Investor reaction to an aggressive plan for new nuclear power plants

Here is a time to preach to the converted. During the past dozen or so years, I have engaged in a number of conversations with well-compensated executives in the energy industry. They have listened to my pitch about the technical benefits of nuclear power, but their closing remarks at the end of the meetings have often included comments about the fact that they cannot take the risk of hurting their stock price by making a choice to develop a new nuclear power system.

The impression that they gave was that they considered nuclear power to be “the third rail” of the energy business where a mere mention of interest would cause investors to abandon their company.

That is an obsolete reaction. Responses in similar meetings has been far more favorable in the past year, and apparently my tiny little company is not the only company that has detected the trend. TXU, for example, has been making some pretty aggressive announcements about their plans for future nuclear plant developments to investors, and their stock price has held up rather nicely.

On 31 August 2006, TXU revealed plans to construct as much as 6 gigawatts of new nuclear capacity. An article about the announcement was published on Trading Markets.com, a site that appeals directly to investors – TXU Reveals Plans For 2-6 Gigawatts Nuclear Power Plants – Update. TXU has been talking about new nuclear plants for a while, but previous announcements had been limited to discussions about adding a couple of new reactors on the site of their existing nuclear station. Here is a quote from yesterday’s article:

John Wilder, Chairman and Chief Executive Officer of TXU, said, “While new nuclear generation cannot come on line in time to meet the growing power needs of Texas for the next 10 years, TXU continues to aspire to be a leader in the commercialization of the next generation of low-cost, clean technology. Nuclear generation offers the potential to deliver our customers lower, stable prices and continue to reduce Texas’ over-reliance on natural gas. Based on top decile performance at our Comanche Peak nuclear power facility and strong knowledge of the Texas market and customers, TXU is uniquely positioned to commercialize this technology in Texas.”

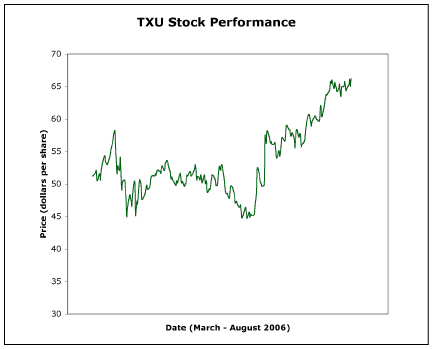

Here is a graph of the performance of that company’s stock during the past six months. Of course, there are many factors that influence stock prices, and TXU has been talking about new coal and natural gas power plants as well as nuclear, but the fact remains that mentioning interest in building new nuclear power plants is no longer a taboo.

Update: Here is another article found in the business section of the Houston Chronicle talking about TXU’s plans. The article, titled TXU Plans to Build Nuclear Plants may be familiar to readers of other publications since it is an AP news wire article written by David Koenig. I love the last line in the article.

Shares of TXU rose $1.21, or 1.9 percent, to $66.21 on the New York Stock Exchange.

Who still believes that an announcement of interest in building new nuclear power plants will automatically scare investors?