Rowe states that merchant power generators cannot make long term investments

A November 9, 2011 Platts headline caught my attention this morning New Calvert Cliffs nuke ‘almost inconceivable’: Exelon CEO. I have been following the Calvert Cliffs Unit 3 story for several years. I used to be a Maryland resident and made a couple of trips down to Calvert County for public meetings on the proposal to nearly double the current productive capacity of the station by adding a 1600 MWe Areva designed EPR.

I’ve also been following Exelon and its effort to maximize the current value of its established fleet of 17 large nuclear plants by doing everything it can think of to reduce the supply of electricity that competes with the output of those reactors. Based on the company’s decision to permanently eliminate the already completed, 2100 MWe Zion nuclear power station, I was not surprised to see Rowe proclaiming that Calvert Cliffs Unit 3 would be a dead letter project if his company succeeds in its current attempt to purchase Constellation Energy.

The below quote from the Platts article, contains several statements that deserve close scrutiny and contemplation.

The Calvert Cliffs-3 project is “utterly uneconomic,” Rowe said after a speech at the Bipartisan Policy Center in Washington.

Exelon “operates in a merchant environment. We can’t make a long-term decision that’s uneconomic because we have no regulatory protection for that,” he said.

“At today’s [natural] gas prices, a new nuclear power plant is out of the money by a factor of two,” Rowe said, echoing one of the main points of his speech. “It’s not 20%, it’s not something where you can go sharpen the pencil and play. It’s economically wrong. Gas trumps it,” he said.

Given recent discoveries of enormous shale gas resources, Rowe said, natural gas prices are expected to remain below $6-$8/MMBtu for the foreseeable future.

The first statement is the idea that the power plant is “utterly uneconomic.” If that was true, one would have to believe that the current backers – including EDF, one of the largest electrical power producers in the world – cannot do math and cannot build spreadsheet models.

The second statement that is also important and has wider implications than just this discussion is the assertion that merchant power generators cannot make long-term decisions. Electrical power production is a business where assets are built to last for many decades, perhaps as long as a century in the case of dams and some carefully maintained nuclear power stations. The product those facilities manufacture is not a fad – there is no prospect that we will slow our consumption of electricity for anything longer than a temporary economic recession. Any power company that is structured in such a way as to be unable to make long-term decisions is in the wrong business.

If merchant power producers truly believe that they cannot make long-term decisions, then perhaps we need to rethink the rules that encourage them to exist in the first place. Buying a natural gas power station based on current gas prices is not without risk – when gas prices soared during the period from 2000-2008, there were massive losses and bankruptcies among gas dependent merchant generators who could not afford to operate the facilities that they had purchased with borrowed money. The value of the electricity they could sell was lower than the cost of the fuel required.

In places like California where a large fraction of the generation infrastructure could only burn gas, the result was an inadequate supply of electricity. If merchant generators do not invest in long term assets that reduce their vulnerability to gas price fluctuations, customers might find out that there simply is not enough power to go around. That situation will not be easy to correct since it is hard to invest in construction projects when energy prices are high and power is in short supply.

Of course, Rowe is smart enough to realize that fuel price risk does not apply to a company whose generation source is a fleet of large nuclear power stations that someone else built. I am still waiting for Exelon to prove that gas is a better source of future power by selling off its existing nuclear plants and investing the proceeds in additional gas-fired generation.

The next couple of paragraphs in the above quote really expose the hypocrisy and obfuscation in Rowe’s comments. First he says that new nuclear compared to gas “at today’s prices” is uneconomic by a factor of 2. Then he stated that recent gas discoveries and production from shale will keep prices below $6-8 per million BTU for the foreseeable future. According to Bloomberg, today’s price for natural gas at the New York City gate is $3.81. Even with Rowe’s prediction that gas prices will remain in the range of $6-8 per million BTU, that is already a factor of 2 greater than today’s prices!

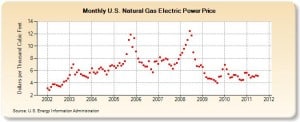

What Rowe’s comments ignore, perhaps hoping that his listeners have forgotten recent history or have no desire to check his statements is that the price of natural gas for electric power producers in the US is anything but stable. Here is a graph of the monthly prices that electric power producers have paid for their gas over the past 9 years. Notice the spikes to prices that are nearly 4 times higher than those in effect today. The same pattern has held ever since interstate prices were deregulated; the best prediction of the price of gas in the future is “it depends.”

Rowe is also asking his audience to ignore the international market. Today’s price for natural gas in Europe, Korea and Japan is between $17-20 per million BTU due to a huge increase in the demand for LNG and pipeline gas as a result of silly decisions to shut down nuclear power stations that were not affected by the Great North East Japan earthquake and tsunami that destroyed the Fukushima Daiichi nuclear station. Though there has been some reduction in demand in Japan as a result of the earthquake that mitigated the loss of production somewhat, nearly all of the lost nuclear output has been replaced by burning more gas and more coal.

Not surprisingly, prices have reacted. Also not surprisingly, North American producers are doing everything they can think of to improve their ability to move cargoes to the areas where the prices are higher. That will take supply out of the US market and increase the prices that we pay here.

If you need shade, the best time to plant a tree was twenty years ago. The second best time is now. That analogy holds true with electrical power generation – since we need as much low emission energy production as possible, the best time to have started building the capacity was 20 years ago. The second best time is now.

Rowe is wrong about the need for new nuclear power plants and about the ability that those plants will have to compete against natural gas in the market. His statements are self serving and provide an excellent example of rent-seeking behavior by a “have” who does not care much about the “have-nots” or about the future prosperity of his country.

Quick correction:

“Buying a natural gas power station based on current gas prices is without risk”

I think the word NOT is missing between “is” and “without”.

“Based on the company’s decision to permanently eliminate the already completed, 2100 MWe Zion nuclear power station, ”

Commonwealth Edison shut down Zion in 1996 at the end of the plant’s useful life. While well maintained nuke plants are economically viable for 60 year today, this is not the case for Zion.

“In places like California ”

The problem in 2000/2001 has many factors. One factor is that California was very slow in issuing permits for new CCGT to replace old SSGT. Merchant power plants had all the investment they could handle once the state got out of the way. An economic and environmental no brainer except in California. Another is that it was a hot drought year. High demand but no hydro. One of California’s large nukes was offline because main turbine bearing were wiped. A large coal plant serving California had a fire in the main transformer. Then a large pipeline serving California failed killing only a few people. Sad to say that the Governor, Secretary of Energy, and POTUS were all in denial and refused to take unpopular measures. Turns out rolling blackouts out are not very popular either.

I am sure that Rod is an apologist for Clinton’s anti-nuke energy policies that worked to make Zion the normal condition for nuke plants. Rod has not read the NATIONAL ENERGY POLICY, May 2001. Bush changed energy policies in the US so that new nukes are an option. If Gore had been elected we would not be debating Calvert Cliff 3.

Then there is Obama. We are back to not having and energy policy. When it comes to energy, he is a Chicago lawyer which is a nice way to see he is an idiot on energy. He has installed a sock puppet at Secretary of Energy and anti-energy folks at EPA and as energy czar. Stopping Yucca Mountain being the first shot across the bow of the nuclear world. There is one standard nuke loan guarantees and another for wind and solar. The purpose of loan guarantees is to encourage long term so that passing fuel cost off to customers is not the only option.

“Rowe is also asking his audience to ignore the international market. ”

Of course Rowe is correct. The situation has changed since 2007. We have stopped importing LNG and are considering exporting it. We are also exporting coal. It is not a matter of forgetting history but a case of learning it in the first place and then applying the lessons to the current situation.

The people who built LNG terminals and proposed new nuke plants is some locations did not see shale gas coming. I think that new nukes can beat shale gas. The US nuke industry has to prove that.

@Kit – I really don’t care much about your opinions of me, but please refrain from calling me an apologist for anyone, especially Clinton. You can search on this site for dozens of articles about the way that the natural gas influenced Clinton Administration did everything it could to erect barriers to success for nuclear energy.

However, I will point out that one of the most important changes in the economic situation that makes me believe that Zion would be an economical source of power occurred during the time that Clinton was still in office. He probably had nothing to do with it, but the first license extensions allowing nuclear plants to operate for longer than 40 years were issued in March 2000, about nine months before he left office. Putting the processes in place to enable that to happen required a sustained effort that lasted almost the entire time he was in office.

By the time he left office in Jan 2001, there were five units whose license had been renewed. Purchasing used nuclear plants had become a rational way for capable operating companies led by people with a reasonable vision for the future to grow their business.

Rod I stand corrected on your position on Clinton.

Once upon a time, I was happy as clam working a NSSS system engineer. Then political people like Ed Smelloff and S. David Freeman worked to close Rancho Seco by telling lies that put a lot of good people out of work. Rancho Seco was very close to being the first nuke plant to transfer ownership to another company who actually had the skills to properly operate a nuke. Rancho Seco would not close today but some made sure that it could never operate again and they did it in the first six months.

My next dream job went away the day Clinton announced a rabid anti-nuke as Secretary of Energy. Building new nukes was off the table as long as Clinton was POTUS. I moved my family again but that dream job went away because of cheap NG. My next two nuke plants were Commonwealth Edison BWRs. Going on the road to put bread on the table is not my idea of a dream job. At both Commonwealth Edison BWR, I was offered a job but I refused to move my family to a plant that was going out of business unless drastic change were made. I did not want to be working at the next Zion. From what I was told, some of the Commonwealth Edison units did have an excellent record.

The 4 Commonwealth Edison BWRs that I was at were in very poor material condition and had lost ‘configuration management’. That is how nuke plants go out of business and it is very expensive when it is possible to recover. I have no reason to think that Zion was recoverable.

Of course there were many nuke plants to demonstrate operational excellence and that nuclear power economical. Plants that would have closed early were instead sold to companies who who how to operate them better. Things are different than when Clinton was president.

While Clinton was against nukes and coal, he was also against drilling for NG except for thing like coal bed methane which reduces ghg. So if NG is the only choice for utilities and you restrict new sources of NG and new pipelines, what is going to happen when demand exceeds supply. Ken Lay failed to mention that when he was playing golf with Clinton.

Clinton was a friend of renewable energy but with friend like Clinton who needs enemies. The same can be said for Obama. Liberals do not build power plants. Renewable energy and nukes have high capital cost. The conservative thinkers who make the decision to start building need confidence that the government is not going to do something stupid during construction. Then there are lawyers and the 9th circus of appeals.

While it may seem counter intuitive, this is an advantage for new nukes. We can afford lots of lawyers and ours do not lose. Case law is settled for nukes.

“Then he stated that recent gas discoveries and production from shale will keep prices below $6-8 per million BTU for the foreseeable future. According to Bloomberg, today’s price for natural gas at the New York City gate is $3.81. Even with Rowe’s prediction that gas prices will remain in the range of $6-8 per million BTU, that is already a factor of 2 greater than today’s prices!”

Rod, good article, but it would be better without the quoted text? Why? Because you’re acting like what he said contradicts itself, but the way I read it, it’s perfectly consistent. . .

I take it to mean that right now, at approx $4/MBTU, he’s saying it’s 1/2 the price. At $8, nuclear would “break even” – but from a business standpoint, it’s *not worth* building something which will only break even. So *today* it *is* uneconomic by a factor of 2 – which is both what he said, and what you said with your price quote. Consistent.

The fact is that at any level, micro economic “planning” is a farce. The whole idea of “merchant” plants was a function of the very ill-concieved *Republican* drive to deregulate the energy industry. Thus planning, to use this abused word, became a victim to the market, that is the short term, this “market” where the spot price for gas becomes a substitute for a serious *national* planning.

The current rightwing drive against “big government”, something totally a-historical and something that would of had the US end up with a standard of living of, say, Ghana, had this made-up philosophy that substitutes for economic policy ever been applied in the United States.

The fact is that US policy since the early 1970s is based on making money for finance capital, that is, speculation. It’s no longer about making money by making things. thus energy has to fit into this irrational mode of ‘production’ where it’s all based on speculation and short term profit.

Few other countries do this. They *remove* energy production from the ups and downs of the market place so that seroius infrastructure can be built, including nukes.

Blaming “Clinton” is sort of a joke. There was *zero* difference in national policy around nukes and Bush only… *only*…brought it out of the closet, kept in there by his father and Regan before him, as well as Clinton.

David Walters

I would add that even though the price of gas is unstable, even if it occasionally peaks, the important metric isn’t the height of the peaks, but the area under the curve. Integration of the price over time.

If Gas can undercut nuclear *most of the time*, from a business standpoint, it doesn’t do any good to have a nuclear reactor whose output is being undersold most of the time – even if it occasionally spikes up into a nice profitable range.

By the way, Rod, despite my criticisms (which I truly hope are constructive), I do think the central thesis of the article is good, and the rest of the article is very insightful. I agree that I think we’re heading to a situation in 10 or 20 years where we’ll really wish we had started building nuclear today.

One additional factor I would add to your article: We’re in a recession right now, which is part of the explanation why gas prices are staying low. I fully expect that as we climb out of that recession, we’re going to be facing some sharp increases in the cost of *all* energy sources. I admit I’m not an economist, so I can’t really provide anything more specific, but only to note that it seems that every time our economy starts to recover, the price of gasoline, gas, and electricity seems to always rise with it, until the rise in price starts hampering further recovery.

We are confusing some things here. The utility makes a decision to produce power from a particular source by comparing the marginal cost of electricity. In this situation, nuclear will always win. Gas has to get much cheaper to be able to sustain that. With our excess capacity in the country for gas production and the level gas prices suggest that this is the lowest we will see natural gas. The hurdle for building new nuclear is that the construction has to be paid for. Thus $8/MMBtu is when that happens. Rowe just wants to maintain the status quo. He has a good deal and wants to keep it.

The unfortunate thing for his service area is that high energy prices as a result of his policy is likely to force businesses to states where they have better labor laws and lower energy prices. I live in Atlanta. We will surely welcome these businesses with southern hospitality.

Thank you John Rowe.

@Rod – Most of your analysis is quite sound, but I feel like you make one error. You say Rowe should put his money where his mouth is and sell off existing nuclear plants to fund new gas plants. But this isn’t Rowe’s claim; it’s a comparison of the enormous CAPITAL cost (plus cost of money) for new nuclear versus new gas NOW. Established nuclear obviously outcompetes gas – because it’s a direct comparison of fuel to fuel costs. Nuclear wins on fuel costs alone even when gas is “cheap.”

Additionally, EDF is much better capitalized than Exelon or other merchant generators. This means they have a better capacity to weather short-term variations in price. They are more capable of making long-term bets on energy prices.

@Steve – the weakness in your analysis is that the performance of existing plants is a huge part of the reason that I assert that Rowe and his analysts are either very poor at their job or are lying through their teeth.

At the time that today’s plants were built, there was just as much angst about their capital cost as exists today about building new reactors. History shows, however, that if you put your head down and your nose to the grindstone, you can complete the facility and, in almost every jurisdiction in the country, get permission to operate it. Once that occurs, the plants will be the lowest MARGINAL cost producers in the market – outside of large scale hydro. That means that no matter what happens, a nuclear operator can always capture whatever market there happens to be. He can ALWAYS undercut gas and force natural gas plants to operate at a lower than expected CF if the demand is too low to support all players.

That is a tremendously valuable characteristic – being the lowest marginal cost producer of a valuable commodity. It covers a lot of risk elements in the overall analysis.

Much of this reminds me of when North Sea gas was in full flow. However production peaked around 2000/1. Now, the North Sea is regarded as a mature province on a decline and the U.K. is looking to nuclear again.

Frankly I don’t think that NG production will be able to keep up, and tight gas doesn’t look like it can keep the promises its made. Nuclear will win in the end by default.

In the long run, we are all dead.

In the long run, our children, grandchildren, etc. are alive.

Standard “rational” accounting does not understand very well the concept of leaving a legacy of inexpensive, reliable energy to future generations. I live in the Pacific Northwest which has such a legacy in hydro generation. I just wish we were building nuclear power plants as a similar legacy to those who will come after us.

They won’t be alive for long if we don’t adopt clean, affordable and reliable energy. For the rich and the poor children of the planet.

Mr Rowes dislike of nuclear probably dates back to the early ’90s when he was CEO of New England Eower. They were joint owners of Yankee Rowe and Connecticut Yankee. Both of these plants were shut down prior to their license expiration date due to an analysis which determined they were not competitive with gas. Part of the problem was that the operating companies for those plants had no real intrest in keeping costs down or operating capacity at the high levels now being seen for nuclear plants due to operating in a regulated environment. With competition looming they looked uncompetitive. Mr Rowe lead the charge to shut down both those plants.

Years later I heard but could not confirm that the analysis was flawed.

If cost and electricity demand trends are the only important factor for new power plants, why are we building windmills and solar? You hear them say “Well of course we built those to get rid of carbon emissions and to get rid of our foreign oil dependency via electric cars!” – but once you mention nuclear they say “Coal and gas are cheaper, so we can’t build it”. How about the cost of wind and solar, especially compare to nuclear? It’s a double standard, a shell game, at the end of which lies total dependency on natural gas for everything from power to heating to cars to industry. If domestic production fails to be as large as promised, Big Oil will be right there to ship it at premium cost from the Arab countries from their new LNG terminals.

Jerry I suppose it depend on what you mean by ‘we’. Decision makers in the power industry build power plants on what they think will be the best choice for their customers to provide affordable, reliable power.

Then there is the ‘we’ that use energy but do not like how it is done based on an agenda that allows them to say anything they want.

I know a nice young man with a master in nuclear engineering from West Virginia. When he was just out of college, he was surprised to find that this much older coworker in the nuclear industry was not anti-coal. I suspected that he was anti-coal based his friends who were miners but instead I got an email with many links to articles in the likes of USA Today on AGW.

So Jerry it does not matter how you produce energy, there is a ‘we’ that is going to not like it.

Does anyone know where a territory map of utilities of the USA exists?

I ask as it seems Exelon is already too big to be taking over yet another utility. It seems to me the other noteworthy issue here is the stifling of competition in the utility sector. Granted most utilities don’t overlap their territories, but when one player can set the national trend in the energy market so easily because of its size, I think we have a big problem.

The more players in the market the better the diversity of risks. I don’t really care that John Rowe may or may not be making good decisions, it’s just the too many people (ratepayers) must now suffer the consequences of those decisions whether they like it or not.

I don’t think a terratory map would be of much value. Merchant generators can sell their power almost anywhere as long as the transmission lines exist between them and their customer.

Check the web sites of one os the ISOs to get an idea of how the system works.

Her’s one: http://www.iso-ne.com/

Here is a link to the PJM grid.

https://edata.pjm.com/eContour/#

Exelon has plants west of Chicago and near filthydepphia. If you add Constellation that will add the Baltimore. Others in PJM that have lots of power plants including nukes are AEP, PP&L, DOMINION, DUKE (may be in another system in Indiana and Ohio), FIRST ENERGY.

So Jason you do not have to worry about Exelon ‘stifling of competition in the utility sector’. Think about the Duke and Progress merger. That will make Duke bigger than France. Speaking of EDF, it owns 49.9 % of Constellation nukes.

That’s an interesting map, thanks.

EDF (Électricité de France) was just fined 1,5 million Euros for spying on Greenpeace.

…and what happens when greenpeace types fire RPGs at EDF? Fame and political office… Sigh

I did not say it was the smart thing to do. But hey, look at Floyd Landis. He was caught spying in France too and found guilty.

There must be something in french wine…

Whose side are the environmentalists on?

http://thegwpf.org/international-news/4309-fossil-fools-facing-bankruptcy-climate-campaigners-embrace-big-oil.html

“But it’s time we stand on our own two feet, and thanks to our many supporters, we can…”

Wait a minute, they are going from one set of donors to another set of donors. Someone please explain to me how that is “standing on our own two feet???

I wonder how long he means by “foreseeable future.”

1year, 5 years, 10 years?

It must be a short time. If as a merchant company they are only allowed to make short term decisions then he can only mean gas will stay low, in the short term.

If his break even target is $8/MMbtu, then using is 20% better target then nuclear would beat gas at a price of $9.6/MMbtu. Above that point nuclear would have to be the economic choice, not gas. We will see what his vies of CC3 are when that price comes. In the no so foreseeable future.

Keep in mind it is the delivered price of NG at the time it is needed. The is a cost of pipelines and storage. Demand for NG is highest in the winter and also is increased demand in the summer. A good source of info is the NEI Market Report.

Why does the NEI provide information on delivered price of NG. The supply chain for nuclear fuel is very secure and competitive. If a natural disaster takes out a few pipelines or railroad bridges , the delivery of fossil fuel stops.

As for current marginal costs, Rowe told the ANS working conferebce in August:

Nuclear production costs for today’s plants average

2.14 cents per kWh – cheaper than coal (3.06cents) and natural gas plants (4.86 cents)…

http://www.exeloncorp.com/assets/newsroom/speeches/docs/spch_Rowe_ANS_110815.pdf

conference

First, there was the tours in Chernobyl and now the J village in Fukushima:

“We are doing all we can to bring this crisis to an end,” said TEPCO spokesman Yoshimi Hitosugi. He said TEPCO had determined that the situation at the plant had improved enough for it to open the “J-Village” staging area on Friday and allow representatives of the Japanese and international media into the plant itself on Saturday.

This is a great post. While CCGT’s may be more economical to build they are tied to commodity price.

And everyone knows how that works. Another key point that stuck out in the article is the infrastructure needed, other consumers are tied into that same infrastructure which begs the question of supply capacity. In a particular geographical region if demand increases, so do prices.

John Rowe will eat these words posted on the Excelon website…

“We need a firm, long-term commitment to energy efficiency and conservation in both our industry and across the economy, as well as a commitment to finance and construct low-carbon generation resources, including nuclear, clean coal and renewables.”

John W. Rowe, Chairman & CEO

Further he came on board New England Power in 1984 when PSNH had filed for bankruptcy due to massive cost over runs at Seabrook. I had met him once when New Hampshire Yankee was being created. He is as far from a hard charging Nuclear executive, in my view. He was a milk toast ROI focused executive with a political bent and not an industry orientation.

Here is the “GOOD NEWS”…he will not be making the decisions on Calvert Cliffs!

“One of America’s leading energy executives is retiring. John Rowe, a revered figure in the electric utility industry in particular, and energy circles in general, brought history and philosophy to the nuts-and-bolts world of generation and transmission.

Rowe, 65, who describes himself as an “industrialist,” has been a utility chief executive for 28 years. Currently, he is chairman and chief executive officer of Chicago-based Exelon Corporation. He will retire early in January when the company’s merger with Maryland’s Constellation Energy is expected to go through.”

With all the ‘Arab Spring’ unrest and its potential impact on oil supplies plus the fact that the ‘Megaton for Megawatt’ program will end in 2013, one has to wonder why the price of Uranium is not skyrocketing.

The market is sleeping on this issue.