Charleston (West Virginia) Daily Mail Warns Readers – Proposed Nuclear Plants Could Affect WVa Coal

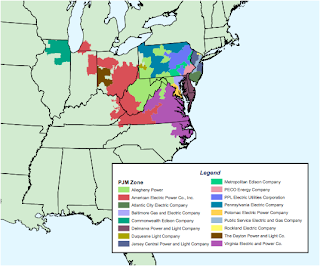

One of the best explanations of electricity supply dispatch curves that I have ever read is available in the Saturday, October 3, 2009 edition of the Charleston Daily Mail under the headline of Proposed nuclear plants could affect WVa coal. That article describes in detail how bidding in the PJM Interconnection transmission network sets prices and determines which power plants to run each day and each hour. The PJM supplies portions of 13 densely populated states in the mid-Atlantic and Midwest from Illinois to New Jersey with competitively priced wholesale power.

Here is a quote from the article:

All 1,500-plus power generation units in PJM set their price each day for the following day.

Placed in order by price and plotted on a chart, the ranking forms what can be called a “dispatch curve” for electricity.

As demand rises through the day, PJM dispatches the plants in order by price, with some variation because of transmission congestion.

And that is where it becomes clear that not all baseload power is created equal.

“Nuclear fuel costs, which typically average about $5 a megawatt-hour, are a fraction of the cost of coal or gas units — typically on average about $25 to $30 per megawatt-hour for coal,” Dominion’s Zuercher said.

Wind, hydropower and nuclear dispatch come first, then coal.

Of course, no one can really predict if they will be able to actually supply wind power, so the reality is that wind gets dispatched if it is there, but something else has to step in immediately if it is not. If there is no coal that can ramp up quickly enough to supply what did not get supplied by wind, a more rapidly responsive supplier like gas may get the nod. Here is another important point to understand:

And newly constructed nuclear plants will dispatch in that same order, Zuercher said. “The market does not consider capital costs,” he added.

Asked whether new nuclear generating units would tend to push coal up the dispatch curve, AEP’s Akins said, “I think you can expect coal to reduce as a result. Any time you inject a nuclear power plant into the dispatch stack, some other baseload has to give, and generally that would be coal.”

This is part of the reason why I advocate nuclear power plants that can provide a varying amount of power. Instead of moving farther up the dispatch stack to higher cost fuels, at least some of the variable load can be supplied by changing the output of the plants already supplying power. If nuclear plants are designed to be profitable at an 80% capacity factor; they would be enormously profitable if the market asks them to run at 82, 88, or 95% capacity. Economically speaking this is no different from any other large capital investment like a refinery, a chip fabrication plant, a steel mill, a sports stadium, or a shopping mall.

I also think it is important for people to understand that the capital cost of a manufacturing facility does not have any effect on its ability to remain a supplier in a competitive market; the thing that counts for a day to day decision process is the marginal cost – the difference in the cost between operating the plant and owning the plant without operating it. The capital cost must be paid whether or not the plant operates. This is not uncommon and helps to explain why some commodities like silicon chips, natural gas, and even oil have such a large variation in price – the raw material costs are actually quite small compared to the cost of building the capacity to serve. Once the capacity is built, the owner will sometimes drop the selling price down to marginal cost of new material in order to keep at least some income flowing.

Only nuclear power can displace significant quantities of coal-fired generation.

AEP maintains that coal’s role is secure.

“AEP believes emphatically that coal does have its place in the mix of the future,” Akins said. “You can’t go all nuclear, you can’t go all coal, you can’t go all natural gas or wind or renewables.”

The article also quotes a rather courageous West Virginia politician who hails from near Oak Ridge Tennessee and grew up knowing that nuclear energy has some interesting and useful properties.

Foster (West Virginia State Senator Dan Foster (D-8&17)) acknowledged that new nuclear power might reduce the demand for fossil fuels.

“It’s just hard to slam the door on something that may be changing dramatically and could be having an impact on our future rather than being very dependent on coal and natural gas,” he said. “I think everything needs to be on the table at this point for the next generation or two.”

Senator Foster introduced a bill to repeal West Virginia’s ban on new nuclear power plants. The bill failed. However, as the article pointed out, there are new nuclear power plants proposed in three of the states that border West Virginia and that participate in the PJM. Even if West Virginia remains adamant about trying to protect its coal industry, the customer base may disappear anyway.

Even though some of the state’s utilities are investing in carbon capture and sequestration projects, that is unlikely to improve coal’s competitive position on the dispatch curve.

Akins emphasized AEP’s commitment to clean-coal technologies and noted the company’s first-of-a-kind carbon capture and sequestration demonstration at the Mountaineer plant in Mason County.

However, he conceded that even as such a technology improves coal’s environmental profile, it will add significant cost.

“My guess is that coal unit pricing would probably go up on the order of … 40 to 60 percent.” he said.

Senator Foster’s bill seems not only courageous – it is challenging one of the state’s largest and most entrenched industries – but also logical and necessary. If there are going to be nuclear plants constructed and operated in competition with coal fired plants using West Virginia mined coal, it would be far better for the state to build and host those plants than for it to stubbornly cling to being a raw materials supplier of a raw material that is going to see falling demand.

Maybe that is why Senator Foster earned a BA in Biochemical Sciences from Harvard College, an MD from Stanford University School of Medicine and completed his residency at Tulane University Associated Hospitals. He is apparently one smart man, even if his political career may be a bit limited by his willingness to speak the truth to some stubborn, but powerful people.