John Rowe explains how Exelon’s self-interest is served by promoting natural gas

John Rowe is the recently retired CEO of Exelon, an electric power generation and natural gas delivery company with the largest fleet of nuclear power plants in the United States. Exelon just completed a merger with Constellation Energy, bringing the total number of nuclear reactors in its fleet to 22 (17 from Exelon and 5 from Constellation).

On March 9, 2011 (just two days before the Great North East Japan earthquake and tsunami added the word “Fukushima” next to TMI and Chernobyl in the antinuclear lexicon), Rowe sat down to talk with Nick Schultz of the American Enterprise Institute (AEI). In his typically ponderous manner, Rowe clearly explains why he views 2008 as a golden time and why Exelon’s stock price is still less than half of its pre-economic crisis peak. He also shows why I believe that having leaders like him at the top of “the nuclear industry” is terrible for both nuclear energy professionals and for those who believe that atomic fission of uranium and thorium is humanities shining hope for a bright future that is not constrained by a lack of power.

Aside: I fall into both categories. That is why I have published this dual portrait in the past, and probably will do so again in the future. By nature and by upbringing I am far closer to George Bailey than to Mr. Potter. I like helping people and making lives better; Rowe likes profits that increase his personal wealth and the wealth of his buddies in the exclusive club of multi-millionaires. End Aside.

For people who understand business and economics, the AEI interview with John Rowe also provides evidence that Exelon has a clear motive to promote natural gas as THE fuel for new electricity generation capacity. Bean counters and model makers at Exelon know that the best way to increase natural gas prices is to build up demand faster than the supply can possibly expand. They should have had their first lesson on that topic during the first week of Econ 101.

There is a predictable result of increasing the demand for a commodity whose supply is constrained, the only questions will be:

- When will the inevitable price increase start happening?

- How high will prices get?

- How long will the high prices remain in effect before demand destruction and newly encouraged suppliers combine to reverse the situation?

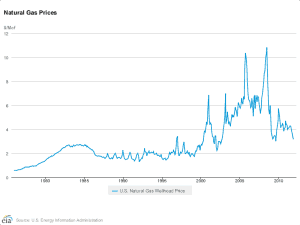

This is a good time to remind people of the historic volatility in natural gas prices in the United States. The last time they behaved in the kind of gradual ascent predicted by Rowe and “the people who do this sort of thing for a living” was before 1978. Back then, interstate gas prices were federally regulated and forced to remain at predictable levels.

This natural gas price graph needs to be hung on the wall at any company that will suffer when natural gas prices start rising again. I can assure you that the companies that benefit from those spikes know the pattern this graph makes by heart. They can probably tell some pretty wild stories about the impressive revenue gains made during the time between the rise and fall.

Though Exelon is not a gas producer, it benefits from natural gas price increases almost as quickly as the most focused gas producers in the US. If you agree with me and believe that gas prices will rise quickly from their current level, Exelon may be a better way to play that bet than a direct investment in a natural gas exchange traded fund. It pays a nice dividend and reduces the risk of being wrong about the timing of the inevitable rise.

(Disclosure: I am not an investment advisor and not trying to encourage any particular investment. I am merely making an observation. Researching and writing this post, however, has encouraged me to place a limit order to purchase Exelon that might be executed on Monday.)

PS – I just watched the video one more time. Rowe makes two claims that just stick in my craw. He says he is a “nuclear guy” and later says he is a “hardware guy.”

Neither is true. He is an accountant, you know the kind of person who wears green eyeshades and who probably got picked on unmercifully as child because he wore glasses and was not very good at sports. Based on video, he is also far more interested in high calorie meals than in exercise.

This interview is pure gold, but I don’t draw the same conclusions you do. First of all, I see a competent and polite man who believes strongly in the potential of fission but has been running up against impassable cultural (and as a result, economic) barriers his entire career. It’s his business to know what’s going on in the energy markets and I believe he’s shared his educated beliefs about that honestly here, and I thank him for it.

He’s told us frankly that:

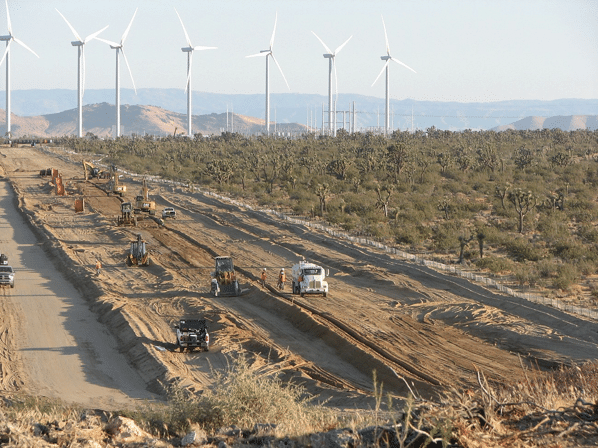

“… we bought John Deere Wind … betting on the political market. We think that, regardless of the speeches I give, many States — perhaps even the federal government — will continue to have renewable energy portfolio standards. If we have to buy it, we want to sell it too. … Right now the wind that’s out there — many thousands of megawatts — is *all* driven by State requirements. It’s always the case of an unwilling buyer and a very willing seller.”

And he’s made a very dire prediction, that wind may become economical in 30 years, but not because it gets cheaper! In other words, that energy becomes very expensive in the future. That would be very bad indeed:

“It could be wind which will become more economic over [the next thirty years] — not because it’s going get that much cheaper, but because other things continue to get more expensive.”

@Carl – you have not been following Exelon as long as I have. Before Rowe became the only CEO, the company, formed via a merger between Commonwealth Edison and PECO, had co-CEO’s. The other one was an amazing leader and visionary named Corbin McNeill.

Unlike Rowe, Corbin saw that new nuclear might be “too expensive”, but did not think of that as a permanent situation. He realized that just like patience and commitment can cause unreliable technology like wind turbines and solar panels to fall in price, similar efforts could push nuclear power plants down in price.

Instead of just complaining, he did something and invested a little of Exelon’s money into a project called the PBMR. That investment was not only provided needed capital, but was also a vote of confidence in a new company. When Rowe took over, he halted the participation and the investment, pulling the rug out from under a potentially game changing technology. He did that because he did not see any room for growth in his service territory; he wanted to pursue a high price strategy rather than an increasing volume strategy.

https://atomicinsights.com/2001/02/exelon-goes-first-pbmr.html

He also ensured that the two unit Zion facility was destroyed rather than restored to operational status. There are lots of links on Atomic Insights about that particular example of greedy behavior.

I hate it when people like Rowe pretend like they have no power or influence over the government’s stupid rules to establish renewable portfolio standards. Instead of just going along, why doesn’t he take the moral high ground and say the truth – wind energy is a silly waste of money if your mission is to provide reliable, low cost, clean power to enable economic prosperity (not just for your customers, but for your company.)

Take a good look at that stock price history. Think about what it might have been if the PBMR project had been vigorously pursued instead of being allowed to wither away. Then tell me again why you think John Rowe is anything more than a selfish, rich accountant with no vision for the future.

I don’t think he’s a selfish, rich accountant, no. He’s obviously not that by looking at him. CEOs kill projects for lots of reasons, and the PBMR project had more than one. I don’t know about Zion so I’ll demur. You continually underestimate tremendous public support for “renewables”. I don’t think the CEO of a nuclear company really has much power to change it.

Rowe must be in the 0.01%. Why would you expect anything that is not self-serving?

I don’t. And you are correct, John Rowe is a very wealthy man who apparently looking down on people. He was also very lucky to have been able to take credit for the exceptional work done by Oliver Kingsley to improve Commonwealth Edison’s nuclear plant performance.

http://money.cnn.com/magazines/fortune/fortune_archive/2006/05/15/8376894/index.htm

In rereading that article I relearned something I once knew, Rowe is not an accountant, as I called him a few days ago. He is a lawyer, a profession with an even higher percentage of greedy non producers than accounting.

You will find out rowe’s self-comes-first stance by asking current and past employees, Are you better of now than 5-years ago? It will go something like this; Thank goodness I still have a job at this miserable work place and, Downsizing former company staff paved the way for upsizing his golden parachute. Wonder if he gets the mummy back now?