Cheap Gas Drumbeat – Quotes from the Chorus of Chanters

This post will be one that evolves over time – especially if I can get some help from readers. My intention is to put together a representative series of quotes and links that show the rhythmic beat of the “cheap gas” mantra. I am not a believer – I think that the oil and gas industry is purposely engaging in a price war designed to drive out the competition. They have a war chest and plenty of cheerleaders, but the history of natural gas prices is anything but predictable.

Here are some starting quotes:

November 2, 2010 (Bloomberg.com) Nuclear Power Gains Clout in Republican House Election Victory, NRG Says

A renaissance in nuclear power may be stalled regardless of action by Congress, said Chris Gadomski, the lead analyst for nuclear power with Bloomberg New Energy Finance.

“I don’t think you can legislate new nuclear, especially in an environment when there is a lot of unconventional natural gas to be tapped and the cost of natural-gas generating facilities are about one 10th of nuclear,” Gadomski said.

November 1, 2010 (Nuclear Information and Resource Service (NIRS)) Letter to The Honorable Jeffrey Zients Acting Director and Deputy Director for Management Office of Management and Budget

All proposed reactor projects face the same challenging economic environment caused by unfavorable market conditions, including escalating estimated construction costs, decreased electricity demand, and low natural gas prices. More loan guarantees will not resolve these fundamental problems.

For example, Constellation’s recent rejection of a $7.5 billion loan guarantee for a new reactor at Calvert Cliffs indicates how poor the economics are for new reactors, especially merchant plants that must operate in competitive markets.

October 31, 2010 (CattleNetwork.com quoting the U. S. Energy Information Agency weekly report) Natural Gas Outlook: Abundant Supplies Making Headlines, Prices Lower

Working natural gas in storage increased to 3,754 Bcf as of Friday, October 22, according to Energy Information Administration’s Weekly Natural Gas Storage Report (see Storage Figure). The implied net injection for the report week was 71 Bcf higher than last year’s net injection of 24 Bcf and the 5-year (2005-2009) average injection of 45 Bcf. This marks the seventh week in a row that this year’s injections exceeded last year’s.

Significantly higher production this year compared to last combined with mild weather and relatively low heating demand has driven storage rapidly higher over the past month. Total storage is now just 1 Bcf below the level seen in 2009, a record-breaking year. Working gas inventories are 312 Bcf above the 5-year average level.

October 26, 2010 (Investing Daily) Exelon: A Nuclear Power Utility in the Bargain Bin

Regarding supply, no new nuclear power plants have been built in the United States since the 1970s, so Exelon’s 11 fully-licensed and operational nuclear power plants are precious commodities that give the company a virtually unassailable competitive advantage. Combine this limited supply with strong support from the Obama administration for nuclear energy, and Exelon is well positioned for the future.

Exelon’s Hedging of Energy Prices Has Pros and Cons

The only problem for Exelon is a short-term one: natural gas prices are cheap right now, which makes electricity prices generated from power plants using natural gas highly competitive with Exelon’s electricity prices. Whereas Exelon is best known for its electric utilities in Chicago and Philadelphia, most investors are surprised to learn that two-thirds of Exelon’s earnings come from the sale of unregulated power in competitive electricity markets, including the PJM Interconnection that serves the Mid-Atlantic states of Pennsylvania, New Jersey, and Maryland.

October 22, 2010 (Minneapolis Star-Tribune) Natural gas elbows its way to center stage

By unlocking decades’ worth of natural-gas deposits deep underground across the United States, drillers have ensured that natural gas will be cheap and plentiful for the foreseeable future. It’s a reversal from a few years ago that is transforming the energy industry.

The sudden abundance of natural gas has been a boon to homeowners who use it for heat and, manufacturers that use it to power factories, but it has upended ambitious growth plans of companies that produce power from wind, nuclear energy and coal.

Billions of dollars’ worth of plans to build wind farms and nuclear reactors have been delayed or scuttled, including Constellation Energy’s Calvert Cliffs nuclear project in Maryland.

October 11, 2010 (Businessweek) Ahead of the Bell: Constellation rising

The move, which was announced Saturday, will likely scrap the planned Calvert Cliffs 3 plant. Nuclear power plants, which take several years and billions of dollars to build, are too costly and high risk to qualify for typical bank loans. The company said in a statement that it no longer sees “a timely path” to reaching a loan agreement with the government.

Analysts had questioned whether it was a good idea to invest in a nuclear power plant at a time when natural gas is so cheap.

September 28, 2010 (Reuters) Fluor says cheap shale gas a hurdle for US nuclear

Fluor Corp (FLR.N), the largest publicly traded U.S. engineering company, said low natural gas prices resulting from a glut of shale production were holding back the development of U.S. nuclear power.

Extensive drilling in shale rock has unlocked a massive amount of U.S. natural gas, weighing down prices despite a bounce in other commodity prices in the past year.

Fluor Chief Executive Alan Boeckmann said on Tuesday that as long as there was no extra cost paid for carbon emissions in the United States, the economics of building plants to burn cheap natural gas would remain better than that of nuclear.

The volatility of natural gas prices is legion. In our current society, even the Hoover Dam would likely have been rejected due to cheap gas and high capital cost. 😉

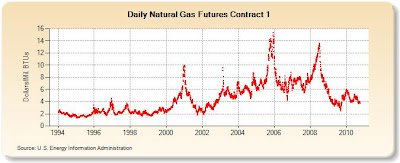

If I were to design an ad for nuclear energy and why it’s a good bet against volatile methane gas, I would post the same price picture of gas with the caption “Gas prices might be low now, but in the past 10 years we’ve seen at least 4 price peaks escalating the price 4 to 5 times.”

If the chart is somewhat consistent, we might see another small to large peak come in the next year or two.

But is the past always prologue? Rod, you have put that graph on gas up a lot, but how do you address the argument that the unconventional reserves are a “game changer?” Never in the past sixteen years of your graph did you have the estimated reserves that are being kicked around now. So, the argument goes, the past doesn’t matter. Until you can undermine that logic, I don’t see how these quotes and the graph make a compelling case to an outside observer.

I read in some international gas journal that overseas players are dubious about the claimed quantities that can be recovered through fracking. If true, that would be a more compelling argument.

@Tom – I have written about the reality of unconventional gas on a number of occasions. Perhaps the best one of the bunch is at

http://atomicinsights.blogspot.com/2010/09/shale-gas-is-not-game-changer-it-is.html

I can send you more or you can just search Atomic Insights for “fracking”.

Each of the posts includes a number of external links, so I am not just sharing my own opinion.

Tom,

An even more compelling argument would be the threat to gas prices if the government decides to protect the aquifers and brings fracking under EPA supervision.

Bill

@Tom – another reader sent me this link via email. Pretty compelling. Of course, it can be dismissed as one man’s opinion, but that is the way things work when there is a focused effort to spread misinformation.

http://videos.thestreet.com/v/35014587/a-republican-congress-means-buy-nat-gas.htm

@Tom – here is another article worth reading

http://www.theglobeandmail.com/globe-investor/talisman-shifts-focus-to-gas-liquids/article1781957/

As you read it, notice the comment about the long term goal for the Marcellus Shale play is to read a billion cubic feet per day.

That sounds like a whole lot of gas until you do the numbers. The US currently produces and consumes about 23 TCF per year. That is 23,000 BCF per year, which works out to 63 BCF per day.

A resource as large as the Marcellus that produces at 1 BCF per day is not all that important to our energy supply picture – especially when the production companies do not feel that current prices are worth the drilling effort.

If there were 500,000 years of gas reserves (along with a way to get rid of the carbon that would be generated by burning 500,000 years worth of gas – just a note for the record, like it or not – the carbon issue has not disappeared: elections do not validate or invalidate science) like we have 500,000 years of uranium and thorium (with recycling and breeding) then maybe I’d call gas a “game changer”. But when there are only 100 years of gas – recently increased to 120 years!, that’s still a very short time. Until gas reserves stretch into deep time, say 1,000 years out, then we can’t afford profligacy with gas.

Our present love affair with profligate consumption of fossil fuels is perhaps one of the biggest “intergenerational equity” considerations ever, one that makes talk about intergenerational equity involving nuclear “waste” look laughable in comparison. What gives us the right to exhaust the “100 years” or even 120 years of gas buried under our land rather than leaving it to our children and grandchildren – to generations yet to come? Why not use what we have plenty of – fissiles and fertiles -rather than going about and raiding the precious stocks of fossil fuels that we have in such limited numbers?

Personally, I’m of the opinion that gas should be price-floored by the government for anything but the traditional uses of heating, cooking, and fertilizer/chemical production to bring home to the American people the core truth of fossil scarcity and global environmental destruction by fossils right now, so we can extend the valuable services that fossils gives our civilization and spread the damage fossil use does to our civilization over the maximum period of time, rather than wastefully burning our precious gas resources in power plants that could be powered with safe, clean, and abundant fissiles (and fertiles) for only a little more in first cost above that of gas.

Why don’t we start with a price floor of $25 or even $50 per million BTU for any natural gas used for power? The price difference between power gas and non-power gas can be used to subsidize of long-term (resources last for at least 1000 years of whole-world energy consumption) non-emitting base load energy development, construction, and research.

The gas and petroleum industry has nothing to fear from fission. After all, even the most enthusiastic proponents of nuclear power don’t think that people are going to be putting Mr. Fission in their basement any time soon…so gas won’t be disappearing there for quite a while. (Though I don’t doubt that district heating using highly pressurized water, perhaps specialized reactors, and in more remote regions, geothermal heat pumps, might eventually change the dynamics of our household boiler rooms all together.)

I really don’t understand it why anti-nukes compare nuclear with the economics of natural gas instead of other carbon free solutions. They claim nuclear is too expensive because it’s more expensive than gas, then they tell us that we should buy solar panels?

@Scott – the reason you are confused is that you accept people at their word. That is part of the reason that the nuclear industry never seems to get untracked – the industry is full of fundamentally honest engineers who cannot believe that someone would verbally work to convince them to buy solar panels when what they are really selling is NATURAL GAS, coal or oil.

(Please do not misunderstand me – I respect most of the people who work at ExxonMobil. I am just using them as an example of the enormous size and financial muscle that has accumulated in an industry that was built on the idea that E is scarce when it is really equal to MC^2 with both M and C being incredibly large numbers.)

ExxonMobil – a company that has less than a 4% share of the world’s petroleum market – had a total revenue stream last year of about $440 BILLION dollars. (That is about 3 times the US Navy’s annual budget for EVERYTHING they operate and purchase.) About half of the energy that ExxonMobil pulls out of the ground is in the form of natural gas. While the price war against alternatives is in effect, their revenues from gas are down rather sharply compared to 2007 and 2008 when gas revenues were skyrocketing. During that time of plenty, ExxonMobil was not wildly spending, it was filling up a war chest for the inevitable battle against its competitors – that is what cyclical commodity companies do if they are run by competent managers.

ExxonMobil has 80,000 employees. (The US Navy employs 330,000 active duty sailors plus another 250,000 full time government civilians and probably an equal number of full time contractors.) The average revenue per person at ExxonMobil was $5.5 million dollars.

Certainly, the vast majority of the employees did not see anything close to that in their paychecks and certainly ExxonMobil has a lot of expenses associated with finding, extracting, processing, transporting, and marketing their product. Those expenses do not disappear into thin air – though Exxon does a lot of drilling, they do not actually put their money into a hole. Every dime they spend goes to a person somewhere. That gives ExxonMobil and its friends an enormous influence on the world’s economy. A substantial share of the revenue falls into the pockets of managers, banks, politicians, media moguls and stockholders who all want to keep that stream flowing.

Continued on next comment

Continued from comment posted at 3:50:17)

In point of fact, ExxonMobil is not one of the major oil companies that is out there selling solar panels or wind turbines – they leave that work to BP, Chevron and Shell. They are the company that is touting algae fuel as an eventual supplement to oil and natural gas.

At least 10 times during an evening of watching election returns on CNN (notice the kind of market research this company does) I saw the story about Joe Weissman, Senior Biofuels Scientist ExxonMobil, whose PhD advisor at Berkeley asked him – in 1975, while I, a grandfather, was in high school – if he wanted to change the world. The guy said “sure” and his advisor said, well let’s grow some algae.

http://www.exxonmobil.com/Corporate/news_ad_us_algae.aspx

That story is illustrated with spinning bluish geometric symbols, beautiful green colors and lots of computer generated graphics designed to look very high tech and chemical. Joe repeatedly told all of the political junkies watching the returns that someday this research might allow them to supplement fuel in automobiles and meet the world’s energy demands. (Each spot lasted thirty seconds, but amazingly enough, he kept on message.)

That frequently repeated spot at a carefully targeted audience is a heroic tale of how hard ExxonMobil is pushing the boundaries of science to help meet some of the challenge that ExxonMobil faces every day to fill up our gas tanks. That is another theme that the O&G industry loves to use – they are working hard in difficult areas and at the edge of science to bring us the fuels that we love to buy and burn.

I happen to have an inside story on algae fuel, having just retired from the exact part of the Navy that has been charged with funding Ray Mabus’s heavily promoted Green Fleet.

The money that has been diverted into that effort came directly from the existing fuels budget. When that budget is stretched to pay for “cutting edge” research, it directly results in a reduction of flying hours and underway fuel consumption. Since Navy leaders would never give up fuel that is directly funding mission, the diversion is coming out of the fuel that is devoted to training pilots and to taking ships underway on training missions and show-the-flag port calls. The people who are responsible for training have told the Navy resource sponsors that they are either close to or at “hard decks” or red lines where pilots will lose their certifications – they are already below the point where proficiency begins to suffer.

The Green Fleet money does not sound like a very large number in a big pot of money, but it is also not buying very much. The algae fuel costs three times as much per gallon as most of our distillate fuels do PER BARREL – it is 100 times as expensive. The people who had to give up those resources from their budget spreadsheets were only one cube away from my desk, and worked for the same three digit branch head. I can personally testify that the story is true.

What I never understood was why the Navy was interested in funding this research when it is supposedly being done by and for some of the world’s richest companies. Why is ExxonMobil allowed to be on the dole?

Others are asking the same question http://www.wired.com/dangerroom/tag/great-green-fleet/ (The guy quoted in the story signed my last two fitreps. I am kind of ignoring one of the mantras we learned at the boat school about taking heed of what you say of your seniors, but what the heck, I’m retired now.)

I will be eternally grateful to Ms. Page, my high school rhetoric teacher, for assigning us the task of carefully watching commercials and reporting on the techniques used to convince us to buy products that we did not know we needed so that the people selling those products can make a far more comfortable living than most of the people that spend their money to buy the products.

At least Michael Economides is relatively honest: he is pronuclear, but basically says we must wait our turn (after the fossil fuels are used up). 😉

Seriously, fossil fuels are more convenient for the general population to use. Exxon was in the nuclear fuel business and lost money. Yes the fossil fuels will run out in about a century, but most folks are unfortunately thinking of “what’s cheapest NOW” rather than planting the proverbial fig trees.

I’m not an environmentalist so I wouldn’t mind the idea of burning fossil fuels so long as it’s cheap. Unfortunately, the green movement has other plans. Any energy consumption is tied to the “guilt” of having caused carbon emissions, and therefore must be rationed. With natural gas as our energy source, the energy conservation campaign can move forward and restrict our travel, heating, cooling, food etc. Local governments are busy waging a war on cars, removing lanes, removing parking spaces, all in the name of reducing carbon emissions. Nuclear power, since it has virtually no emissions, can reverse this trend and preserve our standard of living. If you want to see a picture of the future without nuclear power, look at Denmark.

http://windconcernsontario.wordpress.com/2010/11/01/the-case-against-the-case-against-conventional-energy/

I was fortunate enough to attend the Picton Symposium on Wind Turbine Noise last weekend. Ross McKitrick’s presentation on coal left everyone shaking their head in amazement.

The following quote is Dr. McKitrick’s explanation of the charts (linked above), especially the DSS cost benefit analyses of 2003 and 2005.