Beware of the purveyors of the “cheap gas forever” myth

Both John Rowe, the retired chief executive at Exelon, and Aubrey McClendon, the current chief executive at Chesapeake Energy, would love to create a situation where “everyone” believed that cheap natural gas is going to last for a long time. My assertion is that “cheap” natural gas – which is actually only available in North America – is just a transitory condition caused by a perfect storm combination of factors that include a warm winter, a still struggling economy, drillers whose current cash flows are buttressed by oil revenues, and financially stressed landowners willing to to mortgage their future in return for some quick cash from frackers.

Both Exelon and Chesapeake Energy will benefit mightily when reality returns and the supply of natural gas is found to be insufficient to meet the demand. Both companies were essentially printing money during the period between 2003-2008 when the price of natural gas in the US was 3-5 times as high as it is today. (Exelon is a nuclear focused utility that markets its electricity in regions where the selling price is largely set by the price of natural gas; Chesapeake Energy is a heavily mortgaged natural gas producer whose annual production is second only to ExxonMobil in the continental US.)

When the contributors to the perfect storm begin to disappear, the chattering classes in the business media will learn that record levels of gas in storage amounts to less than one month worth of normal demand. (Specifically, the current total amount of working gas in storage in the lower 48 states is about 2.3 trillion cubic feet. The US consumes 26 TCF per year.) That inventory can be rapidly depleted by only a few sustained months where supplies from wells are less than demand from customers.

No matter how often the myth of eternal low prices is repeated, the reality is that natural gas is a volatile commodity with a volatile price history that is partially based on its gaseous nature. Since it is a gas that is not terribly energy dense, it requires significant effort to store it or move it from place to place. That leads to some very strange pricing patterns. In places where there is more gas than the market can absorb can quickly approach the situation where suppliers are willing to nearly give the stuff away. However, in places like Japan, where there is a suddenly expanded demand, natural gas is a valuable energy source that is selling for 5 times as much per unit of energy as it does in the United States.

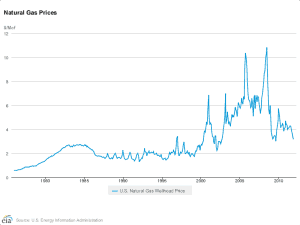

I wish I could burn this graph into the memories of everyone who hears the siren song of the natural gas pushers. Take a hard look at that pricing volatility and ask yourself how the pundits can keep talking about natural gas prices as if they are going to behave in a reasonably predictable fashion for more than a few months at a time.

As the gas industry captures more and more customers by offering its product at incredibly low prices, it is setting us up for one of those inevitable spikes that can refill their depleted coffers with money from customers who are essentially locked in by technology. Gas turbine combined cycle plants may be relatively efficient and cheap, but they cannot run on coal or water cooled nuclear reactors. Even if they could, the conversion would take several years of expensive investment. (Oil and gas companies would like to point out that gas turbine combined cycle plants do have one alternative fuel – distillate fuel oil.)

My guess is that the price of natural gas in the United States will exceed $10 per million BTU for at least one month by the end of 2014. I suspect that the spike will last a lot longer and be far more disruptive if no effective action is taken by people whose perspective is a little less selfish and significantly more far seeing than that expressed by John Rowe in a recent Forbes interview.

Former ComEd CEO Tom Ayers built Exelon’s reactor fleet because, Rowe said, he thought they were best for the environment. But Ayers was suffering from Alzheimer’s Disease by the time the reactors broke even on their initial cost. He died in 2007.

“I’m not fond of investments that don’t pay off before I’m incapable of comprehending it,” said Rowe, who took over as chairman and CEO of Exelon in 2003.

Rowe likes it when people confuse him with being in favor of nuclear energy simply because he used to run a utility that owned a lot of nuclear power plants. Rowe is actually in favor of owning nuclear power plants that someone else built and selling electricity at prices that far exceed the cost of production from those nuclear plants.

That happy – for him – situation is driven by a stacked market where the price-setting competition burns expensive natural gas and everyone that might be building a new nuclear plant is stymied by slow regulators and discouraged investors.

In a related note that falls into the category of people who act more friendly to your cause than is actually the case, have you heard the Administration announce that it has still not provided a single dime under the often touted nuclear loan guarantee program? Have you heard them announce that they are unlikely to ever provide any useful resources under that program?

For regular readers of Atomic Insights, I apologize for my recent silence. Every once in a while, perfect storms happen in real life that interfere with hobbies like trying to help the rest of the world understand energy technologies and market dynamics.

I also want to let you all know that the Atomic Show will be entering a hiatus because our hosting company will be shutting down its servers in the near future as it closes its doors for good.

I agree, there is no way that this endless supply of tight gas that everyone is betting the farm on can possibly be produced at today’s prices. Once the utilities are committed to this fuel the supplier will have them by the short hairs and the price will ratchet up.

Rod Adams wrote:

However, in places like Japan, where there is a suddenly expanded demand, natural gas is a valuable energy source that is selling for 5 times as much per unit of energy as it does in the United States.

And Europe is not far behind on price. With major world markets pricing natural gas this high, there is a sustained pull upwards on the price of natural gas. Even though natural gas in North America is largely “land locked”, market forces will drive changes, e.g., LGN terminals being used for export rather than input. If nothing else, domestic usage trends already in play (reduced gas drilling and wholesale switches from coal to natural gas for power generation) will soon favor the gas produces, i.e., higher prices.

Rod,

I tried to comment on the Bill Gates post but got a strange error message mentioning an error at 1.2 GW.

Great post, Rod. There’s certainly a lot of “cheap gas” talk, but I read The Oil Drum for a dose of reality. One of the commenters I respect highly, Rockman, had this to say about Chesapeake Energy in commenting on the post A Review of the Citigroup Prediction on US Energy:

Shale gas is as much about what Wall Street values as about producing a product. And Wall Street seems to have no concept of anything beyond the value of a company’s shares. The horizon seems to be the next quarter’s results, which leaves very little room for a company to have long-term and/or fiduciary goals. I’m no expert but it sure looks to me like too many companies (and not just energy companies) are on a treadmill that is almost impossible to get off of.

I respect Rockman’s comments as highly as I respect DV82XL’s comments. I hope that you’ll take that as a compliment, DV82XL.

Indeed I shall, and thank-you.

DV8