A few days ago, I wrote about Stanford University’s new Natural Gas Initiative (NGI) and described why I thought the existence of that program helped to explain why some prominent Stanford professors — like Mark Z. Jacobson — actively promote an unrealistic energy supply system dependent on 100% renewable energy.

It’s my contention that the predictable result of aggressively pursing that mirage is the destruction of the nuclear energy industry. Jacobson makes no secret of his support for that result.

Pursuit of the 100% renewable system will also produce a steady increase in sales of natural gas to make up for all of the times when the sun isn’t shining and the wind is blowing too weakly to provide the power that customers need and want.

When I wrote the first piece on the NGI, I had deduced that substantial resources to support the initiative must be coming from individuals or companies with an interest in promoting the expanded use of natural gas.

Smoking gun cases built on deductive logic don’t satisfy most people, so I continued my evidence gathering by writing to the contact listed in the press release announcing the first Natural Gas Initiative symposium.

May 30, 2015

Dear Mr. Golden:

I’m working on a piece about Stanford’s new Natural Gas Initiative. Can you help me find the pages on your web site that identify the major sources of funding for the initiative?

Some of the descriptive language about the Precourt Institute for Energy’s involvement mentions that it provides funding for research and conferences, but the web site for that organization does not clearly indicate where its money originates either.

Thank you for any assistance you can provide.

Best regards,

Rod Adams

Publisher, Atomic Insights

June 4, 2015

Hi Rod,

Sorry for the delayed reply. Initial funding for NGI was provided by Stanford’s School of Earth, Energy and Environmental Sciences; the Precourt Institute for Energy; the Office of the Dean of Research; and, the President’s Fund. The Precourt Institute for Energy is all donor supported, with the primary gift from Jay Precourt, class of ’59 and master’s degree ’60. Other gifts have come from Eric Schmidt Family Foundation, Stinehart/Reed Donor Advised Fund, Doug Kimmelman, ’82 and Mike Ruffatto ’68.

The NGI site is just being built out, but the Precourt site should have that financial information on it and I’ll get that fixed.

Thanks for your interest, and let me know if you need anything else.

-Mark

Mark Golden

Communications

Precourt Institute for Energy

and Precourt Energy Efficiency Center

Stanford University

Jerry Yang & Akiko Yamazaki Environment & Energy Building “Y2E2”

That response led me to additional source material. One article from 2006 describes a $30 million gift from Jay Precourt to establish the Precourt Institute for Energy Efficiency.

An article published in January 2009 describes a combined gift of $100 million.

Details of the $100 million – $50 million from Jay Precourt, $40 million from Tom Steyer and Kat Taylor. This quote from the article describes the sources of the other $10 million. “The balance was contributed by Douglas Kimmelman, senior partner of Energy Capital Partners, Michael Ruffatto, president of North American Power Group Ltd., and the Schmidt Family Foundation.”

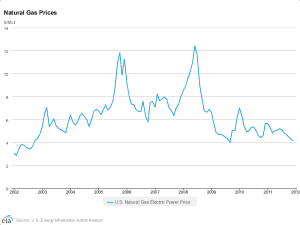

Mr. Precourt is obvously passionate about both Stanford University and energy, having given at least $80 million in gifts during a three year period. That period included a boom, (2006-2008) a peak (summer 2008), and a bust (2008-2009) in natural gas energy prices.

The articles also helped explain the basis for Mr. Precourt’s passions and generosity along with the source of his massive wealth.

Precourt holds bachelor’s and master’s degrees in petroleum engineering from Stanford and an MBA from Harvard University. He has spent his career in the energy industry, holding executive positions at Hamilton Oil Co., Tejas Gas Corp., Shell Oil Co. (which acquired Tejas in 1997), ScissorTail Energy LLC and, most recently, Hermes Consolidated Inc., a gatherer, transporter and processor of crude oil and refined products. He has served as chair and chief executive officer of Hermes since 1999. He also serves as a director of the Halliburton and Apache corporations.

Alumni of elite institutions that provide a valuable education leading to a lucrative career often express their appreciation through generous, tax deductible gifts once they have achieved financial success. It’s no surprise that the gifts are often related to the field they studied or to the industry that became their life’s work.

Precourt’s initial major gift funded an institute that some might consider to be contrary to his ongoing economic interests. The Precourt Institute for Energy Efficiency ostensibly supported programs designed to reduced energy consumption while Precourt has made a career out of finding, gathering and selling energy fuels.

However, there is no long-term conflct between efficently using energy from fossil fuels and selling a growing quantity of fossil fuels. Most astute energy professionals accept the Jevons Paradox, which says that improved energy efficiency incrases overall energy consumption. They understand its value as a marketing tool that both wins friends and improves their revenues.

Precourt’s generous contributions to Stanford have helped to fund Dr. Jacobson’s research and teaching for many years. They have helped to provide an exceptional work environment full of innovative energy technologies that excite and inspire students. Those funds have also helped give Jacobson a promotional platform for selling his 100% renewable vision.

Of course, donors to academic institutions don’t control how the institution decides to spend the money, but they always have the option of not giving additional gifts if the institution takes on programs that offend them.

The fact that Mr. Precourt came back with a $50 million gift after his initial $30 million gift indicates that he was pleased with the results up to that point.

Institutions emphasize academic freedom and don’t overtly control choices made by professors, but they have to keep making decisions about new grants.

The Stanford University undergraduate degree in petroleum engineering that helped to establish Jay Precourt in a career that eventually enabled him to donate more than $80 million to his alma mater has been replaced by a broader degree in Energy Resources Engineering (ERE).

The ERE program covers a wide range of energy-related engineering topics in geology, geothermal, energy efficiency, wind, solar, biomass, hydroelectric without any courses that would include any information about nuclear fission as a clean energy option.

Stanford has been producing petroleum engineers like Mr. Precourt for many decades; it is doing a fine job of leveraging that alumni resource base into continued support for future research.

I’ll conclude by repeating the quote with which I began my first post about Stanford’s new Natural Gas Initiative.

It is virtually impossible to get an educational institution to understand something when its revenue depends on its audience not understanding it.

– Rod Adams, Stanford’s New Natural Gas Initiative, Atomic Insights, May 30, 2015

Big universities also keep close tabs on wealthy alumni, and can be very persuasive at getting them to write large checks. Perks include getting a building or a program named after the alum.

Early in the article, I was thinking about Jevon’s Paradox as a motivation. I’m glad you mentioned it.

Jevons also deduced his paradox could be eliminated via judicious tax on the extracted fuels, thus obtaining more optimal use of a finite resource.

Because we all know that only the wisest people of the highest integrity are chosen by well-informed voters for public service.

…with the emphasis on judicious.

I guess my comment went right over your head. Perhaps you can give us an example of a “judicious tax” and show us that it had the intended effect and had no adverse side effects.

@FermiAged

Your criteria are absolute and thus impossible to meet. No decision of any kind by individuals, corporations or the federal goverment results in meeting all goals and not producing ANY unintended consequences.

Fpr an example of a well targeted tax that met most of its objectives to the point where it was voted to remain in effect by a referendum — twice, I think — please see Penny for Pinellas.

When do we reach the point which allows us to talk of Universities being corrupted by financial donations by parties who might benifit from the doations use.

Well… one needn’t be too hasty. One might, for example, ask from where nuclear engineering departments from Berkeley to Corvalis to MIT to all parts between get their funding. You’ll probably find a variety of answers, each quite spinnable to one’s personal taste.

Or lack thereof 😉

Its weird people think they even need to promote natural gas. Its a low investment default position. I have no doubts the natural gas industry would be fine without promotion so the whole thing seems more than a bit over the top advocacy, Stepford Wives even.

John,

It’s about Market share. You promote Natural Gas to regain market share.

When I first began to study electrical power generation seriously in 2008 and the way that the share of that generation had changed over decades, I realized that the whole fight is over which fuel gets to generate electricity. Coal? Natural Gas, or Nuclear. These are the only three viable options for an industrial economy.

In the 1970’s to 80’s Nuclear power replaced Oil / diesel generators portion of electrical generation. For a while it was Coal and Nuclear in the Electricity Generation market. How to regain market share and dominate for the people who pump oil and or NG out of the ground? – Renewable! Solar and Wind are perfect lost leaders for NG sales.

Nuclear looses through a series of complex rules that do not allow for innovation leading to an expanding market share for Nuclear. Regulations that happen to only affect one industry are designed to eliminate or repress that industry.

At the same time – there is really no true “Nuclear Industry” in the way there is a Coal or Oil industry. Only one or two companies are truly Nuclear and the rest of the power plants are owned by Utilities that also own Coal, Oil, NG, Solar, Wind, Geothermal, Biomass (trees), and Hydro generation. So, who is the millionaire who will donate to Stanford to establish a Nuclear Power research facility?

On the other hand, the new degree from Stanford guarantees that there will be an expanding market for NG and Oil. Since Turbines and Diesel engines are the best quick backups for when the wind stops and the Sun does not shine.

Finally, don’t forget the influence that marketing dollars bring. People who pay for advertising get a voice. Those who don’t pay, don’t play.

David, actually David LeBlanc’s IMSR as well as P:er Peterson’s PBMSR offers low cost, reliable as well as dispatchable back up for wind generated electricity. In addition to their cost advantages, these two Molten Salt technologies offer high safety and reliability. The use of Molten Salt reactors in backup roles, prolongues the lifespan of low cost cores, which can be replaced at the end of their useful life. Th Molten Salt nuclear technology approach, makes wind power a true carbon free source of energy, while Natural Gas and Coul will continue to produce unacceptable levels of cO2, thus continuing to warm the planet.

So why don’t they build working prototypes using their own capital? I ask the question to illustrate why nuclear power development is essentially moribund not because I doubt these concepts have merit.

They are doing that in China and Canada. In the United States, Democrats and Republicans compete to see who can put the greatest obsticles in the path of any new nuclear technology.

You need an entire low-cost plant (including regulatory costs) or else your capital expenses require a high capacity factor.

Poet, both David LeBlanc and Per Peterson have ideas about that. I have discussed on nuclear Green in the past, and on my Ffacebook page more recently. Molten Salts can superheat water, which can be used to drive generator turbines. Professor LeBlanc has the advantage of Canada’s far more friendly regulatory environment. Professor Peterson uses open cycle air turbines, with air heated by heat transfer from secondary salt. He has a bigger regulatory barrier posed by the NRC, but bullite proof safety technology. In addition his power production units can be ordered from a GE catalogue.

@EP,

Thorcon has that low cost plant design. What do you think about their design? Does it meet your idea of a low cost plant?

http://thorconpower.com

This type of idea as well as David LaBlanc’s in Canada make me hopeful for an end run around the whole “renewable + natural gas is the only option” meme.

As I recall, Rod has given some feedback regarding Thorcon’s design and the likelihood that the underground features will be considerably more expensive and difficult than they appear to assume. Since civil engineering is not my field, I’ll sit this one out.

Well put David. Doesn’t really make it seem less weird, just more sad. Universities were theoretically supposed to make any valid counterarguments to known and accepted theory and practice on level ground. I thought so at least.

John,

I am convinced that there is a true market opportunity for Nuclear. It will take a regulatory environment that is at least neutral and the willingness of a investor to put up several billion and the guts to get into the market share fight with advertising.

Yes, we are talking about technologies with tremendous marketing potentials.