Natural Gas Industry Advice – Drill as Fast as Possible Now, Regulate and Improve Later

The March 6, 2011 edition of Energy Now focuses on the controversy surrounding hydraulic fracturing. Thalia Assuras interviews Ian Urbina, the lead author of the recent New York Times series titled Drilling Down and also hosts a panel consisting of a state hydrologist, a former state official, a gas industry representative and an environmental group representative. Then she watched as two politicians with opposing views argued with and interviewed each other. (That is not exactly fair, but watch the show and see if you see what I mean.)

As regular Atomic Insights readers have figured out, I have decided to invest some time in calling the natural gas industry to task for rushing into a rapidly expanding drilling program without due caution and preventative measures. The industry representative who participated in the panel on Energy Now seemed quite proud of the achievement of a 65% recycling rate for fracking fluids, but there has been a lot of unmonitored disposal on the way to that rate. As impressive as “65% of the fluids are being recycled sounds”, that still means that 35% of the fracking fluid is NOT being recycled.

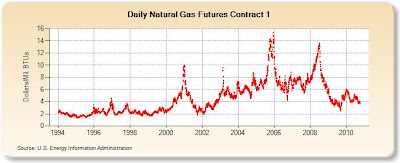

My response to the current dash to gas is to ask, “Why”? What is the point of a rapid, pell-mell rush during a recession that lowered gas demand to a level lower than the existing supply? Is there really a logical motive for the gas industry to drill so fast that they overwhelm the regulators? It is not like the price of natural gas has been skyrocketing and it is not like there is an easy way for natural gas to be used to mitigate the effects of a rapid rise in the price of oil and gasoline.

The companies involved in the rush are not even making much money right now. Chesapeake Energy, the company that is mentioned several times on the show as a source of the initial funds to establish Energy Now. has been selling off assets in order to reduce its debt load. XTO, the North American natural gas extractor that ExxonMobil purchased for $41 billion last year only contributed $36 million in quarterly earnings to ExxonMobil’s bottom line in the 4th quarter of 2010. That is an anemic rate of return on such a large investment – that is roughly a 1.1% return on investment on an annualized basis.

My suspicious nature, trained by competitive business experience and repetitive analysis of “man’s inhumanity to man” in various works of art as a literature major tells me to look beyond the surface. In an expanded look at the current energy market, one can find out that the low price of natural gas today is having a major impact on the rate at which utilities are planning to build new nuclear power plants. Because I know that every reactor-year of delay inserted into nuclear power plant construction plans yields about $365 million in additional revenue for the natural gas industry, I strongly suspect that the gas rush is a strategic effort engage in a price war designed to slow down the nuclear renaissance.

Rapid drilling increases short term supplies, especially when the drilling is in the form of fracking in shale rock formations. In that kind of well, half of the gas that will ever come out will surface within the first year of the frack completion. I found a bit of supporting evidence for my suspicions in the form of a speech that Keith Rattie, Chairman – QEP Resources and Chairman – Questar Corporation gave last summer to the Colorado Oil and Gas Association. Here is a quote from that speech.

America and the world are swimming in natural gas.

Now, to be sure, not everyone’s happy about this. Certainly not Vladimir Putin, nor Mahmoud Ahmadinejad. For years these guys have dreamed of a global natural gas cartel in the image of OPEC. Sorry, guys, but those dreams have been plugged and abandoned by America’s natural gas industry.

The coal industry and some large electric utilities aren’t celebrating. Booming gas supply threatens coal’s dominance and a nuclear renaissance in the electric-power market.

Read the rest of the speech and see if you do not get the impression that the currently low price of gas is part of an overall effort to grab market share from slower moving competitors. Just in case you pass over it, let me quote again from the a paragraph in the speech where Rattie makes a pretty straightforward statement of that plan.

Before I close I’d like to offer an open letter to the environmental groups that funded “GasLand” and press Congress for onerous, redundant, costly, and unnecessary new regulation of HF (Hydraulic Fracturing). Have you considered the unintended consequences of your actions? If not natural gas, what? More coal? More imported oil? More nuclear power?

Wow – what a horrible, scary thought – more nuclear power. (End sarcasm.)

Though it is not stated, the effect of shifting electrical power market share from coal and nuclear energy to natural gas will be a period of rapidly rising gas prices and profitability for gas companies. As gas price history (2001-2008) has shown rather dramatically, neither one of those alternatives can be built quickly enough to respond when demand exceeds supply.

It is even possible that the current attention and questioning of the gas industry is part of that strategy. The industry will soon be able to take cover behind regulators and environmentalists. They will be able to claim that rising prices are not their fault. They will be able to point to the period of lower than expected prices, when they were drilling without being slowed down, and claim that they really wanted to keep moving faster. They can innocently claim that they wanted to keep natural gas prices down, but those darned liberal “greens” and Hollywood film producers got in the way.

See how this all works? Sure, it is a bit complicated, but think of it like a good mystery novel where there is a host of characters with various means, motives and o

pportunities who are all worth investigating. The guilty party in a good mystery is rarely the one who stands up in the first chapter and loudly confesses. In some of the most interesting novels, like Murder on the Orient Express, the surprising conclusion of the intricate tale of intrigue is that there are a number of independently acting parties who share the guilt. (Sorry if that is a spoiler for anyone who has not read that 1934 Agatha Christie classic.)

Additional Reading

New York Times (March 6, 2011) Shale Gas Needs to Allay Concerns

While I would hate to accuse the natural gas industry of true long-term thinking, I would think that part of the rush to drill right now and expand production is a bit of long-ish term thinking. Let’s call it mid-term thinking. Right now, we are in a recession. Demand is low, prices low. Recessions don’t last forever, typically.

I think the Nat Gas suppliers are trying to use the recession as an opportunity to spend money on building their infrastructure (such as it is), setting up wells, getting everything in place while costs are relatively low to them – labor is probably cheaper now than it will be once the economy recovers, perhaps land-leases, equipment, etc – all the costs of doing business for them are, right now, probably lower than they will be once a recover really starts to get going.

In other words, if you have money to spend, a recessionary period is a great time to buy, because you get great discounts.

Once a recovery starts up, prices will increase – but so will the demand (and probably, price) of their product. Which means they are planning to make lots of profits once demand picks up, by buildiing today for tomorrow’s demand.

I’m not saying I disagree with your other points – but I think that, in this case, multiple things can be true at the same time. Yes, of course it’s reasonable that any industry wants to try to get out ahead of it’s competitors while it can – there’s nothing ‘evil’ about that, it’s just how anyone doing business would do – if you can convince people to use your product now, you can delay the growth of your competition. Yes, they will probably take advantage of the efforts to increase regulation as a way to explain higher prices in the future. But, at the same time, generally speaking, more regulatory requirements do really translate to higher costs – that’s certainly been true for nuclear, has it not?

Is it just an ‘excuse’ to say nuclear plants are 5 times or 10 times more expensive now than 3 decades ago, because of regulation?

@Jeff. Low labor and material costs from a recession are an equal opportunity benefit to anybody making new investments (it’s by no means exclusive to NG). The push for natural gas is coming from a low regulatory burden, and not a recessionary opportunity. The window is closing, and they know it

@Jeff – please do not misunderstand me. I am not claiming that the gas industry is “evil”. I am trying my best to get rid of the notion that the negative information that you read about nuclear energy comes from warm and fuzzy environmentalists.

I would much rather have the industry compete with its eyes open against its economic competitors than to have people inside the industry think that they have been shut down by irrational opposition.

The bottom line here is that if the natural gas companies where not doing their best to ward off the threat of nuclear energy cutting deeply into their markets, they would be fools. This is the way the game is played, under the current set of rules, and we should not be surprised that they are playing hardball. To assume anything else is na

@DV82XL – Agreed. The problem is that this interpretation of reality is not what you read in the business or political press. They all seem to be agreeing that the Potential Gas Committee report of 2009 indicates that the US is sitting on a vast lake of readily accessible natural gas that will last for 100 years! (Why won’t supposedly skeptical journalists call them on the math? Even taking the optimistic computations at face value, the numbers work out to just 85 years IF we do not increase the rate at which we are burning gas and IF we manage to extract all of the proven, probable, possible and speculative resources and IF we manage to move all of that gas to an appropriate market.

Some of the shale formations are so far from any market and any existing pipeline that they have got to qualify as stranded.

I keep putting this stuff out in hopes that decision makers in the utility industry recognize that they are being sold the same darned story they all accepted in the 1990s.

Natural gas is useful stuff, but the rate at which it can be extracted is limited and so is the ultimate resource. If it is going to be a transitional fuel, it should be a short transition and the ultimate goal has got to be atomic fission.

One other incentive that was not mentioned here are tax breaks and other “gifts” to the gas industry given for development of “non-traditional” gas exploration. High volume horizontal hydrofracturing qualified for these breaks and incentives which are set to expire in 2017. That is one reason why the rush is on to get those rigs in the ground ASAP.

@LoveCanal2020 – good point. That reinforces my theory that shale gas’s current low price is a deliberate price war aimed at having a long term discouraging effect on the revival of nuclear energy. The major gas suppliers are well aware of the limitations, but they are promoting gas as a long term option anyway. I suspect that part of the reason is that the multinational companies developed an oil end game strategy many years ago that involved a gradual shifting of their customers from oil to LNG as the next thing that would keep the money flowing into their coffers. Only the very largest oil and gas enterprises can afford to make the investments in the infrastructure that enable that rather poor energy carrier to substitute for energy dense crude, but even for them, the investments have a long term payback and require customers to keep on buying even if the prices are higher per unit energy than those associated with crude oil and coal.

The strategy included a focused effort to teach people that burning coal was bad. I think that much of the hype and immediacy of the whole global warming issue was a part of the strategy, because it needed to be done fairly quickly in order to make the LNG investments begin to pay off. The people who came up with the strategy in the 1990s believed that nuclear energy had already been killed off as an option.

Surprise, surprise. The strategists are now flailing and trying other methods to make their money grab work.

About the water recycling rate:

Pennsylvania

Yes, and this all makes perfect sense and if you factor into the equation the current rush to “unload” gas plays around the country by the major players to foreign entities. That is even more evidence that this “shale game” is nothing but a big ruse to try to effect policy and future development of alternatives to gas and oil–be they nuclear, or what have you. Additionally, no one wants to admit that our aging natural gas infrastructure will not be able to safely support such expansion and transition without huge investment in replacement and repairs as well as development which will be fought tooth and nail where ever it goes. Not a recipe for “sound fuel policy”; only a recipe for shareholder dividends and continued advancement of a fuel that should be transitioned AWAY from.