Clean and Doable Liquid Fission (LF) Energy Roadmap for Powering Our World

By: Robert Hargraves and Chris Uhlik

Introduction

This essay responds to an article by Stanford Professor Mark Z. Jacobson et al, 100% Clean and Renewable Wind, Water, and Sunlight (WWS) All-Sector Energy Roadmaps for 139 Countries of the World. Their controversial WWS roadmap has several interesting features and benefits.

- Coal, natural gas, and petroleum energy sources are replaced by WWS.

- Electricity from WWS becomes the universal energy source.

- Everything is electrified, including transportation, industry, and heating.

- Electricity demand grows from 2,400 GW in 2012 to 11,800 GW by 2050.

- Fossil-sourced combustion heat drops to zero from 9,700 GW.

- Clean air ends premature deaths of 3.5 million people per year.

- CO2 emissions drop to zero.

However WWS implementation issues are controversial.

- Solar and wind energy sources are intermittent.

- Energy storage cost assumptions of 0.8 cents/kWh are an order of magnitude too low.

- From 59% to 85% of energy demand must be “flexible” to adjust to supply availability.

- New electric generation nameplate capacity needs are 49,900 GW.

- Over 2.5 million wind turbines plus billions of rooftop solar systems must be built.

- Capital investments are $125 trillion.

- Electricity will cost 11 cents/kWh.

- New global public policies are needed to force adoption of expensive WWS power.

Several authors have pointed out the impossibility of this Stanford WWS roadmap. Jesse Jenkins and Samuel Thernstrom published Deep Decarbonization of the Electric Power Sector. Mathijs Beckers wrote The Non-Solutions Project of Mark Z. Jacobson.

Misled by Jacobson, climate activists such as Bill McKibben of 350.org calls for world war-like mobilization of nations to effect the $125 trillion WWS roadmap.

This present essay describes a doable, affordable liquid fission (LF) power roadmap to solve the multiple issues of climate change, air pollution, and poverty reduction.

Liquid Fission

Advanced, demonstrated liquid fission technology provides an energy source alternative that can economically address a wide scope of global needs:

- Reducing energy poverty and enabling prosperity in developing nations.

- Cutting combustion-sourced air pollution causing millions of premature deaths annually.

- Ending CO2 emissions from burning fossil fuels.

Current light water reactor (LWR) nuclear power plant technology, which generates dependable, emission-free electric power, now provides 11% of world electricity. Liquid fission (LF) power was demonstrated at Oak Ridge National Laboratory in the last century, then politically sidelined. LF technology uses energy-rich thorium and/or uranium fuel dissolved in molten salt. This liquid transfers fission heat energy via heat exchangers to steam turbine electric generators. In contrast to LWRs, LF power plants operate at high temperature and low pressure. LF achieves low electricity costs because of high power conversion efficiency, simplicity of handling liquid fuel, and low-pressure coolant. High safety comes from passive reactivity control and cooling, radioactive materials at low pressure, and high temperature tolerance of materials using molten fuel salt 700°C below its boiling point.

Developing Nations

Electricity from both WWS and new LWR power plants is more expensive than electricity from new coal-fired plants, which costs about 6 cents/kWh. Coal power plants generate 1400 of 2400 GW of today’s global electric power. Advised by climate scientists and international organizations, governments have unsuccessfully strived to reduce global carbon dioxide emissions. CO2 in the atmosphere is now rising at the fastest rate ever recorded. Developing nations have plans to build yet another 1400 GW of coal-fired power plants by 2040. They choose coal plants because these now generate the cheapest, ample, reliable power.

Low-emission WWS sources are intermittent and more expensive electricity generators than coal-fired power plants. Liquid fission can provide energy even cheaper than coal. Simple economic self-interest will induce developing nations, then all nations, to adopt this least expensive, least environmentally harmful energy source. LF is emission-free, reducing deadly particulate air pollution and the heat-trapping atmospheric CO2 contributing to global warming.

WWS and LF Roadmap Similarities

The WWS and LF energy roadmaps agree on the future importance of electrification and conversion of industrial, commercial, residential, and transportation services to use electric energy rather than thermal energy from fossil fuels.

Jacobson’s WWS Table 1 aggregates thermal and electric power as Total, but it’s useful to distinguish them. Here BAU means business as usual.

| Table 1: Electric and thermal power demand | |||

|---|---|---|---|

| Roadmap | Total end-use (GW) | Electric (GW) | Thermal (GW) |

| BAU 2012 | 12,105 | 2,400 | 9,705 |

| BAU 2050 | 20,604 | 4,085 | 16,519 |

| WWS 2050 | 11,840 | 11,840 | 0 |

The WWS 2050 roadmap table projects that (11,840 – 4,085) 7755 GW additional electric power can replace 16,519 GW of thermal power. This is consistent with LF roadmap projections in Figure 2 that converting all energy use to electricity will triple electric power consumption.

Powering Prosperity

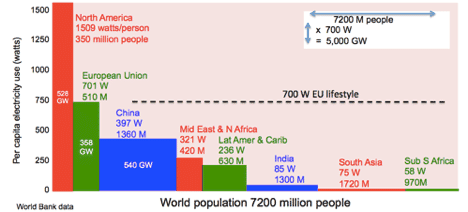

The opportunity to improve human prosperity with electric power is immense. Developing economies typically improve their GDP by $4 per additional kWh. In this Figure 1 projection per capita power grows to about half that of US persons. Though this projection is timeless, the resulting 5000 GW is roughly consistent with Jacobson’s 4085 GW for 2050 BAU.

Liquid Fission Roadmap

Liquid fission power is being developed by several innovative companies. The ThorCon objective is to manufacture power plants at less capital cost than coal-fired plants. Fuel costs for thorium and uranium are much less than for coal, so generated electricity will cost less. ThorCon’s web site projects capital costs of $1.2B per GW of generating capacity, leading to electricity that should cost 3 cents/kWh or less.

These plants are designed to be manufactured in 50 to 500 ton modular blocks by existing shipyards, using proven high-quality steel-fabrication technologies. Complete fitted-out blocks will be barged to excavated shore-side locations and welded together. After achieving mass production, time from firm order to operation will be 2 years. How?

Steel for such a 1-GW LF underground power plant is 36,000 tons. The world’s single largest shipyard can fabricate 2.5 million tons of steel into ships, annually; industry capacity exceeds 15 million tons/year, enough to manufacture more than 400 1-GW power plants per year. Moreover this manufacturing capacity already exists and is underutilized, so production can start soon.

ThorCon International is planning to build LF power plants starting in Indonesia. The first few rows of Table 2 reflect the plans shared with the power company and potential investors. In this extended illustration, as mass production is achieved, LF power plant deployment rates rise progressively to 10, 20, 50, 100, then 200 GW per year after 2040.

| Table 2: Liquid Fission Roadmap | |||

|---|---|---|---|

| Year | Annual Production Rate (GW) | New LF Additions (GW) | Cumulative New LF Power Supply Additions (GW) |

| 2022 | 1 | 1 | |

| 2026 | 3 | 3 | 4 |

| 2027 | 5 | 5 | 9 |

| 2028-2029 | 10 | 20 | 29 |

| 2030-2031 | 20 | 40 | 69 |

| 2032-2033 | 50 | 100 | 169 |

| 2034-2040 | 100 | 700 | 869 |

| 2041-2050 | 200 | 2,000 | 2,869 |

| 2051-2100 | 200 | 10,000 | 12,869 |

Electric Power Sector Decarbonization

By 2050 the LF roadmap additions of 2,869 GW could avoid adding the planned 1400 GW of coal-fired electric generation and then retiring the 1400 GW of existing coal-fired generators. This meets Jenkins’ expert consensus that “Power sector CO2 emissions must fall nearly to zero by 2050 to achieve climate policy goals.” and “There is no disagreement on the question of prioritizing the power sector in decarbonization scenarios.”

Realistically, operating fossil-fueled power plants will likely run to the end of their economic lives. The world is now building more of them at 100 GW per year. Their fires might be extinguished early if LF power costs drop below coal plant incremental operational costs. Coal fuel costs about 2.3 cents/kWh. A carbon tax might incentivize retirement of operating fossil fuel power plants.

Electrification Can End CO2 of Burning Oil, Gas, Coal

Electrify everything! Many processes and applications based on heat from burning fossil fuels can be replaced with electric-powered ones. Immediate electrification opportunities in other sectors are:

- Transportation. Electric cars and trains can cut use of gasoline and diesel fuels.

- Heating and cooling. Electricity can heat and cool buildings with heat pumps. Air conditioning in the mid East and Africa provides a productivity growth opportunity.

- Desalination. Electricity used to desalinate seawater can provide fresh water to arid regions, enabling increased food production, important as climate change progresses.

- Aluminum. Over half the valued added in manufacturing aluminum comes from electricity. Aluminum is substituting for heavier steel in trucks, for example.

By 2050 electrification of transportation and industrial sectors will be feasible. The transportation sector now depends on hydrocarbon fuels such as gasoline and diesel, which are as big a source of CO2 as electric power plants.

Future carbon-neutral onboard liquid fuels may be based on hydrogen from splitting water. Electrolyzing technology such as CuCl catalysis at 530°C will be able to use LF heat and LF electricity to make hydrogen at a conversion efficiency near 50%. At 3 cents/kWh for LF electricity, future hydrogen would cost 1.6 cents per megajoule — the same as energy from $2/gallon gasoline. However the fuel efficiency of a hydrogen-fuel-cell powered electric car is twice that of a gasoline-engine powered car, cutting the fuel cost per mile in half. Trucking ventures such as Nikola are already exploring hydrogen fuel.

Synfuels such as gasoline-substitute methanol (CH3OH) and diesel-substitute dimethyl ether (CH3OCH3) are compatible with today’s internal combustion engines. Their carbon might be recycled from flue gas, or derived from climate-neutral sources such as bio-waste, or CO2 from the atmosphere or dissolved in the ocean, which contains 50 times as much as the air. Future electrification opportunities arising from inexpensive LF electric power include:

- Ammonia. Ammonia (NH3) is used for fertilizer that feeds a third of the world’s people. Today it is made from natural gas methane (CH4), releasing CO2 in the process. It is also a proven alternative vehicle fuel.

- Synfuels. The US navy demonstrated extraction of CO2 dissolved in seawater, with hydrogen from dissociation of water, to synthesize JP-5 jet fuel at $5/gallon.

- Hydrogen. LF-electrolyzed hydrogen itself is a possible on-board vehicle fuel, demonstrated in fuel cell cars.

- Steel. Direct reduction process with electricity and possibly hydrogen may replace coal-fired blast furnaces.

- Cement. Plasma-arc electric heating might reduce the huge quantities of fossil fuel burned to sinter limestone and sand to make cement.

Universal Electrification, Prosperity, and Population Growth

World population is growing, with best guess estimates of perhaps 9.5 billion people by 2100. This Electrified Growth LF roadmap projection below illustrates

- Doubling electric consumption as developing nations achieve prosperity

- Tripling of electric consumption to 2100 W/person as it substitutes for fossil fuel burning

- Increasing world population to 9.5 billion people

This LF roadmap Electrified Growth demand of 20,000 GW exceeds the WWS 11,840 GW, which projects energy consumption of 1200 watts per person in 2050.

LF and WWS Roadmaps Compared

This LF roadmap has many advantages compared to Jacobson’s WWS roadmap.

- Capital required for the LF roadmap to 2100 is $15 trillion rather than $125 trillion for WWS.

- LF electricity at 3 cents/kWh is much less expensive than WWS electricity at 11 cents/kWh.

- There is no need for most energy demand to be “flexible” to adapt to WWS availability.

- Subsidies are not needed for LF. Economic self interest drives demand for carbon-free electricity because it’s cheaper than coal.

Jacobson’s WWS roadmap claims to achieve 100% clean energy generation of 11,840 GW by 2050, while the LF roadmap passes that mark in 2095.

Spending $125 trillion for 2.5 million wind turbines and nearly 2 billion solar plants would unnecessarily consume vast amounts of the planet’s resources — metal, concrete, precious minerals, water and energy that would be far better used to build homes, water and sewage systems, hospitals, and transportation systems for the poor of the world. The WWS scale would be massive. China is the world’s largest industrial producer at $4.5 trillion per year. WWS demands would consume the entire industrial production of China for 28 years.

Enabling Liquid Fission Power

Confidence. Many people needlessly fear nuclear power, which has been shown to be the safest energy source, by far. Liquid fission is advanced nuclear power, even safer. Jacobson’s WWS paper starts off with outrageous false claims about nuclear power, designed to exclude from consideration any advanced nuclear power such as liquid fission.

| Jacobson WWS roadmap claim | ThorCon LF roadmap plan |

|---|---|

| “nuclear plants require 10-19 years between planning and operation” | Shipyard production enables a 2-year construction cycle. |

| “nuclear now costs 2.5-4 times more per unit energy than onshore wind or utility scale photovoltaics” | “LF capital $15 trillion < WWS capital $125 trillion LF energy @ 3 cents/kWh < WWS @ 11 cents/kWh” |

| nuclear “produces 3.4-25.4 times more carbon and pollution per unit energy than wind” | EIA: lifecycle emissions for nuclear/wind/solar are 40/23/42 g-CO2/kWh. LF plants even less than LWR. |

| “expanding the use of nuclear to countries where it doesn’t exist will increase weapons proliferation and meltdown risks” | No proliferation ever from LWR power plants; even less likely with LF technology compliant with IAEA protocols. LF can’t melt down; it’s already melted. |

Proponents of fossil fuels and renewables have long spread groundless fear of possible health effects of low level radiation associated with nuclear power and successfully created excessive government protection bureaucracies, specifically to raise costs of nuclear power to make it uncompetitive.

Enabling liquid fission power is simply a matter of permitting it. Existing nuclear power regulations developed for LWRs are not applicable to LF. New regulatory rules should be implemented based on demonstrated safety testing and modern radiation biology science.

- Money. Capital for electric power plants already exists and flows into construction of fossil-fuel-burning plants to satisfy the developing nations’ demands for 1400 GW of new power. As LF power plants prove to be cheaper than coal, that capital will divert to fund LF rather than coal and natural gas power plants.

- Suppliers. Existing shipyard capacity exceeds 400 GW per year. It is now possible to build LF power plants at rates of 100 GW per year. That is about the rate of new fossil fuel power plant additions. Supercritical high-temperature steam turbine-generators are a major component of LF power plants. These are available from a half dozen companies already supplying such equipment for coal and natural gas power plants. Turbine-generator destinations can be diverted.

- Fuel. Uranium fuel is ample for 20 years of building 100 GW of LF power plants. Fuel recycling will double uranium utility. Doubling prices paid will likely reveal an order of magnitude more reserves. Even resorting to extracting uranium from seawater would only add 1 cent/kWh to LF electricity costs. Thorium is ample.

Liquid Fission and Economics Can Lead Deep Decarbonization of World Energy.

- LF electric power cheaper than coal can displace fossil fuel combustion to satisfy the world’s growing needs for electricity for human development.

- In future, battery electric vehicles, electrification of railroads, and fuels from LF-electrolyzed hydrogen may power the transportation sector even more cheaply than petroleum.

- Using LF power for heating and cooling, desalination, and industrial processes can complete the transition from fossil fuels.

- Economic self-interest can motivate the transition to deep decarbonization.

- Favorable economics will attract existing capital to create the new LF energy sources.

- LF decarbonization is doable. Technology and manufacturing capacity already exist.

- Permission is the only roadblock.

The above is a guest post. Though Atomic Insights generally agrees with and supports the paper’s concepts, the details are the responsibility of the authors. The authors’ work is their own and does not necessarily reprsent the opinions of their employers.

About the authors

Robert Hargraves, Director, ThorCon

AB Dartmouth, math, PhD Brown, high energy physics

Author THORIUM cheaper than coal

Discussion leader Osher@Dartmouth, energy policy

Prior roles: Vice president and CIO Boston Scientific;

Senior consultant Arthur D Little; Vice president Metropolitan Life; President DTSS, software

Assist professor of mathematics Dartmouth College

Chris Uhlik, Vice President, Engineering, ThorCon

BS, MS, PhD Stanford, EE, minors in ME, aero, CS, and math

Prior roles: Engineering Director Google, leading major projects including Gmail, Booksearch, and Streetview; Redwave Networks, internet routers; ArrayComm, cellular communications; Adept Technologies, robotics, Toyota Motor, automotive control systems, Lockheed Missiles & Space; International Power Technology, cogen gas turbines

Thank you for publishing this post. Figures 1 & 2 clearly show that India needs much more access to energy, yet the solutions project states they should use 43% less energy than they do today. It seems the solutions project depends on most Indian citizens actually having a lower standard of living than they do today. http://thesolutionsproject.org/wp-content/uploads/2015/11/100_India-1.pdf

Agree, India needs a lot more energy and it’s needs far outstrip estimates of solar and wind energy. Refs at http://ramblingrahul.blogspot.in/2017/03/make-in-india-and-remove-energy.html.

Since 2011 ~600 Chinese scientists work to solve the problems the MSR Experiment at ORNL didn’t solve. Despite getting all info from the old ORNL scientists, it seems they don’t make progress. Their 2MWth demo should be running now, but they didn’t start construction yet.

One of the unsolved problems:

The high (700degr) temperature in combination with the molten fluoride salt wears the special steel developed at ORNL, Hastelly-N, still too fast.

The Chinese concluded that they should find better steel (but didn’t succeed) and that a different fluoride salt should be developed which would allow to operate at 650 degrees (unclear whether they found something suitable).

The other solution is pursued by some new ventures:

Exchange the whole reactor after 4years. Which is rather expensive.

Especially since cleaning the old radio-active reactors with radio-active fluoride won’t be simple.

So it’s not strange that MSR stayed an unfulfilled promise in the past half century.

Corrosion rates are manageable. Thorcon expects less than 25 microns per year of erosion of our standard 316 stainless steel. In the 4-year replacement life of our major reactor components, this is about 1/10th of a millimeter of corrosion depth. The thinnest components are the primary heat exchanger tubes at about 1.25mm wall thickness. We have an early warning system to detect impending tube failure and a standby module to use with minimal delay if early corrosion is detected. Worries about corrosion are highly exaggerated by people without actual molten salt experience.

How are you so expert about the reasons that the Chinese effort is running behind schedule? Perhaps reasons other than corrosion are at work. For example, they have chosen to use a salt formulation requiring isotopically enriched lithium which is unavailable commercially.

> Exchange the whole reactor after 4years. Which is rather expensive.

Many people manage to replace their cars every 4 years. Replacing the Thorcon reactor core in fact is not a significant operating expense. It is much more expensive to design for 40 year life. We plan to refurbish and recycle almost all of the core components (by mass). The small amount of primary heat exchanger tube is cheap to replace.

ORNL decided that 316 stainless steel wouldn’t do, not even for the experiment (~18months full load), and found it necessary to develop far more expensive Hastelloy-N.

Refurbish

How do you refurbish radio-active steel components (pipes, pump, heat exchanger tubes, vessel) which have hair cracks?

Seems to me that producing new is cheaper.

What about the stability problem ORNL experienced after closing the reactor?

The metallurgist on our team, recently retired from ORNL, disagrees with you. He is confident that 316 will work fine for all the structural steel in contact with salt. We might need something fancier for the HX tubes, but he thinks 316 will have adequate service life even there as well.

We refurbish the HX by replacing the tube bundle. The thicker wall downcomer and shell will not be significantly impacted by “hair cracks” if we design in enough margin. It doesn’t take much. Also, nickle based alloys are fundamentally different to iron based alloys in their corrosion properties. What happens to hastalloy will not be the same as what happens to 316 steel. Also, a titanium modified hastalloy was developed which is relatively immune to thallium induced corrosion.

As for the “stability problem ORNL experienced”… We propose to not leave the reactor for several decades with solidified salt in it. That was a stupidity of the national labs funding process. Basically the lab manager (Union Carbide) played chicken with Congress saying they would not spend ~$50k to remove uranium from the salt before long-term shutdown unless they got budget for it. No budget came. Uranium was left in. Radiolysis released fluorine. Fluorine combined with UF4 to make volatile UF6. UF6 moved down the carbon beds. The Lab found a way to bill for the new “emergency” and extracted several million dollars. That’s one way that government processes are different from profit-minded private enterprise. I’m not saying we are perfect, but we won’t make that particular mistake again.

Chris,

So according to you?

ORNL didn’t need the expensive special steel, Hastelloy-N, which they developed for their experiment in order to avoid fast wear of the vessel, pipes, etc.

While their Hastelloy-N experienced wear and some leaks despite the ~18months full load.

Furthermore the major Chinese project (600 scientist) is wasting major money trying to develop a better steel than Hastelloy-N after getting all details from the most important involved ORNL scientists during their visit to ORNL. They didn’t succeed yet in 2015; check the presentation of Rory O’Sullivan at the Delft 2015 Thorium symposium.

I realize you exchange the hot parts after 4 year, but find it hard to believe that you can reuse those parts if they are made from 316 steel.

Did you do endurance tests at 700°C with similar fluoride salt, velocities and neutron bombardments?

@Bas

Considering the fact that the ORNL project was a pure research effort with no expectation of producing a near term commercial product, it is quite likely that the decision to use Hastelloy-N was driven by a desire for knowledge accumulation. It was not an engineering decision to produce a product that provided adequate service life for a competitive price.

It is worth knowing that the principles involved in ThorCon are hard core realists who know a thing or two about designing, building and operating commercial products in harsh, high stress, corrosive environments where there is no perfect material.

Very large steel ships operating in the world wide oil trade have a different set of specific engineering challenges than molten salt reactors operating at temperatures as high as 700 C in a radioactive environment complicated by neutrons, but there are numerous principles that translate well between the two product development efforts.

“Worries about corrosion are highly exaggerated by people without actual molten salt experience.”

Chris – I think that must be correct for *stable* molten salts, especially given the century of experience in metal treatment via molten salt and so on. Though as the ORNL MSRE people reported, reactor salts are another matter, with fission products, decay products, and activation depositing in the salt nearly every element in the period table, and in particular generating free fluorine via radiation.

French simulation studies by French govt institute ADEME which are illustrated here showed that 80% renewable is the cheapest option for electricity supply in 2050. So the French installed new laws in 2015 which target a fast increase of renewable and a faster decrease of nuclear than Germany (50% in 2025).

That strongly contradicts the conclusions stated in a.o. the linked Jenkins etal review.

Stronger, the simulation studies also showed that 100% by renewable in 2050 would be less than 5% more expensive than 80% renewable.

Did they test their model with Germany’s experience?

You may assume the ADEME scientists consulted with the Germans. Would be stupid if they didn’t.

Don’t forget that by far most of the costs of the German Energiewende is due to high guarantees delivered in the first decade (2000 – 2010) in order to create a mass market which would bring the costs down according to their scientists.

E.g. In 2003/4 house owners who installed rooftop solar got 70€cnt/KWh guaranteed during 20years for all electricity produced (also for what they consumed themselves)!

Those guarantees are ending gradually after 2022, while the cost decrease of wind+solar+storage continue. So the Energiewende costs are predicted to come down gradually from the present 7cnt/KWh towards near zero in 2045.

As biomass costs didn’t come down they are now decreasing the share of biomass by gradually lowering the subsidy.

At ORNL after 4 years of exposure in the reactor vessel there were corrosion cracks 0.1 mm deep. ThorCon’s plan is to exchange entire Cans, including the reactor Pot, every 4 years for inspection, refurbishment, and rebuilding. All these costs are included in the 3 cent/kWh cost estimate.

Is a lining of solid salt against the vessel wall feasible to prevent corrosion, with molten salt of course in the center of the reactor? Or some other high temperature solid such as clay, or other ceramic? Traditional molten salt furnaces use these techniques with the effect of i) minimized corrosion and ii) lowered temperature on the vessel wall.

The source Bas quoted says “Depending on the assumptions, the electricity costs range from €103/MWh10 to €138/MWh.” That’s 10.3 to13.8 cents/kWh. Jacobson quoted 11 cents/kWh. ThorCon estimate for liquid fission power is 3 cents/kWh.

Not only is the model identified by Bas extremely expensive, to get to that price point it depends on a collapse in the cost of power generation from all renewables other than wind and power-to-gas storage suddenly becoming cheap and plentiful. Even then, the model requires “demand management”, i.e. limiting supply to customers when the system isn’t able to meet demand. It’s pretty easy to get a model to work when supply isn’t guaranteed.

In case those reasons aren’t enough, the self-acknowledged limits of the study (section 2.2.4) highlight –

1. It doesn’t model network costs

2. It won’t produce a stable system

3. There is no pathway to reach the targets identified

As for the claim that 80% renewable is the cheapest option for electricity supply in 2050, the report states “Given the uncertainty concerning these cost assumptions, the differences in total costs between scenarios are very likely to be within the margin of error”, so it isn’t even claiming to have the ability to identify the cheapest option. The model also doesn’t consider anything less than 40% renewable power or allow an expansion of nuclear or coal, which puts a pretty big limit on the conclusions that can be drawn from the report.

In contrast, one does suppose, to the Deep Decarbonization Pathways report prepared by the U.S. Depart of Energy two years ago that formed the basis of our UN submission at Marakesh last fall. There’s a summary with links to the original report here.

The National Labs involved were Pacific Northwest and Lawrence-Berkeley. I’m mildly curious why NREL didn’t attend the party, although to be fair NREL prepared a massive Renewable Electricity Futures Study 2012 of their own a few years earlier.

Also to be fair, the NREL study adhered to both the spirit and letter of “renewable” — after all it’s their middle name — and did not allow any future nuclear construction in the scenarios they considered.

PNNL/LBL did.

These were all conservative studies; one assumes the nuclear the latter considered was conventional LWR. Both studies met projected demand with minimal (not zero) demand shifting. NREL’s earlier study did not consider storage other than conventional hydro, meeting load with a 50% increase there plus a staggering (To me. I was staggered) amount of biomass co-fired with some residual coal and gas. Neither did they consider CCS, deeming it and other energy storage options premature for their particular study.

In contrast, PNNL/LBL considered hydrogen storage in conjunction with nuclear, and (hydrogen + syngas + EV battery) storage with their renewables.

The 2012 NREL study projected a bau baseline electric price of 10 – 11 cent/kWh vs (mostly renewables 80% emissions reduction scenarios of 15 – 16 cent.

In the later 2015 study, PNNL/LBL found their (not particularly) high nuclear scenario to be the only one with a snowball’s chance of coming in cheaper than their fossilized baseline, and that depended on admittedly uncertain projections of future fossil fuel prices in the baseline.

The not-particularly-high nuclear scenario capped out at about 40% generation from fission, and slightly more from wind+sun. One speculates the nameless dweebs actually running the simulations might have run a few marginally higher nuclear scenarios off the clock, but if they did, those results didn’t make the final cut.

Ed,

Price levels, etc. in the 2012 NREL study show to be far off reality already (only 5years thereafter).

Apparently their estimations were highly biased with construction periods of 5years for new nuclear, their estimation that expensive CSP would play a role, etc.

Bas,

Making predictions is admittedly hard — particularly about the future.

However, reading my comment is not, and such aspersions regarding NREL are quite unjustifiable.

Specifically, NREL’s estimations regarding new nuclear construction were neither biased, nor inaccurate.

How far off were NREL’s 2012 renewables price estimations, and the relevance thereof, is another issue. One makes the best educated guesses one can, assumes some conditions, completes one’s projections, and gets them out the door.

Certainly LCOE for wind and solar has since dropped considerably. The relevance of such drop, and whether it reflects any increased value-for-money, is highly debatable: fwiw the NREL and the PNNL/LBL studies both considered the LCOE of intermittent generation to be of secondary importance to the all-in cost of reliable electricity.

As an aside but real-world, iirc Russia, China, and South Korea are all taking about 5 1/2 years to construct new GW-scale light-water reactors. YMMV, as does ours. 😉

Robert,

The absolute cost levels depend on calculation methods and estimations regarding (predicted) cost levels in the country, etc.

So I only stated a comparison within the study.

This table from the summary of the study compares the costs of different scenario’s in 2050:

– baseline : € 119/MWh

– 40% renewable: € 117/MWh

– 95% renewable: € 116/MWh

– 80% renewable: € 113/MWh

Of course demand management will help, so all Dutch houses will have a smart meter in 2020. I then can put my dishwasher to operate more accurately at hours when electricity price is cheap when I choose for a supplier who delivers for the APX-Power Exchange price + an admie fee + transport fee + taxes (now we run our dishwasher at night as then electricity is cheaper).

The issue is that the assumed high costs with high renewable penetration, doesn’t show. Not in this French study, neither in German studies, etc.

@Bas

There is a significant flaw in your logic. The factor that makes electricity predictably cheap at night is the existence of power plants that run best at steady state. Operators of those power plants accept lower prices as a better option than halting production and disrupting the economy of steady operation.

When your scheme succeeds in driving those power plants out of the market, there will still be periods when wholesale electricity prices are very low because the supply will exceed the demand, but even the smartest of smart meters will be unable to predict when that situation happens. Depending on the weather conditions, it might be a temporary situation that doesn’t last long enough to complete a cycle on your dishwasher. I can envision your meter sensing that prices are cheap, and sending a signal to start the machine. 40 minutes later, after the wind has changed velocity and clouds have come in off of the ocean, prices on the grid may be several times higher than they were when the cycle started.

You will have one very confused “smart meter” on your hands and wonder why your bills are so unpredictable.

Rod,

You are right that weather, hence power production, can change unpredicted within an hour or so. That would be a pity for me.

But history shows that the chance on that is very low nowadays. Weather predictions for the next 4hours are quite accurate here.

The other, more advanced solution which may arrive here few years later on, implies that the utility indicates every hour the fixed price for the next 4hours to my meter. Which offer the meter may then accept and start the dish washer (depending on the criteria that I installed in the meter).

Note that:

– The utility can buy futures at the APX so it doesn’t have to take a risk itself;

– The meter may not accept and continue on the hourly (or 15minutes as APX trading is in 15min. chunks) variable rate + the surcharges (utility admie, transport, taxes).

@Bas

You just don’t get how confused you are.

You wrote: “But history shows that the chance on that is very low nowadays. Weather predictions for the next 4hours are quite accurate here.”

The problem with your logic is that your proposed system needs to be able to predict and compute how the weather changes over continent-sized areas will affect power production on a minute by minute basis. Though computing power has improved by incredible leaps and bounds, that kind of prediction capability still requires systems that are more the size of rooms than the size of a “smart meter.”

@Rod,

In 4hrs the wind moves the clouds an av. 1cnt/KWh higher.

In 4hrs the wind moves the clouds here on av. 100km or so.

One of the reason 4hrs weather predictions are so accurate here.

Furthermore the weather in Belgium and UK isn’t relevant as the small interconnections to those countries are near always filled with our export, as prices in those countries are higher (as you can see at the APX).

The weather in Germany mostly follows our weather as the main wind is from WSW towards ENE.

what about Dual Fuid Reactor ?Cout it be the final answer?

Dual fluid reactor had fast fission occurring in a chloride salt at very high temperature, with molten lead on the other side of thin walled tubes, in a high neutron flux environment. They proposed making all the tubing out of molybdenum alloy, which is expensive, and difficult to weld. Thorcon’s stainless steel reactor will be much cheaper and easier to make. It is also following the path beaten by the Oak Ridge researchers, whereas fast fission chloride reactors have only ever existed on somebody’s hard drive.

Moltex Energy have a simpler concept for a chloride reactor, with the fuel salt in tubes similar to the lining of the solid fuel rods in current reactors. That avoids the fancy plumbing requirements of the DFR, and means you just use new tubes every year or so, so the longevity of the metal under intense neutron bombardment is less of a concern.

I was wondering if Thorcon might just end up buying Moltex for their innovative reactor design?

Interesting discussion, though with respect to the Jacobson comparisons, I don’t know how principled debate is held with one who thinks it legitimate to include the emissions from the fires from a nuclear war as the carbon emissions assessed on nuclear power. Might as well attempt to debate Caldicott between pie-in-the-face attacks.

Also from the same set of papers, he assumes that coal will be used in the interim during construction of the nuclear plants, and he includes CO2 emissions from coal in the CO2 emissions of nuclear. That is all and well as reported in that paper, but then he cites his paper without context, and starts talking about CO2 emissions as though in a steady state economy, and sneaks CO2 emissions from coal into nuclear power somehow. It’s the height of dishonesty. If there was any honesty and integrity in the so-called green environmental movement, Jacobson would be drummed out of the movement, and removed from his university post.

Thoughtful analysts have concluded that renewables can’t solve the climate/energy issue. Here’s a retrospective evaluation by people at a company that actually tried to solve the problem.

http://spectrum.ieee.org/energy/renewables/what-it-would-really-take-to-reverse-climate-change

Knowing renewables can’t work is only half the issue. What CAN work? Liquid fission power is real, affordable, and globally scaleable, without subsidies. Permission is the only roadblock.

It’s clear that German and Danish scientists are convinced that 100% renewable will be reached against acceptable costs. German Agora think tank stated cheaper than options with nuclear, assuming nuclear socialized hidden costs are also taken into account.

Even offshore is now much cheaper than nuclear. In NL the new auctioned offshore Borssele wind farm (750MW, ~30km off-coast in the North-sea in ~30m deep water, operating in 2020 with 8MW wind turbines which run with a Capacity Factor of ~52%) will produce for <5cnt/KWh on av. (15yrs for 5.7cnt thereafter 3cnt).

And the costs decrease isn't at the end. Vestas is moving towards serial production of 9MW wind turbines (higher = higher CF, etc), while 12Mw is in development.

@BAS

It’s clear that many other experts disagree with the opinions of your selected sources.

Rod,

We agree 🙂

Bas,

You seem like a nice guy. I want you to watch

this video and then tell me why you want

new nuclear to fail.

https://www.youtube.com/watch?v=Q4xjQWBw7i0

Thanks.

It’s a nice video, though it doesn’t touch the real problems of molten salt reactors hence of little relevance.

While Germany and Denmark are slowly attempting to achieve their 100% renewable goals over the next few decades, we should all be thankful for those who promote the ‘temporary’ value of:

“[Germany’s] technology developments such as the new super-critical coal power plants which utilize the low temperature burning, circulating fluidized bed process (which generate with only marginal more CO²/KWh than gas). The new flexible coal plants can generate for ~2.5cnt/KWh, substantial cheaper than gas and oil plants can. As these coal plants are enough flexible to complement wind+solar…”

Bas Gresnigt

http://energypost.eu/barclays-germanys-coal-generation-may-worthless-2030/#comment-273133

It seems that the German Energiewende experiment, as related by a former senior manager Christine Sturm, has experienced major problems. Little wonder she got out while the going was good.

While it is unquestionably possible to develop a wholly renewable electricity grid (note: possible doesn’t mean affordable or sensible), Denmark and Germany aren’t good examples of either renewable usage or cost effectiveness. At this moment in time, Denmark is emitting 375 g of CO2eq per kWh and Germany is emitting 472 g of CO2eq per kWh, and to get to this point electricity costs have soared to a level that is above every other developed country in the world. Sweden and France make an interesting comparison, with current emissions of 64 and 46 g of CO2eq per kWh respectively. Electricity costs for consumers in Denmark and Germany are almost double those in Sweden and France. Also, I’m aware that the amount of renewables isn’t the same as CO2eq emissions, but it is a reasonable metric to track given the ultimate goal.

One thing that comes up reasonably frequently are the “socialized hidden costs” of nuclear. Most of the time when hidden costs come up in conversation it is possible to identify them, even if they are difficult to quantify. I’ve found them much harder to pin down for nuclear, given that construction, regulation, operation and decommissioning are very visible costs. Is anyone able to elaborate on what the socialized hidden costs of nuclear actually are?

“… the socialized hidden costs of nuclear …?”

There is no exact definition. But you may consider how much of the costs below belong to that category:

1. Nuclear laws limit the liability for NPP’s to very low amounts. E.g. in NL <1 billion, in USA <25billion. Considering that the Fukushima cost estimate is now (doubled again) $200billion, it's clear that the major part of an insurance premium which would cover the accident costs is socialized. Invisible for the citizen/rate- & tax-payer until disaster strikes.

Consider that 4 reactors of the world's 400 ended prematurely in extremely expensive disaster and a simple calculation ends at roughly 1 -5cent/KWh socialized costs (depending abut how optimistic you are about the safety of our present fleet).

2. Nuclear law also limits the costs of (storing, etc) nuclear waste. While there are differences per country, it's liability is frequently restricted to 100years. So those costs are shifted to next generations, assuming no useful application can be developed for the waste (after 60yrs accumulated nuclear waste still no such development only wild ideas).

3. Nuclear Power Plants (NPP's) are constructed with substantial subsidies such as loan guarantees, etc.

Consider the new UK Hinkley C NPP:

– the loan guarantees constitute a value of 1.5cnt/KWh

– UK govt agreed that it will take the decommissioning costs above a rather low amount which the owner has to pay;

– UK govt agreed to guarantee that all produced electricity will be paid £92.50/MWh inflation corrected since 2012, during 35years after start of the production (2030?). Considering inflation since then, that price is now already £102/MWh (=$11.9cnt/KWh). With 1.5%/a inflation that price will be $15cnt/KWh in 2030.

Compare with ~ most expensive renewable; Offshore wind farms.

Those were tendered for ~$5.9cnt/KWh for the first 15yrs, thereafter whole sale price which is officially predicted to be then $3.1cnt/KWh. The winner has to take all costs incl. decommissioning (wind farm ~30km off the coast in the North Sea in ~30m deep water predicted to operate with a CF of ~52%). And wind & solar prices are widely predicted to continue their decrease during next decade.

How much of the drop in solar panel cost has already taken place? The Chinese producers are highly fragmented and likely have thin profit margins. Eventually, the production will be consolidated among fewer producers and the price will stabilize and perhaps bounce back up. Then there is the factor of Chinese state subsidies as well as preferential treatment in the US.

I understand that ThorCon is designing modules that generate electricity. I’m wondering about the prospects for two variations: 1) Generating substantial amounts of process heat in addition to electricity. An LF reactor (unlike LWR) operates at a high enough temperature to supply heat for several economically important process. Surely this would be more efficient (though perhaps less convenient) than generating electricity and converting it to heat. 2) Generating steam at a temperature/pressure suitable to feed the turbines in a modern coal-fired power plant (encouraging conversions).

Jim – you are absolutely right about converting coal-fired power plants to nuclear power. Jim Hopf has been working with this concept for a number of years, and has a website devoted to molten salt reactors and converting coal-fired plants to nuclear power. (http://www.skyscrubber.com) Here’s a link to a sample page from his site, discussing the conversion of the Taichung, Taiwan coal-fired power plant to nuclear energy: http://www.skyscrubber.com/taichung_coal2nuclear.htm Hopf cites the Taichung power plant as the single largest emitter of CO2 in the world. (Jim keeps revising his site based on his current enthusiasms; he uses a number of different domain names for the site, making it a moving target.) He is currently very enthusiastic about the ThorCon reactor and ThorCon’s plans. So am I, for that matter.

Terrestrial Energy’s molten salt reactor is actually aimed at producing process heat, as well as heat for generating electricity.

Rod – thanks as always for this post. Robert and Chris – thank you for your essay and for the information on what ThorCon International is doing.

Good article,

–Is your cost of $1.2 billion for a 1 GW ThorCon plant an overnight cost, or does it include financing costs, escalation and owner’s costs?

The ThorCon executive summary lists the $1.2 billion as an overnight cost, with a 4-year build and 10 percent cost of capital. Those assumptions should result in a substantially higher all-in cost, probably about $1.6-1.8 billion, I’m guessing.

I think the higher all-in cost would give a slightly higher per-kwh capex cost of 2.1-2.4 cents per kwh (according to NREL LCOE calculator, 32-year economic life, 10 percent discount rate, 90 percent CF per the ExSum) than the 1.85 cents per kwh that you guys have budgeted.

Still a great price if ThorCon can pull it off.

In a conventional nuclear build, the process runs on for 4–12 years and financing costs are a large fraction of the total cost. In contrast, a ThorCon is built entirely in a shipyard then delivered. Installation and hookup could be as short as a few months. Financing costs are insignificant in such a quick installation. Thus overnight and financed come out almost the same.

Those numbers include margin for yard and ThorCon profit as well as some padding for regulatory costs, materials tracability, etc. We have an independent organization building their own, more comprehensive cost model. They are pushing to inflate some numbers, but so far it looks like we aren’t off by more than 50%.

A most salient point of criticism of MZ Jacobson’s WWS plan has always been that he can’t point to a single nation that has successfully adopted a plan similar to his — true, Norway & Iceland have ably exploited their atypically massive hydro & geothermal energy resource potentials to satisfy the needs of their rather small populations (Norway ~5M, Iceland 25 cents per kWh.

Team ThorCon is certainly ambitious: 100GW(e) of reactors per year!

I’d ask how do they plan to obtain the necessary fissile material? U-235 would require massive scale-up of world’s conventional enrichment capacity. U-233 would require a vary large scale breeding program. I’d suggest first building up a sizable fleet of CANDUs and breeding up a u-233 mine via OTT via DUPIC driver fuel.

@Aaron Rizzio

I guess that depends on what you call “massive” in terms of building additional enrichment and mining capability. Compared to the capital investments of money and facilities that have enabled the shale gas revolution, the investments would be modest and far more limited in terms of sizes and numbers.

The US, for example, has only one rather modest sized enrichment plant operating today. It could easily multiply that by a factor of 10 or more without anyone but the local populations noticing much of an impact – and they would hugely benefit by the workforce growth and facility investments expanding their property tax base.

ThorCon plans a scale-up of the ORNL’s MSRE. It could run on either u235 or u233. The DMSR championed by David LeBlanc is optimized for a more fuel efficient core, it could be done on existing world mine production and SWU capacity.

Norway & Iceland have small populations (Norway ~5M, Iceland 25 cents per kWh.

With favorable permitting worldwide, could ThorCon jump to 100 GW/year of production much more quickly?

Do you have a plan to increase worldwide beryllium production?

It seems that worldwide production is 200-300 tons/year and that a 1MW ThorCon would need about 45 tons of beryllium at startup.

“Approach to engineered safety systems: Physical limit on fuel addition rate; hardware limit on pump speed change rate.”

What physics properties are changed by pump speed changes?

My guess: A slower pump speed keeps the fuelsalt in the graphite longer making the fuelsalt hotter, reducing the density, causing less fuel to be in the graphite, causing fewer fissions, causing less power to be produced. Now, that string of logic is surely wrong or incomplete. Is there something else at work?

Martin, you’re right, plus the Doppler effect causes more neutron absorption by U-238, plus a proprietary physical feature also reduces reactivity as temperature increases. That’s how ThorCon does load following.

Thanks. What an intriguing answer. It seems that nothing is caused by one factor with this reactor. Now, I get to read about Doppler.

Does anyone here have any idea how much the cost of electricity supplied by the Barakah Power Plant is going to be per kw/h? As I think that is a useful benchmark for these comparisons.

It’s hard to find accurate predictions for Barakah, but we should know soon once it’s actually selling electricity. Another useful benchmark is Kudankulam 1 & 2, which went online in 2013 and 2016 respectively. They’re selling electricity for 4.29 INR, or ~6.5 US cents, per kwh.

Kudankulam is a modern greenfield reactor complex with conventional large light water reactors, so it is a good example of typical costs that could be expected for other new build power reactors.

January 1, 2011, Dewa increased electricity charges from 20 fils per kilowatt (KWh) to 23 fils for monthly consumption below 2,000 KWh and from 33 fils to 38 fils per KWh for consumption of more than 6,000 KWh per month.

1 dirham = 0.272294 dollar. 100 fil = 1 dirham 38 fil = 10.4 cents

Do you plan to use simulation as developed at Berkeley (Compact Integral Effects)? This technique looks to be the fastest way to check many plumbing issues at really low temp and cost?

No, but some of the folks from Berkeley are helping us with software simulations.

Use some extra virgin olive oil and some scaled down glass tubes to simulate your piping.

How hard can it be?

When I told my wife about the new term, Liquid Fission abbreviated LF, she immediately smiled and said, “I love LF because I can say it.” My response was, “Its normal to just say “L” “F” because its only two letters. She says, “But Martin listen what you hear when you say “L” followed by the normal sound for “F” ffff.” Me, “You mean elf?” She, “Sometimes you are a little slow.”

The elf technology gives a whole new meaning to Small Modular Reactor.