Creating new markets for uranium

Disclaimer: I have been buying stocks in uranium producers for more than a decade. I accelerated my purchasing in 2011 when stock prices fell after Fukushima. I’ve added to my holdings each time there was a big drop in stock prices.

I am a contrarian who likes to buy high quality assets when they’re on sale.

Now a confession. Though my investments in Uraniumland™ are a small portion of my overall

portfolio, they are underwater and would make me look dumb if I ran an investment fund for other people.

Now a rant. I’m pretty certain that I am not dumb. Uranium is an amazing element. Its compounds and alloys have characteristics that give it fundamental advantages over most competitive or substitute materials that are in the same lines of work.

I was saddened by the headline column in the Sept. 29 issue of Fuel Cycle Week (FCW) describing a significant, employment-reducing reorganization of uranium industry marketing organizations.

Layoffs and retrenchment are always painful. As an investor, though, I was angry to find more evidence of companies that are confused about the difference between making sales to known customers and market creation strategy development.

The trouble with Uraniumland is that it is too insular. To this outsider, uranium producers avoid devising and implementing ways to attract non-consumers, which I’m defining here as anyone who is not currently buying your product. You must help them know that they both need and want what you can provide.

Over 100 Years of Uranium Glass

Here’s one example. When was the last time anyone made a large sale of uranium to the glass industry? Have uranium producers spent any time thinking about how they can take advantage of the unique chemical property of uranium that makes it glow in shades ranging from cream through yellow to lime green when illuminated by a blacklight?

Have they ever thought about the large base of interested non-consumers who are fascinated by the slowly shrinking inventory of glassware manufactured for more than 100 years, between 1830 and 1940?

That market abruptly disappeared because governments thought there was a tightly limited supply. Political leaders in the US, UK, France and Russia decided they needed to corner the uranium market in order to achieve a short term goal.

After being the only legal buyers for almost two decades, governments realized there was far more material than they could ever consider hoarding.

By the time the U.S. government abruptly stopped buying, Hermann Muller and his friends had successfully invented and spread atomic fear by claiming even tiny doses of radiation were harmful.

In response, “safety” regulators imposed tight controls over uranium as a useful material for adding unique colors and a responsive glow to glassware and ceramic products.

Even without a complete prohibition, those rules made it too difficult for anyone in the glass industry to consider reviving their formerly popular lines of uranium glass products or to consider new products like luminous glass bricks for decorative interior or exterior design.

The abrupt disappearance of the uranium glass market wasn’t caused by glass makers getting nervous about the negatively promoted health effects. After all, they routinely take precautions against ingesting the hazardous materials that are inescapable ingredients of their livelihood.

Silica dust is a known hazard, but so are lead and arsenic, two elements that remain in common use in specialty glass making.

Glassmakers knew from a century of experience that uranium glass products were safe and well accepted in the market. But they couldn’t or wouldn’t fight city hall by themselves.

There are provisions in U.S. regulations (10 CFR 40.22 and 40.23) that allow shipping and handling uranium under a general license. Unfortunately, the restrictions on quantity and the documentation requirements are too onerous to allow economic production for anything other than specialty applications.

It’s worth noting that the potential market is huge. Glass is one of the world’s largest material commodities by weight; some of the old recipes for uranium glass contained as much as 25% uranium oxide.

Creating a new uranium glass market would include efforts to promote the fact that low doses of radiation are not harmful. They would also include lobbying efforts to ensure that regulators use modern scientific knowledge to implement less onerous restrictions on commerce in materials like natural uranium or depleted uranium.

When I mentioned the idea of uranium glass to a friend who is a career radiobiologist, she reacted with excitement. Her scientific research over the past 30 years tells her that people would be more healthy with a little more radiation in their environment.

A vibrant uranium glass market would create a new sector of demand and introduce a completely new customer base. Customer diversification is a conventional, but important long term success strategy.

Uranium glass marketing would also result in growing public awareness of the utility and safety of the element. It could help them develop comfort levels approaching those earned by other potentially hazardous commercial items like gasoline, propane and natural gas.

Where’s the Uranium Association?

There once was an organization named the Uranium Institute (UI), which grew out of a somewhat infamous organization known colloquially as the Uranium Cartel or the Uranium Club. It focused on the interests of the uranium mining industry.

UI is now part of the World Nuclear Association. WNA’s membership has a wider span of interests. Although it isn’t exclusively focused on increasing the demand for uranium, it just re-launched the Harmony program, a call to action to governments to do more to ensure that nuclear energy makes the full contribution that society requires to meet its future clean energy needs.

The target for nuclear energy is to provide 25% of electricity in 2050, requiring roughly 1,000 GWe of new nuclear capacity to be constructed.

Instead of focusing on technology, WNA believes it is “vital that the global industry identifies and focuses on demolishing the real barriers to growth.”

While I’m not advocating the creation of an organization that engages in nefarious activities like establishing prices or allocating sales to suppliers, uranium is a commodity product like dairy, avocados, grapes, oil, coal or gas that deserves to have a trade association that can focus on lobbying and joint marketing efforts to build overall demand to match supply.

Though virtually all uranium sold is currently used by the “nuclear industry,” the interests of uranium producers only occasionally intersect with those of the rest of the industry.

It makes no sense for uranium producers to depend on the nuclear industry and expect that the nuclear industry shares its legitimate desire to regain enough pricing power to enable pro table and expanding sales.

In fact, it seems conventionally obvious that utility companies and their fuel purchasing arms would prefer for the uranium mining industry to continue as a tightly linked dependent with no other customers competing for the material.

If there was a Uranium Association, it could help stimulate creation of the uranium glass industry described above. It could also stand beside the currently lonely Nuclear Energy Institute and the American Association for Clean Coal Electricity.

Those organizations support the Department of Energy’s proposed rule that would require regional transmission organizations and independent system operators (RTO/ISO) to establish tariffs to provide full cost recovery and a fair profit for operating nuclear plants and certain coal plants that have large coal stockpiles.

A coalition of 11 organizations collectively calling themselves Energy Industries Associations filed a motion opposing the proposal.

Those groups, representing oil, natural gas, wind, solar and biomass, want the public to believe that today’s electricity markets are fair.

They claim there are no government hands pushing certain power sources to the detriment of others.

Environmental Progress says that the rule could be a big win for nuclear energy. The uranium industry could help by explaining the importance of maintaining the current nuclear fleet and its clean, reliable, affordable power supply.

It could explain why the vital uranium industry needs to keep its current customer base so that it has the human capital resources to expand.

That could be necessary to support the potentially large number of advanced reactors that might arise out of one or more of the 50 or so designs actively being developed.

Taking clues from competitors, the Uranium Association could describe its decades worth of proven reserves while also helping the public understand that there is virtually no limit on the amount of material remaining to be discovered.

A Uranium Association could respond with hard facts when the natural gas industry brags about its potential to supply almost 100 years worth of fuel that only produces half as much CO2 as coal does.

Eat Your Own Dog Food

Many sectors of the nuclear fuel cycle industry buy large quantities of electrical power. Some installations are located in remote areas without reliable connection to an affordable grid power supply.

It would make conventional marketing sense for companies whose profitability depends on customers purchasing uranium fuels and related services to use their own products.

This choice would help its direct, power plant-operating customers build interest and sales.

Fuel cycle companies could express their desire to purchase bundled power that is produced in environmentally friendly nuclear plants, just as companies can signal their high moral standards by arranging to purchase bundled wind or solar electricity from the power grid.

Some might even consider making public announcements that they want to be customers for independent power producers that use small modular reactors to supply a local power grid in remote mining towns.

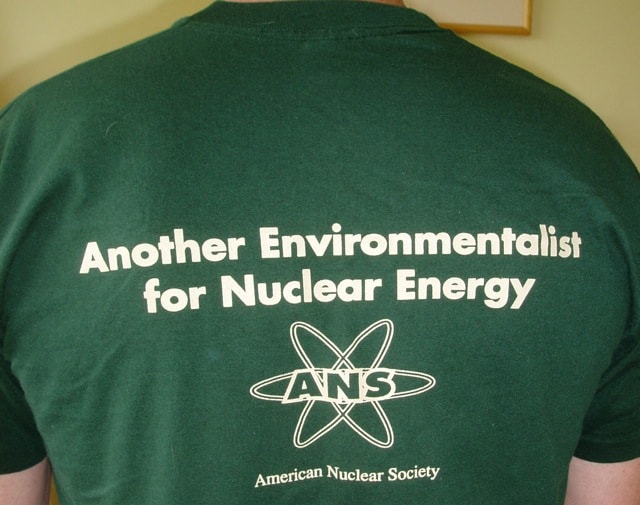

Supplier companies and the leaders of those companies should show the value, ease of use and safety of their product in personal, demonstrable ways.

Customers are less likely to remain uncomfortable if they recognize that the people in the know support their words with actions.

Nothing tells the public that they are right to be concerned about safety than fuel producers who show by their actions they are reluctant to be too close to a power plant using that fuel.

Final Thoughts and Recommended Reading

“It is no wonder that corporate leaders throughout the world see market creation as a central strategic challenge to their organizations in the upcoming decade.

“They understand that in an overcrowded and demand-starved economy, profitable growth is not sustainable without creating, and re-creating, markets. That is what allows small companies to become big and what allows big companies to regenerate themselves.”

That is the concluding paragraph from a seminal article in the Harvard Business Review titled “Creating New Market Space.” It was published in the Jan-Feb 1999 issue. It provides case studies and advice that is highly relevant to today’s uranium fuel supply industry.

Market creation is a term of art that can result in useful search results for more ideas.

The most important message is that success comes from action and creative thinking. Repeated rounds of cost cutting and retrenchment under the assumption that suppliers are passive acceptors of whatever “the market” decides will only continue a downward spiral.

The uranium fuel cycle industry produces useful material and value-added enhancements to that material. Companies in that line of business should not allow them to shrink because they accepted false limitations and overt negative propaganda from competitors.

Note: The above was first published in the October 6, 2017 edition of Fuel Cycle Week. It has been revised and republished here with permission.

Rod,

Any thoughts on Lightbridge (LTBR) You had a post a while ago when it was at it’s 52 week highs that articulated the bull case. The stock has fallen all the way back to 1 which is frustrating because they appear in an even better place than they were when the stock was at 2.41. They also recently issued a PR about Halden testing,but that PR was frustrating to me because they failed to mention a date. I don’t understand the haphazard way management communicates with shareholders. Often missing key information about timelines and revenues. I think part of why Lightbridge is so low is the many close but no cigar attempts at a joint venture in the past over many years that has made the market deeply skeptical. The thing that keeps me in though is the JV with Areva now appears very close and I have to assume Areva would not get this close to the finish line with LTBR if there wasn’t real value to the fuel. I just wish management would for once stick to dates and start testing the damn fuel. Do you still think they are legit or a perpetual wait and see stock?

@Brian:

I’m not a licensed investment adviser. However, I can say that the nuclear world rewards patience – sometimes.

What Lightbridge is doing isn’t easy.

The US Department of Energy has, or did have, a “Depleted Uranium Utilization Program” aimed at finding commercial outlets for the enormous stocks of DU sitting around at enrichment plants. Some of that, of course, is well above present-day tails fractions & thus worth re-enriching, & the laser-enrichment folks are still hopeful of getting some value by driving the tails fractions down even further, but that still leaves a great mass of the stuff.

This program supported some work, which I want to find out more about, on the use of UO2 for semiconductor devices. Apparently it has some properties which look considerably more attractive than those of silicon, & it’s much cheaper than the exotic gallium arsenide. While U for decorative glass & ceramics is a small (although certainly highly visible) market no matter what, semiconductor devices could be a very large one.

I see problems with ROHS restrictions. Uranium is a toxic heavy metal and would probably be prohibited in any uses which don’t allow lead-based solder.

Lead is very mobile. Uranium in the form of ceramic oxide is not. And in any case even metallic uranium is far less toxic than materials such as gallium arsenide or mercury cadmium telluride, which are commonly used in semiconductor devices. Don’t forget, these components are normally processed in a highly hands-off fashion, & then sealed in plastic or ceramic encapsulations before leaving the factory.

Likewise for uses and markets for Thorium. Its like marijuana.. Since the government and environmentalist clansmen have oppressed, vilified, suffocated, and bankrupted useful applications of nuclear materials why not create “bootleg” uranium glass, as an act of defiance?

You’d probably have to do it outside the US.

There are some artists who use uranium in ceramics & glass work, both within & outside the US. But in general, I believe the obstacles in getting hold of any sizeable quantity are discouraging so far as commercial production is concerned.

Re: “why not create “bootleg” uranium glass, as an act of defiance?”

If uranium glass really is of great worth, the “bootlegging” might not be done as a simple act of defiance — the motivation could be more akin to other bootlegging (or counterfeiting and forgery): to make money.

Rod, a revised essay concerning uranium glass would make a suitable op-ed for TNYT. Maybe emphasize the silly laws which disable that use of uranium.

Do you imagine the stockpile of depleated U is so small that more extractiom would occure if the market expanded?

I don’t think DU is a factor, period. Who’s going to sell it? Then there’s the cost of conversion from UF4/UF6.

If you’re making uranium glass or the like, it seems far more likely that you’ll just buy yellowcake from somebody in an amenable jurisdiction and turn it into product. If you turn it into a lot of pretty things that travel well, it only matters where you are if you can’t find workers with the right skills. That may be a problem in Namibia but probably not Kazakhstan.

You’d also have to beware of import restrictions, but that’s only a problem if the customs inspectors know what they’re looking at. Natural uranium is going to have a bit of a radiation signature and a whopping X-ray shadow, but I bet lead crystal has a big shadow too.

You might be able to do this. Maybe selling cool bowls and things which glow when set on the black-light base? 2 pounds of glass, maybe 10% U, 100k of them takes about 18 MT U… that’s looking significant.

Double score if you can make cool-glowing glass beads threaded on optical fiber from the laser-diode pump. Triple if you can incorporate it into earrings.

I’m not talking about expanding the mining industry as much as I’m trying to suggest a way to expand the current demand back up to something that balances the current supply capacity.

Right now, the demand is so low that prices in nominal dollars – ignoring the effects of inflation – are 1/2 of the 1973 price.

Miners are struggling because those prices are at or below their production costs, leaving some unsavory choices that harm both investors and employees.

Who’s up for starting a uranium glass kickstarter project? Nuclear power industry may not feed the kids much longer …

I bought uranium stocks myself, in 2007 and before. I think they doubled at the time of peak price. Anyway, I tried to be patient. Kept listening to all the predictions of a comeback (by investment hucksters), which never came. Things just kept getting worse. After awhile, I learned to ignore them (came to believe that they were probably trying to find suckers to unload their shares onto).

Finally, after a full decade, my patience ran out. After I retired, I opted to sell half my stock portfolio, to put it into safer investments. I used by uranium stock losses to offset gains in other stocks, to avoid a huge tax bill. Sold the uranium stocks for literally a penny on the dollar (most lost ~99%, the minor companies anyway; Cameco was merely down a factor of several). Who knows, at today’s prices, they could be a wise, longer-term investment, but I don’t know for sure, or have any faith in that.

I was going to buy into the uranium stocks back then too, but then I thought if the industry took a turn for the worse, it would hurt both my job and my investments. So I invested in other things…

The US is about a year away from launching people into Earth orbit aboard commercial spacecraft. And there’s serious talk about establishing a permanent human presence on the Moon and Mars.

The Moon appears to be rich in thorium but rather deficient in uranium reserves. Mars appears to be deficient in both.

The export of natural uranium and even depleted uranium from Earth to the Moon could be a growing demand starting in the 2020s onward as human populations steadily grow on the surfaces of the Moon and Mars.

But long before that, uranium demand on Earth is going to jump dramatically once its realized that we are going to have to use uranium to produce carbon neutral synthetic fuels on a massive scale in order to stop the rapid global warming and global sea rise caused by fossil fuels. And this will probably mean the mass production of remotely sited ocean nuclear reactors using uranium that’s mostly extracted from seawater.

Marcel

“And this will probably mean the mass production of remotely sited ocean nuclear reactors using uranium that’s mostly extracted from seawater.”

I’ve liked that idea for a long time.

An added bonus would be taking cooling water from deep in the ocean (Ocean Thermal Energy Conversion — OTEC — style) which would give a thermodynamic benefit AND would provide micronutrients for a phytoplankton bloom. That plankton could be the basis for new stocks of fish and a portion of the biomass created would end up on the abyssal plain (thus providing carbon sequestration).

I’d say that you’re optimistic with, “once its realized that we are going to have to use uranium to produce carbon neutral synthetic fuels on a massive scale in order to stop the rapid global warming”. The part that’s optimistic being that people will actually realize that.

I work (employed again as of June, yay!) with experienced engineers, most of them electrical and almost all of them are thoughtlessly invested in the wind and solar mantra. There is little chance of convincing them that wind does not reduce CO2 emissions even with studies and evidence and the facts from Germany. One fellow doesn’t believe that wind is too intermittent to run a grid and they all seem to think that batteries will be a practical storage system that will balance wind and solar. But none of them have, you know, actually done any math on these topics.

And these are folks whose profession involves analyzing things with math.

They still believe and are emotionally and unconsciously invested in the idea that building wind and solar is synonymous with reducing CO2 emissions. I think in the younger cases it is part of their “hip” (for want of a better word) identity. They wouldn’t be as cool, if they didn’t believe.

I despair of defeating this insidious meme. But I’ll keep trying.

I should qualify that by “younger” I mean thirties to mid forties. The twenty-somethings seem a little more receptive to facts. I don’t understand the demographics at work. Maybe the thirty – forties group was raised by hippies?

The only possible upside for the uranium market is if the US tries to ramp up exports to divert markets away from Russian + “stans” exports as we are trying to do with LNG. The largest western aligned uranium exporters are Canada, Australia and the US which together supply about 35%. So this strategy is probably not viable.

Outside of Russia and Asia, new large nuclear is dead once current construction is completed. The climate change line that the nuclear industry foolishly hoped would save it is being increasingly rejected. How many climate change activists are bemoaning the cancellation of VC Summer?

I expect that there will be a strong rebound in natural gas prices within the next 3-5 years. Today, there are numerous natural gas exploration/production and pipeline companies at multiyear lows. This is where I am looking for long term investments. Plus companies that build LNG terminals.

There is a possibility that fewer existing nuclear plants will close than expected which is good if NG prices spike. At least one positive!

I think the NG price recovery will not help large nuclear because of cost and construction times will prevent large nuclear from taking advantage. Plus the AP1000 debacle will still be relatively fresh in the minds of utilities, PSCs and the money people. It really is dead.

NuScale has a good shot at getting their prototype built. We will see how costs and operability plays out. They are partnered with Fluor which is publicly held.

I doubt we will see any of the other SMRs or thorium reactors go beyond the artwork stage outside of Asia.

NuScale has a good shot at getting their prototype built. We will see how costs and operability plays out. They are partnered with Fluor which is publicly held.

I doubt we will see any of the other SMRs or thorium reactors go beyond the artwork stage outside of Asia.

BWXT has a good mix of commercial nuclear and defence/aerospace work and pays a dividend. I am waiting for the price to come down a bit before buying. They would be an ideal candidate to buy Westinghouse from Toshiba. Sadly, it looks like Wall $treet money shysters (Blackstone and Apollo) will get Westinghouse, milk it, saddle it with debt and sell it.

I noted that there is strong support for nuclear power in Korea. The anti-nuclear government has relented and it looks like two nuclear plants under construction and put on hold will be completed. KEPCO will benefit from this and pays a nice dividend. I will buy on the next big Korea scare which should drop the price. If large nuclear has any chance at all in NA or Europe, KEPCO is likely to be the builder.

But the future is natural gas.

I don’t like this at all, since my education and career have been entirely in nuclear power. But it is the sad reality.

According to World Nuclear News those two nuclear power plants will be the last ones KEPKO builds, baring a change in the South Korean government.

Seeing U’s position in the periodich table, wouldn’t it be a very interesting catalyst in the (petro)chemical industry?

I believe that when Fritz Haber was doing the original research into catalysts for making ammonia from Nitrogen and Hydrogen, he discovered that one of the best was uranium. High cost at the time compared to certain iron crystals ruled it out.

More research is needed.