will be reviewed again by the Georgia Public Service Commission on Thursday. Even with the prospect of receiving some federal support for the first 8 years of operation the PSC staff has determined that completion is uneconomic compared to an alternative involving natural gas using a reasonable price projection.

There is strenuous opposition to the project continuation from the usual suspects including professional antinuclear groups and groups that oppose electricity rate increases.

The failure by Congress to extend the commercial operation deadline for qualification means that the Public Service Commissioners will have an even more challenging barrier blocking them from approving project completion, even though project cancellation will have some serious negative consequences.

There have already been several opportunities to include the PTC extension. The tax reform bill was the last chance before the GA PSC review that will result in a go or no-go decision. There is no way I could advise the PSC to trust that the federal government will eventually do the right thing and extend the deadline.

I can hope, however, that the PSC will decide to go forward even without the possibility of receiving $2 billion in compensation for their leadership and willingness to step out to restore an important national capability.

While it’s very disheartening if this is true it may bolster the case for Lightbridge fuel since it improves safety and economics in existing reactors. This is assuming they can overcome persistent doubts and delays. If they can and if the industry becomes more profitable then nuclear could receive more tax dollars. Everyone loves you when you’re winning but hard to find a friend when you’re down.

“while every Republican senator that is not being treated for brain cancer voted for the bill” while true this is an insensitive statement and should be re-phrased

If it’s true, it’s not insensitive to either McCain or the rest of the GOP. I want to know how they could cut the AMT for corporations but not individuals? How could they leave favorable tax treatment for unreliables?

I skipped sensitivity training.

I thought Vogtle had a 50/50 chance of surviving until the PTC was dropped and Jacksonville Energy Authority reportedly wants out. Now I expect Vogtle will be cancelled. Even if Vogtle survives, large nuclear is dead in this country at least for decades. Large nuclear evolved in a different era that is more past than present.

I wasn’t involved with construction but my observations tell me that we really don’t have the human resources for large nuclear construction, which despite the AP1000’s “modular construction”, still required > 5000 construction workers and who seemed to be a real struggle to find. Many were in their 50s or older (a consequence of years of downplaying vocational skills in the education system). The medical incident rate was somewhat high, not just injuries but heart attacks etc. Another thing I noticed was the large amount of trash thrown along the sides of the road taken by most of the construction workers (who were the main users of this remote road).

Hopefully, NuScale won’t have these problems.

In talking to a couple of people involved in the VCS project, apparently there were a lot of bodies thrown on the project for no reason other than a friend of a friend, etc. Unfortunately, these projects were looked upon by some as jobs programs instead of a race to the top.

Until we as a country get away from the idea that large infrastructure projects are there just to create jobs, we will continue to have outrageous cost overruns and delays.

I have never heard that. I did hear that many would often be idle until their specific job packages were ready. Productivity rarely met projections. Westinghouse would continue to repeat boilerplate about schedule improvements were being evaluated. Turned out that when SCANA and Southern looked at internal WEC documents, there was no integrated project schedule. I don’t see how their bankruptcy shields them from criminal liability.

I wonder if site productivity has improved at Vogtle since Southern took over. It did not at Summer, though there may not have been enough time. Really, if design changes are holding things up and your designer is in bankruptcy turmoil, there is not much you can do.

Once

My first summer job was Signalman “Helper” on the RR. I was amazed at the Union rules and their strangle hold. E.g. in replacing the insulators between sections of track for the crossing signals a Signalman handles the insulation and a Track worker handles the nuts, bolt and washers. I got one warning the first time i touched a bolt in trying to align the insulators.

I then discovered the IBEW and the other unions at Nuclear power plants. The unions there have an even stronger hold than the RR unions. E.g. A Union Operator was the only person allowed to touch the elevator button on the typical elevator like in any office building you have been in. Witnessed several walkouts (always on Friday) when a non “Operator” touched the button for the floor he wanted.

Note: “Operator” is referring to the union title of those construction workers that “operate” equipment, that is start the sump pump and other electrical equipment. Some one else would lower the sump pump into the pit so that the water could be pumped out.

I’m still waiting for someone to prove to me how reducing the corporate tax rate indefinitely results in higher wages and more jobs. We’re living in fantasy land: the gap between the haves and have nots has never, ever been larger. That being said, no one is going to move forward with large scale nuclear in this country. We just don’t have the horses in the stable to do it anymore, and we’ve been surpassed by the other nationally backed players worldwide. I was very, very hopeful for SCANA and Southern until we fell on our faces. Vogtle isn’t looking too good right now, even at 65% completion. Can NuScale pull off the upset and actually prevail in the face of all this?

“I’m still waiting for someone to prove to me how reducing the corporate tax rate indefinitely results in higher wages and more jobs”

Corporate America has done very well by their lobbyists with this bill. They will hire more. Just wait until 2018. Any Republican voted out of office will take one of the increased lobbying jobs and be paid better than his or her elected position.

Let’s not forget that the original tax bill passed by the House of Representatives included the PTC extension, which is set to expire in 2020. Not a single Democrat voted for that bill, the the Democrats have done squat to save Vogtle, which I agree is most likely dead very soon.

@Jim Horner

If so, why didn’t the House representatives to the conference committee stand firm on maintaining the PTC.

There weren’t any Democrats invited to the meetings.

I suspect the nuclear PTC was tossed under the bus as a sweetener for deficit “hawks”. The same “hawks” that shovel billions down the maw of the pentagon.

As y’all probably know, the Republicans have not given up on the PTC. From ANS Policy Wire…

“Last night the Senate Finance Committee released a bill that would “extend a series of lapsed or soon-to-expire energy-related tax credits,” including the nuclear power production credit that would remove a 2020 deadline to take advantage of the credit. The office of Senator Johnny Isakson (R-GA) said they are “hopeful it gets done before the end of the year or early next year.”

E&E News reports that the chairman of the Georgia Public Service Commission has said he’s received assurances from both Isakson and Speaker Paul Ryan (R-WI) that Congress will take up the power production credit. The Georgia Public Service Commission is set to vote on the fate of Vogtle today.”

Jim

More here, including a link to the bill.

Thank you Brain for looking it up.

And the Brain cancer comment – why? – perhaps they were distracted by the opportunity of reducing taxes for 80 percent of Americans or that 47 percent of the actual savings would be to households making between 40,000 to 200,000.

@John T. Tucker

I never cease to be impressed by people who manage to believe that tax cuts are the best way to improve the country.

That’s especially true from a party that often claims to want government to be run more like a business.

What business chooses to reduce prices on premium products even if customers have demonstrated that they will pay the high prices, even if they occasionally complain about them?

Of course, I am biased towards ensuring that the government has the resources that it needs to keep paying its obligations – including my pension – and to help its citizens to have access to increasing prosperity.

Much of the money is not only wasted, it actually works AGAINST us. Most of military spending actually gets us in trouble and rather than used for any rational defensive needs actually creates more insecurity.

We pay for dysfunctional families to expand. We pay to import poor people.

And that pension (social security)? I’m planning to apply at 62 because with the new demographics social security will no longer be the “third rail”. When it goes broke, don’t count on those “doing the jobs Americans won’t do” to support a tax hike to save it.

Rod is a retired Naval officer. I assume he’s referring to his military pension.

We are $20T in debt. What we really need are large federal spending cuts and a balanced budget amendment to the COTUS that prevents spending in excess of revenue except in the case of extreme national emergency such as a world war.

The GOP tax plan is likely to help just about everyone’s purse in the near term, but the potential losers are our children who will have to shoulder this burden. I suppose if GDP stays above 3%, it may all work out.

No administration wants a balanced budget amendment in their first term, as it is likely to stifle growth for a while. You may have noticed that now that Republicans are in charge (officially, but I wish they would be united and actually take charge), the Democrats are now concerned about the deficit again, because they certainly don’t want to see life improve for the average voter.

The Democrats say that this tax bill will mainly benefit the wealthy. Well, of course that is true, as the wealthy pay the most taxes, and the poor pay none, or less than none.

Ironically, the Democrats also say that millions of Americans will pay more (e.g. some blue states with high state/local/property taxes) due to the $10k limit on state/local/property taxes. While that is true too, by definition, it is the wealthier people who will pay more, as they are the ones that will not be able to deduct their exorbitant SLAPT any more. I thought I heard them say that the wealthier paying more is a good thing? Isn’t the real problem with the tax rate in California, New York & New Jersey?

Merry Christmas to all.

Looks as though it’s another bill we have to pass to see what’s in it? I just didn’t get a chance to read the 479 plus pages, did anyone else here?

Vogtle has just received a stay of execution!

I was a consultant at Diablo Canyon and got chewed out by a (union) I&C tech because I touched “his” meter. It was like “Don’t touch that meter!”, and all we were doing was checking for a low-resistance ground fault. My professionalism finally got the best of me and I told him I was going to fix this thing whether he liked it or not.

I heard a horror story at Shoreham that they’d have an outside person come in and calibrate an in-line pressure or flow rate meter. A union guy would come along with a pipe wrench and smash the faceplate of the meter. They knew that would require re-calibration and, oddly enough, there only union guys around to do it. When Cuomo was making noises about having LIPA take the plant from LILCO these incidents were mentioned to him, but since Cuomo was in their pockets he gave them a pass and threatened to bring the utility executives up on RICO charges, the lousy rat.

They’ll do anything to protect their jobs at the expense of safety and other peoples money. I’m a union member but some of their policies/rules get vacuous at times.