What does expiration of “held by production” leases mean to gas boom

Platts Energy Week recently aired a short segment discussing a topic that I was dimly aware of, but had not taken the time to pursue. According to Platts, natural gas market analysts are discussing the overall impact of the expiration of something called “held by production leases”.

Platts’s explanation piqued my interest, but the presenter’s time was quite limited, so her further explanation was cut off before she could finish.

In the state of Pennsylvania, the location of a lot of the Marcellus Shale activity, a land owner can lease the mineral rights for minerals under their property to a developer. If the developer successfully drills for oil and/or gas, the developer will continue to hold the lease rights while the field is in production as long as they continue to pay the negotiated royalty or lease rate.

Some producers will drill and produce a field simply to retain the rights to drill on the same property in the future, even if the current market prices for the products of the well are too low for an adequate profit margin. The property owners who have signed leases that include a held by production clause have no legal ability to halt continued production or drilling. Similar rules can also apply in other states, including Louisiana.

However, at least 100 leases that are currently held by production might expire in the next year or so as drillers move low production rigs in search of higher returns from “wet” gas areas that are rich in natural gas liquids that sell for a higher price per unit of heat. Many analysts currently believe that this action will not have a substantial effect on natural gas production, but they could be wrong.

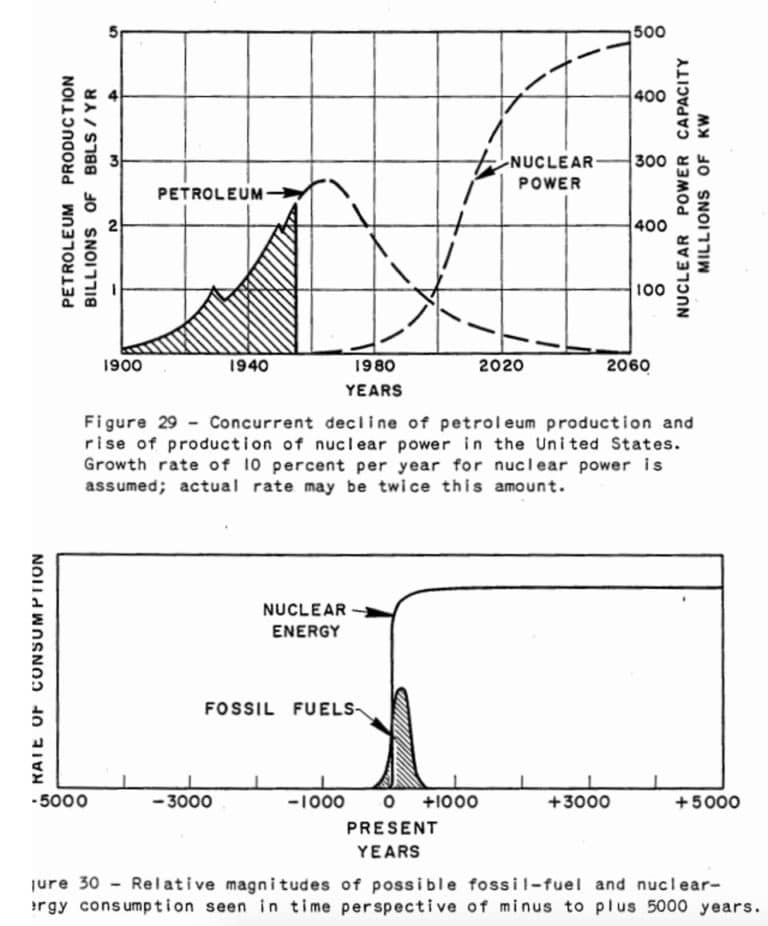

My interpretation of the gas boom remains that it is a reasonably well orchestrated component of a price war sponsored by the major multinational oil and gas firms aimed at slowing down the development of the only real market rival that they have – nuclear energy. By over producing domestic US natural gas and keeping prices low, they have hypnotized utility executives into believing that they can defer nuclear projects well into the future and generate required power by just buying “cheap natural gas.” For a devious minded person like me, the Gas Daily article titled Lease-held drilling deals expiring, but boom isn’t provides several supportive hints that the strategy I am guessing has been developed is, in fact, continuing to show signs of successful implementation.

My bold prediction – within the next two years, I expect to see natural gas prices at the Henry Hub climb by at least 50% in the United States above the present level of approximately $4.80 per MMBTU.

(Note: Natural gas has traded for less than $4.00 per MMBTU during 2011. The average wellhead price in the US 2009 was $3.67 and in 2010 it was $4.16).

This quote is somewhat provoking for the same reasons as well:

“I believe at least half of our gas drilling is what I would call involuntary,” outgoing Chesapeake Energy CFO Marc Rowland admitted in an earnings call last month. “It’s being incentivized by something other than the gas price…It might be the need to hold acreage… And I think that’s, in large part, true across the industry that there’s an enormous amount of drilling today that is economic. It’s just economic for reasons other than what current gas prices are.”

The final paragraph from the Platts article seems particularly telling.

As “those synthetic incentives expire, we think production costs will have to be rationalized,” he said. “At current and short-term pricing in the $4/MMBtu to $5/MMBtu range, the only areas that are truly profitable area the liquids-rich areas.”