Avena (no, really, that is the word in the Reuters headline) considers opening US uranium mines

I fully expect that by the time you read this, Reuters will have made a correction, but I was surprised this morning to find a link in my daily Google Alert on the terms “nuclear fuel recycle” labeled Aveva (emphasis added) considering reopening U.S. uranium mines. The lead for the article reassured me that there was not a new entry into the uranium mining or nuclear energy field:

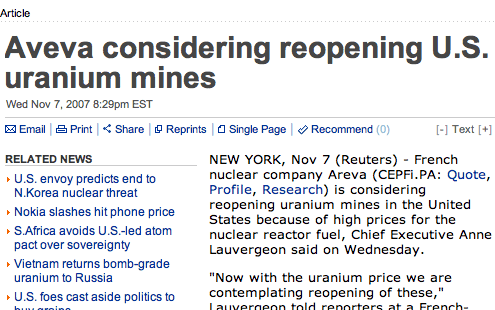

NEW YORK, Nov 7 (Reuters) – French nuclear company Areva (CEPFi.PA: Quote, Profile, Research) is considering reopening uranium mines in the United States because of high prices for the nuclear reactor fuel, Chief Executive Anne Lauvergeon said on Wednesday.

“Now with the uranium price we are contemplating reopening of these,” Lauvergeon told reporters at a French-American Foundation reception, referring to mines closed in the 1990s.

This is one more example of the fact that you have to look beyond the headlines – they are generally written by someone other than the article author. The old saw in journalism is that you can write almost anything you want about someone as long as you spell their name correctly; I presume that rule is even more important when the subject of the article is one of the world’s largest companies in an industry that has the potential for extremely rapid growth.

Reading a little deeper into the article, I found an interesting statement for future predictions about uranium prices and also found the statement that caused Google to pick this article as one that I would be interested in reading:

A uranium price of $30 to $35 per pound would need to be sustained to justify the reopenings, she added.

Aveva was also considering building a reprocessing and recycling facility for spent fuel in the United States, Lauvergeon said, and was considering several possible sites, including in New Mexico and Ohio.