Are Natural Gas Producers Purposely Flooding The Market? If So, Why?

I am a suspicious cynic who cannot forget the lessons learned from literature about man’s inhumanity to man, which is often driven by a hunger for winning, pure greed or a desire for increased power. During the past week or so, I have begun to get a feeling that there is more going on in the natural gas market than meets the eye, or that has been discussed by other observers. There is a distinct possibility that natural gas producers are flooding the market with gas to distract customers and discourage them from seeking long term alternatives.

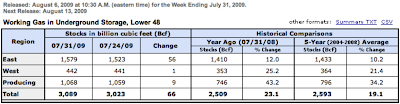

Here are some facts – natural gas storage levels in the US are getting close to their highest level ever, with about 3 trillion cubic feet in storage, about 23% more than this time last year and about 19% above the five year average level. Last week, producers added another 66 billion cubic feet to the storage inventory; according to some observers, all of the US storage locations will soon be full. In spite of these numbers, the Houston Chronicle is reporting that most of the major independent natural gas producers in the US are increasing production even in the face of a “glut”. At least one stock analyst believes that is irrational behavior driven by illogical CEO compensation plans.

Consider the possibility that the gas company decision makers, most of whom have been intimately involved in the business for their entire careers and have seen wild market swings, recognize that their long term financial prosperity hinges on maintaining strong demand for their product. When prices steadily improved during the period from 2000-2008, they earned record profits and received large bonus packages. Their customers, however, were none too happy and began looking for other options. The high prices actually destroyed some of the potential demand because companies using natural gas as a raw material input for readily transportable products like plastics or chemicals moved their production facilities to places where gas was much cheaper.

Electric power companies, some of the least price sensitive customers with no option to move electricity production factories to another country, shifted as much production as possible to their existing coal, hydro and nuclear plants, erected windmills to reduce fuel consumption and began making the long term plans required to construct new coal and/or nuclear power plants. Natural gas companies reacted to these moves by continuing their heavy marketing investments to teach people about how clean and American their product is and by working in parallel with groups like the Sierra Club to slow down companies like TXU which was planning 11 large coal fired power plants in Texas.

Gas interests also heavily promoted a recent report by the Potential Gas Committee claiming that the gas resources in the United States were much larger than previously thought. The New York Times picked up the story without questioning the source of the report, the American Gas Association hosted the press release, and the gas industry leaders started making the rounds of talk shows and showing up on commercials touting the apparent increase in supply. Jay Rosser, a spokesman for T. Boone Pickens, pointed to that report when he said:

“This should quiet any skeptic who is concerned about using our abundant supplies of natural gas as an important transitional fuel.”

There were some observers in less noticed corners of the media world who pointed out that the Potential Gas Committee is a group of “volunteers” with significant interests in the health of the gas industry and that the PGC receives its funding from a “diverse array of companies, organizations, and individuals that for whatever reason are interested in the Nation’s future supply of natural gas.” The page displaying the logos of the organizations providing support to the PGC should provide plenty of food for thought for any cynic: it includes (among others) Chesapeake Energy, CenterPoint Energy, Nabors Drilling USA, American Gas Association, Cabot Oil and Gas Exploration, and Wolverine Oil and Gas Corporation.

I find it amusing – or perhaps disturbing – that anytime a politician makes a statement or votes on an issue, journalists will list his or her lifetime campaign receipts from any organization with an interest in the issue, but when a “non-profit” group issues a report with serious financial implications in a major industry like energy, there is almost never a corresponding comment about the funding sources for that non-profit group. Just because a group is organized as a non-profit does not mean they are organized or staffed by people who do not care about making money or accumulating power.

Back to my theory about why gas companies are producing as much as they can, even in the face of a seeming overabundance of their product. One thing to consider is just how difficult it is to store any gaseous product and how little buffer there really is between abundance and scarcity for a gas that is in heavy use. That three trillion cubic feet in storage sounds like a huge number in isolation, but the average monthly demand in the US is about two trillion cubic feet, with some winter months reaching as high as 2.8 trillion cubic feet. There is not much slack there – just a few disturbances in production, a bit of an uptick in economic activity, and a few hot or cold days can make a huge difference in the balance between supply and demand.

However, if gas companies can keep storage reservoirs full for a while, they should receive plenty of daily or weekly reports about the “glut” of gas from the financial press. Those reports will make headlines and get picked up by news television and radio shows, especially those that play during the morning and evening commute in places where they reach decision makers. With a continuing drumbeat of stories about the “glut of natural gas”, those decision makers will be distracted from their efforts to find alternatives.

Some will wonder why there are still people suggesting politically challenging, long-term solutions like building large, expensive coal or nuclear plants when there is such a “cheap” and “easy” response of just burning gas. As many market watchers often repeat, there is already more installed generating capacity designed to burn natural gas than there is to burn coal. Like many Americans, decision makers are often lazy or too busy to read the whole story, run the numbers, recognize the difference between a peaker and a 24 x 7 generator, or wonder if they are being sold a bill of goods.

One more thing to consider – though natural gas companies are producing rapidly this year, they have greatly curtailed their exploration and drilling efforts. It will not be long before production reflects that reduced investment, supplies begin to dry up, a

nd the supply/demand balance begins to shift back in favor of the suppliers. That natural process will be accelerated if the marketers like T. Boone Pickens are successful in their effort to increase the number of gas addicts who will have a hard time switching to other alternatives.

Update: (Posted at 1415 on August 8, 2009) – There is was an article published by The Economist a couple of days ago about the UK’s electrical power choices. Dark days ahead. The article subtitle is a bit more enlightening about the situation:

A shortage of power-generation capacity could lead to blackouts across Britain—and a dangerous reliance on foreign gas.