A key phrase in an FPL press release needs to be repeated

FPL – Florida Power and Light – is the electric power utility that serves the southeast part of Florida where 4.5 million people live and where I grew up. It is also the company where my father worked as a transmission substation engineer for a bit more than 35 years. I have very fond memories of the company’s annual picnics at a park built under the shadows of the stacks at the Cutler plant and of Christmas parties that included gifts from Santa for every child based on sex and age. Mom still receives regular checks from the company as a pension and from dividends. In other words – I have a lot of biases in favor of FPL.

Recently Florida’s Public Service Commission (PSC) approved plans to build two new units at the Turkey Point power station, now the site of five large generating units with a combined total power capacity of 2,196 MWe. (Here is a list of the units at Turkey Point: Unit 1 – 398 MW oil/natural gas-fired, Unit 2 – 400 MW oil/gas-fired, Units 3 and 4 – two 693 MW nuclear units (Westinghouse PWR), Unit 5 – 1,150 MW combined-cycle gas-fired, and a handful of 2 MW and 3 MW oil-fired turbines.)

Under current plans, units 6 and 7 will be two more Westinghouse designed PWRs (AP-1000) that will bring the total site power up to about 4,500 MWe. In a development that has surprised and disappointed many pro-nuclear bloggers, FPL has indicated that they are expecting that the project to build the two plants and integrate them into the southeast Florida power grid will cost between 12-24 Billion dollars. That indicates a cost per kilowatt capacity of between $5,000 and $10,000 – WAY more than the numbers that are often used. I contacted a friend at FPL who is not involved in any of the business cost computations who told me that the scuttlebutt conversations are all focused on the rather dramatic commodity price inflation that has affected steel, copper, concrete, and seems poised to have a big impact on labor rates.

Tthe company is trying to be cautious in its planning and in preparing people for what the plants might cost, but the inflation worries are very real. The idea that a new nuclear power plant might cost $1600 – 2500 per kilowatt needs to be considered as quaint as the idea that a barrel of oil costs $30 or that a million BTUs of natural gas cost only $3.00.

Here is a key phrase in FPL’s press release that needs to be understood and repeated:

Over the long term, operating expenses for nuclear plants are projected to be much lower than expenses for fossil-fuel plants, despite higher initial investment costs. For example, between January 2000 and July 2007, FPL’s existing nuclear units saved customers $8.7 billion in fuel costs (emphasis added) compared to natural gas and oil.

Building any power station is a long term decision. The initial choices between uranium, thorium, MOX, gas, coal, and oil will have cost consequences that can only be estimated. There are plenty of people who want to help in the decision process – some of them sell various forms of fuel and many would love the utilities to make plant choices that provide “lock-in”.

Thought they are on a completely different scale, power plants adhere to the old business school story about the difference between razors and razor blades – the initial cost is only a small part of the long term ownership cost if the razor blades are disposable, costly and rapidly consumed. Of course, business schools generally focus on the supplier side of the equation – they teach MBA students how much better the revenue is when you can sell lots of razor blades in a situation where the customer is restricted in their choices because of the psychological effect of owning a nice looking razor.

The B schools successfully transferred that concept to the natural gas company marketing departments. The gas industry helped finance their colleagues in the gas turbine industry and obtained the marketing assistance of “alternative” energy gurus like Amory Lovins to help persuade utility customers to buy seemingly economical “razors” (aka combined cycle gas turbines) that could only use a couple of types of razor blades – gas and oil. At late 1990s prices, that decision made sense, but only if the purchaser did not look around and see that everyone else was also buying large and increasing quantities of the “cheap” non renewable “razor blades”. Once utilities and independent power producers had purchased enough gas turbines, the fuel suppliers gained the upper hand. The predictable (see, for example a December 2000 article titled Bandwagon Gas Market results are now evident.

It will not be easy to change that momentum because at the same time they built the turbines, the turbine manufacturers were tearing up their ability to produce components for plants using uranium, thorium and MOX. It is going to take ten to fifteen years of hard work and plenty of investment to regain that capacity. Bottom line – do not be surprised when new nuclear power plants cost more than they would have if we had started construction in the mid 1990s – when there were only a few voices advocating that path. Just imagine the value that a newly commissioned AP-1000 started in 1998 would have in today’s energy market!

One final thought – what if we could use the gas turbine manufacturing infrastructure to produce plants that could use uranium, thorium or mixed oxide fission fuels? Wouldn’t that be a great way to upset the well laid plans of fossil fuel suppliers?

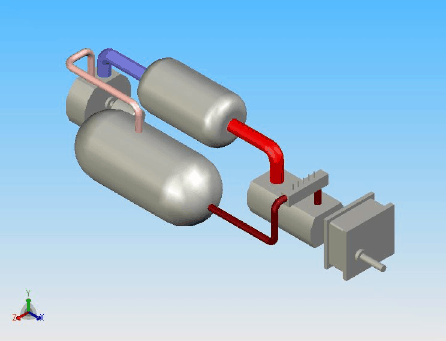

Okay, that was a sneaky plug for the design concept behind Adams Engines(TM). Nitrogen at pressures and temperatures similar to those found in a combustion turbine cycle is a Brayton Cycle working fluid that acts a lot like air. It can effectively transfer heat from a relatively large (low power density) pebble bed reactor or a liquid fluoride reactor using uranium and thorium salts.

Both of those reactor designs operate at temperatures high enough for Brayton Cycles. They are also passively safe and do not need pressure vessels manufactured by Japan Steel to turbines designed to run on air. It can then transfer heat to either water or atmospheric air in a sealed cooler and be pumped back into the reactor using air compressors. The components necessary for this type of power plant are different from those needed for a light water reactor and not subject to the same cost and schedule constraints. Here is an artist concept to help you imagine the possibilities.

Heck – if you already own some of those gas turbine “razors” think about how cool it would be if you could replace the combustors with a pebble bed or a liquid fluoride reactorand the exhaust stacks with some air coolers. That would upset your current fossil pusher, wouldn’t it?