From the Utah Perspective, Destroying the Zion Nuclear Station is a Big Business Win

There were two contrasting announcements of decisions on the fate of silent, but potentially productive nuclear power stations in the past week. On the positive side, the Tennessee Valley Authority’s board of directors included $248 million for engineering, evaluation, maintenance, preservation, establishing a regulatory framework, and long lead time procurement of items needed to finally complete Bellefonte Unit 1 in its budget for fiscal year 2011, which begins on October 1, 2010. That unit was started in 1974 and had reached about 85% completion when its construction was suspended in 1988.

In contrast, Exelon and EnergySolutions announced that their long pending decision to transfer custody of Zion units 1 and 2 would take effect on September 1, 2010. That transfer is being made to enable EnergySolutions to dismantle the plants, a process that will involve approximately 200 workers at the site for a period of 10 years. The custody transfer allows a more cost effective distribution of the risk associated with low level waste disposal that will be a major part of the project costs. The project costs will be paid out of the $900 million decommissioning fund that has accumulated from funds set aside by adding a small fee to the price of the electricity produced during the 25 or so years that the nuclear power plants were owned and operated by Commonwealth Edison as a rate-regulated monopoly utility company.

(Aside: There is a difference between the project cost in the press release of $1 billion and the $900 million that is currently in the decommissioning fund. The press release number takes into account the effect of investment returns and inflation over the ten year life of the project. As I learned in my most recent assignment, one of the important questions associated with any budget number is “what year dollars are you using?” A budget projected in “then year” dollars always has larger numbers than one that is projected using this year’s dollars and taking out the inflation escalation computed for future years. End Aside.)

The announcement of the date for starting the Zion dismantling project was the headline story in a press release discussing a number of capital investment projects. As Michael Pacilio, Exelon’s chief nuclear officer and president, described the package of projects, “This is our own economic stimulus program for Illinois”.

Here is a video clip from a Utah television station that provides a glimpse of the story from the point of view of the Utah company that will be running the project and storing the low level waste from the construction demolition.

The project is being marketed to people in Illinois as a beneficial effort to clean up a site that is currently hosting an unused industrial facility. The implied promise is that completing the project will allow the lakefront site to be returned to more productive uses. As the above video clip shows, and as experience in several communities around the countries with “orphan” nuclear fuel dry storage areas reinforces, that result is not yet certain. Under the current US used fuel storage model, the Zion nuclear plant site would be turned into a “greenfield” surrounded by an imposing fence and heavily armed guards protecting a small, isolated pad holding a few dozen dry storage casks. The only jobs involved will be security guards and there will be no output of beneficial products.

A few weeks ago, while at the ANS Utility Working Conference, I spoke to a man who was one of the operators at the Zion nuclear plant up until the very last day that it operated. He told me that the plant’s physical condition was far better than that of the plant that he went to after he reluctantly moved from the Zion area. He mentioned that there had been some conflicts between his union and the plant management, which might have helped the company to decide that it was not worth the effort to go through the necessary steam generator replacement.

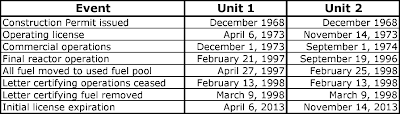

In 1998, when Zion was “permanently” shut down, no nuclear plants had received operating license extensions, few had successfully replaced steam generators, and natural gas cost less than $2 per million BTU with projections from the gas industry and the Energy Information Agency of low prices for the foreseeable future. Here is a quote from a document titled NRC: Zion Nuclear Power Stations 1 & 2

On January 14,1998, the Unicom Corporation and ComEd Boards of Directors authorized the permanent cessation of operations at ZNPS for economic reasons. The cost and time it would take to repair the steam generators combined with the cost of electricity in a deregulated environment in Illinois made continuing operation of ZNPS uneconomical.

Why is Exelon committed to dismantling a facility that has numerous characteristics in common with Browns Ferry unit 1, which was recently restored to operating condition and Bellefonte unit 1, which is planned for completion? Isn’t there a market in the United States for emission-free power generation? Wouldn’t it be better for the Illinois economy if the local company that owned the plant decided to restore it to operation so it could generate low marginal cost electrical power, jobs, income and taxes instead of turning it over to a company from Utah to dismantle it and potentially leave behind a still unusable site?

It is too bad that there are no companies in the world with the equipment that would be required to relocate the plant to a place where the operators would put it to use.

Previous Coverage on Atomic Insights

June 14, 2010 – Public Versus Private Power – It’s Time to Reopen the Discussion

March 22, 2009 – Chicago Buys Meaningless Carbon Credits – Refurbishing Zion Would be a Better Investment With Real Climate Payoffs

March 14, 2009 – Discussing Zion Versus Wind Turbines

February 5, 2009 – Unfriending Exelon

January 24, 2009 – Exelon’s Strategy is Working for Stockholders but not Always for Customers

December 5, 2008 – More Questioning About the Zion Reactors

June 5, 2008 – Could Zion be the Next Browns Ferry

Additional Information

(Disclosure: My personal investment portfolio includes some shares of EnergySolutions.)

Wouldn’t it be more prudent and conducive to shareholder value to put Zion up for auction and see if perhaps someone would buy it?

To katana0182 (Dave): I live in the Chicago area, and as I understand it, Exelon/Commonwealth Edison has positioned itself, through the state’s electricity rate deregulation, to game the system and “auction” power from itself (Exelon, the electricity producer) to itself (Com Ed, the customer-service electricity provider) at what amounts to a going rate, making for both substantial profits and rates to customers that don’t reflect the low cost of nuclear generation. If a merchant were to take over and operate Zion, and sell the power within the Illinois market for less than Exelon does (but still enough to make a decent profit), Exelon would be forced to lower its own price (to itself), or otherwise Com Ed would have to buy the lower-cost power from the merchant company that runs Zion. Exelon’s whole cozy structure relies on power available in large quantities costing about as much as Exelon currently charges itself. So Exelon has no incentive to sell Zion to a merchant. If I have some or all of this wrong, I’ll accept correction from someone who has verifiable inside knowledge, but people in Illinois have been grumbling about this for some time.

That is what you got from “deregulation.” “Public” utilities avoid owning power plants. They sold them to “generation” companies that are not controlled by the PUC (public utility commission), or whomever controls rates in your state, but the parent holding company still owns the plant.. That way they can make a higher profit.

It appears all of kit’s experience is with government utilities (SMUD, BPA), they follow even different rules, and the governing (controlling) board only worry about reelection.

By the way, Zion has quite a few years left on its original license, could get a 20 year extension, AND, many plants are already talking about a second extension. Far short of it’s useful life – unless you work for the goverment. The one I worked at has people assigned to the second extension project already (part time).

I have worked at two ComEd plants and was at one that the one in worse physical condition when Zion was shut down. I was offered jobs with ComEd at both Frankly, I am surprised any of those plant are still running.

Before that I was in the navy for 10 years, two nukes in the EU, and two others in the US. When you get used to a high level professionalism and commitment to customers, it is hard to work someplace that does not have a clue about those things.

Both management and the unions at those ComEd plants were a barrier to the safe operation of the nuke plant. They were so busy pointing fingers at each other they forgot their responsibility to their customers and neighbors.

I would like to think that things are better under Exelon.

The statement in the 1998 article about continued operation being “uneconomical” is an interesting one. The question of whether something is “economical” is less simple than you think. Instead of a straight yes or no answer, you have two questions. Economical for whom, and economical over what time frame. Specifically, is it economical for the utility (Exelon) or the customer/ratepayers. It is also common for something to not be a net positive (for cash flow) over the short term, but be very economical over the long term. In any event, John Rowe made it clear that he’s only interested in the next ten year timeframe, with respect to that issue.

Strictly speaking the statement in the article (from Exelon?) was not incorrect. The fact is that doing the necessary refurbishments/maintenence and keeping the plant open would have reduced Exelon’s profits, certainly over the near term, and possibly over the long term as well. Thus, it could be said that the plant was “uneconomical”. For Exelon, that is. The ratepayers would have saved money, but hey, they’re not the ones making the decision….

Northern Illinois is a deregulated market (which Exelon pushed). Also, that region is mainly coal and nuclear, and has few high-variable-cost gas plants to set a high (marginal) market price for power in that deregulated market. Not only would keeping Zion open (or opening it, today) cost Exelon money, but it would push down the market price for power in the region by creating more ample supply in general, and specifically by reducing the amount of time gas plants have to operate (which results in a high marginal, market price for power). Exelon’s profits are maximized if there is just enough non-gas generation so that gas has to be used for the last increment of power most or all hours of the day. That sets a high market price (based on the last, most expensive power increment) which results in Exelon making a huge profit on its remaining, nuclear generation. Exelon has been working towards this “ideal” balance in the region for a while now, by adding only gas. And by closing Zion…..

BTW, I agree that Kit’s statement about “end of its useful life” was ridiculous. Nuclear plants last 60, or perhaps 100 years.

Jim

Do you know something about poorly maintained PWRs that I do not? I certainly agree that a properly maintained nuke can last 60 years and maybe 100 hundred years.

So Jim do you want a company that would put profits above its community running a nuke?

There is not better job in the world that being at a nuke where your management empowers excellence. It is very frustrating to work places where excellence is just a slogan.

@Kit P – I agree that nuclear companies should put serving its community above profits, especially short term profits, in its priority hierarchy of decision making. It has been my experience that keeping profits on the list of concerns, but secondary to service, often yields better results. That philosophy is difficult to quantify and frustrates the heck out of people who want to operate purely “on the numbers”. What happens to improve results is that many resource wasting fights melt away when the employees, customers and the community realize that the company is in business for the long haul and really does take its responsibilities seriously.

When the fighting – including the unproductive fighting between management and labor that you mentioned in a previous comment – fades away, there is more money left over. That can lead to both high profits and lower prices, making free enterprise approach ever closer to the ideal of both supplier and customer who are happy with the deal that they strike. The supplier makes money, the customer gets the product that they want for the money that they spend and things are sustainable.

My commentary about Exelon over the years has been based on the fact that I detect at least some amount of milking a cash cow that was built by others – people like Corbin McNeill and Oliver Kingsley. Operating well run and well maintained nuclear plants is indeed a profitable industry, but if you want to grow your profits in a geographically restricted area whose power consumption is flat or declining, adding new capacity is a failing strategy. (Exelon has experienced at least two expensive, failed attempts to expand into new territory in the past 10 years. )

If you are not willing to build new capacity or restore currently idle capacity the accounting answer for higher profits is to attack costs. Since fuel, outage and spare parts costs are pretty well minimized already, the only available area for cost reductions is in personnel and that is normally achieved with reducing head count.

I have worked on budget preparation in the personnel and training area in an historically excellent organization that has been managed for the past ten years by people who have earned MBAs at major civilian institutions. Training and head count have been reduced to what I consider to be hazardous levels in an attempt to free up cash for “recapitalization”. I could be wrong, but I am observing similar behavior at Exelon and hearing hallway conversations that reinforce that observation.

Rod your commentary is based on some silly notion of class warfare. You select hallway observations to reinforce your mindset.

The overarching observation is that the nuke plants that used to be poorly managed managed by ComEd and PECO now run very well. In my experience, that does not happen without good management.

Your assertion is a Catch 22. Either shutting down Zion is a good management decision or if it is a bad one we do not want to restart Zion under bad management.

Rod has neither the experience or specific knowledge to determine what the correct choice is.

Kit P, do you really think these silly word-games of yours are impressing anyone? They are transparent. On-site management of a nuke plant, be it good or otherwise, is not necessarily logically tied to long-term corporate strategy. Your comment implies that you cannot differentiate between these two fields. I don’t actually believe that of you, of course. You are simply attempting to mislead people.

Where are our public advocacy lawyers when you need them? Surely there is some aspect of criminal law being violated in the signing over of a perfectly good public asset to a bunch of crooks – ahem!- business men. In Washington there are 250,000 lawyers, more than in the whole of the French nation. Of course they have Civil law, a dfferent system. On a different tack this is where advocacy for the community would pay off in support for a correctly aligned green group, particularly one that whines more about the cost of nuclear power construction than its in principle existence. National recovery considerations would also recommend restoration action on Zion to Washington all it would need is 2 GW of industrial projects to be planned at finalization of project to avoid conflicting with Exelons market rorting, eg metals processing, server farming, aerospace, military manufacture, battery manufacture, educational institutions, medical- scientific labs. Restoration of Zion could be the linchpin of a greater Illinois restoration.

Oops! that’s 50,000 Washington lawyers out of a population of 500,000, versus 45,000 French lawyers out of French pop of 65M.

Well, if EnergySolutions will own Zion and the licenses as of September 1st, why doesn’t EnergySolutions leave the decommissioning fund as is, find someone to invest a few hundred million dollars, repair/replace/retrofit the steam generators on one unit, reopen the unit, then once a few more hundreds of millions are made, reopen Unit 2?

If the plant’s off of Exelon’s balance sheet, they have no more say in its operation, such as it is, right?

Think shareholder value. A working plant – especially in a market with a tight supply of power – could be an asset to take EnergySolutions to the next level.

Or if EnergySolutions doesn’t want to operate it, some investor looking for an underpriced and undervalued asset capable of great performance could buy it off their hands for a few hundred million dollars (a large profit achieved with minimal expense for EnergySolutions) sink a few hundred more millions in, and have a running plant.

Dave,

I think the deal between EnergySolutions and Exelon is a little more complicated than that. ES will not own the plant outright. Handing the site back over to Exelon after the plant is decommissioned (and the spent fuel is placed into storage casks) is written into the contract. You could think of it this way, the decommissioning fund was turned over to EnergySolutions; the actual plant wasn’t.

It would be great if EnergySolutions could do that, though.

You broadly stimulate all of the economy, not just a tiny narrow renewable energy sector, by making wise energy choices that actually drive down the cost of energy and make energy cheaper. The best forms of climate remediation also make energy cheaper than electricity produced from burning the fossil fuels you are attempting to replace. – http://bit.ly/ctcJIV

**Make energy cheaper and distribute it to a wider group of citizens**