Vermont Yankee: Clean Kilowatt Cow That Deserves Saving

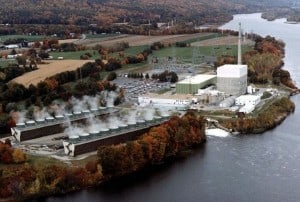

Vermont Yankee is a 650 MWe nuclear power plant in excellent physical condition. It has an operating license that is valid through 2031 and it is run by a well-trained operational staff.

It supplies power to a grid where 60% of the capacity comes from natural gas that is delivered via a constrained pipeline system.

That system proved to be incapable of delivering sufficient fuel to meet demand during numerous days during the past winter.

Fuel supply constraints in New England were severe enough on cold days during Winter 2013-2014 to push gas prices to a peak of $125 per MMBTU.

Virtually every dual-fueled generator in the region switched to distillate fuel oil on extremely cold days because that premium liquid fuel only cost $22 per MMBTU.

There were days during the winter when 25% of New England’s electricity came from burning distillate; fully 4% of the kilowatt hours during the months of December, January, February and March came from oil, up from just 0.6% the prior year.

If Vermont Yankee had not been running, electricity generators on the New England grid would have needed to purchase an additional 100 million cubic feet of natural gas every day.

On the days when natural gas was too pricy, Vermont Yankee’s daily output would have been replaced by burning almost a million gallons of diesel fuel.

In either case, the generators that would replace Vermont Yankee’s output would daily produce an extra 325,000 kilograms of CO2.

Even with all of those excellent reasons for keeping Vermont Yankee running Entergy, the plant’s current owner, has announced that it will shut the plant down for good when its current fuel load has been consumed. That will happen at the end of this year.

According to its press releases, Entergy has determined that it is no longer economical to continue operating the plant.

What Entergy has not clearly explained, however, are the factors that have combined to make the numbers unacceptable.

Unpopular for 50 Years

Vermont Yankee has been controversial since before it was built. Opponents sued during the construction permit process in 1966 to force the installation of cooling towers.

Four states intervened in its operating license hearings in 1971, leading to complaints about a significant cost overrun during construction.

In 2002, with about nine years remaining on its operating license, Entergy purchased the plant from owners who were considering an early decommissioning.

Though some people assumed that the plant would shut down at the end of its initial operating license, Entergy recognized that the plant was making a nice profit and had the potential for increased returns once its fixed price electricity supply contract expired.

Entergy performed a power uprate modification and renewed the operating license. Both actions were opposed by many, including powerful members of Vermont’s state government.

Some opponents have made it quite clear that they want Vermont Yankee shut down to make room in the market for the sources of generation that their companies or their friends’ companies supply.

Opposition groups have worked hard to publicize every VY miscue, no matter how minor the impact on public health and safety, using a campaign that portrayed Entergy as an untrustworthy, absentee owner from a foreign place called Louisiana.

The opponents even brought Helen Caldicott to Vermont for a whirlwind speaking tour telling people all about the evils of the nuclear industry and the hazards of the smallest quantities of radiation.

In response, Entergy has spent tens of millions of dollars on lawyers, lawsuits, reactionary public relations, and recovery efforts to alleviate public pressures.

The cost of the struggle, along with the drain on executive time, contributed to the decision that the plant was no longer worth operating.

Cooperative Business Model?

I had the opportunity to tour Vermont Yankee in late March. Throughout the tour, I was impressed by the plant’s material condition. I met people who take pride in their work but who are saddened by the closure plans and worried about the future.

When I left the plant I ended up following a truck on the highway from Cabot Creamery that said “Owned by Dairy Farmers Since 1919.” That started the wheels turning.

Vermont has a deep history of cooperative businesses. One of its larger employers is the King Arthur Flour Company, which transferred ownership from the family founders to employees in 2004.

The state is also one of several states that allows companies to incorporate as ‘B’ corporations with bylaws that enforce social goals that sometimes conflict with maximizing profits.

Vermont Yankee might not be worth operating as a less-productive-than-expected cash cow by a ‘C’ corporation that does not have strong local ties or even a good local reputation.

However, it is very definitely worth operating as a “clean kilowatt cow” by owners who feel personally responsible for its continued safe and reliable operation.

Most of the opposition’s talking points will disappear for a group of local owners; reduced opposition will reduce expenses that add to operating costs.

Financing can be arranged for a business that is immediately profitable and sells a product that never goes out of style.

In a world that has been fighting over oil supplies for as long as most of us can remember, it seems very short-sighted for state government leaders to encourage a nuclear plant to shut down when part of its output will be likely to be replaced by burning more oil.

It is not too late for nuclear proponents to target Vermont Yankee as a symbolic model for saving a valuable asset, supporting a talented group of professionals, and reminding people that nuclear plants are very good at what they are designed to do.

They produce large quantities of clean, reliable electricity and reduce our excessive dependence on fossil fuels.

If that doesn’t meet the definition of a ‘B’ corporation I don’t know what would.

The above article first appeared in the April 10, 2014 issue of Fuel Cycle Week. It is reprinted here with permission.

Would Entergy entertain the idea?

What about Vermont?

Has it been taken up publicly?

This fits with something I’ve been wondering for a while.

Should natural monopolies like electricity distribution, and to almost the same extent electricity generation, be organized as customer cooperatives?

This would avoid price gouging etc. that a monopoly could otherwise engage in, & since the owners are nearby there aren’t perverse incentives to run things in a dirty or unsafe manner.

Does anyone know of studies of such things finding problems with running things that way?

I do not remember the source, but I do remember reading/hearing the results of a study which found that on the average municipal owned utilities in the USA have lower rates and higher customer satisfaction than utilities where the market has been “deregulated” and there is supposedly competition amongst the providers or in markets where a monopoly has been granted to a private enterprise — if any such exist.

I wrote about cooperative ownership at some length in Chapter 9 of my book, Prescription for the Planet. You can download it for free here: tinyurl.com/9992kma . Nebraska did it in a big way, the story’s in there. I believe about 25% of US electricity comes from nonprofits of various kinds. So there is a long and well-established track record for something like this, and Vermont would be a natural for it if not for the antie scaremongers there who just won’t let up.

I like your invention of the term “Clean Kilowatt Cow” in the vein of “Cash Cow”, Rod.

I’m sure following that dairy truck played a big role in sparking the idea.

@Joel Riddle

Thank you. You are right about the inspiration, but it was also inspired by a few other thoughts.

For about 5 years (2004-2008), the merchant nuclear energy plant operators were flying high and loving life because they were operating plants that they had either paid off as rate regulated monopolies or purchased at fire sale prices. Their total O&M including fuel was about 2-3 cents per kilowatt hour, yet they were often selling electricity at prices in excess of 8 cents per kilowatt hour.

Some of the executives even began to think of themselves as wonderfully smart for being able to make so darned much money from assets that almost bankrupted their predecessors.

That was the “cash cow” era for nuclear plant operators like Entergy, Dominion, First Era, Constellation and Exelon.

Now that the market has changed and the going has gotten a little rough, they are throwing in the towel and quitting even though the cow is still producing just as much of the product it was designed to produce as it was in the “golden era of nuclear energy.”

That’s a quote from John Rowe, one of the merchant generating plant company executives who thought he was so much smarter than his predecessors.

The cows are still doing exactly what they were designed to do. They cannot help it if the product is not bringing in as much cash. It is still just as important to the customers to have it.

If there is a cash flow benefit to the actions taken by Entergy and related expectations are “baked in” to overall plans, or, if there is some other over-riding economic imperative for shut-down with respect to the Company balance sheet, then it is unlikely that Entergy would even entertain any selling scenario. At this point Entergy may even have enforceable agreements that preclude anything other than shut-down.

Also, when you have competitors that can realize cash flow, or its equivalent, while bidding in their power at less than nothing, and that operate in an environment structured so that grid operators and ratepayers cover, through other mechanisms, other marginal costs that they induce for the system, then plants like this are going to have a very, very difficult time, even if the owner of the plant has a different perspective on the need for a profit.

I thought that it would be great if some kind of cooperative had purchased Kewuanee and kept it operative, and surely this must have crossed the mind of some of the IBEW folks, but this kind of thing just does not seem to be in the cards.

@Frank Jablonski

If there is a cash flow benefit to the actions taken by Entergy and related expectations are “baked in” to overall plans, or, if there is some other over-riding economic imperative for shut-down with respect to the Company balance sheet, then it is unlikely that Entergy would even entertain any selling scenario.

And if there are not any of those considerations in play, then Entergy would be shortsighted to avoid the discussion, right?

It is simply hard for most Americans to believe that a company would be better off closing an asset that they are responsible for cleaning up than to sell that asset to another entity along with the responsibility for the eventual clean up. Even if the selling price is low, it would be better than the cost of the current plan of action.

That is especially true in the case of a plant that has a decommissioning fund that appears to be at least $300 million short of the projected cost of decommissioning.

Rod,

If what you say is correct — that shutting down VY is a net liability — then I don’t see why Entergy wouldn’t agree to sell the unit to its own plant employees for a customary “$1”, plus assumption of all liabilities — and that’s the key here: you say VY ‘s decommission fund is $300M below projected costs. Do we know what decommission route Entergy has planned? SAFSTOR? DECON? Presumably they would shut the plant down and simply wait for the decommission fund portfolio to grow until enough cash accumulates to finish the job (haven’t there been instances in which a NPP was decommissioned for less than projected costs allowing the parent corporation to pocket the difference?).

Also recall that if the plant is to continue to operate under the present regulatory regime the NRC requires an additional half $billion in estimated compliance costs to meet apparently new safety mandates on Mk 1 BWRs in the wake of Fukushima. I don’t know what the time frame would be to complete this NRC mandated work or, by way of comparison, what Entergy spent on the extensive 20% uprate a decade ago.

So I would go first to seek the opinion of the plant employees themselves who you report like their jobs, have a vested interest in keeping them, along with a demonstrated ability to operate the facility. Turn VY into a worker’s cooperative. Let that stew in the VT political arena between Shumlin and Sanders.

Also I imagine Entergy’s costs for VY severance and retirement benefits are not insignificant, maybe they would consider an ESOP deal. Without VY workers enthusiastic cooperation saving the plant would be difficult. Does anyone know exactly what the balance sheet or cash flow for VY actually is as a stand-alone unit apart from the rest of the Entergy fleet? Is it possible to sue for discovery of this information? The all important question: is it making money? Given what must have been huge quark spreads this past winter for ISO-NE it would be hard for it not to be, maybe Entergy is having second thoughts.

@Aaron Rizzio

You have asked some very pertinent questions. Are you aware that there is a Save Vermont Yankee page on Facebook where some of the plant employees and their supporters can be found?

One big issue that I have found is that right now there are several who are quite bitter about the way that their neighbors in the state have treated them and the callous disregard they have had for the 650 jobs they were fighting to get rid of. For at least a few of the workers, there is some excitement about leaving Vermont in the rearview mirror.

I don’t think that is a widely held perspective based on the conversations I had while visiting.

Rod,

I’m eager for answers on the fundamentals of VY’s accounting because it is vital to know if there’s some legitimate economic reason why an amortized NPP cannot operate profitably in a region paying some of the highest electricity rates in the country. I’d think the workers of VY would want to know exactly what profit/loss margins led Entergy to pull the plug on them.

You’ll be interested to know the ISO-NE Q4 gas prices averaged $7.74/MMBTU, 2014’s Q1 numbers haven’t been published yet. That likely meant the fuel cost for a CCGT was about 5¢ per kWh. Not O&M+F, just fuel. Day ahead and real time prices on ISO-NE averaged $57 and $60 per MWh, respectively. On a busy day in mid-Dec ISO-NE baseload was just under 14GW, mid-day shoulder 18GW, and afternoon peak load was 20GW. So VY represents close to 5% of ISO-NE baseload. The operating reserve requirement is set at 413MW — less than VY. “OP4” Operating Procedure No. 4, Action during a Capacity Deficiency, had to be declared when reserve margins fell below that requirement unexpectedly one day when Hydro-Quebec decided to curtail exports to New England.

I haven’t looked it up but the payroll for VY with 650 employees is likely at least $100 million/yr. Every 18 months I read on their Facebook page they have 1000 additional people come to town and help them with their refueling — 1000 people, could this be possible? So maybe VY takes ~3¢kWh to clear OM+F and break-even, a bit pricier than an average US NPP perhaps, but definitely competitive in ISO-NE. These are my guestimates; I’d like to know how Entergy could manage to lose money on these margins.

A couple other wrinkles: even before the post-Fukushima NRC admin ruling was handed down VY was looking at $200M replacement costs for a condenser. Interesting Arnie Gunderson was testifying before the VY legislature that NRC would hit VY with $40M in added compliance costs, even he couldn’t have dreamed it would turn out to be $500M.

As of April 4, 2014 the VY decommissioning fund stood at $614 million, last year this time it was $540 million so the portfolio is well managed; suggestions are that it will take a $billion to get them to “greenfield” conditions as Entergy promised the VT state legislature when it bought the unit; but federal regulations allow them 60 years to complete decommissioning. They could reasonably be expected to make more money off managing the decommissioning fund than operating the reactor. They could SAFSTOR the unit and in 40 years they could turn $600M into $10 billion (in today’s dollars), spend a billion on decommissioning and walk away with $9 billion or $225M/yr, probably more than their profit margin on electricity sales.

Thats a tremendous amount of gas. With all the fud we have seen regarding Vermont Yankee still the safety thing with gas is routinely overlooked. I don’t know if you’ve seen the mess one storm did in W Florida ( http://www.pnj.com/ ) a couple days ago, but just yesterday in the same area the jail exploded killing 2 inmates and sending over 150 to the hospital. ( http://www.pnj.com/story/news/local/escambia-county/2014/05/01/explosion-at-escambia-central-booking/8550741/ ) I cant help but think they are connected as we saw so many of the ground freeze related explosions this winter up north.

Gas not only has major issues in natural disasters, but also in inclement weather it seems.

Vermont Yankee is a safer cow as well.

Unfortunately, being a cooperative will not change the fact that Gov. Shumlin, other politicians and the people in Vermont who elected them hate, hate, Hate the facility. Maybe Entergy says it is uneconomical because of all the lawyers, lawsuits, etc. Cooperative will probably work in other places but what can be done about the fact people in Vermont hate the place? It sounds like the only problem with Vermont Yankee is…. the Vermont part.

Yes, it seems a lot like that is true. Im not a Glenn Beck fan by any means but a few excerpts from a blaze article (the rest is behind a subscription wall) are a uncomfortably true narration at least. ( http://www.theblaze.com/stories/2014/04/30/our-favorite-villain-how-the-green-left-made-nuclear-power-the-bad-guy/ ). If any of you are interested here is a such a captain planet episode form the very early 90s ( http://youtu.be/xraNHY2BeCA )

“When the scientist admits that he supported nuclear power on the basis it was clean and plentiful in an attempt to solve the energy crisis, the Planeteers recommend he instead research geothermal power.” – Snort! HAHHAHA – It seems the “renewable” separate energy reality thing, and fud marketing scheme is nothing new. Capitan Planet was a Ted Turner creation as well.

Well perhaps this pertains here as well. On a separate but parallel note and something I am probably more qualified to discus I recently read a art related article published back in 2007 on the old, anti nuke All Atomic Comics.

Article: “Cartooning and Nuclear Power: From Industry Advertising to Activist Uprising and Beyond”( http://www.apsanet.org/imgtest/psapr07rifas.pdf )

It felt weird, I had expected a unhealthy dose of anti nuclear sentiment form the artist/author of the article. What I got felt more like a narrative academic review and, almost like remorse or the fact he had indeed moved on from his early impressions of nuclear.

Of course the article seems to give the impression that the situation kinda ended but with captain planet, shortening attention spans and other forms of reference its clear that type of discourse probably just moved into other media. Its also strange how much the landscape has changed since the article was written in 2007 and truth in some of the predictions.

Where this seemingly off topic romp applies here is that I think a lot of this early sentiment with other pieces of th puzzle laid the foundation today for the complete and disastrous misconception that the energy (in kind and scope) from NP facilities like VY could be easy to replace.

BTW: Here is a predictive bit of All Atomic Comics some of you in the industry might find amusing ( http://upload.wikimedia.org/wikipedia/en/d/d5/All-Atomic_Comics_05-crop.jpg ).

The solution to the worry expressed in the comic was to simply keep looking for uranium. It is amazing how much we found.

@John T Tucker

Captain Planet was a Ted Turner creation as well.

Ted Turner was not only Mr. Jane Fonda, but he also is one of the largest landowners in the western US. On just one of his huge spreads in Colorado, there are more than 1,000 natural gas wells in production.

Yikes, I didn’t know he was also such a gasser. How he can peddle his environmentalism with a straight face is beyond me.

NG BTW still isnt recovering the way I would have expected by now. I wonder what this next year will bring ( http://www.eia.gov/naturalgas/weekly/ )

@John T Tucker

How he can peddle his environmentalism with a straight face is beyond me.

I suspect that you are an engineer and project your natural — and professionally reinforced — code of honor and integrity onto others. There was a time, before I ran a small business, when I also believed that other people could not keep a straight face when lying through their teeth. Believe it or not, I was wrong.

@John T Tucker

T. Boone is pretty sure about the direction and is loving the resulting profits.

http://www.cnbc.com/id/101624860

Ive taken a lot of science and math over the years. Dumb persistence has gotten me quite far. My degrees however are in fine arts.

@John T Tucker

You still seem to believe that your fellow humans are as honest as you are. That’s nice but often naive when it comes to people who live their lives with money as their only way of keeping score.

@BobinPgh

I paid a lot of attention to the debate in Vermont over the past five years. There was certainly animosity towards the facility, partially due to the continued reluctance among electric company executives to pay media outlets to run ads that help people understand the importance of what the facility was producing.

However, a lot of the real animosity was aimed at “Entergy Louisiana” and about way that the company could not be trusted because they told the government that Vermont Yankee did not have any buried pipes at the time that there was a tritium leak detected.

Technically, the man who said that was correct. For an engineer, a buried pipe is one that is directly in contact with the ground. A pipe that runs inside of a concrete lined trench that is below the level of the ground is an “underground pipe” not a “buried pipe.” However, the accusation that the company “lied” stuck.

I think there would be a lot more support among the rational people in Vermont — and they are a majority, just like in every other place on earth — if the plant was operated by locals who had a stake in the ownership of the plant.

There is every possibility that I am wrong, but I intend to spend a few days to a few weeks this summer and fall finding out.

Besides – governors are just temporarily in charge. Their term does not last longer than 4 years.

Sounds like it is a wonder that it was built in the first place, but was there always the level of hate? Also wonder again, why not just shut down until a new governor is elected? Still that doesn’t solve the problem of the lawyers and lawsuits (which customers end up paying for)

I go a green building blog and most of writers are in Vermont. They don’t like VY, but they tell people to buy electric induction cooktops and electric heat pumps. Ask, why and get a super long answer I can’t understand.

Might this idea work for Kewanee? In fact, may it work far better, given the relative lack of political opposition, and the fact that it is a PWR, not as subject to expensive Fukushima upgrades?

Or is the point that the Midwest is not as vulnerable to gas price spikes and supply limits.

@Jim Holm

Unfortunately, Dominion was in a hurry to get rid of Kewaunee’s operating license. Once that has been turned in, getting a new one means meeting all current regulatory standards or explaining why you should get an exception. It has never been done before. It’s probably a $100 million dollar effort just to get permission to return to the status that the plant had when it was shut down, even without including the cost of any required system upgrades.

It seems that the “continuing ed” for reactor operators is expensive. Again, I ask, why could there not be a team of people who would be willing to go to any nuclear power station and be able to restart it on short notice? Just as a new hospital can get doctors or a reopened salon can get hairdressers? Maybe if this existed there would not be a shutdown as permanent like Kewaunee, knowing it can be restarted again. Some people must be willing to do this.

@BobinPgh

Are you volunteering to be a vagabond? By the way, did you know that a reactor operator’s license is valid for one unit only? Even on sites where there are more than one units, operators need to go through the training program and sit for the license exam for each unit.

What would be wrong with being a “vagabond”? Some people might be willing to travel, after all, all of the “outage” people do. And why should a license be good for only one unit? I could understand maybe brand specific but how did a situation like that be allowed to happen? I mean, a doctor can work at any hospital in their state that will accept them.

As for a shut down plant never having been restarted, why be so negative? There’s a first time for everything.

Oh, and 100 million to restart may not be that much money. Disney spent that much on the 7 Dwarfs mine ride, a “kiddie coaster” that took 3 years to construct. Their New Fantasyland reportedly costs 700 million and must be less complex than a nuclear powerplant (and while it looks and smells better, it still is crowded with strollers). Besides, don’t the customers just end up paying?

@BobinPgh

What would be wrong with being a “vagabond”?

I didn’t say there was anything wrong with it. Remember, I am a retired US Naval officer who has deployed, moved more than a dozen times, and been a “geographic bachelor” for a total of about 5 years. I simply asked if you were willing to take on a role that you are suggesting for others.

As for a shut down plant never having been restarted, why be so negative? There’s a first time for everything.

Trite. There are many things that have never been done and many others that are not worth repeating. My opinion is that the effort is not worth the reward. You are free to have a different opinion and to put your money where your digits are.

Besides, don’t the customers just end up paying?

Not in price competitive markets. Higher cost suppliers sometimes eat those costs and eventually fail.

Actually, if I were trained in the industry, I would be willing to travel (without the kids, I can do that). Why is it that the operators are only licensed for 1 unit? I’m sorry you feel that places like Kewaunee could not be restarted, just because it wasn’t done that way before.

FYI – at certain sites, where the units are extremely similar, like Turkey Point 3&4 or Diablo Canyon 1&2, a single operator license, RO or SRO, is good for both units.

At others, even though the plants appear superficially to be very similar, i.e. Indian Point 2&3, there are enough substantive differences to requires separate licenses.

It reinforces the old adage that the French have one kind of nuclear plant and a hundred kinds of cheese. In America it is the opposite.

Kewaunee, SONGS, Crystal River and, sad to say, Vermont Yankee are all lost causes. It might be more productive to look for ways to keep Clinton, Quad Cities, Byron and other Exelon plants running.

http://articles.chicagotribune.com/2014-03-09/business/ct-exelon-closing-nuclear-plants-0308-biz-20140309_1_quad-cities-plant-byron-plant-exelon

@Pete51

I have not heard the fat lady start singing about Vermont Yankee. It is May 1, 2014. The plant’s license to operate does not expire for another 18 years. It is not scheduled to shut down until December 27, 2014.

When people recognize that the initial conditions have changed dramatically, they should reset their spreadsheet assumptions and rerun the numbers. From the end of the summer of 2013, who would have expected that gas prices in the US would be nearly $5 per MMBTU on the first day of May with more than 3 trillion cubic feet left to add to storage before the end of storage season?

Vermont Yankee is unique because it needs a Certificate of Public Good from the state in order to operate. As I understand it, the current CPG expires at the end of the year. There will not be another one granted. As BobinPgh says above, the state’s governor and legislature absolutely despise the plant’s existence. I don’t want to see VY shut down any more than you do, but unless the political affiliations of the governorship and legislature suddenly change in the next 8 months, everyone in political power expects and wants the plant to cease operations. Anything else would be seen as a betrayal.

Utilities in New England actually had to burn jet fuel in order to keep the lights on in January.

http://www.forbes.com/sites/peterdetwiler/2014/01/24/iso-new-england-burns-jet-fuel-to-keep-the-lights-on-during-january-cold-snap/

@Pete51

There will not be another one granted.

Who says? Did you read the decision of the board that limited the CPG to just a year? It was all about the owner, not the plant.

@Pete51

Utilities in New England actually had to burn jet fuel in order to keep the lights on in January.

That is the betrayal here. I spent 33 years in uniform, partially to ensure that Americans had access to the energy they needed. Idiots that want to close down a well performing nuclear plant so they can burn even more oil are coming close to treason in my book.

They’re over the line in mine.

Then again, so are the people who buy monster trucks to drive around as a badge of “coolness”. I’ve long wanted another $3/gallon in fuel taxes to make them consider the price of certain standards of “cool”.

@E-P

I am with you on fuel taxes, but would not like to see the suppliers capturing more of our resources with increased prices of similar magnitude. It’s interesting to note how much political grief accompanied a proposal for a 50 cents per gallon tax. At the time that proposal went down in flames (1990s), gas prices in the US were about $1 per gallon.

” I’ve long wanted another $3/gallon in fuel taxes to make them consider the price of certain standards of “cool””

When I lived in Idaho I very much enjoyed the high volume of these “cool” trucks acting “cool” in the ditches and snowbanks they landed in every time we experienced our first major snowfall.

I think some of the points made by Aaron Rizzio May 2, 2014 at 1:34 AM are quite startling if true. Specifically:

“They could SAFSTOR the unit and in 40 years they could turn $600M into $10 billion (in today’s dollars), spend a billion on decommissioning and walk away with $9 billion or $225M/yr, probably more than their profit margin on electricity sales.”

If this is typical of some of the other financially troubled plants it does not indicate a bright future for their prospects. When the decom fund is worth more than both the physical asset itself and the money making potential of operating, the writing is on the wall. According to Wikipedia in 2002 when Entergy bought VY, the plant value was $180M, decom fund was $310M and they were locked in to a fixed price sales contract for 10 years at 4.5 cents/kwh.

Add in the NRC’s $500M post Fuku upgrade cost reserve (I don’t know the basis of that number), a hostile environment, and I can understand the shutdown decision. Especially if the decom fund can be turned into $10B asset against a $1B liability over time. (Wouldn’t have a clue on that assumption and anybody who lived through both the dotcom and house bubble crash might have doubts also)

But that means Entergy is just a market investor, not a power company. Unfortunate, short sighted state of affairs, but it may be the reality.

Plant owners mining the decommissioning fund is yet another example of the law of intended consequences, in this case the regulations requiring decommissioning funding. Not that its a bad thing to plan ahead, but when that results in premature shutdown of perfectly healthy and valuable generating infrastructure, things that are and will be valuable to the country’s energy security, then the regulations are working at cross-purposes to the larger value of these plants. But the “free market” does not have a mechanism for pricing the long-term value of those assets from that point of view. It’s based on what the “free market” going rate is, and what the value of the decommissioning fund is and is projected to be. So, obviously, a first step is some kind of regulatory reform that caps the growth of the decommissioning fund at a value to match the anticipated decommissioning costs. That doesn’t mean the company can’t invest its profits in other ways, just not in a way that distorts the value of the decommissioning fund relative to the value of the underlying asset and the true cost of disposing of it when the time comes. Of course, JMO, and I make no claims to being a financial expert. Just trying to look at things from a common sense viewpoint.

mjd & Wayne SW,

The decommissioning fund itself isn’t working as the perverse incentive here, VY collects a nuclear levy of one or two mills (millage rate) per kWh sold, so $5-10 million/yr is built up in addition to whatever latitude Entergy is given to invest the balance of the fund; all things being equal, ceteris paribus, Entergy would keep the plant running another 20 or 40 years after which time the fund would be just that much bigger. Assuming the fund grows at historical returns of a conservative balanced portfolio, ~7%/yr, it doubles every decade. It’s the NRC compliance cost more than anything else that did VY in; and the added taxes VT was fixing to pile on them that Meredith Angwin points out, and FERC, ISO-NE market rules, which are perverse. Entergy was willing to invest reportedly $400M a decade ago in VY for the largest ever extended power uprate with the expectation that they could operate in a deregulated market some day, but more and more regulatory costs and disincentives keep accumulating.

The onus is now on the VY critics who promised that neither VT CO2 emissions or electric rates would increase (indeed, they’d go down!); the German Energiewende experience is not encouraging. Hawaii has lots more sun, wind, waves and geothermal lava than VT and they’re paying 35¢kWh for the privilege of burning oil for 80% of their electricity. I’d like to see just how many wind turbines it would take to replace VY’s 2-5MT/yr of CO2 displacement. VT could just hook up a HVDC line to Hydro Quebec, which HI can’t do.

BTW I’m unaware of any such fund or millage fee for any coal generator in the US (– anyone?) Duke Energy (who’s CEO endorsed Obama in 2008) exec estimates it could cost from $7- 10 billion just to clean up the coal ash sludge pits which line the lakes and rivers of North Carolina alone. At one point the US was burning as much as a billion tons of coal per year. Coal typically contains 2-4ppm uranium (~95% of UNF) & thorium, radon; thus a far greater mass of radionuclides goes completely unregulated to this day, on the order of >200kT tons of U & Th vs 70kT of used LWR fuel.

Maybe it is not a dispositive factor in VY’s case, but I seem to remember it coming up in the discussion about premature shutdown of Kewaunee. Dominion claimed that KNPP was losing about $20 million a year and they shut it down to gain “access” to the decommissioning fund, which gives them a positive revenue stream in place of a negative one. While the plant was running the decommissioning fund was available in terms of cash flow. But shutting down made it a net gainer. I think if this is the case then the existence of the fund becomes a disincentive (along with negative profits) to continue operation. It even discourages the company from looking at cost-saving measures which might have helped the plant’s case. If it were me I would have at least taken a look at cost-cutting strategies rather than jumping willy-nilly into decommissioning.

Super discussion.

Two factors on VY.

First, legislature passed a law about a year ago that raised the “generation tax” (per kWh tax) on VY from something reasonable to $12 million a year. Not sure what it used to be and not in a position to look it up right now. But $12million is a fair hunk of change for a 600MW plant. Law on taxes was written to apply “only to generators larger than 200MW built after1965.” In other words, totally targeted at VY.

Second, revenue share agreement means VY has to share money it receives from power sales over 6.1cent per kWh. Shares with distribution utilities. This year….VY is sending $18 million to Green Mountain Power.

So we are looking at close to $30 million ( 12 plus 17 million) that VY can’t add to its bottom line…basically because it is in Vermont. Of course they would pay a generation tax elsewhere also, but probably more like ?$5? million.

Meredith- Your post at the ANS Nuclear Cafe titled “Millions for education, but not one cent for tribute” gives a great summary of all of the special taxes and fees that VY is forced to pay. Adding it all up really exposes the outright extortion the state has engaged in. There’s the old fable about killing the goose that lays golden eggs.

For others, who are interested…

http://ansnuclearcafe.org/2013/12/04/millions-for-education-but-not-one-cent-for-tribute/

Meredith, if your tax discussion is true (no doubt it is), it just proves Mr. Hansen’s assessment in Rod’s latest post that the Democratic Party needs to change its position on nuke power. I’m assuming the VT Legislature passed the tax, and as you say it appears to target VY. It certainly fogs the issue (at least for me) about just where the VT voters stand on VY.

Near where I live, FirstEnergy shut down Hatfield-Perry, a profitable coal-fired plant with the stated reason being that it would be too expensive to implement the new EPA “clean coal legislation”. But behind the scenes, everyone knew that the REAL reason was that the utility wanted to bust the union at the plant.

Is it possible something similar is happening at Entergy?

I think Entergy is just tired of the lawyers, lawsuits, protests and the whole aggravation factor. Perhaps the reason is not just money but the aggravation factor of these facilities that is causing the shutdowns.

I hope that is the case. If so, the only way to get rid of the aggravation is to sell the plant and leave the state. If they continue on their present course and speed, Entergy is going to be involved in Vermont politics for a very long time, perhaps 60 years.

The problem is: Where does all this hate, Hate, HATE for VY come from? If that is not somehow dealt with, then the next owner will just have the aggravation, which is probably why nobody has offered to buy the plant. Other parts of the country don’t hate nuclear power plants, at least not as much as seems to be in Vermont. For example, San Onofre would probably still be operating if it did not need expensive replacements despite the protests. But with the protests + the repairs, again, too much aggravation. Is there something about Vermont that makes the situation so unfavorable?

@wayne moss

I wouldn’t be surprised. That is the real reason that Commonwealth Edison shut down Zion in the 1990s.

This decision wasn’t union busting. VY and the IBEW were on good terms. IBEW paid for an excellent economic assessment of VY, for example, in 2010

http://www.vtep.org/studies/IBEW%20Heaps%20VY%20Economic%20Report.pdf

I am not just being rosy-happy here. If Entergy had decided to do union busting, they would have shut down Pilgrim, which had a relatively recent strike and lock- out. VY would not have been the target.

@Meredith Angwin

Thank you for reminding me about Pilgrim’s contentious labor-management issues.

Have you heard of the concept of a “warning shot?” What if Entergy wanted to keep Pilgrim workers in line and decided to use Vermont Yankee to do it?

There has been a lot more animosity in Vermont, and their purchase agreement with Vermont has been quite a bit less lucrative than the one with Pilgrim. They did not cede as much power to Massachusetts as they did to Vermont, so that state has not managed to extract as much tribute.

Just something to think about.

Rod,

I disagree. When a big company shuts down one facility, it does put others on warning that —this ain’t a good time to ask for raises. But that is not the same as union-busting.

If anything, I think this choice on Entergy’s part would send the message: “Hey, union and workers. Turns out that running a plant well and getting along with management doesn’t matter all that much to us. We’re closing you, VY, and keeping Pilgrim anyhow.”

But IMHO, the message isn’t about labor relations. The statement above is not the message. It isn’t about union-busting. It’s about Entergy having had just about enough of legislative extortion in Vermont.

@Meredith

You’re probably right. You’ve been much closer to the issue for far more years.

On the other hand, I’ve heard some pretty interesting anecdotes about the way that Commonwealth Edison used the Zion closing to implement the kinds of work rules on the rest of the units in their fleet that enabled them to be one of the lowest cost producers of electricity from nuclear power plants in the United States.

Union-management struggles are often more about work rules than they are about pay and benefits.

600 farmers, doctors, and small business men

An ethanal plant near me was started by a group of local investors. The model might apply to buying a nuclear plant also. The group set up a limited liability partnership and sold shares to anyone wishing to invest. The minimum investment was $10,000. One of the interesting questions asked was “Is your investment more than 10% of your net worth? If it is we do not recommend you make this investment. As I remember, 160 million needed to be raised to fund the project. The other 40% of the funds was borrowed.

Most of the investors were farmers looking for a hedge for the price of corn but lots of doctors also invested. Could 600 nukes be found to invest in this project? Would 200 to 300 million be enough?

If you are interested, you can contact the ethanol plant for details on how the fund raising was conducted and/or how to start a partnership.

I hate to sound pessimistic, but any new VY investors had better budget for an upcoming $100M refueling outage, a few dozen $M post-Fukushima upgrades, another couple $100M for the new condenser, and another $10M for a bevy of top-notch lawyers (my own guesstimates).

Probably the best investment Entergy could have made, but too late now, would have been a few million $ in PR, local advertising, and well-placed campaign contributions over the last ten years. As usual, these are things this intensely inwardly-focused industry continues to do poorly.

@Atomikrabbit

Let’s round up and say that all of the costs you envision could total between $1 and $1.5 billion. That’s not bad for 650 MWe of fueled, reliable electrical power production in New England. It would be hard to build a gas plant and fuel it for 18 months at that price. Of course, the gas plant would also produce at least 400 grams of CO2 per kilowatt-hour.

It would be difficult, if not impossible to have the gas plant ready to go by the winter of 2015-2016 unless there is already a site that has been permitted and surveyed. In contrast, a refurbished VY could be ready within a year after a 2014 shutdown with a new condenser and all post-Fukushima mods complete.