Atomic Energy Wells

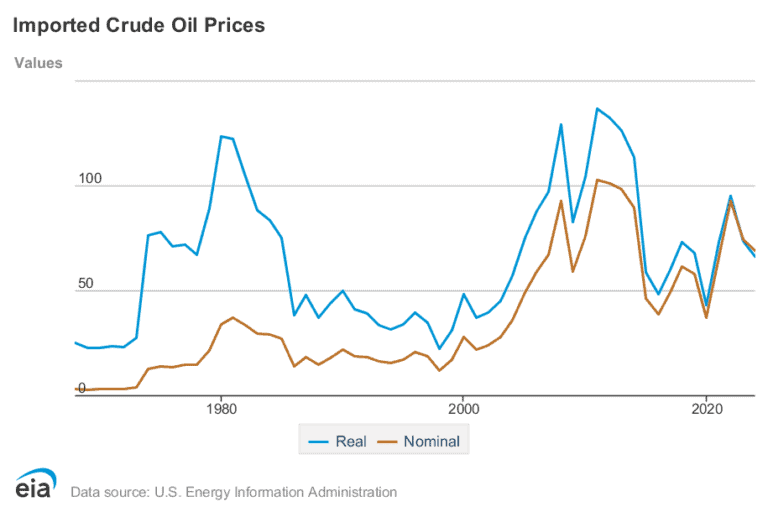

Petroleum – a term includes oil, gas and derivatives – wells have been going dry for more than 150 years. Until the late 2000s, the solution to that problem of resource depletion has been to find a new place to drill. We now have the alternative of drilling deeper and using hydraulic fracturing techniques to…